News

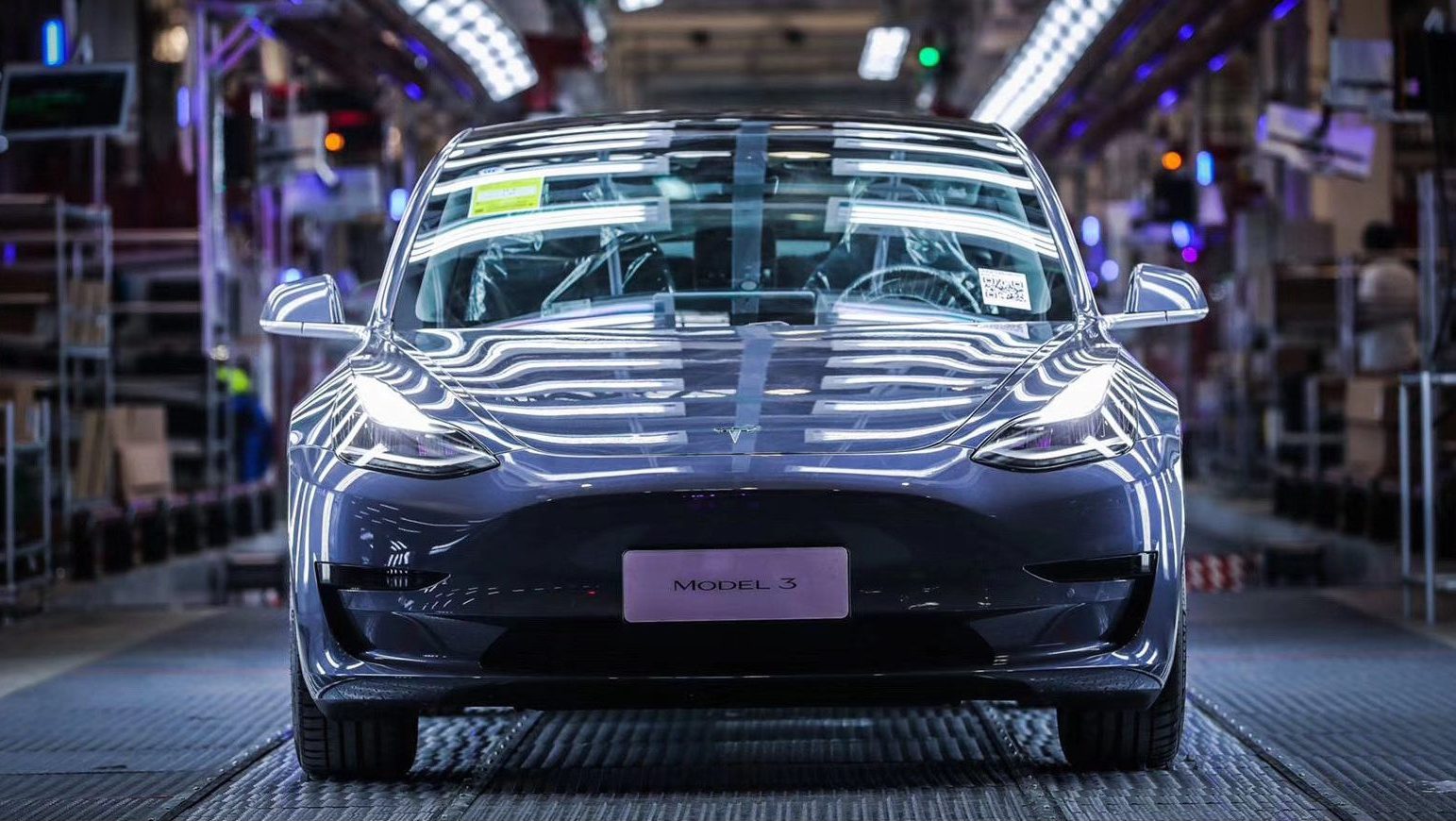

Tesla’s China-made Model 3 will be a cash cow for the automaker as margins set to improve even more

A new report by equity research firm suggests that Tesla’s gross margin for Made-in-China (MIC) Model 3 could increase to 40 percent or even higher, and with higher profit margins, the electric car manufacturer can create the conditions that will further help stimulate sales in the country.

