News

SpaceX to kick off October with two launches and landings in 48 hours

SES-11 to be the last launch from LC-39A ahead of pad modifications for Falcon Heavy

After successfully weathering Hurricane Irma, SpaceX is preparing to remedy a slow month with three or even four launches in October.

Beginning on October 2nd, schedules have firmed up for the launch of SES-11 aboard a refurbished Falcon 9 first stage. SES, a Luxembourg-based satellite communications company, took the courageous and pioneering step of purchasing the first reused Falcon 9 for a commercial launch, culminating in the successful SES-10 mission in March 2017. Following that successful first reuse, SpaceX would later launch Bulgariasat-1 aboard a similarly-refurbished booster. SES-11 will become the third commercial reuse of an orbital rocket when it launches early next month from SpaceX’s LC-39A launch pad, and is currently expected to attempt a landing on a drone ship in the Atlantic Ocean.

All 10 Iridium NEXT satellites for the third launch are onsite at Vandenberg. Launching on a Falcon 9, October 4, 6:06am PDT (1:06pm UTC). pic.twitter.com/xBSWpYOx32

— NSF – NASASpaceflight.com (@NASASpaceflight) September 20, 2017

If all goes as planned, SpaceX will launch a second Falcon 9 as few as 36 hours after the SES-11 mission, this time carrying the third batch of 10 Iridium NEXT satellites from Vandenberg Air Force Base, California. All ten satellites have arrived at SpaceX’s VAFB facilities and will be attached to the payload dispenser and later encapsulated inside Falcon 9’s payload fairing over the next two weeks. The Iridium-3 launch will also see the Falcon 9 first stage land aboard SpaceX’s second drone ship, and is bound to be reminiscent of the two back-to-back launches SpaceX conducted on both coasts earlier this summer.

Iridum NEXT satellites being attached to the payload dispenser at SpaceX’s VAFB facilities. (Iridium)

Meanwhile, SpaceX has received an FCC license for first stage recovery activities beginning on October 14th, which meshes well with a scheduled launch date for KoreaSat-5, also 10/14. This date is dependent upon a number of variables that are currently hard to account for, and may slip further into October due to work expected to begin at the LC-39A pad after the launch of SES-11. Confirmed by Chris Bergin of NASASpaceflight.com, SpaceX is planning for SES-11 to be the last mission from the venerable launch pad for several weeks at a minimum, likely closer to several months.

10 days (Sept. 29) to SpaceX Falcon 9 (SES-11) Static Fire…at 39A. Oct. 2 launch, then all hands on deck to prep 39A TEL for Falcon Heavy. pic.twitter.com/B2zxLILqkU

— NSF – NASASpaceflight.com (@NASASpaceflight) September 19, 2017

This downtime is meant to begin at the same time LC-40, SpaceX’s second East coast pad, is reactivated for Falcon 9 launches. In the best-case scenario, this will allow the company to continue business as usual as it modifies LC-39A for Falcon Heavy, which is expected to begin on-pad testing later this year and potentially conduct an inaugural launch as early as November. As such, KoreaSat-5’s Falcon 9 may end up being the pathfinder SpaceX uses to solve the problems and squash the bugs that will inevitably arise while activating a new launch pad. Delays ought to be expected.

Following KoreaSat-5, the next SpaceX launch is not yet clear but will likely be Iridium-4, NEXT satellites 31-40. Including the three launches discussed above, SpaceX is likely to conduct 7-8 more launches before the end of 2017, not counting Falcon Heavy’s inaugural launch due to uncertainty.

News

Tesla Sweden appeals after grid company refuses to restore existing Supercharger due to union strike

The charging site was previously functioning before it was temporarily disconnected in April last year for electrical safety reasons.

Tesla Sweden is seeking regulatory intervention after a Swedish power grid company refused to reconnect an already operational Supercharger station in Åre due to ongoing union sympathy actions.

The charging site was previously functioning before it was temporarily disconnected in April last year for electrical safety reasons. A temporary construction power cabinet supplying the station had fallen over, described by Tesla as occurring “under unclear circumstances.” The power was then cut at the request of Tesla’s installation contractor to allow safe repair work.

While the safety issue was resolved, the station has not been brought back online. Stefan Sedin, CEO of Jämtkraft elnät, told Dagens Arbete (DA) that power will not be restored to the existing Supercharger station as long as the electric vehicle maker’s union issues are ongoing.

“One of our installers noticed that the construction power had been backed up and was on the ground. We asked Tesla to fix the system, and their installation company in turn asked us to cut the power so that they could do the work safely.

