News

Tesla nears $100 billion market cap, closes in on Volkswagen as 2nd most valuable automaker in world

Tesla quietly crept up the $100 billion market capitalization mark in extended trading hours on Tuesday. Tesla stock was pegged at $547.20 at the end of the trading day but saw an increase to $555 in after-hours trading, pushing the all-electric carmaker’s valuation to $100 billion.

This further widens Tesla’s lead as the most valuable automaker in the US. It also puts the Elon Musk-led electric car company close to dethroning Volkswagen ($100.59 billion) as the second most valuable car company in the world. Toyota currently holds the title as the world’s most valuable automaker at $232 billion.

The highly anticipated jump into the $100 billion threshold comes as Tesla shares soared more than 7 percent on Tuesday, following one analyst’s bullish predictions.

In a note to investors, New Street analyst Pierre Ferragu raised his 12-month price target to $800, up from an initial target of $530.

The analyst believes Tesla will be able to deliver 2 to 3 million cars annually by 2025 and anticipates “industry-leading margins” that will raise stock prices to $1,100 to $1,700 per share and propel Tesla’s market cap to $250 to $530 billion.

Tesla just traded as a $100 billion company for the first time (in after-hours trading) $tsla pic.twitter.com/tRfr3Q6aZk

— Tom Randall (@tsrandall) January 21, 2020

Most valuable automaker in the US

Tesla crossing the $100 billion barrier is the latest in a series of financial gains for the carmaker. It follows last week’s record-breaking achievement as Tesla surged past Ford’s record $81 billion valuation in 1999.

Although the numbers do not account for inflation and debt, this remains an impressive feat for Elon Musk, who led the company from its early days in 2003 to become the arguably most disruptive company in automotive history. Investors who have stayed with the carmaker since its initial public offering in 2010 have seen their investments increase by 1,100 percent.

Currently, Tesla’s valuation is near the value of the Big Three combined: Ford at $36.64 billion, General Motors at $49.99 billion, and Fiat-Chrysler at $21.38 billion.

Continued growth leading to gains

The most recent win comes hot on the heels of Tesla’s debut of the Made-in-China Model 3. Musk himself flew to Gigafactory 3 in Shanghai, China to personally deliver the first locally made Model 3 to the first Chinese customers. He also formally announced a Model Y program in the country.

Gigafactory 4 is also poised to rise in Brandenburg, Germany. Tesla recently announced its board of directors has approved the purchase contract for a 300-hectare property in Grunheide that will serve as the site for its fourth electric vehicle factory.

Tesla’s Q4 2019 report also spiked investor optimism as the company announced it has delivered 119,000 vehicles from October to December last year. This boosts Tesla’s annual deliveries to 367,500 vehicles in 2019, up by more than 50 percent from 2018.

News

Tesla Robotaxi ride-hailing without a Safety Monitor proves to be difficult

Tesla Robotaxi ride-hailing without a Safety Monitor is proving to be a difficult task, according to some riders who made the journey to Austin to attempt to ride in one of its vehicles that has zero supervision.

Last week, Tesla officially removed Safety Monitors from some — not all — of its Robotaxi vehicles in Austin, Texas, answering skeptics who said the vehicles still needed supervision to operate safely and efficiently.

BREAKING: Tesla launches public Robotaxi rides in Austin with no Safety Monitor

Tesla aimed to remove Safety Monitors before the end of 2025, and it did, but only to company employees. It made the move last week to open the rides to the public, just a couple of weeks late to its original goal, but the accomplishment was impressive, nonetheless.

However, the small number of Robotaxis that are operating without Safety Monitors has proven difficult to hail for a ride. David Moss, who has gained notoriety recently as the person who has traveled over 10,000 miles in his Tesla on Full Self-Driving v14 without any interventions, made it to Austin last week.

He has tried to get a ride in a Safety Monitor-less Robotaxi for the better part of four days, and after 38 attempts, he still has yet to grab one:

Wow just wow!

