Back in 2018, Elon Musk and Tesla (NASDAQ:TSLA) proposed a compensation plan that was just about as insane as the vehicles that the company produces. Dubbed as one of the most radical CEO payment plans in corporate history, it required Musk to hit a series of market cap and operational targets before he is compensated. If he succeeds, he is paid heartily, making him one of the wealthiest persons in the world by net worth. If he fails, he gets nothing.

“If all that happens over the next ten years is that Tesla’s value grows by 80 or 90%, then my amount of compensation would be zero,” Elon Musk said, describing his payment plan to The New York Times.

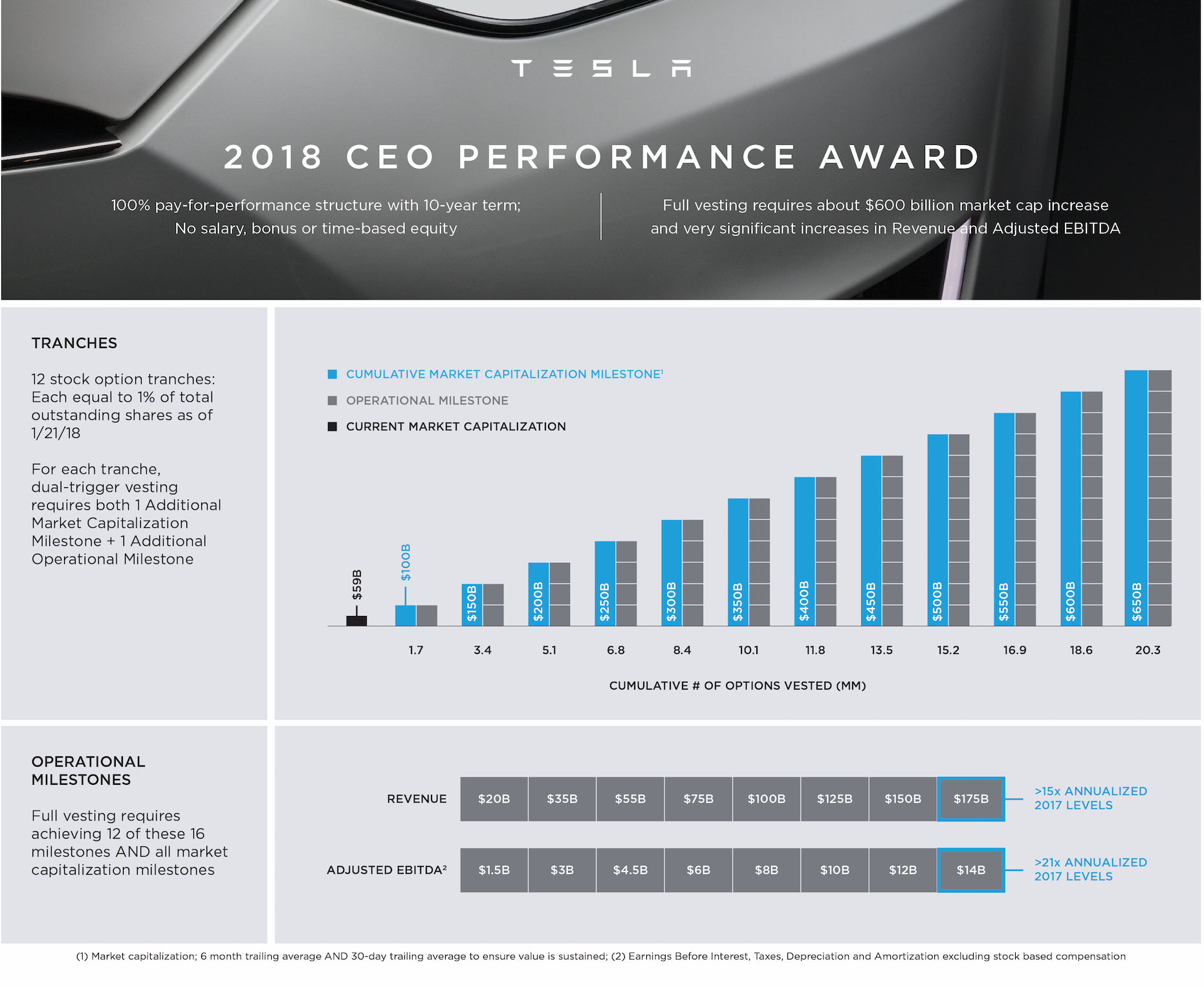

A dozen Market cap targets were set, each $50 billion more than the next, starting at $100 billion and so on. Revenue and adjusted profit goals were also established. For each tranche that is achieved, Elon Musk would have the option to purchase about 1% of Tesla stock at $70 per share. Considering that Tesla’s market cap only stood at $59 billion then, the ambitious compensation plan was dubbed as laughably impossible by critics.

