News

SpaceX nears big US govt. missions as ULA handwaves about risks of competition

Speaking at the 2018 Von Braun Symposium in Huntsville, Alabama, ULA COO John Elbon expressed worries that the US National Security Space (NSS) apparatus could be put at significant risk if it comes to rely too heavily on the commercial launch industry to assure access to space.

Given that the US military’s launch capabilities rest solely on SpaceX and ULA and will remain that way for at least three more years, Elbon’s comment was effectively an odd barb tossed in the direction of SpaceX and – to a lesser extent – Blue Origin, two disruptive and commercially-oriented launch providers.

- The history of ULA and its Delta IV rocket is far wilder than most would expect. (Tom Cross)

- The first stage of Parker Solar Probe’s Delta IV Heavy rocket prepares to be lifted vertical. (ULA)

Reading between the lines

For the most part, Elbon’s brief presentation centered around a reasonable discussion of ULA’s track record and future vehicle development, emphasizing the respectable reliability of its current Atlas V and Delta IV rockets and the ‘heritage’ they share with ULA’s next-generation Vulcan vehicle. However, the COO twice brought up an intriguing concern that the US military launch apparatus could suffer if it ends up relying too heavily on ‘commercially-sustained’ launch vehicles like Falcon 9/Heavy or New Glenn.

To provide historical context and evidence favorable to his position, Elbon brought up a now-obscure event in the history of the launch industry, where – 20 years ago – companies Lockheed Martin and Boeing reportedly “set out to develop … Atlas V and Delta IV” primarily to support the launch of several large satellite constellations. The reality and causes of the US launch industry’s instability in the late ’90s and early ’00s is almost indistinguishable from this narrative, however.

Despite the many veils of aerospace and military secrecy surrounding the events that occurred afterward, the facts show that – in 1999 – Boeing (per acquisition of McDonnell Douglas) and Lockheed Martin (LM) both received awards of $500M to develop the Delta IV and Atlas V rockets, and the military further committed to buying a full 28 launches for $2B between 2002 and 2006. Combined, the US military effectively placed $3B ($4.5B in 2018 dollars) on the table for its Evolved Expendable Launch Vehicle (EELV) program with the goal of ensuring uninterrupted access to space for national security purposes.

- Crew Dragon arrives at ISS. (SpaceX)

- Boeing’s Starliner spacecraft. (Boeing)

- A mockup of Boeing’s Starliner capsule is explored by one of NASA’s Commercial Crew astronauts, clad in a Boeing spacesuit. (Boeing)

- SpaceX’s Commercial Crew pressure suit seen on NASA astronauts during testing. (SpaceX)

Rocketing into corporate espionage

“The robust commercial market forecast led the Air Force to reconsider its acquisition strategy. The EELV acquisition strategy changed from a planned down-select to a single contractor and a standard Air Force development program [where the USAF funds vehicle development in its entirety] to a dual commercialized approach that leveraged commercial market share and contractor investment.” – USAF EELV Fact Sheet, March 2017

The above quote demonstrates that there is at least an inkling of truth in Elbon’s spin. However, perhaps the single biggest reason that the EELV program and its two awardees stumbled was gross, inexcusable conduct on the part of Boeing. In essence, the company’s space executives conspired to use corporate espionage to gain an upper-hand over Lockheed Martin, knowledge which ultimately allowed Boeing to severely low-ball the prices of its Delta IV rocket, securing 19 of 28 available USAF launch contracts.

Ultimately, Lockheed Martin caught wind of Boeing’s suspect behavior and filed a lawsuit that began several years of USAF investigations and highly unpleasant revelations, while Boeing also had at least 10 future launch contracts withdrawn to the tune of ~$1B (1999). USAF investigations discovered that Boeing had lied extensively to the Air Force for more than four years – the actual volume of information stolen would balloon wildly from Boeing’s initial reports of “seven pages of harmless data” to 10+ boxes containing more than 42,000 pages of extremely detailed technical and proprietary information about Lockheed Martin’s Atlas V rocket proposal.

