Investor's Corner

Tesla stock (TSLA) one week after the Q1 2016 Report

Post Q1 Report Action

The technical response of the stock market to last week’s Tesla Q1 2016 report has been mostly negative. The stock lost quite a bit since last week, standing at around $208 when I write this, but overall 12-month Analyst Price Targets have actually increased with the average raising from $253 to $277, indicating that the Top Analysts did not see the report as negatively as this past week’s market action.

This is a small sample of the reactions from Top Analysts, noting that none of them changed their position to BUY, SELL or HOLD.

Adam Jonas of Morgan Stanley, reiterated a BUY with $333 price target, commenting that “we forecast ~70k units in 2016 (vs. the reiterated guidance of 80-90k shipments), which is composed of ~16k Model X and ~54k Model S units. In 2Q, we forecast ~17k deliveries–inline with the outlook.”

Charlie Anderson of Dougherty resumed coverage of TSLA with a BUY and price target of $500, noting that “the focus coming out of the Q1 report is on managements decision to pull-forward its production goal of 500K vehicles from 2020 to 2018. While this aggressive schedule certainly increases the risk of nearer-term stumbles, it also significantly pulls forward the earnings power. Tesla has set a goal to produce 1MM vehicles by 2020, roughly 2x what most observers previously believed. Our view is that demand is not the question; it is solving the manufacturing challenges deftly as they come.”

Brian Johnson of Barclays reiterated a SELL with $165 price target.

Ryan Brinkman of J.P. Morgan reiterated a SELL with $185 price target, as he “Doubts Tesla Motors Can Meet Accelerated Production Target.”

Colin Rusch or Oppenheimer reiterated a BUY with $385 price target, indicating that “we believe the critical characteristic of TSLAs business model over the next 24 months will be operating leverage. We believe the company can achieve 15%+ incremental operating margins as it ramps the Model 3. We modeling TSLA reaching 500k vehicles in 2019 vs. the target of 2018, noting the company has a history of setting nearly unachievable goals. Effectively we are accelerating ramp by a year from our previous expectations, but calculate that if the company reaches its 500k vehicle target in 2018 and 1M in 2020, our EPS estimates will prove ~30% too low.”

See the table below from TipRanks (tipranks.com) for a complete summary of the current top analyst ratings.

Swing Trading TSLA using the MACD

This is the first post where I will start outlining techniques that traders may want to use when trading TSLA stock.

I am mostly a “swing trader”. Swing Trading is a short term trading method that can be used when trading stocks and options. Whereas Day Trading positions last less than one day, Swing Trading positions typically last two to six days, but may last as long as two weeks (for TSLA sometime six-seven weeks). Swing traders use technical analysis to look for stocks with short-term price momentum. These traders aren’t interested in the fundamental or intrinsic value of stocks, but rather in their price trends and patterns.

There are a number of technical indicators that swing traders use. Today I will cover the MACD. The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of prices. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. The Exponential Moving Average (EMA) is a type of moving average that is similar to a simple moving average, except that more weight is given to the latest data.

The good thing is that you really do not have to calculate any of these indicators yourself, as pretty much all trading platforms that I know of provide you with such indicators as an option when displaying the stock chart of a given security.

The following stock chart from Wall Street I/O shows the TSLA market data as “candlestick” (showing open, close, high and low of the day) for the past year, plus it also shows the MACD for the same period.

One technique that swing traders use is to enter a “long” trade when the MACD “crosses to the bulls”, and exit the trade when the MACD “crosses to the bears”. I have indicated these points in the chart for the huge run up between the February low and April high.

Micah Lamar is the CEO of Wall Street I/O (wallst.io), where together with his team of experts he helps people learn stock and option trading. Disclosure: I have been a subscriber to wallst.io for a few years.

This past weekend, Micah run a “MACD Validation” experiment on TSLA 1-year behavior up to last Friday close. The results are as follows.

Micah found that “if one had bought TSLA stock exactly a year ago, and held it for the full year, one would have incurred a $30 loss per share.

If one had bought and held TSLA stock while the MACD was bullish, one would be up $22 for the year.

If one had sold (short) TSLA stock while the MACD was bearish, one would be up $51 for the year.”

Someone trading both sides (long and short the stock) would be up a whopping $73, or a $30% gain.

Of course, trading the same entry and exit points based on the MACD with put or call options instead of stock would have resulted in returns 10 to 100 times or better than if just trading TSLA stock.

Micah indicates that “TSLA is a great stock for swing traders: the reason is that it has so much “beta.” A high beta indicates that a security is much more “volatile” than the rest of the market. Most high-tech stocks like TSLA have a beta of greater than 1, offering the possibility of a higher rate of return, but also posing more risk.

As far as where TSLA is today, it is still in “bearish” territory (as far as the MACD and other indicators are concerned), which for me it means that it is untouchable on long trades as “too risky”, and since I do not like to play on the downside for stocks of companies that are in my “buy what you know” list, I will not trade it again until the MACD crosses back to the bulls.