“Mr. Musk’s critics — and there are many — are likely to contend that the new compensation plan is just the company’s latest publicity stunt. He has been called a modern-day P.T. Barnum who has created the illusion of success while consistently missing production estimates. The company continues to lose money; at one point last year, it was losing almost a half-million dollars an hour… Jim Chanos, a short-seller who has bet against Tesla’s shares — and has thus far been on the losing side of that trade — has contended that Tesla is worthless,” the NYT wrote then.

That was just over three years ago.

In a securities filing last Friday, Tesla noted that Elon Musk had achieved 6 of his 12 operating targets, and two more were probable soon. A good number of these targets reflected an adjusted version of earnings before interest, taxes, depreciation, and amortization. Two others represented revenue targets. As noted in a report from The Wall Street Journal, Tesla had also reached 11 of Elon Musk’s 12 market cap targets.

This is incredibly impressive considering that Musk’s 10-year performance award is only in its third year. The long-term plan was designed for a 10-year period, and even Musk, in a statement to the NYT, spoke of a decade-long timeframe when he described his performance award. “I actually see the potential for Tesla to become a trillion-dollar company within a 10-year period,” he said.

While his net worth will radically increase due to his Tesla performance award, Musk could not simply sell his shares and disappear. Under the terms of his payment arrangement, even once his TSLA shares vest, Musk would have to hold them for an additional five years before he is even allowed to sell them. And as per Elon Musk’s previous statements, this is something that he does not intend to do.

Musk’s 10-year Tesla performance award is arguably one of the most shareholder-friendly executive payment plans in the market. Other companies typically install outsize packages that often come at the expense of shareholders because executives are compensated even if they underperform. Tesla’s all-or-nothing plan for Elon Musk, on the other hand, greatly benefits shareholders as their holdings will increase in value as Tesla hits its market cap goals. This is great for long-term shareholders who hold the stock, as well as Tesla employees, as they receive TSLA shares when they are employed by the company.

At the end of December, Elon Musk owned about 22.4% of TSLA’s outstanding shares, up from 20.8% a year earlier. Tesla also has a market cap of $683.42 billion as of Friday’s close.

Disclaimer: I am long TSLA.

Don’t hesitate to contact us for news tips. Just send a message to tips@teslarati.com to give us a heads up.

Elon Musk

Tesla engineers deflected calls from this tech giant’s now-defunct EV project

Tesla engineers deflected calls from Apple on a daily basis while the tech giant was developing its now-defunct electric vehicle program, which was known as “Project Titan.”

Back in 2022 and 2023, Apple was developing an EV in a top-secret internal fashion, hoping to launch it by 2028 with a fully autonomous driving suite.

However, Apple bailed on the project in early 2024, as Project Titan abandoned the project in an email to over 2,000 employees. The company had backtracked its expectations for the vehicle on several occasions, initially hoping to launch it with no human driving controls and only with an autonomous driving suite.

Apple canceling its EV has drawn a wide array of reactions across tech

It then planned for a 2028 launch with “limited autonomous driving.” But it seemed to be a bit of a concession at that point; Apple was not prepared to take on industry giants like Tesla.

Wedbush’s Dan Ives noted in a communication to investors that, “The writing was on the wall for Apple with a much different EV landscape forming that would have made this an uphill battle. Most of these Project Titan engineers are now all focused on AI at Apple, which is the right move.”

Apple did all it could to develop a competitive EV that would attract car buyers, including attempting to poach top talent from Tesla.

In a new podcast interview with Tesla CEO Elon Musk, it was revealed that Apple had been calling Tesla engineers nonstop during its development of the now-defunct project. Musk said the engineers “just unplugged their phones.”

Musk said in full:

“They were carpet bombing Tesla with recruiting calls. Engineers just unplugged their phones. Their opening offer without any interview would be double the compensation at Tesla.”

Interestingly, Apple had acquired some ex-Tesla employees for its project, like Senior Director of Engineering Dr. Michael Schwekutsch, who eventually left for Archer Aviation.

Tesla took no legal action against Apple for attempting to poach its employees, as it has with other companies. It came after EV rival Rivian in mid-2020, after stating an “alarming pattern” of poaching employees was noticed.

