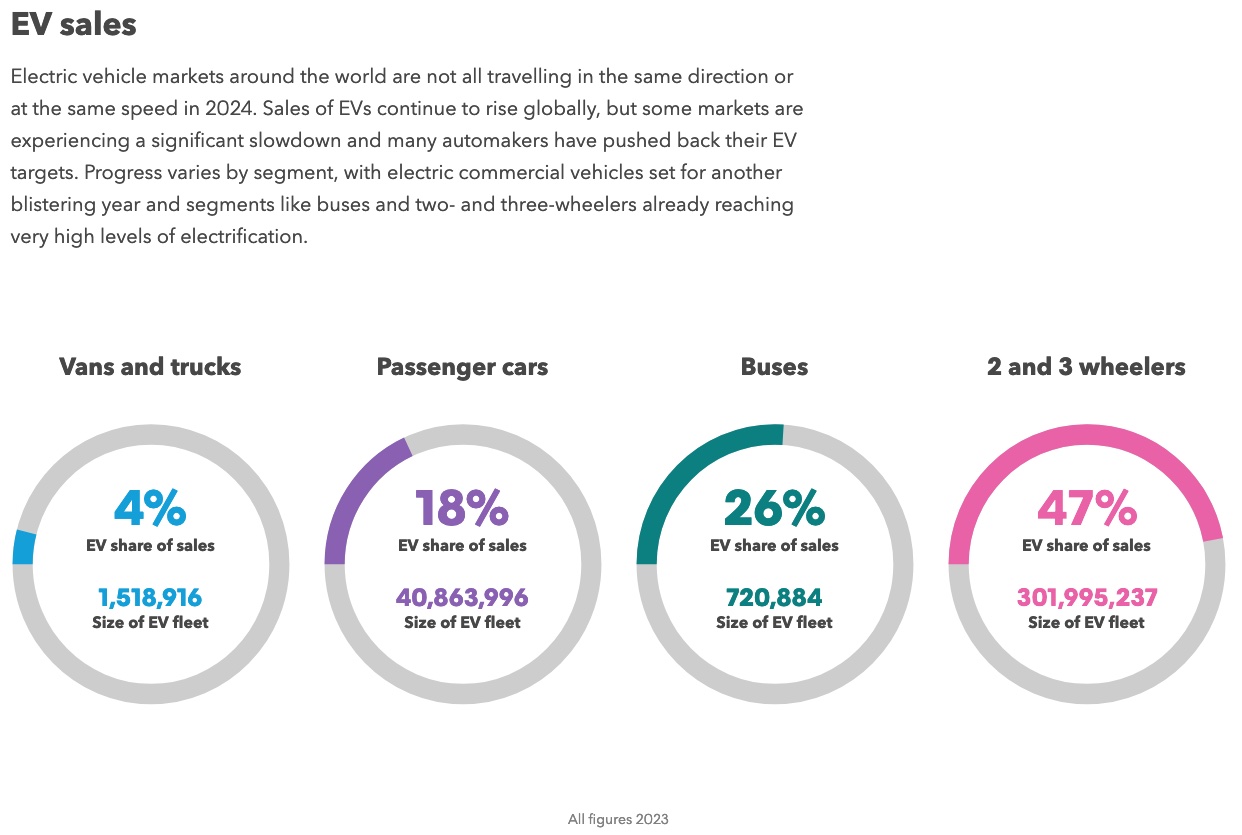

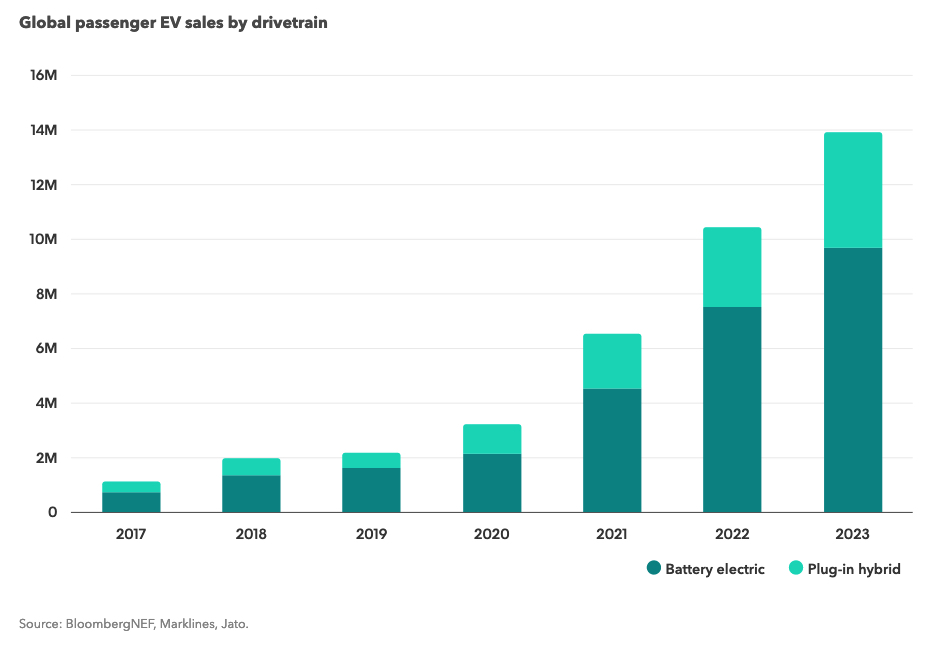

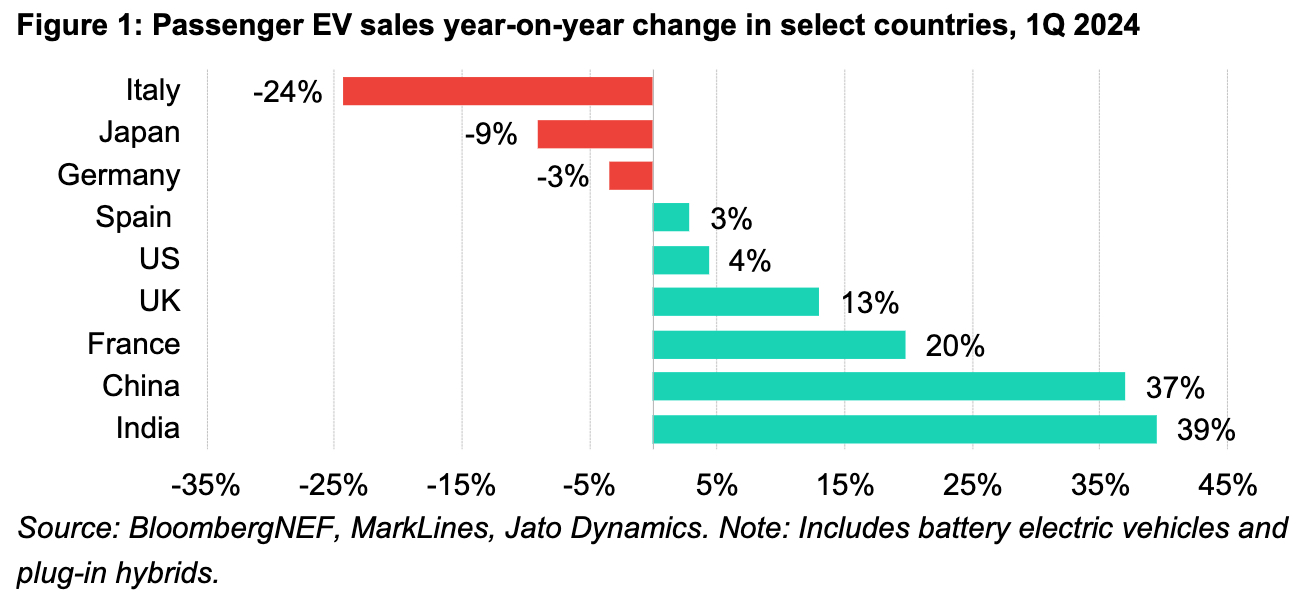

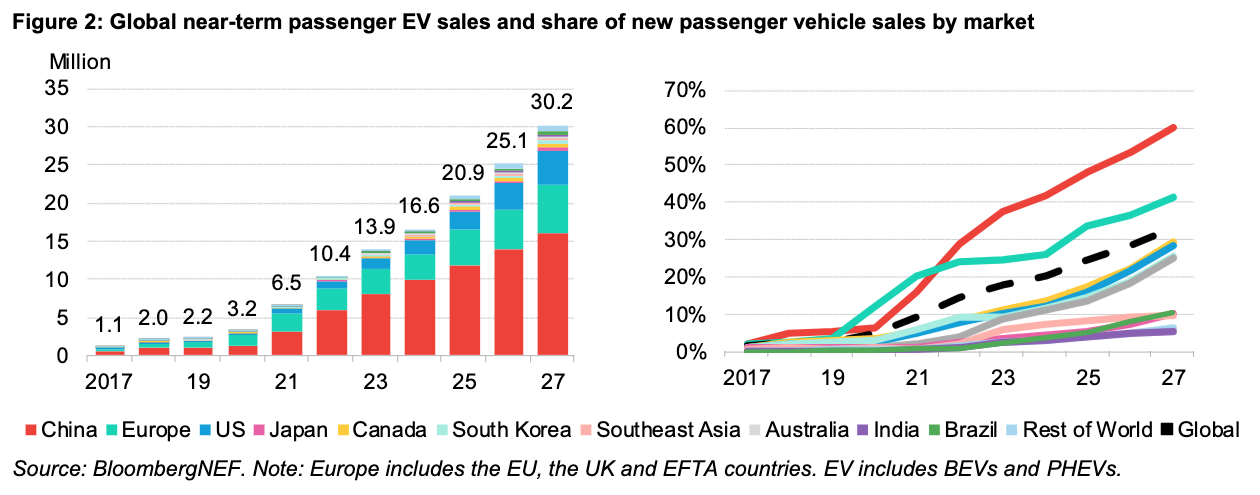

The auto industry continues to shift toward electric vehicles (EVs), and while sales growth has slowed somewhat this year at many companies and in many markets, recent guidance shows that it may only be in the near-term. In a recent outlook of the global EV market, one publication has recently suggested that EV growth may be advancing substantially in some developing markets, while others have seen increased plugin hybrid EV (PHEV) sales.