It’s 8:30PM, 29° out ice storm hailing & Tesla Robotaxi service has turned back on!

Waymo is offline & vast majority of humans are home in the storm

Ride 38 was still supervised but by far most impressive yet pic.twitter.com/1aUnJkcYm8

— David Moss (@DavidMoss) January 25, 2026

Tesla said last week that it was rolling out a controlled test of the Safety Monitor-less Robotaxis. Ashok Elluswamy, who heads the AI program at Tesla, confirmed that the company was “starting with a few unsupervised vehicles mixed in with the broader Robotaxi fleet with Safety Monitors,” and that “the ratio will increase over time.”

This is a good strategy that prioritizes safety and keeps the company’s controlled rollout at the forefront of the Robotaxi rollout.

However, it will be interesting to see how quickly the company can scale these completely monitor-less rides. It has proven to be extremely difficult to get one, but that is understandable considering only a handful of the cars in the entire Austin fleet are operating with no supervision within the vehicle.

News

Tesla gives its biggest hint that Full Self-Driving in Europe is imminent

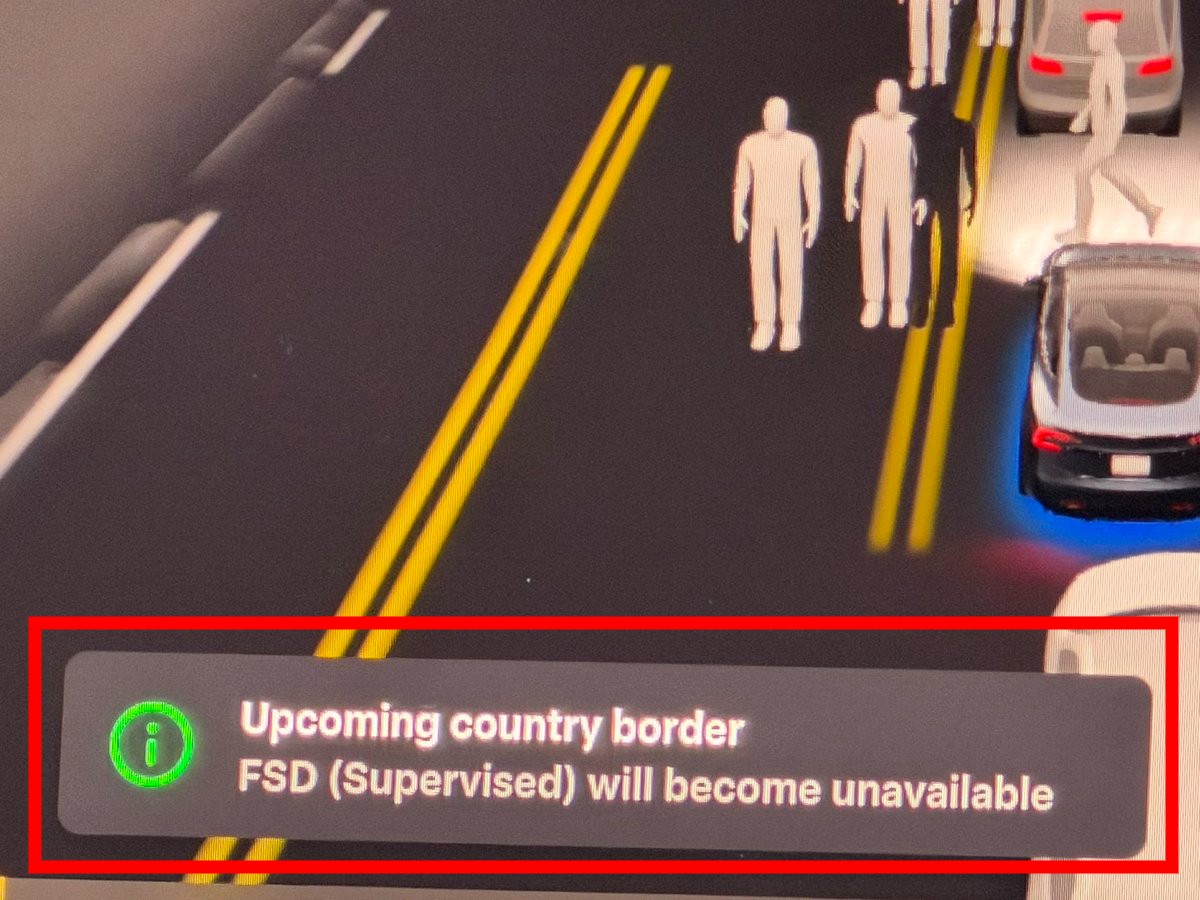

Tesla has given its biggest hint that Full Self-Driving in Europe is imminent, as a new feature seems to show that the company is preparing for frequent border crossings.

Tesla owner and influencer BLKMDL3, also known as Zack, recently took his Tesla to the border of California and Mexico at Tijuana, and at the international crossing, Full Self-Driving showed an interesting message: “Upcoming country border — FSD (Supervised) will become unavailable.”

FSD now shows a new message when approaching an international border crossing.

Stayed engaged the whole way as we crossed the border and worked great in Mexico! pic.twitter.com/bDzyLnyq0g

— Zack (@BLKMDL3) January 26, 2026

Due to regulatory approvals, once a Tesla operating on Full Self-Driving enters a new country, it is required to comply with the laws and regulations that are applicable to that territory. Even if legal, it seems Tesla will shut off FSD temporarily, confirming it is in a location where operation is approved.

This is something that will be extremely important in Europe, as crossing borders there is like crossing states in the U.S.; it’s pretty frequent compared to life in America, Canada, and Mexico.

Tesla has been working to get FSD approved in Europe for several years, and it has been getting close to being able to offer it to owners on the continent. However, it is still working through a lot of the red tape that is necessary for European regulators to approve use of the system on their continent.