Investor's Corner

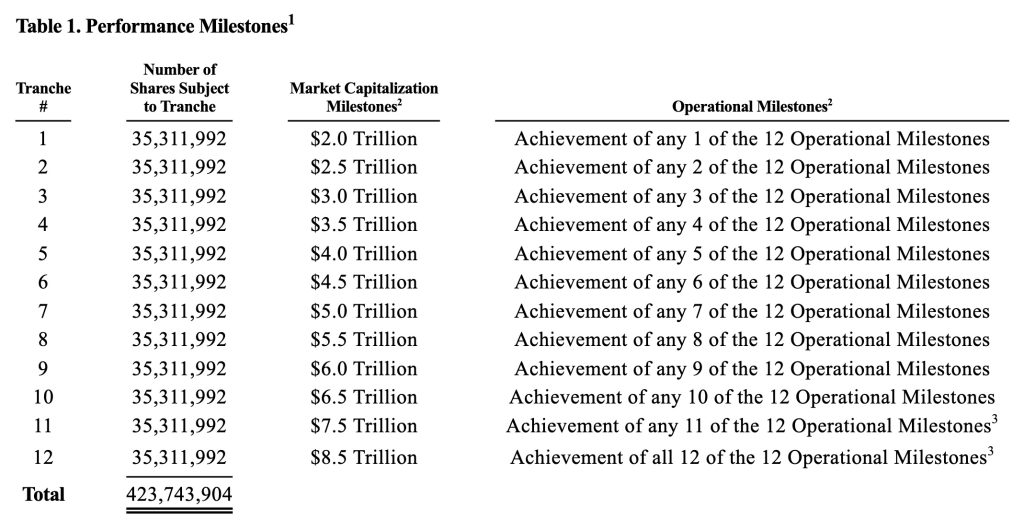

Elon Musk’s new pay plan ties trillionaire status to Tesla’s $8.5 trillion valuation

Shareholders are expected to vote on the proposal at the annual meeting on November 6.

Tesla’s board has proposed a new compensation package for CEO Elon Musk that could make him the world’s first trillionaire and Tesla the most valuable company in history.

The 2025 CEO Performance Award, outlined in a securities filing on Friday, would be worth up to $900 billion in Tesla stock (NASDAQ:TSLA) if the automaker achieves a series of aggressive performance and valuation goals, according to the New York Times.

Shareholders are expected to vote on the proposal at the annual meeting on November 6.

Tesla is aiming for an insane $8.5 trillion market cap

The package requires Musk to lift Tesla’s market capitalization from about $1.1 trillion today to $8.5 trillion over the next decade. At that level, Tesla would surpass every major public company in existence. Nvidia, currently the world’s most valuable firm, has a market cap of around $4.2 trillion today, as noted in a Motley Fool report. Microsoft and Apple follow at $3.8 and 3.6 trillion each, while Saudi Aramco is valued at around $1.5 trillion.

If Tesla achieves its $8.5 trillion target, it would be worth more than twice Nvidia’s present valuation and nearly eight times its current size. The compensation plan also requires Tesla’s operating profit to grow from $17 billion last year to $400 billion annually.

Elon Musk’s path to a trillionaire status

Apart from leading Tesla to become the world’s biggest company in history, Musk is also required to hit several product targets for the electric vehicle maker. These include the delivery of 20 million Tesla vehicles cumulatively, 10 million active FSD subscriptions, 1 million Tesla bots delivered, and 1 million Robotaxis in operation.

Tesla board chair Robyn Denholm and director Kathleen Wilson-Thompson said retaining Musk is “fundamental to Tesla achieving these goals and becoming the most valuable company in history.” If successful, the plan would raise Musk’s Tesla stake from 13% to about 25%, further consolidating his control. It would also result in the CEO earning $900 billion in TSLA stock, allowing him to effectvely become a trillionaire.

The proposal mirrors a 2018 compensation plan that was invalidated in Delaware court earlier this year in the way that it is focused on very aggressive targets and operational milestones. Tesla has since shifted its corporate registration to Texas, where challenges from potential activist shareholders are less of a risk.

Tesla’s SEC filing can be viewed below.

www-sec-gov-Archives-edgar-data-1318605-000110465925087598-tm252289-4_pre14a-htm… by Simon Alvarez

Investor's Corner

Shareholder group urges Nasdaq probe into Elon Musk’s Tesla 2025 CEO Interim Award

The SOC Investment Group represents pension funds tied to more than two million union members, many of whom hold shares in TSLA.

An investment group is urging Nasdaq to investigate Tesla (NASDAQ:TSLA) over its recent $29 billion equity award for CEO Elon Musk.

The SOC Investment Group, which represents pension funds tied to more than two million union members—many of whom hold shares in TSLA—sent a letter to the exchange citing “serious concerns” that the package sidestepped shareholder approval and violated compensation rules.

Concerns over Tesla’s 2025 CEO Interim Award

In its August 19 letter to Nasdaq enforcement chief Erik Wittman, SOC alleged that Tesla’s board improperly granted Musk a “2025 CEO Interim Award” under the company’s 2019 Equity Incentive Plan. That plan, the group noted, explicitly excluded Musk when it was approved by shareholders. SOC argued that the new equity grant effectively expanded the plan to cover Musk, a material change that should have required a shareholder vote under Nasdaq rules.