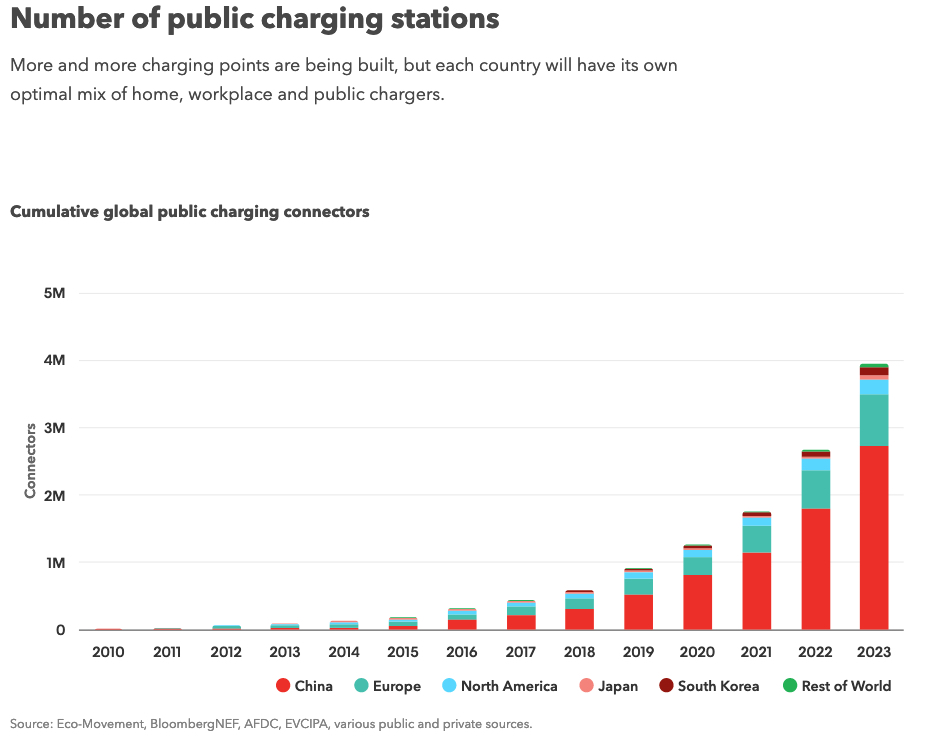

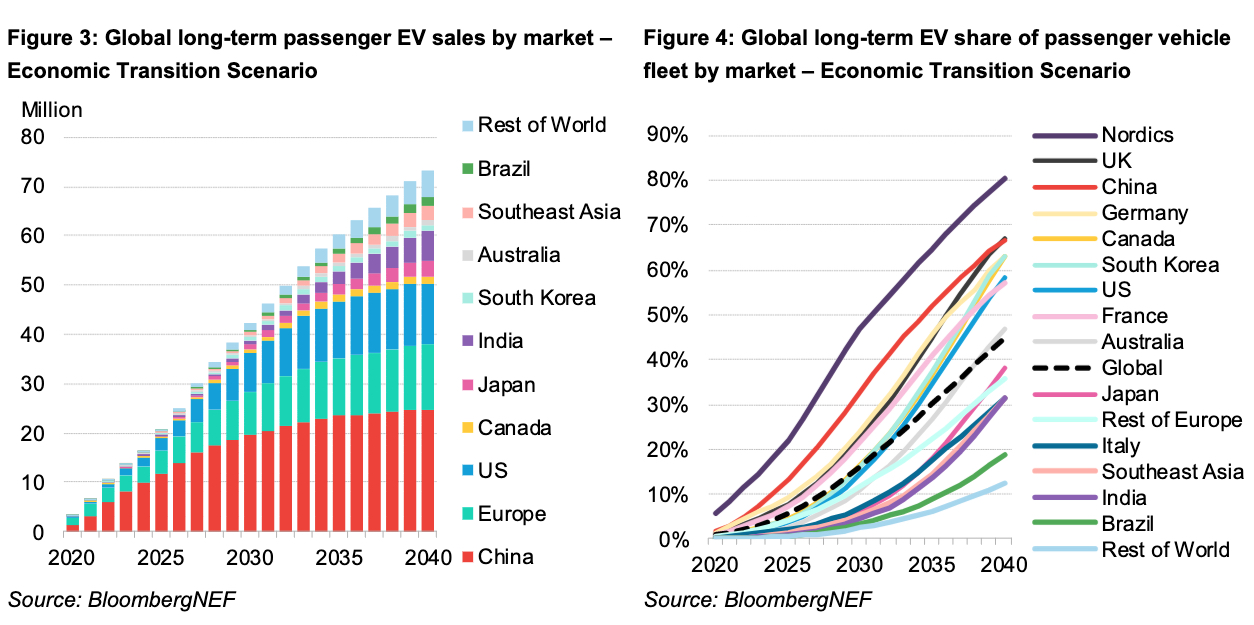

BloombergNEF released its 2024 Electric Vehicle Outlook earlier this month, part of an annual report that takes an in-depth look annually at electrification, shared mobility, autonomous driving, and other factors affecting transport. The report is massive and is packed with insights, including data on themes like overall passenger EV sales, global market uptake, charging station deployment, and more.