Elon Musk

Tesla to a $100T market cap? Elon Musk’s response may shock you

There are a lot of Tesla bulls out there who have astronomical expectations for the company, especially as its arm of reach has gone well past automotive and energy and entered artificial intelligence and robotics.

However, some of the most bullish Tesla investors believe the company could become worth $100 trillion, and CEO Elon Musk does not believe that number is completely out of the question, even if it sounds almost ridiculous.

To put that number into perspective, the top ten most valuable companies in the world — NVIDIA, Apple, Alphabet, Microsoft, Amazon, TSMC, Meta, Saudi Aramco, Broadcom, and Tesla — are worth roughly $26 trillion.

Will Tesla join the fold? Predicting a triple merger with SpaceX and xAI

Cathie Wood of ARK Invest believes the number is reasonable considering Tesla’s long-reaching industry ambitions:

“…in the world of AI, what do you have to have to win? You have to have proprietary data, and think about all the proprietary data he has, different kinds of proprietary data. Tesla, the language of the road; Neuralink, multiomics data; nobody else has that data. X, nobody else has that data either. I could see $100 trillion. I think it’s going to happen because of convergence. I think Tesla is the leading candidate [for $100 trillion] for the reason I just said.”

Musk said late last year that all of his companies seem to be “heading toward convergence,” and it’s started to come to fruition. Tesla invested in xAI, as revealed in its Q4 Earnings Shareholder Deck, and SpaceX recently acquired xAI, marking the first step in the potential for a massive umbrella of companies under Musk’s watch.

SpaceX officially acquires xAI, merging rockets with AI expertise

Now that it is happening, it seems Musk is even more enthusiastic about a massive valuation that would swell to nearly four-times the value of the top ten most valuable companies in the world currently, as he said on X, the idea of a $100 trillion valuation is “not impossible.”

It’s not impossible

— Elon Musk (@elonmusk) February 6, 2026

Tesla is not just a car company. With its many projects, including the launch of Robotaxi, the progress of the Optimus robot, and its AI ambitions, it has the potential to continue gaining value at an accelerating rate.

Musk’s comments show his confidence in Tesla’s numerous projects, especially as some begin to mature and some head toward their initial stages.

Elon Musk

Celebrating SpaceX’s Falcon Heavy Tesla Roadster launch, seven years later (Op-Ed)

Seven years later, the question is no longer “What if this works?” It’s “How far does this go?”

