General Motors says it has a plan to dethrone Tesla: the undisputed king of electric vehicles.

GM CEO Mary Barra said in November that the company responsible for the Chevy Volt would build a million EVs in 2025. The question is, how will it get there, and what steps will it take to dethrone Tesla, who produced more than 509,000 EVs in 2020 and delivered 98% of them.

“We are committed to fighting for EV market share until we are number one in North America,” Barra said after detailing the plans for 30 EV models by 2025. The project requires a $27 billion investment from one of the U.S’s most notorious automakers. But in the past, car companies have outlined their plans to beat Tesla, and they’ve continuously fallen short, not accounting for Tesla’s planned growth.

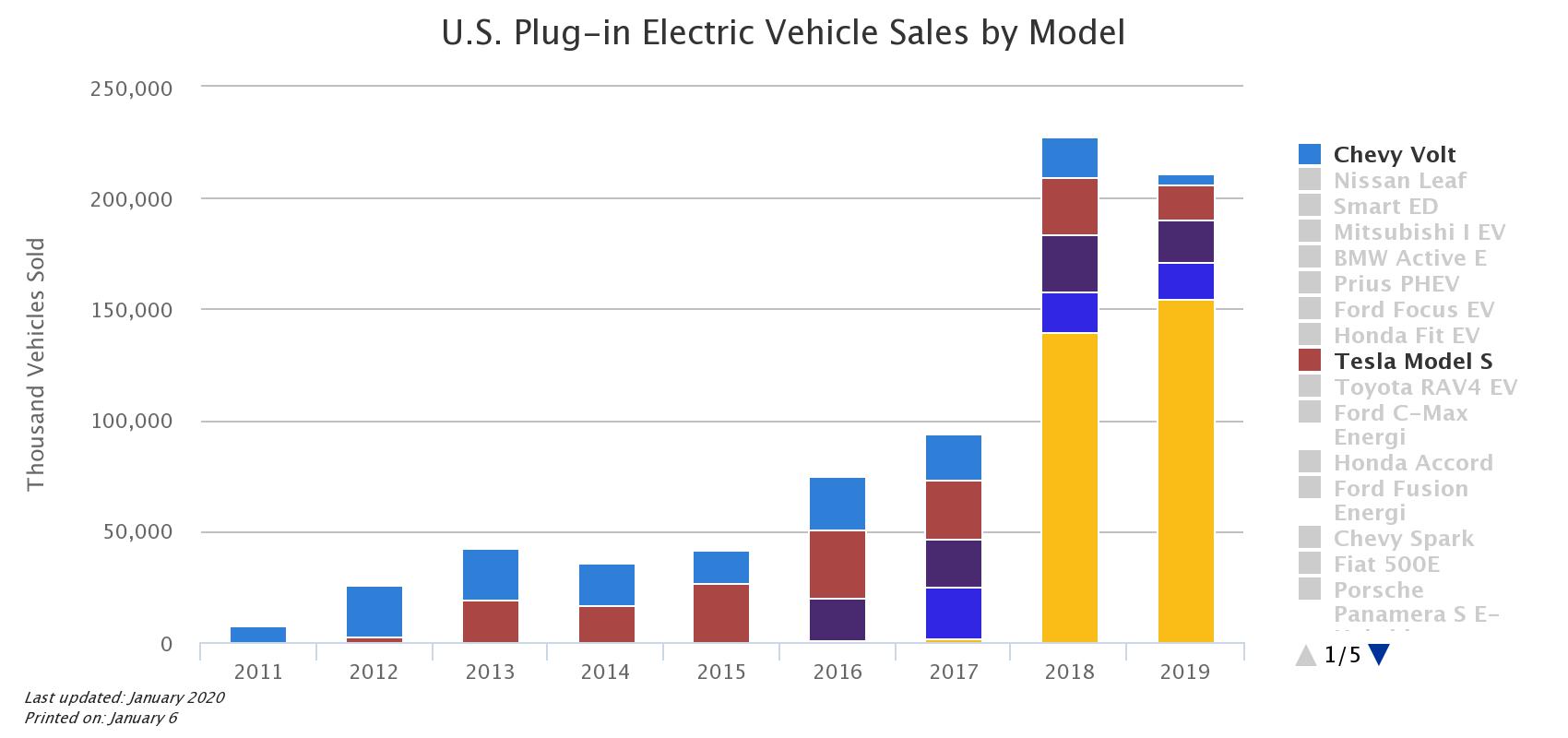

In 2012, GM was the undisputed leader in EVs. The Chevy Volt sold 23,461 units that year. Then Tesla came along with the Model S. Five years later, Tesla had figured out that it could build a mass-market vehicle with the Model 3, proving that it’s not about the number of models. Still, the focus should be on affordability and efficiency. Tesla showed that it had figured out the formula for a fun, fast, efficient, and affordable electric car. It was a riddle that legacy automakers that had the cash and infrastructure to develop hadn’t solved.

