Ford, General Motors (GM), and BMW announced earlier this week that they would partner with the Sacramento Municipal Utility District (SMUD) to roll out an EV charging scheduling program.

The electric grid is undergoing significant change right now. Utilities are moving away from fossil fuels, consumers are buying more and more EVs and driving up demand for electricity; and at the same time, some homeowners are generating their own power. This rapidly changing environment means utilities face new challenges in meeting customer demand. To address this, Ford, GM, BMW, and SMUD are working together to schedule EV charging.

Scheduling EV charging allows for a couple of things. First, it moves excess demand away from peak hours when utility companies may already be having trouble meeting demand. Second, it allows EV owners to charge their vehicles when electricity is cheapest and least demanded. Third and finally, the grid becomes more balanced in power production and usage.

The charging scheduling program the companies are implementing will pay customers to charge their vehicles at set times of the day. This initial program will operate as a testing round, allowing SMUD to balance customer electricity usage and ultimately find the best way to spread out demand throughout the day.

While the program will be available to Ford, GM, and BMW customers, with the vast majority of EVs on the road in the US being Tesla’s, Tesla’s absence from the deal is quite thought-provoking. It is also not immediately apparent how the program will interact with customers who generate their own power or those with home battery systems, as these factors could significantly change how their vehicles interact with the grid.

As more and more utilities face the challenge of balancing new power generation systems with rapidly increasing demand, expect more utilities to implement charging scheduling into their grid management. Electric vehicles consume a significant amount of power and ensuring that electric grids remain stable will require customers to be flexible about when and where they charge during the day.

What do you think of the article? Do you have any comments, questions, or concerns? Shoot me an email at william@teslarati.com. You can also reach me on Twitter @WilliamWritin. If you have news tips, email us at tips@teslarati.com!

Energy

Tesla launches Cybertruck vehicle-to-grid program in Texas

The initiative was announced by the official Tesla Energy account on social media platform X.

