Investor's Corner

[Updated] Insider reveals possible SpaceX IPO, Tesla shareholders will reportedly have early access

SpaceX is preparing to IPO this year, according to a leaked report posted to a trading forum and tipped off to Teslarati. A user by the name of Jushuatree provides very specific detail in what will likely be the most anticipated and talked about IPO in the last decade.

Updated: SpaceX President Gwynne Shotwell issued a statement confirming that there are no plans for a SpaceX initial public offering, contrary to Empire Capital’s original communication to its investors.

Updated: Teslarati was able to connect with Empire Capital Partners via phone call and speak to a representative in regards to the reported email sent by the firm. Empire Capital Partners confirmed the email, however also qualified it by saying they were reaching out to clients floating the idea of a SpaceX IPO in an attempt to gather more interest from clients in Tesla, Inc. They do not have any evidence of SpaceX preparing for an IPO, and they believed the best way to gain potential early interest is through an investment in Tesla.

The post reveals that Empire Capital Partners, a hedge fund focused on the technology sector, is soliciting interest in a pre-IPO for SpaceX and telling investors that the company has positioned a large stake in Tesla. Reportedly, Tesla investors will have exclusive early access to buy into the “Biggest opportunity of the decade” as soon as the initial public offering is released.

While news of a SpaceX IPO will likely trigger mass interest from institutional investors and Tesla shareholders, it’s important to note that a long process awaits before the Elon Musk-backed space company goes public. SpaceX has not yet filed an S-1 filing with the U.S. Securities and Exchange Commission which can take upwards of 30 days to review, not including any time required for additional amendments made to the filing. The S-1 filing allows the company to submit financial information to the SEC ahead of launching on the public markets. Companies looking to make an initial public offering then proceed with a “roadshow” to convince institutional investors to invest in the company. After that, the company would set the pricing of the IPO and begin the offering.

[Update: Empire Capital Partners, in fact, has no relation with a hedge fund run by Scott Fine and Peter Richards. The compay’s official entity is Empire Capital GP, LLC]

Empire Capital Partners is a global asset manager, based in Connecticut, with $1.13B in assets and was founded in 2005. ECP was founded by Scott A. Fine and Peter J. Richards, and they have participated in several large IPOs including Box, Square, Twitter, Fitbit, and Esty. The company lists SpaceX as a partner on their website and a featured investment that is “live” to their customers.

According to the insider note posted to Sharetrader, ECP has a “10-year history of substantial financial investment” with SpaceX. The note indicates that the hedge fund has been working on the deal for the past 18-months and looking forward to presenting “the biggest pre-IPO opportunity of 2017, maybe even the decade” to its investors.

“Empire Capital Partners is proud to present to you, the fantastic opportunity, in which you are able to take full advantage by getting involved at the ground level. This is sure to be the biggest pre-IPO opportunity of 2017, maybe even the decade. SpaceX is the brainchild of Elon Musk, a highly undervalued company founded in 2002. SpaceX raised $1 billion from Google Inc. and Fidelity Ventures in January 2015. This investment accounts for less than 10% of the company’s estimated value, conservatively between $10 and $12 Billion US Dollars.” reads the email sent to Joshuatree.

SpaceX will list on the NYSE, while Tesla is listed on the NASDAQ. Tesla’s IPO in 2010 went for $17 per share and raised over $226M. Tesla has since raised several billion dollars from the public markets since, including $1.4B in March this year, and continues to see strong demand from investors.

Musk stated in 2015 that a SpaceX IPO would be unlikely in the future, stating, “It will go public once we have regular flights to Mars.” Since then, Musk has seen incredible success in the public markets. Tesla continues to set record highs and currently worth over $51B, becoming one of the largest automakers in the world. Additionally, the overall conditions in the market are at near all-time highs – a prime condition for a SpaceX IPO.

SpaceX was founded in 2002 by Elon Musk and has since risen to become a multi-billion dollar company with over 5,000 employees. The company has completed dozens of flights over the past couple of years and landed several lucrative contracts with NASA, The Department of Defense, SES, and Iridium. Outside of SpaceX’s current operations, Musk has even larger plans for the company. Musk revealed in June 2016 that SpaceX intends to build a rocket capable of reaching Mars and transporting large masses of people. Called, Interplanetary Transport System (ITS), SpaceX is looking to build a 40-story tall re-useable rocket capable of carrying hundreds of people to the red planet. The company has lofty goals to start testing the ITS rocket after 2020 but requires significant funding for the program. At its inception, Elon Musk injected roughly $100M in capital into the company.

