News

Tesla Battery Day can mean doomsday for legacy carmakers shifting to electric

Tesla is expected to hold its Battery Day in April as Elon Musk announced during the company’s Q4 earnings call. The chief executive said the company has a “compelling story” to tell about things that can “blow people’s minds.” These statements do not only pique the interest of the electric vehicle community; they also hint of updates that can spell disaster for legacy car manufacturers trying to catch up with Tesla in the electric vehicle market.

Batteries are key to staying on top of the electric vehicle segment and Tesla is the leader of the pack when it comes to batteries and energy efficiency. This has been validated by organizations such as Consumer Reports and even by competitors who go deep into their pockets and go as far as cutting their workforces to catch Tesla in terms of hardware, software, and battery technology.

Come Tesla Battery Day, the obvious would be made more obvious. Tesla could further widen the gap and set itself apart from the rest, not just as the maker of the Model 3, Model Y, Cybertruck or other vehicles in its lineup but as an energy company.

Mass Production Of Cheaper Batteries

Batteries are among the most expensive components of an electric vehicle. This is true for Tesla and other electric vehicle manufacturers. With pricey batteries, car manufacturers cannot lower prices of their vehicles and therefore cannot encourage the mass adoption of zero-emission cars.

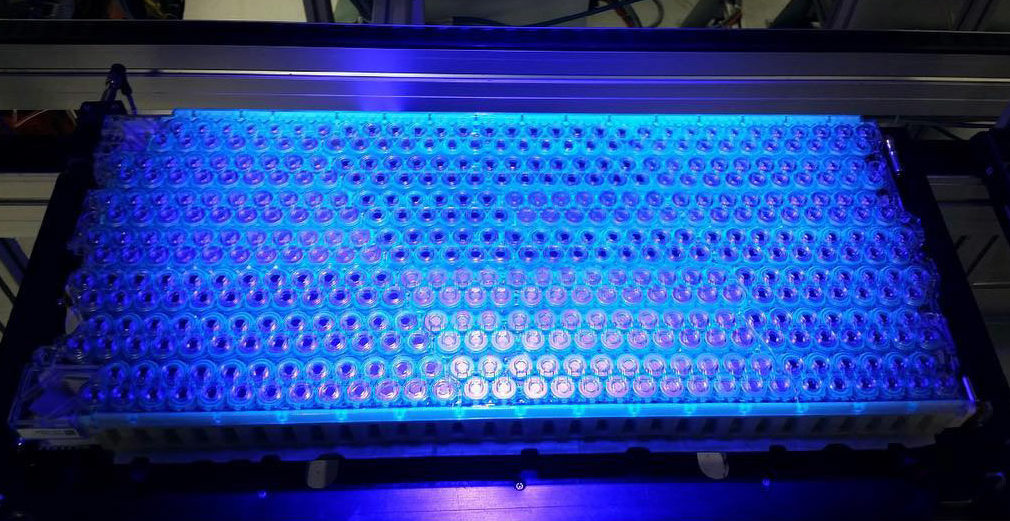

Tesla has reportedly been running its “Roadrunner” secret project that can lead to mass production of battery cells at $100/kWh. According to rumors, Tesla already has a pilot manufacturing line in its Fremont facility that can produce higher-density batteries using technology advancements developed in-house and gained through the Maxwell acquisition. With a $100/kWh battery, the prices of Tesla’s vehicles can be competitive even without government subsidies.

Aside from the Roadrunner project, Tesla has also been setting itself up to succeed in the battery game and dominate the market with its partnerships. It has a long relationship with Panasonic that helped it manufacture batteries in Giga Nevada, but has also signed battery supply agreements with LG Chem and CATL in China.

Battery prices have been going down significantly in the last decade. According to BloombergNEF, the cost of batteries dropped by 13% last year. From $1,100/kWh in 2010, the price went down to around $156.kWh in 2019. This is predicted to come close to the target $100/kWh by 2023. If Tesla achieves the $100/kWH cost sooner than the rest, it will give the company a massive advantage over its competitors and that will eventually lead to better profit margins.

Aside from cheaper batteries, the increased battery production capacity is also key in bringing products such as the all-electric Cybertruck and Tesla Semi to life.

“The thing we’re going to be really focused on is increasing battery production capacity because that’s very fundamental because if you don’t improve battery production capacity, then you end up just shifting unit volume from one product to another and you haven’t actually produced more electric vehicles… make sure we get a very steep ramp in battery production and continue to improve the cost per kilowatt-hour of the batteries,” Musk said during the Q4 2019 earnings call.

Enhanced Tesla Batteries

Tesla already has good batteries through its years of research, experimentation, and partnerships with battery producers. It has invested a good amount of money and effort to make sure it’s leading the battery game.

This advantage is made very clear on how Tesla was able to produce the most efficient electric SUV today in the form of the soon-to-be-released Model Y crossover with an EPA rating of 315 miles per single charge versus the Porsche Taycan with a range of around 200 miles.