“When everything was restored, the question arose: ‘Wait a minute, can we reconnect the station to the electricity grid? Or what does the notice actually say?’ We consulted with our employer organization, who were clear that as long as sympathy measures are in place, we cannot reconnect this facility,” Sedin said.

The union’s sympathy actions, which began in March 2024, apply to work involving “planning, preparation, new connections, grid expansion, service, maintenance and repairs” of Tesla’s charging infrastructure in Sweden.

Tesla Sweden has argued that reconnecting an existing facility is not equivalent to establishing a new grid connection. In a filing to the Swedish Energy Market Inspectorate, the company stated that reconnecting the installation “is therefore not covered by the sympathy measures and cannot therefore constitute a reason for not reconnecting the facility to the electricity grid.”

Sedin, for his part, noted that Tesla’s issue with the Supercharger is quite unique. And while Jämtkraft elnät itself has no issue with Tesla, its actions are based on the unions’ sympathy measures against the electric vehicle maker.

“This is absolutely the first time that I have been involved in matters relating to union conflicts or sympathy measures. That is why we have relied entirely on the assessment of our employer organization. This is not something that we have made any decisions about ourselves at all.

“It is not that Jämtkraft elnät has a conflict with Tesla, but our actions are based on these sympathy measures. Should it turn out that we have made an incorrect assessment, we will correct ourselves. It is no more difficult than that for us,” the executive said.

Elon Musk

Music City Loop could highlight The Boring Company’s real disruption

The real story behind the tunneling startup’s Nashville tunnel project is the company’s targeted $25 million per mile construction cost.

Recent commentary on social media has highlighted what could very well prove to be The Boring Company’s real disruption.

The analysis was shared by tech watcher Aakash Gupta on social media platform X, where he argued that the real story behind the tunneling startup’s Nashville tunnel project is the company’s targeted $25 million per mile construction cost.

According to Gupta’s breakdown, Nashville’s 2018 light rail proposal was priced at roughly $200 million per mile. New York’s East Side Access project reportedly cost about $3.5 billion per mile, while Los Angeles Metro expansion projects have approached $1 billion per mile.

By comparison, The Boring Company has stated it can construct 13 miles of twin tunnels in the Music City Loop for between $240 million and $300 million total. That implies a cost near $25 million per mile, or roughly a 95% reduction from industry averages cited in the post.