We’ve provided a copy of the original e-mail tipped off to Teslarati and reportedly sent by Empire Capital Partners to its clients.

We are currently positioning the bulk of our clients into ‘Tesla Motors Inc.’ a company trading on the NASDAQ in New York under the trading symbol ‘TSLA.’ The company has an ancillary company preparing for a formal listing in the New York Stock Exchange, as an IPO (Initial Public Offering) called SPACE X. The reason we are putting all our preferred clients into TESLA; is what we know. Not only is TESLA going to show solid gains in the short term – yielding clients anywhere upwards of 20%. We have insight that the SPACE X IPO will be the most lucrative, and sought after IPO of 2017! Elon Musk, the founder of PayPal, and CEO of Tesla, Solar City and Space X has announced – the existing shareholders of Tesla will have exclusive option to buy into the Initial Public Offering of Space X as soon as they are released. Elon Musk likes to take care of his own. We have bought an institutional position in TESLA and are using the shares that we have acquired to bring new clients on board at a discount, in order to show them how Empire Capital Partners can deliver in 2017. Our goal is simple. We want to show you the power of information and get you involved in the Space X IPO. The minimum investment into TESLA is $10,000.00 USD and that would allow you to take advantage of the Initial Public Offering of SPACE X once it is announced. You can find additional information about TESLA at http://www.tesla.com

Empire Capital Partners has, with SpaceX, a 10 year history of substantial financial investment. We have spent the last 18 months in analytical research having crossed all the T’s and dotted all the I’s.

Empire Capital Partners is proud to present to you, the fantastic opportunity, in which you are able to take full advantage by getting involved at the ground level. This is sure to be the biggest pre-IPO opportunity of 2017, maybe even the decade. SpaceX is the brainchild of Elon Musk, a highly undervalued company founded in 2002. SpaceX raised $1 billion from Google Inc. and Fidelity Ventures in January 2015. This investment accounts for less than 10% of the company’s estimated value, conservatively between $10 and $12 Billion US Dollars.

Although SpaceX is known by the general public for its work on reusable rockets, the well-known giant Google has other interests Google’s interest peaked with Musk’s recent announcement when he outlined a plan for a global communications system that would use satellites to beam low-cost internet around the world.

Elon exclaimed, “Larger than anything that has been talked about to date,” He added, “at least five years and $15 billion to build and will implement 700 tiny satellites 750 miles above the Earth.” Google has long had similar ambitions itself by spreading internet around the world, including to remote regions. Google would then boost the number of people who have access to its services and of course all the extra revenue that comes with it! SpaceX points out that two thirds of the world have no access at all. It’s why we’re so focused on new technologies. New technologies that have the potential to bring hundreds of millions more people online in the coming years.”

Facebook and Google have already been working with balloons and drones trying to figure out how to spread Internet access. The internet space race is on! With Google heavily investing such large amounts into SpaceX, TALK ABOUT A WINNING COMBINATION! GOOGLE AND ELON MUSK! Now might be the time to sell those Facebook shares and back SpaceX by investing into the only clear winner of that race.

Even combining Google and SpaceX’s achievements and technologies, there are still a lot of big questions and challenges around how Musk’s satellite vision will work. Another big challenge would be installing ground-based antennas and computer terminals to receive the satellite signals. One thing that you can count on, the sure fire bet!

IF ELON MUSK PUTS HIS MIND AND MONEY INTO IT. IT WILL HAPPEN!

Fidelity invested in SpaceX in January 2015, putting up $16.75 million to join Google in a $1Billion investment. Fidelity now values its SpaceX stake at $19.25 million, a 15% increase. SpaceX said the two new additional investors owned just under 10% of the company. Google put the vast majority of cash into SpaceX’s billion-dollar financing round — $900 million for a 7.5% stake in the company. That implies SpaceX’s new valuation is $12 billion and puts the company ahead of companies like Dropbox, Snapchat and Airbnb, but behind Xiaomi, Uber and Palantir.

As a private company, SpaceX’s financials are fairly opaque, it has booked as much as $7 billion in future revenue from 60 commercial launch bookings over the next several years, and last year won a $2.6 billion contract to build the Dragon 2 and transport astronauts to the International Space Station. It also is bidding for a second contract to ferry cargo to the International Space Station (ISS), which is expected to be worth hundreds of millions of dollars.

SpaceX now ranks fourth on The Wall Street Journal’s list of billion-dollar private companies, securing an easy $12 Billion valuation.

