News

Tesla adjusts delivery estimates after select Model Y variants sell out for 2022

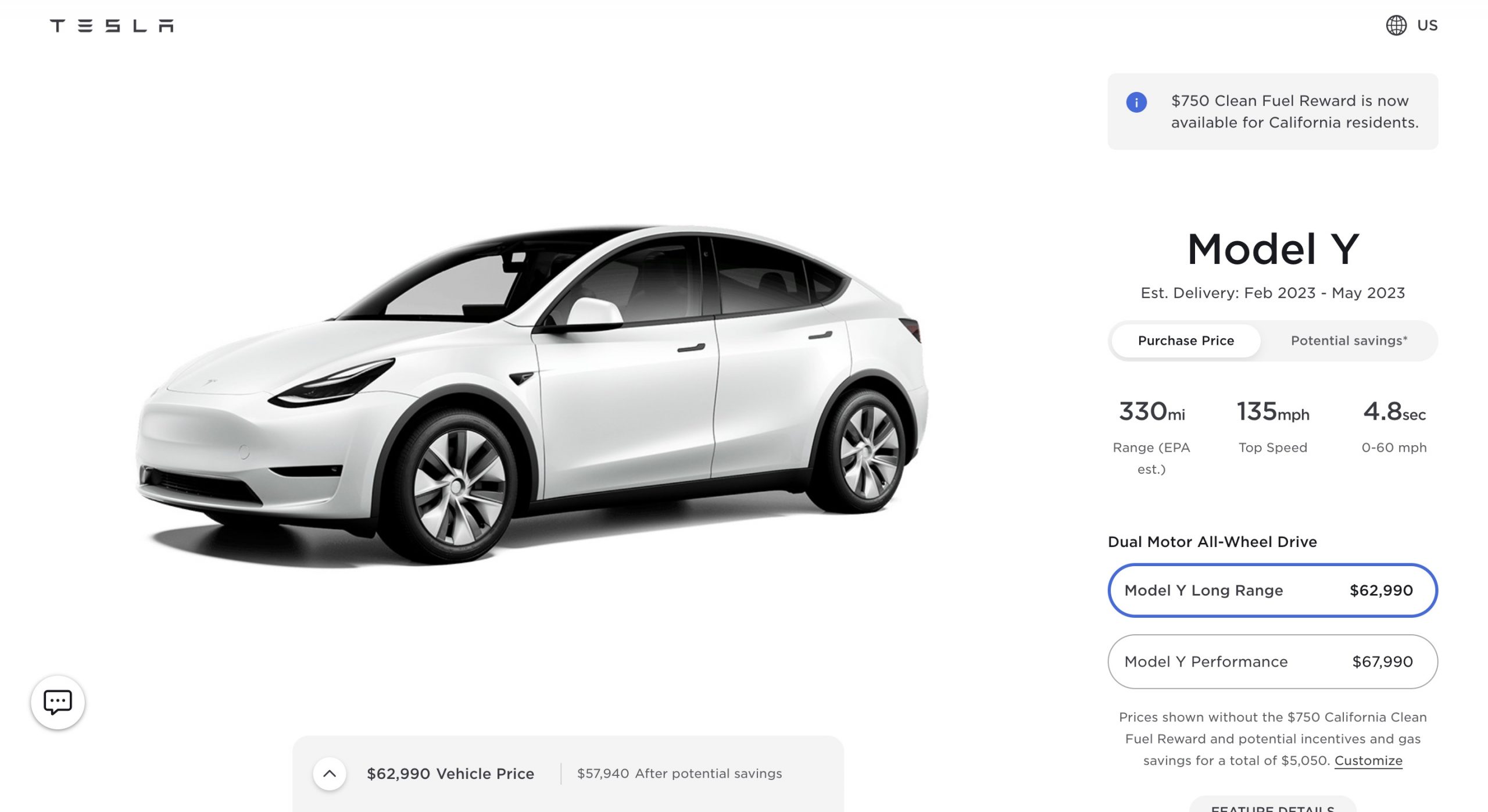

Tesla adjusted delivery estimates of select Model Y variants in the United States. The Pearl White and Midnight Silver base Model Y Long Range with 19” Gemini wheels is sold out for the remainder of 2022, with delivery estimates expected between February 2023 and May 2023.

Base Model Y LR variants in Deep Blue, Solid Black, and Red Multi-Coat are still available this year, with delivery estimates between November 2022 and February 2023. The three paint options come with an additional charge.

The Model Y Long Range with Induction wheels has an estimated delivery date between November 2022 to February 2023 for all available colors. Meanwhile, the Model Y Performance with 21” Überturbine Wheels have estimated delivery dates between June and August 2022.