Credit: U.S. Department of Energy, Alternative Fuel Vehicle Data Key: Blue: Chevy Volt, Burgundy: Tesla Model S, Purple: Tesla Model X, Royal Blue: Chevy Bolt, Yellow: Tesla Model 3

Despite the Model 3 giving Tesla and its frontman Elon Musk significant production issues, the vehicle has become the most popular EV in the U.S., China, and other territories. Led by the Model 3, Tesla held 58 percent of the U.S. EV market share in 2019, and Financial Post states that the automaker could own as much as 80 percent of the market share for 2020.

GM’s plan is simple: depend on its Ultium battery, which will amplify production and the development new, all-electric models. It plans to decrease the cost of battery production to the $100/kWh threshold, which will activate price parity with gas cars, in three years. It then plans to get that down to $75/kWh in 2025. These projections come from Emmanuel Rosner, an analyst with Deutsche Bank.

The problem is: Tesla detailed its complete roadmap to decrease the cost of its price per kWh during the company’s Battery Day event in September 2020, and it shows prices as low as $50/kWh.

This brings in significant possibilities for GM moving forward, especially if it can continue to leverage more affordable battery costs past 2025. However, it will need more help beating Tesla, which at this time, analysts see as the leader for the foreseeable future.

A Tesla Model 3 recently battled a Chevy Bolt on a drag race in Moscow. [Credit: KindelTech/YouTube]

“Price is going to be what determines who is the market leader, and Tesla looks set to win on price for the foreseeable future,” Luke Gear, an analyst at IDTechEX, says.

Past the financials, Tesla’s growth, which is fueled by a strict and non-diversified focus on EVs only, gives the company an explicit advantage moving forward. On the other hand, GM has to combat the development of its 30 planned EVs with its existing fleet of gas-powered vehicles. Tesla can continue developing its EVs without any other distractions. Its name and reputation as the leader in the sector will help attract young and fresh engineering talent, especially in software and manufacturing, which are some of the company’s main focuses.

ALSO READ:

GM watches Tesla go from “graveyard-bound” to inspiration in pursuit of million-mile battery

GM’s goal is considerably lofty, and its words will not win over the Tesla faithful who are critical of the companies who talk a big game but fail to back it up. Many automakers have come along with a plan to disrupt Tesla’s domination in the EV sector, only to figure out that building an effective EV goes past putting a battery pack into a familiar chassis. But even if they don’t become the leader, will it be considered a complete failure?

“If they keep putting out tons of great products…and they take a ton of share from Tesla, are their EV efforts a failure then? I would say no,” David Whiston of Morningstar said.

What do you think? Leave a comment down below. Got a tip? Email us at tips@teslarati.com or reach out to me at joey@teslarati.com.

News

Tesla opens first public Tesla Semi Megacharger site in Los Angeles

The development was highlighted in a post on social media platform X by the official Tesla Semi account.

Tesla has opened its first public Tesla Semi Megacharger site in Los Angeles. The station reportedly offers up to 750 kW charging speeds and is open to Tesla Semi customers.

The development was highlighted in a post on social media platform X by the official Tesla Semi account.

Tesla Semi Megachargers

The Los Angeles site seems to be the first public Tesla Semi Megacharger that is not located at a Tesla factory. It is also the third Megacharger site currently visible on Tesla’s map.

The Megacharger system is designed specifically for the Tesla Semi and is capable of delivering extremely high charging speeds to support long-haul trucking operations. Infrastructure such as this will likely play a key role in making the Semi competitive with diesel-powered transport trucks.

Tesla’s progress with the Semi has also drawn attention in recent days after Elon Musk biographer Ashlee Vance shared photos from inside the Tesla Semi factory near Giga Nevada. The images suggested that preparations for higher production volumes may be underway, hinting that a broader ramp of the Tesla Semi’s production indeed be approaching.

New deployment strategies

Tesla has continued expanding its broader charging network through several new strategies aimed at accelerating infrastructure deployment. One of these initiatives is the Supercharger for Business program, which allows third parties to purchase Tesla Supercharger equipment and deploy charging stations while still integrating with Tesla’s network.

The program recently marked a milestone in Alpharetta, Georgia, where the city deployed four 325 kW city-branded Superchargers near the Alpharetta Department of Public Safety on Old Milton Parkway. The chargers support the city’s Tesla Model Y police vehicles while also remaining accessible to the public.