“If you rewind the clock 20 years, there were folks on a panel like this having dialogue about commercial launch, and there were envisioned several constellations that were going to require significant commercial launch. Lockheed Martin and Boeing set out to develop launch vehicles that were focused on that very robust commercial market – in the case of McDonald Douglas at the time, which later became Boeing, the factory in Decatur was…sized to crank out 40 [rocket boosters] a year, a couple of ships were bought to transport those…significant infrastructure put in place to address that envisioned launch market.” – John Elbon, COO, United Launch Alliance (ULA)

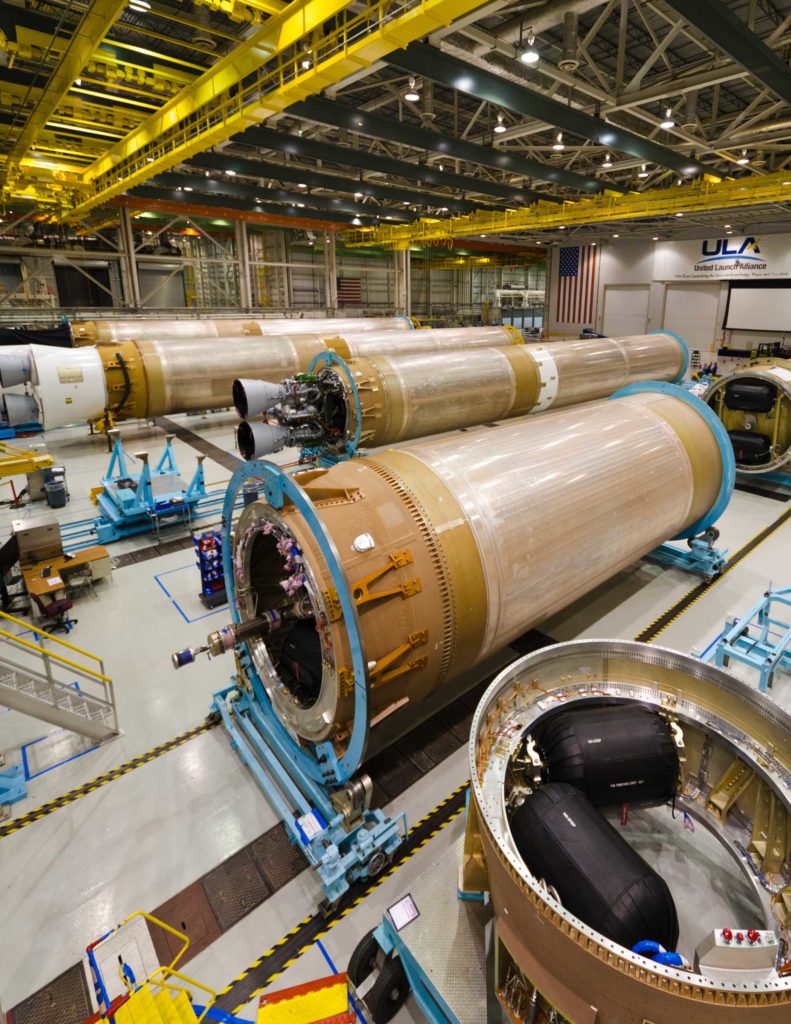

- ULA’s Decatur, Alabama factory now produces both Delta IV and Atlas 5. (ULA)

- ULA’s Atlas 5 launched AEHF-4 for the USAF earlier this month. (ULA)

In reality, Boeing was so desperate to secure USAF launches – despite the fact that it knew full well that Delta IV was too expensive to be sustainably competitive – that dozens of employees were eventually roped into a systematic, years-long, highly-illegal program of corporate espionage specifically designed to beat out government launch competitor Lockheed Martin. Humorously, Delta IV was not even Boeing’s design – rather, Boeing acquired designer McDonnell Douglas in late 1996, five days before the USAF announced the decision to reject Boeing and another company’s EELV proposals, narrowing down to two finalists (McDonnell Douglas and Lockheed Martin).

Seven years after the original lawsuit snowballed, Boeing settled with Lockheed Martin for a payment of more than $600M in 2006, accepting responsibility for its employees’ actions but admitting no corporate wrongdoing. Five years after that settlement, John Elbon became Vice President of Boeing’s Space Exploration division. This is by no means to suggest that Elbon is in any way complicit, having spent much of his 30+ years at Boeing managing the company’s involvement in the International Space Station, but more serves as an example of how recent these events are and why their consequences almost certainly continue to reverberate loudly within the US space industry.

SpaceX forces change

Worsened significantly by the consequences of Boeing’s lies about the actual operational costs of its Delta IV rocket (it had planned to secretly write off a loss on each rocket in order to steal USAF market share from LockMart), the commercial market for the extremely expensive rocket was and still is functionally nonexistent. 35 out of the family’s 36 launches have been contracted by the US military (30), NOAA (3), or NASA (2); the rocket’s first launch, likely sold at a major discount to Eutelsat, remains its one and only commercial mission.