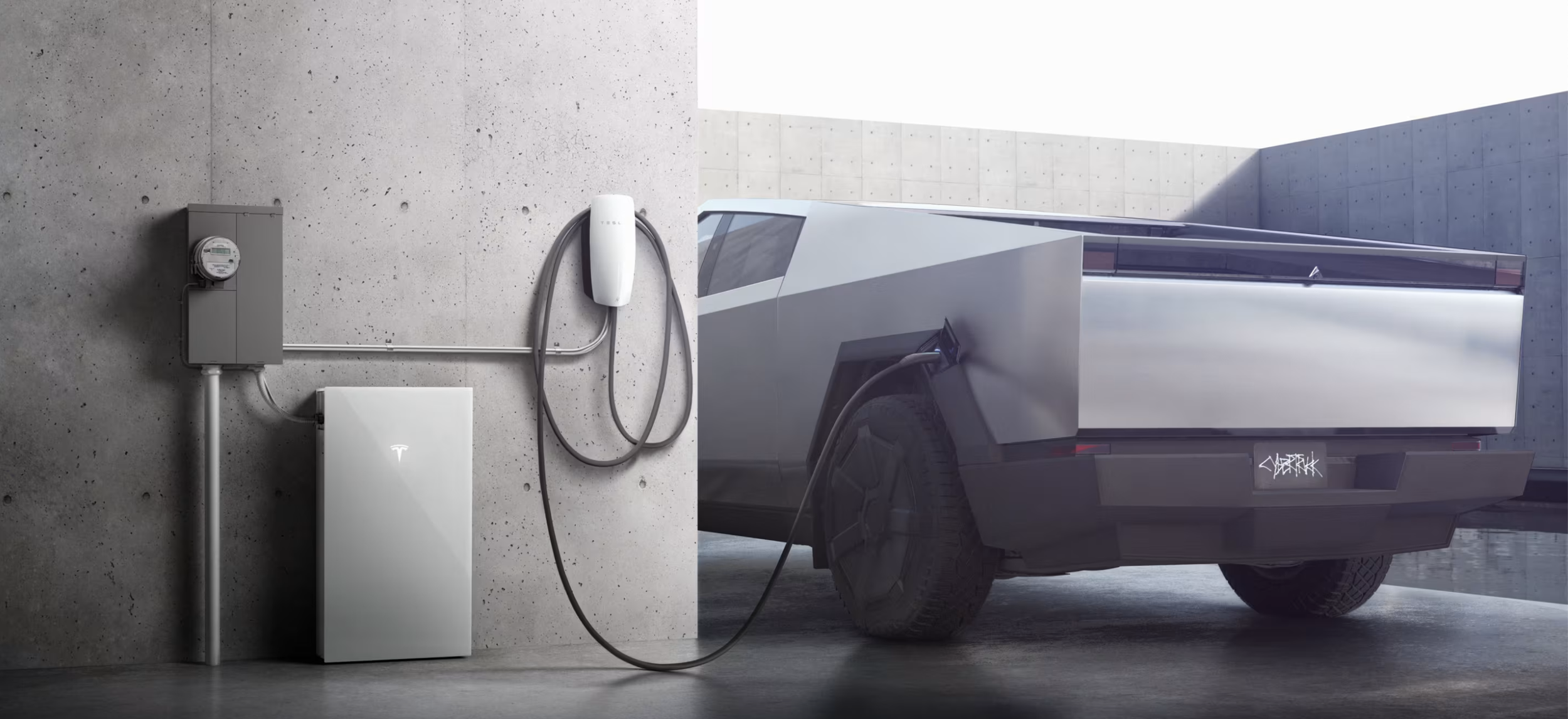

Tesla has launched a vehicle-to-grid (V2G) program in Texas, allowing eligible Cybertruck owners to send energy back to the grid during high-demand events and receive compensation on their utility bills.

The initiative, dubbed Powershare Grid Support, was announced by the official Tesla Energy account on social media platform X.

Texas’ Cybertruck V2G program

In its post on X, Tesla Energy confirmed that vehicle-to-grid functionality is “coming soon,” starting with select Texas markets. Under the new Powershare Grid Support program, owners of the Cybertruck equipped with Powershare home backup hardware can opt in through the Tesla app and participate in short-notice grid stress events.

During these events, the Cybertruck automatically discharges excess energy back to the grid, supporting local utilities such as CenterPoint Energy and Oncor. In return, participants receive compensation in the form of bill credits. Tesla noted that the program is currently invitation-only as part of an early adopter rollout.

The launch builds on the Cybertruck’s existing Powershare capability, which allows the vehicle to provide up to 11.5 kW of power for home backup. Tesla added that the program is expected to expand to California next, with eligibility tied to utilities such as PG&E, SCE, and SDG&E.

Powershare Grid Support

To participate in Texas, Cybertruck owners must live in areas served by CenterPoint Energy or Oncor, have Powershare equipment installed, enroll in the Tesla Electric Drive plan, and opt in through the Tesla app. Once enrolled, vehicles would be able to contribute power during high-demand events, helping stabilize the grid.

Tesla noted that events may occur with little notice, so participants are encouraged to keep their Cybertrucks plugged in when at home and to manage their discharge limits based on personal needs. Compensation varies depending on the electricity plan, similar to how Powerwall owners in some regions have earned substantial credits by participating in Virtual Power Plant (VPP) programs.

Cybertruck

Tesla updates Cybertruck owners about key Powershare feature

Tesla is updating Cybertruck owners on its timeline of a massive feature that has yet to ship: Powershare with Powerwall.

Powershare is a bidirectional charging feature exclusive to Cybertruck, which allows the vehicle’s battery to act as a portable power source for homes, appliances, tools, other EVs, and more. It was announced in late 2023 as part of Tesla’s push into vehicle-to-everything energy sharing, and acting as a giant portable charger is the main advantage, as it can provide backup power during outages.