SpaceX’s value exceeds that of rivals. United Launch Alliance, a key SpaceX competitor in the US, is reportedly the subject of a $2 billion takeover bid by the space firm Aerojet. But ULA has older technology and less commercial business than SpaceX. Arianespace, the European private launch contractor, was valued between $340 and $640 million as France prepared to sell its stake in the firm this summer, but it does not manufacture its own rockets.

Elon Musk

Tesla analyst issues stern warning to investors: forget Trump-Musk feud

A Tesla analyst today said that investors should not lose sight of what is truly important in the grand scheme of being a shareholder, and that any near-term drama between CEO Elon Musk and U.S. President Donald Trump should not outshine the progress made by the company.

Gene Munster of Deepwater Management said that Tesla’s progress in autonomy is a much larger influence and a significantly bigger part of the company’s story than any disagreement between political policies.

Munster appeared on CNBC‘s “Closing Bell” yesterday to reiterate this point:

“One thing that is critical for Tesla investors to remember is that what’s going on with the business, with autonomy, the progress that they’re making, albeit early, is much bigger than any feud that is going to happen week-to-week between the President and Elon. So, I understand the reaction, but ultimately, I think that cooler heads will prevail. If they don’t, autonomy is still coming, one way or the other.”

BREAKING: GENE MUNSTER SAYS — $TSLA AUTONOMY IS “MUCH BIGGER” THAN ANY FEUD 👀

He says robotaxis are coming regardless ! pic.twitter.com/ytpPcwUTFy

— TheSonOfWalkley (@TheSonOfWalkley) July 2, 2025

This is a point that other analysts like Dan Ives of Wedbush and Cathie Wood of ARK Invest also made yesterday.

On two occasions over the past month, Musk and President Trump have gotten involved in a very public disagreement over the “Big Beautiful Bill,” which officially passed through the Senate yesterday and is making its way to the House of Representatives.

Musk is upset with the spending in the bill, while President Trump continues to reiterate that the Tesla CEO is only frustrated with the removal of an “EV mandate,” which does not exist federally, nor is it something Musk has expressed any frustration with.

In fact, Musk has pushed back against keeping federal subsidies for EVs, as long as gas and oil subsidies are also removed.

Nevertheless, Ives and Wood both said yesterday that they believe the political hardship between Musk and President Trump will pass because both realize the world is a better place with them on the same team.

Munster’s perspective is that, even though Musk’s feud with President Trump could apply near-term pressure to the stock, the company’s progress in autonomy is an indication that, in the long term, Tesla is set up to succeed.

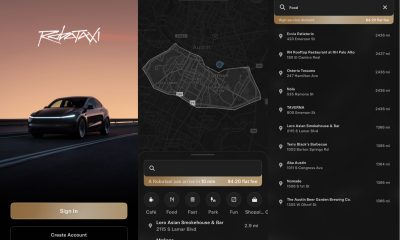

Tesla launched its Robotaxi platform in Austin on June 22 and is expanding access to more members of the public. Austin residents are now reporting that they have been invited to join the program.

Elon Musk

Tesla surges following better-than-expected delivery report

Tesla saw some positive momentum during trading hours as it reported its deliveries for Q2.

Tesla (NASDAQ: TSLA) surged over four percent on Wednesday morning after the company reported better-than-expected deliveries. It was nearly right on consensus estimations, as Wall Street predicted the company would deliver 385,000 cars in Q2.

Tesla reported that it delivered 384,122 vehicles in Q2. Many, including those inside the Tesla community, were anticipating deliveries in the 340,000 to 360,000 range, while Wall Street seemed to get it just right.

Tesla delivers 384,000 vehicles in Q2 2025, deploys 9.6 GWh in energy storage

Despite Tesla meeting consensus estimations, there were real concerns about what the company would report for Q2.

There were reportedly brief pauses in production at Gigafactory Texas during the quarter and the ramp of the new Model Y configuration across the globe were expected to provide headwinds for the EV maker during the quarter.

At noon on the East Coast, Tesla shares were up about 4.5 percent.

It is expected that Tesla will likely equal the number of deliveries it completed in both of the past two years.

It has hovered at the 1.8 million mark since 2023, and it seems it is right on pace to match that once again. Early last year, Tesla said that annual growth would be “notably lower” than expected due to its development of a new vehicle platform, which will enable more affordable models to be offered to the public.

These cars are expected to be unveiled at some point this year, as Tesla said they were “on track” to be produced in the first half of the year. Tesla has yet to unveil these vehicle designs to the public.