The $29 billion package was designed to replace Musk’s overturned $56 billion award from 2018, which the Delaware Chancery Court struck down, prompting Tesla to file an appeal to the Delaware Supreme Court. The interim award contains restrictions: Musk must remain in a leadership role until August 2027, and vested shares cannot be sold until 2030, as per a Yahoo Finance report.

Even so, critics such as SOC have argued that the plan does not have of performance targets, calling it a “fog-the-mirror” award. This means that “If you’re around and have enough breath left in you to fog the mirror, you get them,” stated Brian Dunn, the director of the Institute for Comprehension Studies at Cornell University.

SOC’s Tesla concerns beyond Elon Musk

SOC’s concerns extend beyond the mechanics of Musk’s pay. The group has long questioned the independence of Tesla’s board, opposing the reelection of directors such as Kimbal Musk and James Murdoch. It has also urged regulators to review Tesla’s governance practices, including past proposals to shrink the board.

SOC has also joined initiatives calling for Tesla to adopt comprehensive labor rights policies, including noninterference with worker organizing and compliance with global labor standards. The investment group has also been involved in webinars and resolutions highlighting the risks related to Tesla’s approach to unions, as well as labor issues across several countries.

Tesla has not yet publicly responded to SOC’s latest letter, nor to requests for comment.

The SOC’s letter can be viewed below.

Investor's Corner

Tesla investors may be in for a big surprise

All signs point toward a strong quarter for Tesla in terms of deliveries. Investors could be in for a surprise.

Tesla investors have plenty of things to be ecstatic about, considering the company’s confidence in autonomy, AI, robotics, cars, and energy. However, many of them may be in for a big surprise as the end of the $7,500 EV tax credit nears. On September 30, it will be gone for good.

This has put some skepticism in the minds of some investors: the lack of a $7,500 discount for buying a clean energy vehicle may deter many people from affording Tesla’s industry-leading EVs.

Tesla warns consumers of huge, time-sensitive change coming soon

The focus on quarterly deliveries, while potentially waning in terms of importance to the future, is still a big indicator of demand, at least as of now. Of course, there are other factors, most of them economic.

The big push to make the most of the final quarter of the EV tax credit is evident, as Tesla is reminding consumers on social media platforms and through email communications that the $7,500 discount will not be here forever. It will be gone sooner rather than later.

It appears the push to maximize sales this quarter before having to assess how much they will be impacted by the tax credit’s removal is working.

Delivery Wait Time Increases

Wait times for Tesla vehicles are increasing due to what appears to be increased demand for the company’s vehicles. Recently, Model Y delivery wait times were increased from 1-3 weeks to 4-6 weeks.

This puts extra pressure on consumers to pull the trigger on an order, as delivery must be completed by the cutoff date of September 30.

Delivery wait times may have gone up due to an increase in demand as consumers push to make a purchase before losing that $7,500 discount.

More People are Ordering

A post on X by notable Tesla influencer Sawyer Merritt anecdotally shows he has been receiving more DMs than normal from people stating that they’re ordering vehicles before the end of the tax credit:

Anecdotally, I’ve been getting more DMs from people ordering Teslas in the past few days than I have in the last couple of years. As expected, the end of the U.S. EV credit next month is driving a big surge in orders.

Lease prices are rising for the 3/Y, delivery wait times are… pic.twitter.com/Y6JN3w2Gmr

— Sawyer Merritt (@SawyerMerritt) August 13, 2025

It’s not necessarily a confirmation of more orders, but it could be an indication that things are certainly looking that way.

Why Investors Could Be Surprised

Tesla investors could see some positive movement in stock price following the release of the Q3 delivery report, especially if all signs point to increased demand this quarter.

We reported previously that this could end up being a very strong rebounding quarter for Tesla, with so many people taking advantage of the tax credit.

Whether the delivery figures will be higher than normal remains to be seen. But all indications seem to point to Q3 being a very strong quarter for Tesla.

-

News6 days ago

News6 days agoTesla is overhauling its Full Self-Driving subscription for easier access

-

Elon Musk1 week ago

Elon Musk1 week agoElon Musk shares unbelievable Starship Flight 10 landing feat

-

Elon Musk1 week ago

Elon Musk1 week agoElon Musk reveals when SpaceX will perform first-ever Starship catch

-

Elon Musk1 week ago

Elon Musk1 week agoSpaceX Starship Flight 10 was so successful, it’s breaking the anti-Musk narrative

-

Elon Musk2 days ago

Elon Musk2 days agoTesla’s next-gen Optimus prototype with Grok revealed

-

News4 days ago

News4 days agoTesla appears to be mulling a Cyber SUV design

-

News1 week ago

News1 week agoTesla expands crazy new lease deal for insane savings on used inventory

-

News7 days ago

News7 days agoTesla talks Semi ramp, Optimus, Robotaxi rollout, FSD with Wall Street firm

![TSLA analyst coverage [Source: TipRanks] TSLA analyst coverage [Source: TipRanks]](http://www.teslarati.com/wp-content/uploads/2016/05/TipRanks-1.png)