Cybertruck’s Powershare system supports both vehicle-to-load (V2L) and vehicle-to-home (V2H), making it flexible and well-rounded for a variety of applications.

However, even though the feature was promised with Cybertruck, it has yet to be shipped to vehicles. Tesla communicated with owners through email recently regarding Powershare with Powerwall, which essentially has the pickup act as an extended battery.

Powerwall discharge would be prioritized before tapping into the truck’s larger pack.

However, Tesla is still working on getting the feature out to owners, an email said:

“We’re writing to let you know that the Powershare with Powerwall feature is still in development and is now scheduled for release in mid-2026.

This new release date gives us additional time to design and test this feature, ensuring its ability to communicate and optimize energy sharing between your vehicle and many configurations and generations of Powerwall. We are also using this time to develop additional Powershare features that will help us continue to accelerate the world’s transition to sustainable energy.”

Owners have expressed some real disappointment in Tesla’s continuous delays in releasing the feature, as it was expected to be released by late 2024, but now has been pushed back several times to mid-2026, according to the email.

Foundation Series Cybertruck buyers paid extra, expecting the feature to be rolled out with their vehicle upon pickup.

Cybertruck’s Lead Engineer, Wes Morrill, even commented on the holdup:

As a Cybertruck owner who also has Powerwall, I empathize with the disappointed comments.

To their credit, the team has delivered powershare functionality to Cybertruck customers who otherwise have no backup with development of the powershare gateway. As well as those with solar…

— Wes (@wmorrill3) December 12, 2025

He said that “it turned out to be much harder than anticipated to make powershare work seamlessly with existing Powerwalls through existing wall connectors. Two grid-forming devices need to negotiate who will form and who will follow, depending on the state of charge of each, and they need to do this without a network and through multiple generations of hardware, and test and validate this process through rigorous certifications to ensure grid safety.”

It’s nice to see the transparency, but it is justified for some Cybertruck owners to feel like they’ve been bait-and-switched.

Energy

Tesla starts hiring efforts for Texas Megafactory

Tesla’s Brookshire site is expected to produce 10,000 Megapacks annually, equal to 40 gigawatt hours of energy storage.

Tesla has officially begun hiring for its new $200 million Megafactory in Brookshire, Texas, a manufacturing hub expected to employ 1,500 people by 2028. The facility, which will build Tesla’s grid-scale Megapack batteries, is part of the company’s growing energy storage footprint.

Tesla’s hiring efforts for the Texas Megafactory are hinted at by the job openings currently active on the company’s Careers website.

Tesla’s Texas Megafactory

Tesla’s Brookshire site is expected to produce 10,000 Megapacks annually, equal to 40 gigawatt hours of energy storage, similar to the Lathrop Megafactory in California. Tesla’s Careers website currently lists over 30 job openings for the site, from engineers, welders, and project managers. Each of the openings is listed for Brookshire, Texas.

The company has leased two buildings in Empire West Business Park, with over $194 million in combined property and equipment investment. Tesla’s agreement with Waller County includes a 60% property tax abatement, contingent on meeting employment benchmarks: 375 jobs by 2026, 750 by 2027, and 1,500 by 2028, as noted in a report from the Houston Business Journal. Tesla is required to employ at least 1,500 workers in the facility through the rest of the 10-year abatement period.

Tesla’s clean energy boom

City officials have stated that Tesla’s arrival marks a turning point for the Texas city, as it highlights a shift from logistics to advanced clean energy manufacturing. Ramiro Bautista from Brookshire’s economic development office, highlighted this in a comment to the Journal.

“(Tesla) has great-paying jobs. Not just that, but the advanced manufacturing (and) clean energy is coming to the area,” he said. “So it’s not just your normal logistics manufacturing. This is advanced manufacturing coming to this area, and this brings a different type of job and investment into the local economy.”