The report published by China-based equity firm Chuancai Securities and shared with Teslarati by Tesla Model S/X owner and Twitter user Ray4Tesla, says that parts domestication will be key to achieve higher profit margins with the MIC Model 3.

A Chinese research paper I was reading shows the gross margin for MIC #Model3 is as high as 35% vs 20% for US-made Model 3s. Production efficiency will further improve margins. pic.twitter.com/gXGdzg7WjF

— Ray (@ray4tesla) January 15, 2020

“We assume that depending on the progress of Tesla’s parts domestication, the cost of raw materials will fall by 10%-20%. In this case, gross profit margin of Model 3 produced by the Chinese factory will reach more than 35%, which is much higher than the American factory by about 20% gross profit level,” the report reads. In October 2018, Tesla said that its Model 3 gross margins were more than 20 percent but this was adjusted when it decided to drop the price of the electric sedan to make it accessible to more US buyers.

The report also estimates that after the localization of parts, Tesla’s expenses for raw materials for the China-made Model 3 will drop by 10 to 20 percent. It also takes note of cheaper manufacturing costs and labor costs. Taking into account all of these factors, the researchers concluded that the total production cost may fall by 20-28 percent and thereby further improving profit margin.

This new report from China practically says that the MIC Model 3 has the potential to be its cash cow — read: high volume sales and higher profit margins. This is aside from the fact that Tesla CEO Elon Musk has also formally launched the Model Y program in the country during the event for the first public deliveries of the company’s mass-produced electric sedans. According to the report, buyers of the affordable SUV in the country might still enjoy preferential purchase tax, from which its smaller sibling was also exempted from.

Tesla has the potential to claim China, the biggest automotive market in the world, to be its strong foothold. If that happens, it can boost the possibility of sustained profitability for the brand that Musk wants to achieve.

With Musk planning to create an engineering and design center in China, it will not be a surprise if the Gigafactory 3 will play a key role in conquering potential markets in Asia and in pushing for the growth of the brand int its existing markets in the region.

The analysis of the researchers is consistent with earlier rumors that Tesla can further lower the price of the Model 3 once it sources parts, including expensive parts such as its battery, from local suppliers. For now, Tesla has lowered the price of the Model 3 in China to around $42,919 from the original price tag $50,000 as the new year kicked off, a move that practically undercut other brands such as BMW and Mercedes that offer vehicles in the same segment and the electric car manufacturer surely sparked more interest as showrooms in the country were filled with potential buyers.

At present, Tesla’s Gigafactory 3 in Shanghai already has a run rate of 3,000 units per week and plans to hit that production goal as more workers are added to the frontline.

News

Tesla to improve one of its best features, coding shows

According to the update, Tesla will work on improving the headlights when coming into contact with highly reflective objects, including road signs, traffic signs, and street lights. Additionally, pixel-level dimming will happen in two stages, whereas it currently performs with just one, meaning on or off.

Tesla is looking to upgrade its Matrix Headlights, a unique and high-tech feature that is available on several of its vehicles. The headlights aim to maximize visibility for Tesla drivers while being considerate of oncoming traffic.

The Matrix Headlights Tesla offers utilize dimming of individual light pixels to ensure that visibility stays high for those behind the wheel, while also being considerate of other cars by decreasing the brightness in areas where other cars are traveling.

Here’s what they look like in action:

- Credit: u/ObjectiveScratch | Reddit

- Credit: u/ObjectiveScratch | Reddit

As you can see, the Matrix headlight system intentionally dims the area where oncoming cars would be impacted by high beams. This keeps visibility at a maximum for everyone on the road, including those who could be hit with bright lights in their eyes.

There are still a handful of complaints from owners, however, but Tesla appears to be looking to resolve these with the coming updates in a Software Version that is currently labeled 2026.2.xxx. The coding was spotted by X user BERKANT:

🚨 Tesla is quietly upgrading Matrix headlights.

Software https://t.co/pXEklQiXSq reveals a hidden feature:

matrix_two_stage_reflection_dip

This is a major step beyond current adaptive high beams.