Pearl White and Midnight Silver color options are free for Model Y orders. Deep Blue paint costs an extra $1,000, Solid Black is an additional $1,500, and Red will add $2,000 to the base Model Y LR’s price tag. The 20” Induction wheels are an extra $2,000. Customers may also add a Tow Hitch to their Model Y order for $1,000.

The base Model Y LR’s price without additions or potential savings is $62,990 in the US. The Model Y Performance’s price is $67,990 before options and deductions. Prices and delivery dates in other countries or territories vary.

During the Q1 2022 earnings call, Elon Musk and Tesla CFO Zachary Kirkhorn explained that the company’s current vehicle prices considered supply chain price changes. As such, Tesla’s current vehicle prices reflect the rising prices of raw materials.

As Musk pointed out, the vehicles ordered today will be delivered in the future. However, raw material prices are constantly increasing. Tesla CFO Zachary Kirkhorn explained this further during the Q1 2022 earnings call.

“And so, to Elon’s point, what we’re trying to do here because it is quite an unprecedented situation of raw material movement and all of these various lags and all this uncertainty around renegotiating contracts is we’re trying to anticipate where things will go and make sure that the pricing that we have in place at the time that the raw material costs increases hit us, that they align, and that the company can remain financially healthy in various scenarios as we look out over the next four quarters,” elaborated Kirkhorn.

The Teslarati team would appreciate hearing from you. If you have any tips, reach out to me at maria@teslarati.com or via Twitter @Writer_01001101.

Elon Musk

Starbase after dark: Musk’s latest photo captures a Spaceport on the brink of history

SpaceX’s Starbase city in Boca Chica, Texas is rapidly transforming the southern tip of the Lone Star State into one of the most ambitious launch complexes in history.

A striking nighttime photograph of SpaceX’s Starbase facility in Boca Chica, Texas, shared recently by Elon Musk on X, offers a dramatic glimpse of an operation that is rapidly transforming the southern tip of the Lone Star State into one of the most ambitious launch complexes in history.

The most immediately visible change in the photo is the presence of two fully erected Starship launch towers dominating the coastal skyline. The second orbital launch pad, known as Pad B, now features its fully erected tower, OLIT-3, which stands approximately 474 feet tall and incorporates an integrated water-cooled flame trench designed to minimize damage and reduce turnaround time between launches. The dual-tower silhouette against the night sky signals a decisive shift from experimental testing facility to high-cadence launch operations.

Grok Image concept of Elon Musk’s latest Starbase photo via X

Back at Starbase, Pad 2 is approaching hardware completion, with upgraded chopstick arms, a new chilldown vent system, and all 20 hold-down arms now fitted with protective doors to shield them from the intense exhaust of up to 33 Raptor 3 engines, according to a deeper dive by NASASpaceFlight.

SpaceX has also received approval to nearly double the footprint of the Starbase launch site, with groundwork already underway to add LNG liquefaction plants, expanded propellant storage, and additional ground support infrastructure.

The photo also carries a milestone civic dimension. Starbase officially became a Texas city in May 2025 after a community vote, with SpaceX employees elected as mayor and commissioners of the newly incorporated municipality. That legal status streamlines launch approvals and gives SpaceX direct control over local infrastructure decisions.

The FAA has approved an increase in launches from Starbase in Texas from five to twenty-five per year, clearing the runway for the kind of flight frequency needed to fulfill Starship’s ultimate mission of ferrying cargo and crew to the Moon, servicing the Department of Defense, deploying next-generation Starlink satellites, and eventually establishing Elon Musk’s long sought after goal of a self-sustaining human presence on Mars.

Seen from above in the dark, Starbase looks less like a test site and more like a spaceport.

News

Tesla loses Director who designed one of the company’s best features

Thomas Dmytryk, who has spent over 11 years with Tesla and helped to develop Over-the-Air updates and the company’s vehicles’ ability to utilize them to improve, has decided to leave.

Tesla has lost the director who designed one of the company’s best features: Over-the-Air updates.

Thomas Dmytryk, who has spent over 11 years with Tesla and helped to develop Over-the-Air updates and the company’s vehicles’ ability to utilize them to improve, has decided to leave. In a lengthy statement on LinkedIn, Dmytryk said that he’s “closing the book.” He had nothing but good things to say:

“After 11 incredible years at Tesla, I’m closing the book. It’s been the ride of a lifetime: always on the news, innovating relentlessly, constantly pushing the limits. Tesla is THE place for talented, passionate people. I feel insanely lucky to have been part in that culture for so long.”