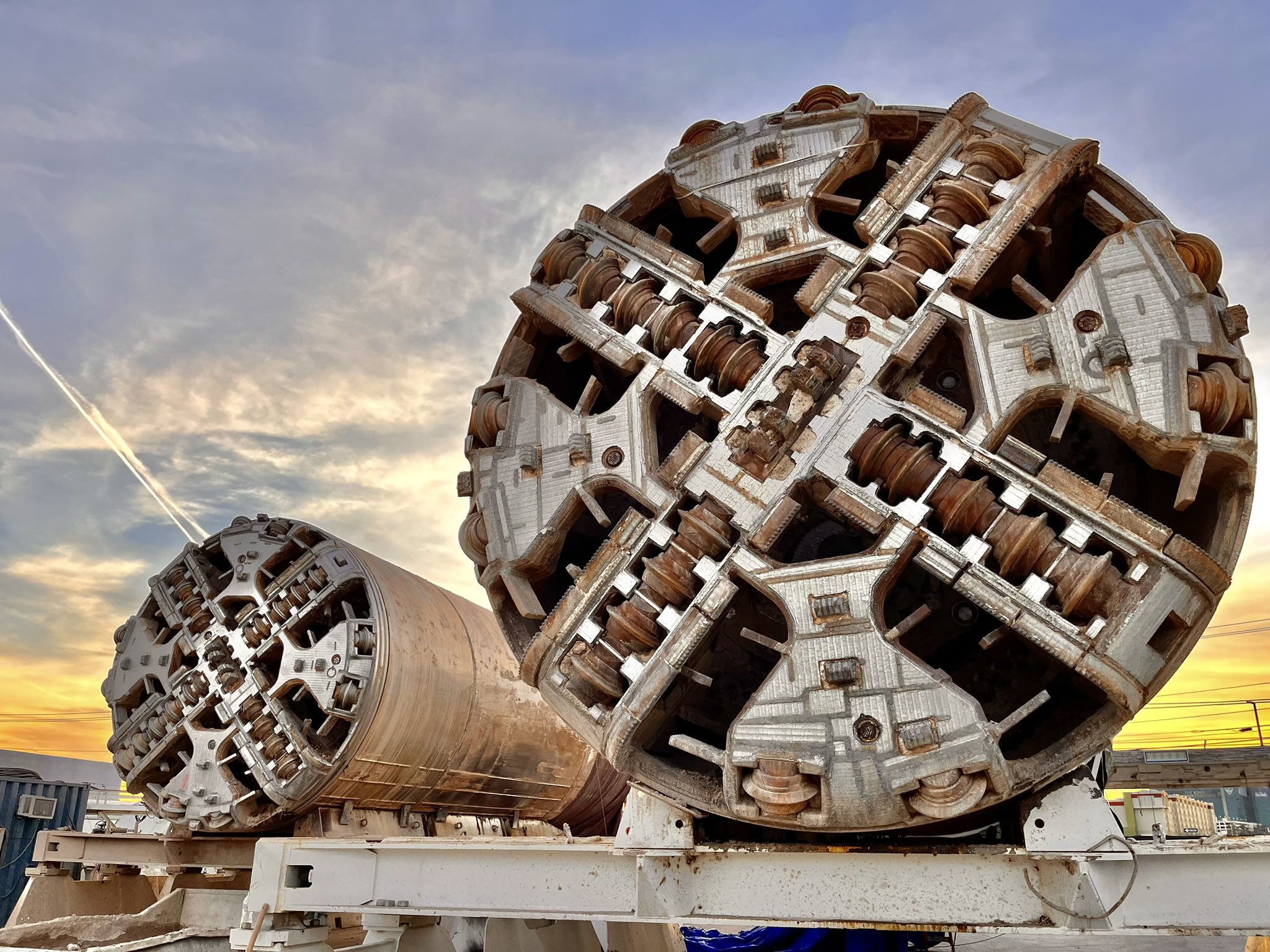

Several technical departures from conventional tunneling allow the Boring Company to lower its costs, from its smaller 12-foot diameter tunnels to its fully electric Prufrock machines that are designed to mine continuously with no personnel inside the tunnel and their capability to “porpoise” for easy launch and retrieval.

Tesla and Space CEO Elon Musk responded to the post on X, stating simply that “Tunnels are so underrated.”

The Boring Company has seen some momentum as of late, with the company recently signing a construction contract in Dubai and the Universal Orlando Loop progressing. Recent reports have also pointed to tunnels potentially being constructed to solve traffic congestion issues near the Giga Nevada area.

While The Boring Company’s tunnels have so far been used for Loop systems publicly for now, Elon Musk recently noted that the tunneling startup’s underground passages would not be limited only to ride-hailing vehicles.

In a reply to a post on X which discussed the specifications of the Music City Loop, Musk clarified that “any fully autonomous electric cars can use the tunnels.” This suggests that vehicles potentially running systems like FSD Supervised, even if they are not Teslas, could be used in systems like the Music City Loop in the future.

Elon Musk

SpaceX IPO could push Elon Musk’s net worth past $1 trillion: Polymarket

The estimates were shared by the official Polymarket Money account on social media platform X.

Recent projections have outlined how a potential $1.75 trillion SpaceX IPO could generate historic returns for early investors. The projections suggest the offering would not only become the largest IPO in history but could also result in unprecedented windfalls for some of the company’s key investors.

The estimates were shared by the official Polymarket Money account on social media platform X.

As noted in a Polymarket Money analysis, Elon Musk invested $100 million into SpaceX in 2002 and currently owns approximately 42% of the company. At a $1.75 trillion valuation following SpaceX’s potential $1.75 trillion IPO, that stake would be worth roughly $735 billion.

Such a figure would dramatically expand Musk’s net worth. When combined with his holdings in Tesla Inc. and other ventures, a public debut at that level could position him as the world’s first trillionaire, depending on market conditions at the time of listing.

The Bloomberg Billionaires Index currently lists Elon Musk with a net worth of $666 billion, though a notable portion of this is tied to his TSLA stock. Tesla currently holds a market cap of $1.51 trillion, and Elon Musk’s currently holds about 13% to 15% of the company’s outstanding common stock.

Founders Fund, co-founded by Peter Thiel, invested $20 million in SpaceX in 2008. Polymarket Money estimates the firm owns between 1.5% and 3% of the private space company. At a $1.75 trillion valuation, that range would translate to approximately $26.25 billion to $52.5 billion in value.

That return would represent one of the most significant venture capital outcomes in modern Silicon Valley history, with a growth of 131,150% to 262,400%.

Alphabet Inc., Google’s parent company, invested $900 million into SpaceX in 2015 and is estimated to hold between 6% and 7% of the private space firm. At the projected IPO valuation, that stake could be worth between $105 billion and $122.5 billion. That’s a growth of 11,566% to 14,455%.

Other major backers highlighted in the post include Fidelity Investments, Baillie Gifford, Valor Equity Partners, Bank of America, and Andreessen Horowitz, each potentially sitting on multibillion-dollar gains.