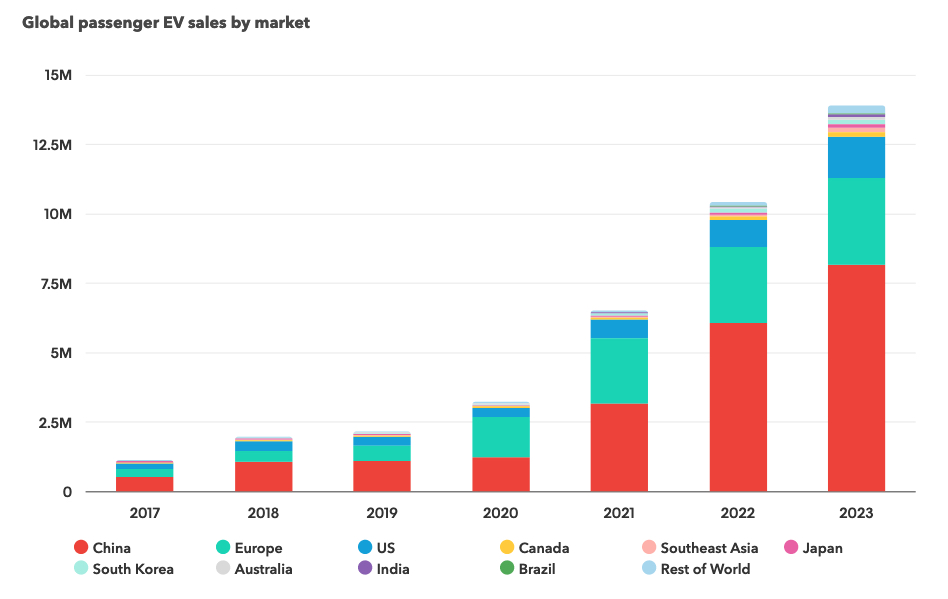

Last month, Bloomberg data suggested that the ongoing EV sales slowdown in the U.S. may not last very long, and data from the outlet’s EVO report suggests that many countries didn’t see similar slowdowns in the first quarter of the year. In particular, the publication notes that certain developing EV markets, including Thailand, India, Turkey, and Brazil actually eclipsed record sales during Q1, while China remains the EV sales leader.

“China still dominates the global EV market, but sales are rising quickly elsewhere too,” writes BloombergNEF in the report’s executive summary. “Electric vehicles are no longer only a wealthy country phenomenon. Developing economies like Thailand, India, Turkey, Brazil and others are all experiencing record sales as more low-cost electric models are targeted at local buyers.”

Still, the report also notes that many automakers have softened near-term EV targets, including Tesla, Mercedes-Benz, General Motors, and Ford.

Despite this, oil displacement from the adoption of EVs continues to increase across vehicle segments, and the report says that sales of internal combustion engine (ICE) vehicles has peaked, with the overall ICE fleet expected to peak soon. The outlet predicts that global road transport oil demand will peak in 2027, while road transport emissions will peak in 2028.

Even the simple executive summary of the over-260-page financial report has a lot of important insights, and you can see many of BloombergNEF’s charts from the abridged intro and its web page detailing the new report below.

Credit: BloombergNEF | 2024 Electric Vehicle Outlook Credit: BloombergNEF | 2024 Electric Vehicle Outlook Credit: BloombergNEF | 2024 Electric Vehicle Outlook Credit: BloombergNEF | 2024 Electric Vehicle Outlook Credit: BloombergNEF | 2024 Electric Vehicle Outlook Credit: BloombergNEF | 2024 Electric Vehicle Outlook Credit: BloombergNEF | 2024 Electric Vehicle Outlook

Check out the full summary of the BloombergNEF Electric Vehicle Outlook here, or use that link to request the full Executive Summary.