It appears the intense lifestyle of developing and creating intensively for so long might have caught up to Dmytryk, who did not give his definitive plans for the future, and it appears he may be taking some time off before jumping into a new venture:

“The future? Extremely bright. Ambitions intact, just getting started as a transformative company that could elevate billions of lives. So why leave now?! Human life’s always been my North Star, right now I need to be with mines. I’ve always admired Tesla’s top leadership and vision. But what I’ve always found incredible is the tenacity, brilliance and devotion of people on the front line. YOU make Tesla unstoppable. I wish you all the best and of course EPIC wins.”

The move was first reported by NotaTeslaApp.

Over-the-Air updates are among Tesla’s best features. They are used to improve the Full Self-Driving suite, add features, remedy recalls, and more. Many vehicles have the ability to receive OTA updates, as I did in a Ford Bronco previous to my Model Y. However, Tesla does them better than anyone else: they’re seamless, effective, and frequent. Your car always improves.

The move is a blow to Tesla, of course, considering Dmytryk’s massive contribution to the company and extremely long tenure spent, but not something that is overwhelmingly detrimental. Tesla deals with a lot of extremely intelligent people, some of whom are the best in their field, so they are sure to find a suitable replacement.

However, it’s no secret that the company has been losing some of its top talent, some of whom were in executive roles. Some have left to take on new projects, and others have not revealed their career plans.

It seems at least some of those employees are simply deciding to walk away and try new things after working so hard for so long. According to Dmytryk’s LinkedIn, he also played a large part in Musk’s acquisition of X, as he stated he “worked at Twitter/X ~45/week while working at the same pace for Tesla.”

That averages a 13-hour day, seven days a week, or 18 hours for the normal five-day work week.

News

Tesla’s most wanted Model Y heads to new region with no sign of U.S. entry

Unlike the standard Model Y, the “L” stretches the wheelbase by roughly 150 mm and the overall length by about 177 mm to 4,976 mm. The result is a genuine 2-2-2 seating layout that gives six adults proper legroom and cargo space — a true family hauler without the cramped third-row compromises of many three-row SUVs.

Tesla’s most wanted Model Y configuration is heading to a new region, and although U.S. fans and owners have requested the vehicle since its release last year, it appears the company has no plans to bring it to the market.

According to fresh regulatory filings, the six-seat Model Y L is coming to South Korea with signs indicating an imminent launch. The extended-wheelbase configuration, already a hit in China, just cleared energy-efficiency certification from the Korea Energy Agency, paving the way for deliveries as early as the first half of 2026.

The vehicle is already built at Tesla’s Giga Shanghai facility in China, making it an ideal candidate for the Asian market, as well as the European one, as the factory has been known as a bit of an export hub in the past.

$TSLA

BREAKING: The official launch of Tesla Model Y L in S.Korea seems to be quite imminent.Additional credentials related to Model YL were released today.

✅ Battery Manufacturer: LG Energy Solutions

✅ Number of passengers: 6 people

✅ Total battery capacity: 97.25 kWh… pic.twitter.com/hmy64XYi80— Tsla Chan (@Tslachan) March 6, 2026

It seems like Tesla was prepping for this release anyway, as the timing was no accident. A camouflaged Model Y L prototype was spotted testing on Korean highways the same day the certification dropped. Tesla has already secured similar approvals for Australia and New Zealand, with both markets expecting the larger Model Y in 2026.

Unlike the standard Model Y, the “L” stretches the wheelbase by roughly 150 mm and the overall length by about 177 mm to 4,976 mm. The result is a genuine 2-2-2 seating layout that gives six adults proper legroom and cargo space — a true family hauler without the cramped third-row compromises of many three-row SUVs.

South Korean filings list it as an all-wheel-drive imported electric passenger vehicle with a 97.25 kWh total battery capacity supplied by LG Energy Solution. Local tests show an impressive 543 km (337 miles) combined range at room temperature and 454 km (282 miles) in colder conditions, easing one of the biggest concerns for Korean EV buyers.

Tesla Model Y lineup expansion signals an uncomfortable reality for consumers

But for U.S. fans, things are not looking good for a launch in the market.

CEO Elon Musk has been blunt. The six-seater “wouldn’t arrive in the U.S. until late 2026, if ever,” he said, pointing to the company’s heavy bet on unsupervised Full Self-Driving and robotaxi platforms like the Cybercab. With the Model X slated for discontinuation, many families hoped the stretched Model Y would slide into the lineup as an affordable three-row bridge. So far, that hope remains unfulfilled.

For now, South Korean drivers will be among the first buyers outside China to enjoy the spacious, efficient Model Y L. Tesla continues its global rollout strategy, tailoring vehicles to regional tastes while North American customers keep refreshing their apps and crossing their fingers.

The Model Y L proves the appetite for practical, family-sized electric SUVs is stronger than ever. Hopefully, Tesla will listen to its fans and bring the vehicle to the U.S. where it would likely sell well.