This feature seems to be one that would be extremely useful in Europe, considering the fact that crossing borders into other countries is much more frequent than here in the U.S., and would cater to an area where approvals would differ.

Tesla has been testing FSD in Spain, France, England, and other European countries, and plans to continue expanding this effort. European owners have been fighting for a very long time to utilize the functionality, but the red tape has been the biggest bottleneck in the process.

Tesla Europe builds momentum with expanding FSD demos and regional launches

Tesla operates Full Self-Driving in the United States, China, Canada, Mexico, Puerto Rico, Australia, New Zealand, and South Korea.

Elon Musk

SpaceX Starship V3 gets launch date update from Elon Musk

The first flight of Starship Version 3 and its new Raptor V3 engines could happen as early as March.

Elon Musk has announced that SpaceX’s next Starship launch, Flight 12, is expected in about six weeks. This suggests that the first flight of Starship Version 3 and its new Raptor V3 engines could happen as early as March.

In a post on X, Elon Musk stated that the next Starship launch is in six weeks. He accompanied his announcement with a photo that seemed to have been taken when Starship’s upper stage was just about to separate from the Super Heavy Booster. Musk did not state whether SpaceX will attempt to catch the Super Heavy Booster during the upcoming flight.

The upcoming flight will mark the debut of Starship V3. The upgraded design includes the new Raptor V3 engine, which is expected to have nearly twice the thrust of the original Raptor 1, at a fraction of the cost and with significantly reduced weight. The Starship V3 platform is also expected to be optimized for manufacturability.

The Starship V3 Flight 12 launch timeline comes as SpaceX pursues an aggressive development cadence for the fully reusable launch system. Previous iterations of Starship have racked up a mixed but notable string of test flights, including multiple integrated flight tests in 2025.

Interestingly enough, SpaceX has teased an aggressive timeframe for Starship V3’s first flight. Way back in late November, SpaceX noted on X that it will be aiming to launch Starship V3’s maiden flight in the first quarter of 2026. This was despite setbacks like a structural anomaly on the first V3 booster during ground testing.

“Starship’s twelfth flight test remains targeted for the first quarter of 2026,” the company wrote in its post on X.