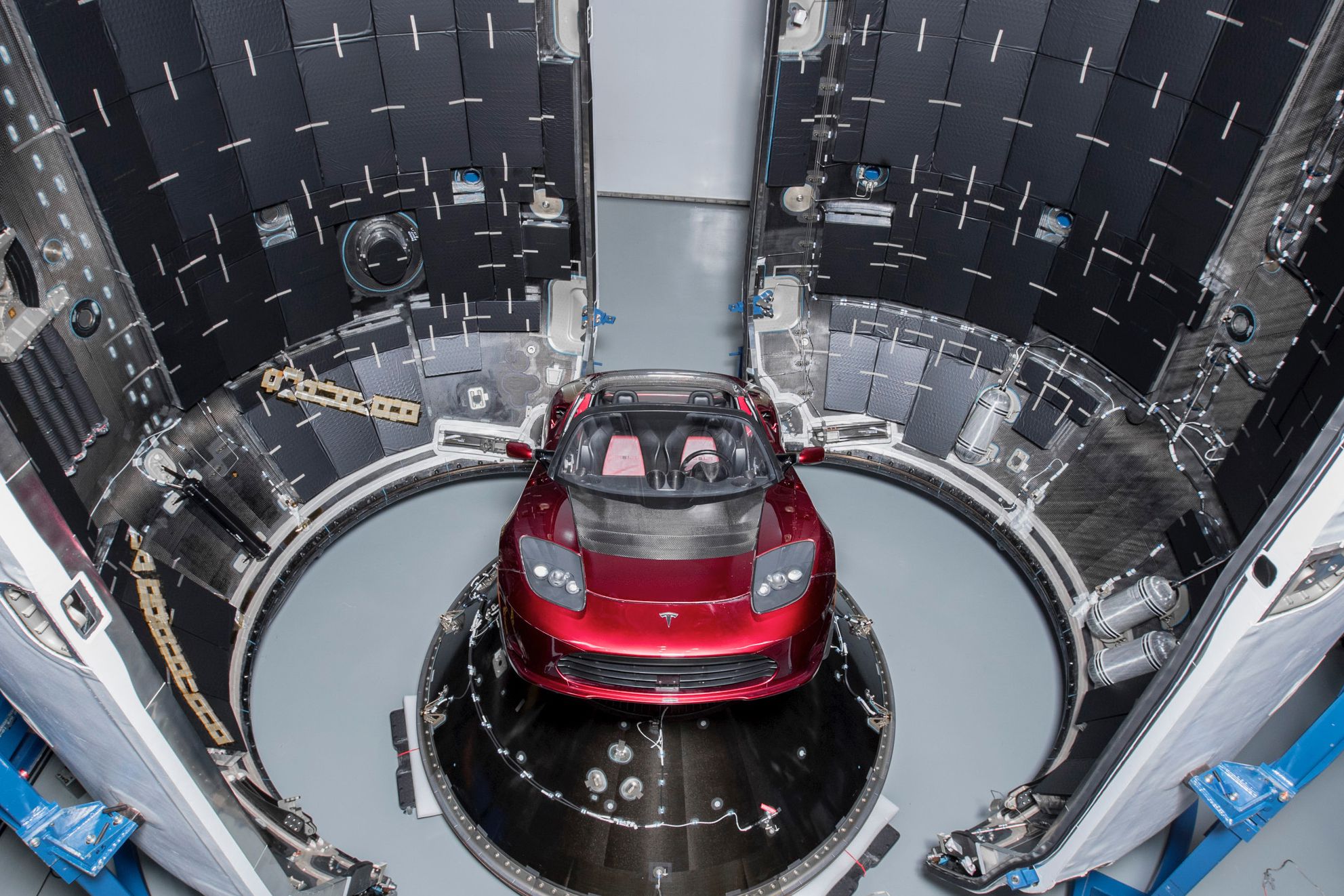

When Falcon Heavy lifted off in February 2018 with Elon Musk’s personal Tesla Roadster as its payload, SpaceX was at a much different place. So was Tesla. It was unclear whether Falcon Heavy was feasible at all, and Tesla was in the depths of Model 3 production hell.

At the time, Tesla’s market capitalization hovered around $55–60 billion, an amount critics argued was already grossly overvalued. SpaceX, on the other hand, was an aggressive private launch provider known for taking risks that traditional aerospace companies avoided.

The Roadster launch was bold by design. Falcon Heavy’s maiden mission carried no paying payload, no government satellite, just a car drifting past Earth with David Bowie playing in the background. To many, it looked like a stunt. For Elon Musk and the SpaceX team, it was a bold statement: there should be some things in the world that simply inspire people.

Inspire it did, and seven years later, SpaceX and Tesla’s results speak for themselves.

Today, Tesla is the world’s most valuable automaker, with a market capitalization of roughly $1.54 trillion. The Model Y has become the best-selling car in the world by volume for three consecutive years, a scenario that would have sounded insane in 2018. Tesla has also pushed autonomy to a point where its vehicles can navigate complex real-world environments using vision alone.

And then there is Optimus. What began as a literal man in a suit has evolved into a humanoid robot program that Musk now describes as potential Von Neumann machines: systems capable of building civilizations beyond Earth. Whether that vision takes decades or less, one thing is evident: Tesla is no longer just a car company. It is positioning itself at the intersection of AI, robotics, and manufacturing.

SpaceX’s trajectory has been just as dramatic.

The Falcon 9 has become the undisputed workhorse of the global launch industry, having completed more than 600 missions to date. Of those, SpaceX has successfully landed a Falcon booster more than 560 times. The Falcon 9 flies more often than all other active launch vehicles combined, routinely lifting off multiple times per week.

Falcon 9 has ferried astronauts to and from the International Space Station via Crew Dragon, restored U.S. human spaceflight capability, and even stepped in to safely return NASA astronauts Butch Wilmore and Suni Williams when circumstances demanded it.

Starlink, once a controversial idea, now dominates the satellite communications industry, providing broadband connectivity across the globe and reshaping how space-based networks are deployed. SpaceX itself, following its merger with xAI, is now valued at roughly $1.25 trillion and is widely expected to pursue what could become the largest IPO in history.

And then there is Starship, Elon Musk’s fully reusable launch system designed not just to reach orbit, but to make humans multiplanetary. In 2018, the idea was still aspirational. Today, it is under active development, flight-tested in public view, and central to NASA’s future lunar plans.

In hindsight, Falcon Heavy’s maiden flight with Elon Musk’s personal Tesla Roadster was never really about a car in space. It was a signal that SpaceX and Tesla were willing to think bigger, move faster, and accept risks others wouldn’t.

The Roadster is still out there, orbiting the Sun. Seven years later, the question is no longer “What if this works?” It’s “How far does this go?”