EVs to increase almost tenfold by 2030 under current policies: IEA

What are your thoughts? Let me know at zach@teslarati.com, find me on X at @zacharyvisconti, or send us tips at tips@teslarati.com.

News

Tesla exec pleads for federal framework of autonomy to U.S. Senate Committee

Tesla executive Lars Moravy appeared today in front of the U.S. Senate Commerce Committee to highlight the importance of modernizing autonomy standards by establishing a federal framework that would reward innovation and keep the country on pace with foreign rivals.

Moravy, who is Tesla’s Vice President of Vehicle Engineering, strongly advocated for Congress to enact a national framework for autonomous vehicle development and deployment, replacing the current patchwork of state-by-state rules.

These rules have slowed progress and kept companies fighting tooth-and-nail with local legislators to operate self-driving projects in controlled areas.

Tesla already has a complete Robotaxi model, and it doesn’t depend on passenger count

Moravy said the new federal framework was essential for the U.S. to “maintain its position in global technological development and grow its advanced manufacturing capabilities.

He also said in a warning to the committee that outdated regulations and approval processes would “inhibit the industry’s ability to innovate,” which could potentially lead to falling behind China.

Being part of the company leading the charge in terms of autonomous vehicle development in the U.S., Moravy highlighted Tesla’s prowess through the development of the Full Self-Driving platform. Tesla vehicles with FSD engaged average 5.1 million miles before a major collision, which outpaces that of the human driver average of roughly 699,000 miles.

Moravy also highlighted the widely cited NHTSA statistic that states that roughly 94 percent of crashes stem from human error, positioning autonomous vehicles as a path to dramatically reduce fatalities and injuries.

🚨 Tesla VP of Vehicle Engineering, Lars Moravy, appeared today before the U.S. Senate Commerce Committee to discuss the importance of outlining an efficient framework for autonomous vehicles:

— TESLARATI (@Teslarati) February 4, 2026

Skeptics sometimes point to cybersecurity concerns within self-driving vehicles, which was something that was highlighted during the Senate Commerce Committee hearing, but Moravy said, “No one has ever been able to take over control of our vehicles.”

This level of security is thanks to a core-embedded central layer, which is inaccessible from external connections. Additionally, Tesla utilizes a dual cryptographic signature from two separate individuals, keeping security high.

Moravy also dove into Tesla’s commitment to inclusive mobility by stating, “We are committed with our future products and Robotaxis to provide accessible transportation to everyone.” This has been a major point of optimism for AVs because it could help the disabled, physically incapable, the elderly, and the blind have consistent transportation.

Overall, Moravy’s testimony blended urgency about geopolitical competition, especially China, with concrete safety statistics and a vision of the advantages autonomy could bring for everyone, not only in the U.S., but around the world, as well.

News

Tesla Model Y lineup expansion signals an uncomfortable reality for consumers

Tesla launched a new configuration of the Model Y this week, bringing more complexity to its lineup of the vehicle and adding a new, lower entry point for those who require an All-Wheel-Drive car.

However, the broadening of the Model Y lineup in the United States could signal a somewhat uncomfortable reality for Tesla fans and car buyers, who have been vocal about their desire for a larger, full-size SUV.

Tesla has essentially moved in the opposite direction through its closure of the Model X and its continuing expansion of a vehicle that fits the bill for many, but not all.

Tesla brings closure to Model Y moniker with launch of new trim level

While CEO Elon Musk has said that there is the potential for the Model Y L, a longer wheelbase configuration of the vehicle, to enter the U.S. market late this year, it is not a guarantee.

Instead, Tesla has prioritized the need to develop vehicles and trim levels that cater to the future rollout of the Robotaxi ride-hailing service and a fully autonomous future.

But the company could be missing out on a massive opportunity, as SUVs are a widely popular body style in the U.S., especially for families, as the tighter confines of compact SUVs do not support the needs of a large family.