Atlas V, typically priced around 30% less than comparable Delta IV variants, has had a far more productive career, albeit with very few commercial launches since the Dec. 2006 formation of the United Launch Alliance. Since 2007, just 5 of Atlas V’s 70 launches have been for commercial customers. Frankly, although Atlas V was appreciably more affordable than Delta IV, neither rocket was ever able to sustainably compete with Europe’s Ariane 5 workhorse – Ariane 5 cost more per launch, but superior payload performance often let Arianespace manifest two large satellites on a single launch, approximately halving the cost for each customer. Russia’s affordable (but only moderately reliable) Proton rockets also played an important role in the commercial launch industry prior to SpaceX’s arrival.

After fighting tooth and nail for years to break ULA’s US governmental launch monopoly, SpaceX’s first dedicated National Security Space launch finally occurred less than a year and a half ago, in May 2017. SpaceX has since placed a USAF spaceplane and a classified NSS-related satellite into orbit and been awarded launch contracts for critical USAF payloads, most notably winning five of five competed GPS III satellite launches, to begin as early as mid-December. Falcon 9 will cost the USAF roughly 30% less than a comparable Atlas 5 contract, $97M to ULA’s ~$135M.

- The aft connection mechanisms on Falcon Heavy Flight 1 and Flight 2 appear to be quite similar. It’s possible that SpaceX has chosen to reuse aspects of the hardware recovered on Flight 1’s two side boosters. (SpaceX)

- Falcon 9 Block 5 booster B1046 seen during both of its post-launch landings. (SpaceX/SpaceX)

A bit more than two decades after Boeing bought McDonnell Douglas and began a calculated effort to steal trade secrets from Lockheed Martin, Elbon – now COO of the Boeing/Lockheed Martin-cooperative ULA – seems to fervently believe that the most critical mistake made in the late 1990s and early 2000s was the USAF’s decision to partially support the development of two separate rockets. Elbon concluded his remarks on the topic with one impressively unambiguous summary of ULA’s position:

“We have to make sure that we don’t get too much supply and not enough demand so that the [launch] providers can’t survive in a robust business environment, and then we lose the capability as a country to do the launches we need to do … [That’s] the perspective we have at ULA and it’s based on the experience that we’ve been through in the past.”

In his sole Delta IV vs. Atlas V case-study, what ULA now seems to think might have been “too much supply” under the USAF’s EELV program appears to literally be the fundamental minimum conditions needed for competition to exist at all – two companies offering two competing products. Short of directly stating as much, it’s difficult to imagine a more concise method of revealing the apparent belief that competition – at all – is intrinsically undesirable or risky.

Elon Musk

Tesla is ramping up its advertising strategy on social media

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

Tesla seems to be ramping up its advertising strategy on social media once again. Marketing and advertising have not been a major focus of Tesla’s, something that has brought some criticism to the company from its fans.

However, the company looks to be making adjustments to that narrative, as it has at times in the past, as ads were spotted on several different platforms over the past few days.

On Facebook and YouTube, ads were spotted that were evidently placed by Tesla. On Facebook, Tesla was advertising Full Self-Driving, and on YouTube, an ad for its Energy Division was spotted:

Tesla also threw up some ads on YouTube for Energy https://t.co/19DGQMjBsA pic.twitter.com/XQRfgaDKxY

— TESLARATI (@Teslarati) March 9, 2026

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

In 2022, Tesla’s U.S. ad spend was roughly $152,000, a rounding error compared to General Motors’ $3.6 billion the following year.

Traditional automakers averaged about $495 per vehicle on ads; Tesla spent $0. CEOElon Musk’s stance was explicit: “Tesla does not advertise or pay for endorsements,” he posted on X in 2019. “Instead, we use that money to make the product great.”

The strategy relied on word-of-mouth from delighted owners, Elon’s massive X following, viral product launches, media frenzy, and customer referrals. A great product, Musk argued, sells itself. It does not need Super Bowl spots or billboards. Resources poured into R&D instead, with Tesla investing nearly $3,000 per car, far more than rivals.

Tesla counters jab at lack of advertising with perfect response

This reluctance wasn’t arrogance; it was philosophy, and Musk made it clear that the money was better spent on the product. Heavy spending on ads was seen as wasteful when innovation and authenticity drove organic demand. Shareholder calls for marketing budgets were ignored.

The current shift, paid Facebook ads promoting Full Self-Driving (Supervised) and YouTube Shorts offering up to $1,000 back on Powerwall batteries, marks a pragmatic evolution.

These targeted campaigns coincide with the end of one-time FSD purchases and a March 31 deadline for FSD transfer eligibility on new vehicles.