What it means:

• The car detects highly reflective objects

Road signs,… pic.twitter.com/m5UpQJFA2n— BERKANT (@Tesla_NL_TR) February 24, 2026

According to the update, Tesla will work on improving the headlights when coming into contact with highly reflective objects, including road signs, traffic signs, and street lights. Additionally, pixel-level dimming will happen in two stages, whereas it currently performs with just one, meaning on or off.

Finally, the new system will prevent the high beams from glaring back at the driver. The system is made to dim when it recognizes oncoming cars, but not necessarily objects that could produce glaring issues back at the driver.

Tesla’s revolutionary Matrix headlights are coming to the U.S.

This upgrade is software-focused, so there will not need to be any physical changes or upgrades made to Tesla vehicles that utilize the Matrix headlights currently.

Elon Musk

xAI’s Grok approved for Pentagon classified systems: report

Under the agreement, Grok can be deployed in systems handling classified intelligence analysis, weapons development, and battlefield operations.

Elon Musk’s xAI has signed an agreement with the United States Department of Defense (DoD) to allow Grok to be used in classified military systems.

Previously, Anthropic’s Claude had been the only AI system approved for the most sensitive military work, but a dispute over usage safeguards has reportedly prompted the Pentagon to broaden its options, as noted in a report from Axios.

Under the agreement, Grok can be deployed in systems handling classified intelligence analysis, weapons development, and battlefield operations.

The publication reported that xAI agreed to the Pentagon’s requirement that its technology be usable for “all lawful purposes,” a standard Anthropic has reportedly resisted due to alleged ethical restrictions tied to mass surveillance and autonomous weapons use.

Defense Secretary Pete Hegseth is scheduled to meet with Anthropic CEO Dario Amodei in what sources expect to be a tense meeting, with the publication hinting that the Pentagon could designate Anthropic a “supply chain risk” if the company does not lift its safeguards.

Axios stated that replacing Claude fully might be technically challenging even if xAI or other alternative AI systems take its place. That being said, other AI systems are already in use by the DoD.

Grok already operates in the Pentagon’s unclassified systems alongside Google’s Gemini and OpenAI’s ChatGPT. Google is reportedly close to an agreement that will result in Gemini being used for classified use, while OpenAI’s progress toward classified deployment is described as slower but still feasible.

The publication noted that the Pentagon continues talks with several AI companies as it prepares for potential changes in classified AI sourcing.

Elon Musk

Elon Musk denies Starlink’s price cuts are due to Amazon Kuiper

“This has nothing to do with Kuiper, we’re just trying to make Starlink more affordable to a broader audience,” Musk wrote in a post on X.

Elon Musk has pushed back on claims that Starlink’s recent price reductions are tied to Amazon’s Kuiper project.

In a post on X, Musk responded directly to a report suggesting that Starlink was cutting prices and offering free hardware to partners ahead of a planned IPO and increased competition from Kuiper.

“This has nothing to do with Kuiper, we’re just trying to make Starlink more affordable to a broader audience,” Musk wrote in a post on X. “The lower the cost, the more Starlink can be used by people who don’t have much money, especially in the developing world.”

The speculation originated from a post summarizing a report from The Information, which ran with the headline “SpaceX’s Starlink Makes Land Grab as Amazon Threat Looms.” The report stated that SpaceX is aggressively cutting prices and giving free hardware to distribution partners, which was interpreted as a reaction to Amazon’s Kuiper’s upcoming rollout and possible IPO.

In a way, Musk’s comments could be quite accurate considering Starlink’s current scale. The constellation currently has more than 9,700 satellites in operation today, making it by far the largest satellite broadband network in operation. It has also managed to grow its user base to 10 million active customers across more than 150 countries worldwide.

Amazon’s Kuiper, by comparison, has launched approximately 211 satellites to date, as per data from SatelliteMap.Space, some of which were launched by SpaceX’s Falcon 9 rocket. Starlink surpassed that number in early January 2020, during the early buildout of its first-generation network.

Lower pricing also aligns with Starlink’s broader expansion strategy. SpaceX continues to deploy satellites at a rapid pace using Falcon 9, and future launches aboard Starship are expected to significantly accelerate the constellation’s growth. A larger network improves capacity and global coverage, which can support a broader customer base.

In that context, price reductions can be viewed as a way to match expanding supply with growing demand. Musk’s companies have historically used aggressive pricing strategies to drive adoption at scale, particularly when vertical integration allows costs to decline over time.