As per a report from EVwire, the project was designed not only to support fleet charging but also to generate economic returns that could offset the city’s investment. Tesla’s Supercharger for Business program has already attracted several participants, including businesses and charging providers such as Suncoast Charging, Pie Safe bakery in Idaho, Francis Energy in Oklahoma, and Wawa convenience stores.

Elon Musk

The Boring Company’s Vegas Loop moves 82k riders during CONEXPO

The Loop’s feat was highlighted by The Boring Company in a post on its official account on social media platform X.

The Boring Company said its Vegas Loop system transported roughly 82,000 passengers during the recent CONEXPO-CON/AGG construction trade show in Las Vegas. The event was held at the Las Vegas Convention Center (LVCC) from March 3-7, 2026.

The Loop’s feat was highlighted by The Boring Company in a post on its official account on social media platform X.

CONEXPO-CON/AGG 2026

CONEXPO-CON/AGG is one of the largest construction trade shows in North America. This year’s event was quite impressive, attracting more than 140,000 construction professionals from 128 countries across the world.

Considering the number of this year’s attendees, the LVCC Loop seemed to have proven itself to be a very useful transportation solution. A video posted by The Boring Company on its official X account featured attendees expressing their enthusiasm for the underground transport system, with some stating that they would like to see similar tunnels across Las Vegas.

The LVCC Loop is only part of the greater Vegas Loop network, which is actively under construction.

New Vegas Loop extensions

One of the newest additions is a station at the Fontainebleau Las Vegas resort on the Strip. The station is located on level V-1 of the resort’s south valet area, according to a report from the Las Vegas Review-Journal. From the Fontainebleau, passengers can travel free of charge to stations serving the Las Vegas Convention Center, as well as to Loop stations at Encore and Westgate.

The system is also expanding beyond the Strip corridor. In December, The Boring Company began offering Vegas Loop rides to and from Harry Reid International Airport. These trips include a limited above-ground segment after receiving approval from the Nevada Transportation Authority to allow surface street travel tied to Loop operations.

The Boring Company President Steve Davis previously told the Review-Journal that the University Center Loop segment, which is currently under construction, is expected to open in the first quarter of 2026. The extension would allow Loop vehicles to travel beneath Paradise Road between the convention center and the airport, with a planned station just north of Tropicana Avenue.

News

Tesla preps to build its most massive Supercharger yet: 400+ V4 stalls

The project will be an expansion of the current Eddie World Supercharger in Yermo, California, and will take place in several stages.

Tesla is preparing to build its most massive Supercharger yet, as it recently submitted plans for an over 400-stall Supercharging station in California, which would dwarf its massive 168-stall location in Lost Hills, California.

The project will be an expansion of the current Eddie World Supercharger in Yermo, California, and will take place in several stages.

The expansion, adjacent to the existing Eddie World Supercharger, which is currently comprised of 22 older V2 and V3 stalls limited to 150 kW, unfolds across six phases.

Construction on Phase 1 begins later this year with 72 V4 stalls. Subsequent stages will progressively add hundreds more, culminating in over 400 next-generation chargers. Site plans label expansive parking arrays across Phases 1–5 along Calico Boulevard, with Phase 6 design still to be determined.

Tesla is planning an absolutely massive Supercharger expansion in Yermo, California!!

Over the course of 6 phases, Tesla is set to add over 400 V4 stalls in a commercial development known as Eddie World 2.

The first phase, which should begin construction sometime this year,… pic.twitter.com/ks5Y5dE8lR

— MarcoRP (@MarcoRPi1) March 6, 2026

The project was first flagged by MarcoRP, a notable Tesla Supercharger watcher.

Strategically located midway on I-15 between Los Angeles and Las Vegas, the station targets heavy EV traffic on this high-demand corridor.

The surrounding 20-mile stretch already hosts over 200 high-power stalls (including 40 at 250 kW, 120 at 325 kW, and more), plus 96 in nearby Baker—yet bottlenecks persist during peak travel.

In scale, it eclipses all existing Tesla Superchargers. The current record holder, the solar- and Megapack-powered “Project Oasis” in Lost Hills, California, offers 164 stalls. Barstow’s former leader had 120. Eddie World 2 will be more than double that size, cementing Tesla’s dominance in ultra-high-capacity charging.

Tesla finishes its biggest Supercharger ever with 168 stalls

Development blends charging with convenience. Architectural drawings show integrated retail: a 10,100 square foot Cracker Barrel, a 4,300 square foot McDonald’s, a 3,800 square foot convenience store, additional restaurants, drive-thrus, outdoor dining, and lease space.

EV-centric features include pull-through bays for Cybertrucks and trailers, ensuring accessibility for larger vehicles and future Semi trucks.