Although there are other companies out there that manufacture this body style, many are interested in sticking with Tesla because of the excellent self-driving platform, expansive charging infrastructure, and software performance the vehicles offer.

Additionally, the lack of variety from an aesthetic and feature standpoint has caused a bit of monotony throughout the Model Y lineup. Although Premium options are available, those three configurations only differ in terms of range and performance, at least for the most part, and the differences are not substantial.

Minor Expansions of the Model Y Fail to Address Family Needs for Space

Offering similar trim levels with slight differences to cater to each consumer’s needs is important. However, these vehicles keep a constant: cargo space and seating capacity.

Larger families need something that would compete with vehicles like the Chevrolet Tahoe, Ford Expedition, or Cadillac Escalade, and while the Model X was its largest offering, that is going away.

Tesla could fix this issue partially with the rollout of the Model Y L in the U.S., but only if it plans to continue offering various Model Y vehicles and expanding on its offerings with that car specifically. There have been hints toward a Cyber-inspired SUV in the past, but those hints do not seem to be a drastic focus of the company, given its autonomy mission.

Model Y Expansion Doesn’t Boost Performance, Value, or Space

You can throw all the different badges, powertrains, and range ratings on the same vehicle, it does not mean it’s going to sell better. The Model Y was already the best-selling vehicle in the world on several occasions. Adding more configurations seems to be milking it.

The true need of people, especially now that the Model X is going away, is going to be space. What vehicle fits the bill of a growing family, or one that has already outgrown the Model Y?

Not Expanding the Lineup with a New Vehicle Could Be a Missed Opportunity

The U.S. is the world’s largest market for three-row SUVs, yet Tesla’s focus on tweaking the existing Model Y ignores this. This could potentially result in the Osborne Effect, as sales of current models without capturing new customers who need more seating and versatility.

Expansions of the current Model Y offerings risk adding production complexity without addressing core demands, and given that the Model Y L is already being produced in China, it seems like it would be a reasonable decision to build a similar line in Texas.

Listening to consumers means introducing either the Model Y L here, or bringing a new, modern design to the lineup in the form of a full-size SUV.

Elon Musk

Elon Musk reiterates Tesla Optimus’ most sci-fi potential yet

Musk shared his comments in a series of posts on social media platform X.

Elon Musk recently reiterated one of the most ambitious forecasts for Tesla’s humanoid robot, Optimus, stating it could become the first real-world example of a Von Neumann machine. He also noted once more that Optimus would be Tesla’s biggest product.

Musk shared his comments in a series of posts on social media platform X.

Optimus as a von Neumann machine

In response to a post on X that pondered on sci-fi timelines becoming real, Musk wrote that “Optimus will be the first Von Neumann machine, capable of building civilization by itself on any viable planet.” In a separate post, Musk wrote that Optimus will be Tesla’s “biggest product ever,” a phrase he has used in the past to describe the humanoid robot’s importance to the electric vehicle maker.

A Von Neumann machine is a class of theoretical self-replicating systems originally proposed in the mid-20th century by the mathematician John von Neumann. In his concept, von Neumann described machines that could travel to other worlds, use local materials to create copies of themselves, and carry out large-scale tasks without outside intervention.

Elon Musk’s broader plans

Considering Musk’s comments, it appears that Optimus would eventually be capable of performing complex work autonomously in environments beyond Earth. If Optimus could achieve such a feat, it could very well unlock humanity’s capability to explore locations beyond Earth. The idea of space exploration becomes more than feasible.

Elon Musk has discussed space-based AI compute, large-scale robotic production, and the role of SpaceX’s Starship in transporting hardware and materials to other planets. While Musk did not detail how Optimus would fit with SpaceX’s exploration activities, his Von Neumann machine comments suggest he is looking at Tesla’s robotics as part of a potential interplanetary ecosystem.