With the acquired technologies from companies such as Maxwell and recently a possible purchase of a lithium-ion battery cell specialist startup in Colorado, Tesla demonstrates it’s not stopping its efforts to perfect its battery technology. Maxwell manufactures battery components and ultracapacitors and it’s just a matter of time before Tesla makes use of these technologies.

When asked about Maxwell’s ultracapacitor technology during the Q4 2019 earnings call, Musk said, “It’s an important piece of the puzzle.”

Musk also referenced the Maxwell acquisition during an extensive interview at the Third Row Podcast. “It’s kind of a big deal. Maxwell has a bunch of technologies that if they are applied in the right way I think can have a very big impact,” Musk said during a Third Row Podcast interview.

There are rumors out of China claiming that Tesla may come up with a battery that combines the best traits of Maxwell’s supercapacitors and dry electrode technologies. This could mean batteries that could charge faster, pack more energy density, and last longer.

Controlling Battery Supply

Knowing what works and what doesn’t for electric car batteries puts Tesla on top of the game. Of course, add to that what could be the best battery management system that makes Tesla vehicles among the most efficient if not the best in utilizing their batteries. With the advantage on hardware and software fronts, the thought of Tesla becoming a battery supplier is far from being a crazy idea.

Its competitors such as Audi and Jaguar have recently expressed concerns about their battery supplies as they both depend on LG Chem. Tesla– aside from its partnerships with Panasonic, LG Chem, and CATL — pushes the limit to develop its new battery cells in-house and that opens up a lot of possibilities for Tesla as a business.

“It would be consistent with the mission of Tesla to help other car companies with electric vehicles on the battery and powertrain front, possibly on other fronts. So it’s something we’re open to. We’re definitely open to supplying batteries and powertrains and perhaps other things to other car companies,” Musk was quoted as saying.

Recent job postings for a cell development engineer and equipment development engineers suggest that Tesla might actually be considering the idea of introducing a battery line of its own. But of course, the next-generation batteries would be first used for its vehicle lineup. Once it meets that demand and hits economies of scale, one can only imagine how Tesla could play the important role of supplying batteries to other carmakers.

Whether Tesla would announce cheaper batteries, enhanced electric car batteries, or give updates about its efforts, Battery Day in April will most definitely be worth the wait. For other car manufacturers, time would pause during that day as they listen to what Elon Musk and his team will say. And most likely, after the company talk, other car manufacturers will have to go back to their drawing boards once more in an attempt to catch up.

News

Tesla Semi pricing revealed after company uncovers trim levels

This is a step up from the prices that were revealed back in 2017, but with inflation and other factors, it is no surprise Tesla could not come through on the numbers it planned to offer nine years ago. When the Semi was unveiled in November 2017, Tesla had three pricing levels:

Tesla Semi pricing appears to have been revealed after the company started communicating with the entities interested in purchasing its all-electric truck. The pricing details come just days after Tesla revealed it planned to offer two trim levels and uncovered the specs of each.

After CEO Elon Musk said the Semi would enter volume production this year, Tesla revealed trim levels shortly thereafter. Offering a Standard Range and a Long Range trim will fit the needs of many companies that plan to use the truck for local and regional deliveries.

Tesla Semi lines up for $165M in California incentives ahead of mass production

It will also be a good competitor to the all-electric semi trucks already available from companies like Volvo.

With the release of specs, Tesla helped companies see the big picture in terms of what the Semi could do to benefit their business. However, pricing information was not available.

A new report from Electrek states that Tesla has been communicating with those interested companies and is pricing the Standard Range at $250,000 per unit, while the Long Range is priced at $290,000. These prices come before taxes and destination fees.

$TSLA – TESLA IS QUOTING $290,000 FOR ITS 500-MILES ELECTRIC SEMI TRUCK – ELECTREK

— *Walter Bloomberg (@DeItaone) February 10, 2026

This is a step up from the prices that were revealed back in 2017, but with inflation and other factors, it is no surprise Tesla could not come through on the numbers it planned to offer nine years ago. When the Semi was unveiled in November 2017, Tesla had three pricing levels:

- $150,000 for a 300-mile range version

- $180,000 for a 500-mile range version

- $200,000 for a limited “Founders Series” edition; full upfront payment required for priority production and limited to just 1,000 units

Tesla has not officially released any specific information regarding pricing on the Semi, but it is not surprising that it has not done so. The Semi is a vehicle that will be built for businesses, and pricing information is usually reserved for those who place reservations. This goes for most products of this nature.

The Semi will be built at a new, dedicated production facility in Sparks, Nevada, which Tesla broke ground on in 2024. The factory was nearly complete in late 2025, and executives confirmed that the first “online builds” were targeted for that same time.

Meaningful output is scheduled for this year, as Musk reiterated earlier this week that it would enter mass production this year. At full capacity, the factory will build 50,000 units annually.