This move likely signals Tesla adapting to scale, as well as a more concerted effort to stop misinformation regarding its platform. As EV competition intensifies and the company bets big on robotaxis and energy storage, pure organic buzz may not suffice to hit adoption targets. Selective digital ads allow precise, cost-effective reach without abandoning core principles.

If successful, it could foreshadow measured expansion into marketing, boosting high-margin software and home energy revenue while preserving Tesla’s innovative edge. But, it’s nice to see the strategy return, especially as Tesla has been reluctant to change its mind in the past.

News

Tesla Model Y outsells everything in three states, but Ford dominates

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

The Tesla Model Y was the best-selling vehicle in three different states in the U.S. last year, according to new data that shows the all-electric crossover outsold every other car in a few places. However, Ford widely dominated the sales figures with its popular F-Series of pickups.

According to new vehicle registration data compiled by Edmunds and visualized by Visual Capitalist, the Ford F-Series, encompassing models like the F-150, F-250, F-350, and F-450, claimed the title of best-selling vehicle in 29 states.

This dominance underscores the pickup truck’s unbreakable appeal across much of the country, particularly in rural, Midwestern, Southern, and Western states, where towing capacity, durability, and utility for work or recreation remain top priorities.

The Tesla Model Y is the best-selling vehicle in California, Washington, and Nevada

How many states will it dominate next year? https://t.co/ERyoyce42D

— TESLARATI (@Teslarati) March 9, 2026

The F-Series has held the crown as America’s overall best-selling vehicle for decades, a streak that continued strong into 2025 despite broader market shifts.

Yet, amid this truck-heavy reality, Tesla made a notable breakthrough. The Model Y emerged as the top-selling vehicle, not just the leading EV, but the outright best-seller in three key states: California, Nevada, and Washington.

These West Coast strongholds reflect regions with robust EV infrastructure, high environmental awareness, generous incentives, and tech-savvy populations. In California alone, nearly 50 percent of new vehicle registrations were electrified, far outpacing the national average of around 25 percent.

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

Elon Musk: Tesla Model Y is world’s best-selling car for 3rd year in a row

Elsewhere, Japanese crossovers filled many gaps: Toyota’s RAV4 and Honda’s CR-V topped charts in several urban and densely populated Northeastern and Midwestern states, where fuel efficiency, reliability, and family-friendly features win out over larger trucks.

While Ford’s broad reach shows traditional preferences persist, at least for now, Tesla’s Model Y victories in high-population, influential states signal a gradual but undeniable transition toward electrification. As charging networks expand and battery technology improves, more states could follow the West Coast’s lead in the coming years.

This 2025 map captures a pivotal moment: pickup trucks still rule the majority, but EVs are carving out meaningful territory where consumer priorities align with sustainability and innovation. The road ahead promises continued competition between legacy giants and electric disruptors.

Elon Musk

Elon Musk shares updated Starship V3 maiden launch target date

The comment was posted on Musk’s official account on social media platform X.

SpaceX CEO Elon Musk shared a brief Starship V3 update in a post on social media platform X, stating the next launch attempt of the spacecraft could take place in about four weeks.

The comment was posted on Musk’s official account on social media platform X.

Musk’s update suggests that Starship Flight 12 could target a launch around early April, though the schedule will depend on several remaining milestones at SpaceX’s Starbase launch facility in Texas.

Among the key steps is testing and certification of the site’s new launch tower, launch mount, and tank farm systems. These upgrades will support the next generation of Starship vehicles.

Booster 19 is expected to roll to the launch site and be placed on the launch mount before returning to the production facility to receive its 33 Raptor engines. The booster would then return for a static fire test, which could mark the first time a Super Heavy booster equipped with Raptor V3 engines is fired on the pad.

Ship 39 is expected to undergo a similar preparation process. The vehicle will likely return to the production site to receive its six engines before heading to Massey’s test site for static fire testing.

Once both stages are prepared, the booster and ship will roll out to the launch site for the first full stack of a V3 Super Heavy and V3 Starship. A full wet dress rehearsal is expected to follow before any launch attempt.

Elon Musk has previously shared how SpaceX plans to eventually recover Starship’s upper stage using the launch tower’s robotic arms. Musk noted that the company will only attempt to catch the Starship spacecraft after two successful soft landings in the ocean. The approach is intended to reduce risk before attempting a recovery over land.

“Should note that SpaceX will only try to catch the ship with the tower after two perfect soft landings in the ocean. The risk of the ship breaking up over land needs to be very low,” Musk wrote in a post on X.

Such a milestone would represent a major step toward the full reuse of the Starship system, which remains a central goal for SpaceX’s long-term launch strategy.