Dan Ives of Wedbush said in a note to investors this morning that the company’s rebound in China in June reflects good things to come, especially given the Model Y and its ramp across the world.

He also said that Musk’s commitment to the company and return from politics played a major role in the company’s performance in Q2:

“If Musk continues to lead and remain in the driver’s seat, we believe Tesla is on a path to an accelerated growth path over the coming years with deliveries expected to ramp in the back-half of 2025 following the Model Y refresh cycle.”

Ives maintained his $500 price target and the ‘Outperform’ rating he held on the stock:

“Tesla’s future is in many ways the brightest it’s ever been in our view given autonomous, FSD, robotics, and many other technology innovations now on the horizon with 90% of the valuation being driven by autonomous and robotics over the coming years but Musk needs to focus on driving Tesla and not putting his political views first. We maintain our OUTPERFORM and $500 PT.”

Moving forward, investors will look to see some gradual growth over the next few quarters. At worst, Tesla should look to match 2023 and 2024 full-year delivery figures, which could be beaten if the automaker can offer those affordable models by the end of the year.

Investor's Corner

Tesla delivers 384,000 vehicles in Q2 2025, deploys 9.6 GWh in energy storage

The quarter’s 9.6 GWh energy storage deployment marks one of Tesla’s highest to date.

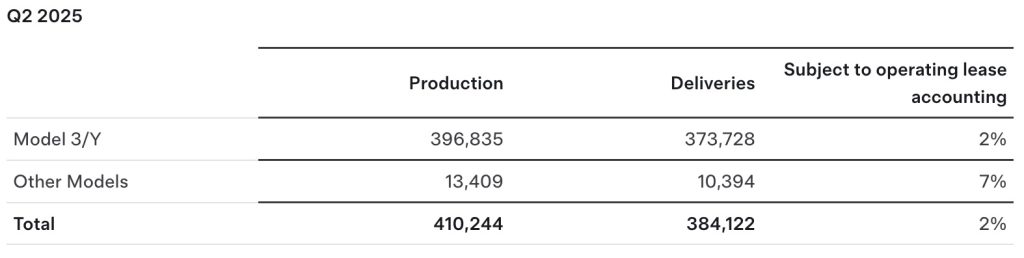

Tesla (NASDAQ: TSLA) has released its Q2 2025 vehicle delivery and production report. As per the report, the company delivered over 384,000 vehicles in the second quarter of 2025, while deploying 9.6 GWh in energy storage. Vehicle production also reached 410,244 units for the quarter.

Model 3/Y dominates output, ahead of earnings call

Of the 410,244 vehicles produced during the quarter, 396,835 were Model 3 and Model Y units, while 13,409 were attributed to Tesla’s other models, which includes the Cybertruck and Model S/X variants. Deliveries followed a similar pattern, with 373,728 Model 3/Ys delivered and 10,394 from other models, totaling 384,122.

The quarter’s 9.6 GWh energy storage deployment marks one of Tesla’s highest to date, signaling continued strength in the Megapack and Powerwall segments.

Year-on-year deliveries edge down, but energy shows resilience

Tesla will share its full Q2 2025 earnings results after the market closes on Wednesday, July 23, 2025, with a live earnings call scheduled for 4:30 p.m. CT / 5:30 p.m. ET. The company will publish its quarterly update at ir.tesla.com, followed by a Q&A webcast featuring company leadership. Executives such as CEO Elon Musk are expected to be in attendance.

Tesla investors are expected to inquire about several of the company’s ongoing projects in the upcoming Q2 2025 earnings call. Expected topics include the new Model Y ramp across the United States, China, and Germany, as well as the ramp of FSD in territories outside the US and China. Questions about the company’s Robotaxi business, as well as the long-referenced but yet to be announced affordable models are also expected.

-

Elon Musk4 days ago

Elon Musk4 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News1 week ago

News1 week agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoFirst Look at Tesla’s Robotaxi App: features, design, and more

-

News2 weeks ago

News2 weeks agoSpaceX and Elon Musk share insights on Starship Ship 36’s RUD

-

News2 weeks ago

News2 weeks agoWatch Tesla’s first driverless public Robotaxi rides in Texas

-

News1 week ago

News1 week agoWatch the first true Tesla Robotaxi intervention by safety monitor

-

News2 weeks ago

News2 weeks agoTesla has started rolling out initial round of Robotaxi invites

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla to launch in India in July with vehicles already arriving: report