News

Tesla executive moves on after 13 years: ‘It has been a privilege to serve’

“It is challenging to encapsulate 13 years in a single post. The journey at Tesla has been one of continuous evolution. From the technical intricacies of designing, building, and operating one of the world’s largest AI clusters to impactful contributions in IT, Security, Sales, and Service, it has been a privilege to serve,” Jegannathan said in the post.

Tesla executive Raj Jegannathan is moving on from the company after 13 years, he announced on LinkedIn on Monday.

“It is challenging to encapsulate 13 years in a single post. The journey at Tesla has been one of continuous evolution. From the technical intricacies of designing, building, and operating one of the world’s largest AI clusters to impactful contributions in IT, Security, Sales, and Service, it has been a privilege to serve,” Jegannathan said in the post.

After starting as a Senior Staff Engineer in Fremont back in November 2012, Jegannathan slowly worked his way through the ranks at Tesla. His most recent role was Vice President of IT/AI Infrastructure, Business Apps, and Infosec.

However, it was reported last year that Jegannathan had taken on a new role, which was running the North American sales team following the departure of Troy Jones, who had held the position previously.

While Jegannathan’s LinkedIn does not mention this position specifically, it seemed to be accurate, considering Tesla had not explicitly promoted any other person to the role.

It is a big loss for Tesla, but not a destructive departure. Jegannathan was one of the few company executives who answered customer and fan questions on X, a unique part of the Tesla ownership experience.

Tesla to offer Full Self-Driving gifting program: here’s how it will work

It currently remains unclear if Jegannathan was removed from the position or if he left under his own accord.

“As I move on, I do so with a full heart and excitement for what lies ahead. Thank you, Tesla, for this wonderful opportunity!” he concluded.

The departure marks a continuing trend of executives leaving the company, as the past 24 months have seen some significant turnover at the executive level.

Tesla has shown persistently elevated executive turnover over the past two years, as names like Drew Baglino, Rohan Patel, Rebecca Tinucci, Daniel Ho, Omead Afshar, Milan Kovac, and Siddhant Awasthi have all been notable names to exit the company in the past two years.

There are several things that could contribute to this. Many skeptics will point to Elon Musk’s politics, but that is not necessarily the case.

Tesla is a difficult, but rewarding place to work. It is a company that requires a lot of commitment, and those who are halfway in might not choose to stick around. Sacrificing things like time with family might not outweigh the demands of Tesla and Musk.

Additionally, many of these executives have made a considerable amount of money thanks to stock packages the company offers to employees. While many might be looking for new opportunities, some might be interested in an early retirement.

Tesla is also in the process of transitioning away from its most notable division, automotive. While it still plans to manufacture cars in the millions, it is turning more focus toward robotics and autonomy, and these plans might not align with what some executives might want for themselves. There are a wide variety of factors in the decision to leave a job, so it is important not to immediately jump to controversy.

News

Lemonade launches Tesla FSD insurance program in Oregon

The program was announced by Lemonade co-founder Shai Wininger on social media platform X.

Tesla drivers in Oregon can now receive significant insurance discounts when using FSD, following the launch of Lemonade’s new Autonomous Car insurance program.

The program was announced by Lemonade co-founder Shai Wininger on social media platform X.

Lemonade launches FSD-based insurance in Oregon

In a post on X, Wininger confirmed that Lemondade’s Autonomous Car insurance product for Tesla is now live in Oregon. The program allows eligible Tesla owners to receive roughly 50% off insurance costs for every mile driven using Tesla’s FSD system.

“And… we’re ON. @Lemonade_Inc’s Autonomous Car for @Tesla FSD is now live in Oregon. Tesla drivers in Oregon can now get ~50% off their Tesla FSD-driven miles + the best car insurance experience in the US, bar none,” Wininger wrote in his post.

As per Lemonade on its official website, the program is built on Tesla’s safety data, which indicates that miles driven using FSD are approximately twice as safe as those driven manually. As a result, Lemonade prices those miles at a lower rate. The insurer noted that as FSD continues to improve, associated discounts could increase over time.

How Lemonade tracks FSD miles

Lemonade’s FSD discount works through a direct integration with Tesla vehicles, enabled only with a driver’s explicit permission. Once connected, the system distinguishes between miles driven manually and those driven using FSD, applying the discount automatically to qualifying miles.

There is no minimum FSD usage requirement. Drivers who use FSD occasionally still receive discounted rates for those miles, while non-FSD miles are billed at competitive standard rates. Lemonade also emphasized that coverage and claims handling remain unchanged regardless of whether a vehicle is operating under manual control or FSD at the time of an incident.

The program is currently available only to Teslas equipped with Hardware 4 or newer, running firmware version 2025.44.25.5 or later. Lemonade also allows policyholders to bundle Tesla insurance with renters, homeowners, pet, or life insurance policies for additional savings.