News

China puts Faraday Future’s Jia Yueting on official “Blacklist”

Faraday Future’s early financier, Jia Yueting, and reportedly the company’s largest shareholder has been placed on China’s official “Blacklist” for credit defaulters. The 44-year old Chinese billionaire and technology entrepreneur who once had grand visions to become China’s Steve Jobs, and take on the likes of Tesla, Apple, and Netflix through various high-flying ventures, is finding himself in even deep waters, according to the New York Times.

China’s court in Beijing has added Jia’s name to its official database for debt defaulters, after the court ruled that he owed roughly $73 million (480 million yuan) to Ping An Securities, an investment arm of China’s second-largest insurer. Jia along with two executives of LeEco, a company that Jia also controls, are arguably the most famous names on the government list.

The public list at shixin.court.gov.cn is maintained by China’s top court. In speaking with local business entrepreneurs in Beijing, Teslarati learned that the list was created as part of a government effort to publicly shame individuals that have taken on debt, largely during the time when the country was fueled by massive investments into growth opportunities, yet unable to pay back these debts. The government database is also part of a “social credit system” that will eventually be used to assign “a citizen score” for individuals based on their spending habits, loan repayment and good behavior in public.

According to the Times,

“Citing Chinese laws, the court order says Mr. Jia cannot engage in ‘high spending’ or any spending ‘not necessary for living and working.’ The relevant law elaborates further, stating that people whose spending is restricted cannot travel first-class on planes or trains, spend at expensive hotels or golf courses, buy or build luxurious houses, purchase cars that are not necessary for business operations, travel for leisure or pay for their children to study at private schools.”

This latest development doesn’t bode well for the future of Jia’s Los Angeles-based electric car startup, Faraday Future, that’s seen its executive team disband.

Faraday Future’s Vice President of Design and one of the company’s “founding executives”, Richard Kim, resigned earlier this month. The resignation of a man who led the design for the company’s once-promising FF91 electric car was seen as a fatal blow for Faraday, and akin to Tesla’s Chief Designer, Franz von Holzhausen, departing.

Kim was one of three founding executives that departed Faraday Future in the last four months. Nick Sampson, SVP of R&D, and SVP Dag Reckhorn are the two remaining founding executives.

Elon Musk

Tesla Full Self-Driving’s newest behavior is the perfect answer to aggressive cars

According to a recent video, it now appears the suite will automatically pull over if there is a tailgater on your bumper, the most ideal solution for when a driver is riding your bumper.

Tesla Full Self-Driving appears to have a new behavior that is the perfect answer to aggressive drivers.

According to a recent video, it now appears the suite will automatically pull over if there is a tailgater on your bumper, the most ideal solution for when a driver is riding your bumper.

With FSD’s constantly-changing Speed Profiles, it seems as if this solution could help eliminate the need to tinker with driving modes from the person in the driver’s seat. This tends to be one of my biggest complaints from FSD at times.

A video posted on X shows a Tesla on Full Self-Driving pulling over to the shoulder on windy, wet roads after another car seemed to be following it quite aggressively. The car looks to have automatically sensed that the vehicle behind it was in a bit of a hurry, so FSD determined that pulling over and letting it by was the best idea:

Tesla appears to be implementing some sort of feature that will now pull over if someone is tailgating you to let the car by

Really cool feature, definitely get a lot of this from those who think they drive race cars

— TESLARATI (@Teslarati) February 26, 2026

We can see from the clip that there was no human intervention to pull over to the side, as the driver’s hands are stationary and never interfere with the turn signal stalk.

This can be used to override some of the decisions FSD makes, and is a great way to get things back on track if the semi-autonomous functionality tries to do something that is either unneeded or not included in the routing on the in-car Nav.

FSD tends to move over for faster traffic on the interstate when there are multiple lanes. On two-lane highways, it will pass slower cars using the left lane. When faster traffic is behind a Tesla on FSD, the vehicle will move back over to the right lane, the correct behavior in a scenario like this.

Perhaps one of my biggest complaints at times with Full Self-Driving, especially from version to version, is how much tinkering Tesla does with Speed Profiles. One minute, they’re suitable for driving on local roads, the next, they’re either too fast or too slow.

When they are too slow, most of us just shift up into a faster setting, but at times, even that’s not enough, see below:

What has happened to Mad Max?

At one point it was going 32 in a 35. Traffic ahead had pulled away considerably https://t.co/bjKvaMVTNX pic.twitter.com/aaZSWmLu5v

— TESLARATI (@Teslarati) January 24, 2026

There are times when it feels like it would be suitable for the car to just pull over and let the vehicle that is traveling behind pass. This, at least up until this point, it appears, was something that required human intervention.

Now, it looks like Tesla is trying to get FSD to a point where it just knows that it should probably get out of the way.

Elon Musk

Tesla Megapack powers $1.1B AI data center project in Brazil

By integrating Tesla’s Megapack systems, the facility will function not only as a major power consumer but also as a grid-supporting asset.

Tesla’s Megapack battery systems will be deployed as part of a 400MW AI data center campus in Uberlândia, Brazil. The initiative is described as one of Latin America’s largest AI infrastructure projects.

The project is being led by RT-One, which confirmed that the facility will integrate Tesla Megapack battery energy storage systems (BESS) as part of a broader industrial alliance that includes Hitachi Energy, Siemens, ABB, HIMOINSA, and Schneider Electric. The project is backed by more than R$6 billion (approximately $1.1 billion) in private capital.

According to RT-One, the data center is designed to operate on 100% renewable energy while also reinforcing regional grid stability.

“Brazil generates abundant energy, particularly from renewable sources such as solar and wind. However, high renewable penetration can create grid stability challenges,” RT-One President Fernando Palamone noted in a post on LinkedIn. “Managing this imbalance is one of the country’s growing infrastructure priorities.”

By integrating Tesla’s Megapack systems, the facility will function not only as a major power consumer but also as a grid-supporting asset.

“The facility will be capable of absorbing excess electricity when supply is high and providing stabilization services when the grid requires additional support. This approach enhances resilience, improves reliability, and contributes to a more efficient use of renewable generation,” Palamone added.

The model mirrors approaches used in energy-intensive regions such as California and Texas, where large battery systems help manage fluctuations tied to renewable energy generation.

The RT-One President recently visited Tesla’s Megafactory in Lathrop, California, where Megapacks are produced, as part of establishing the partnership. He thanked the Tesla team, including Marcel Dall Pai, Nicholas Reale, and Sean Jones, for supporting the collaboration in his LinkedIn post.

Elon Musk

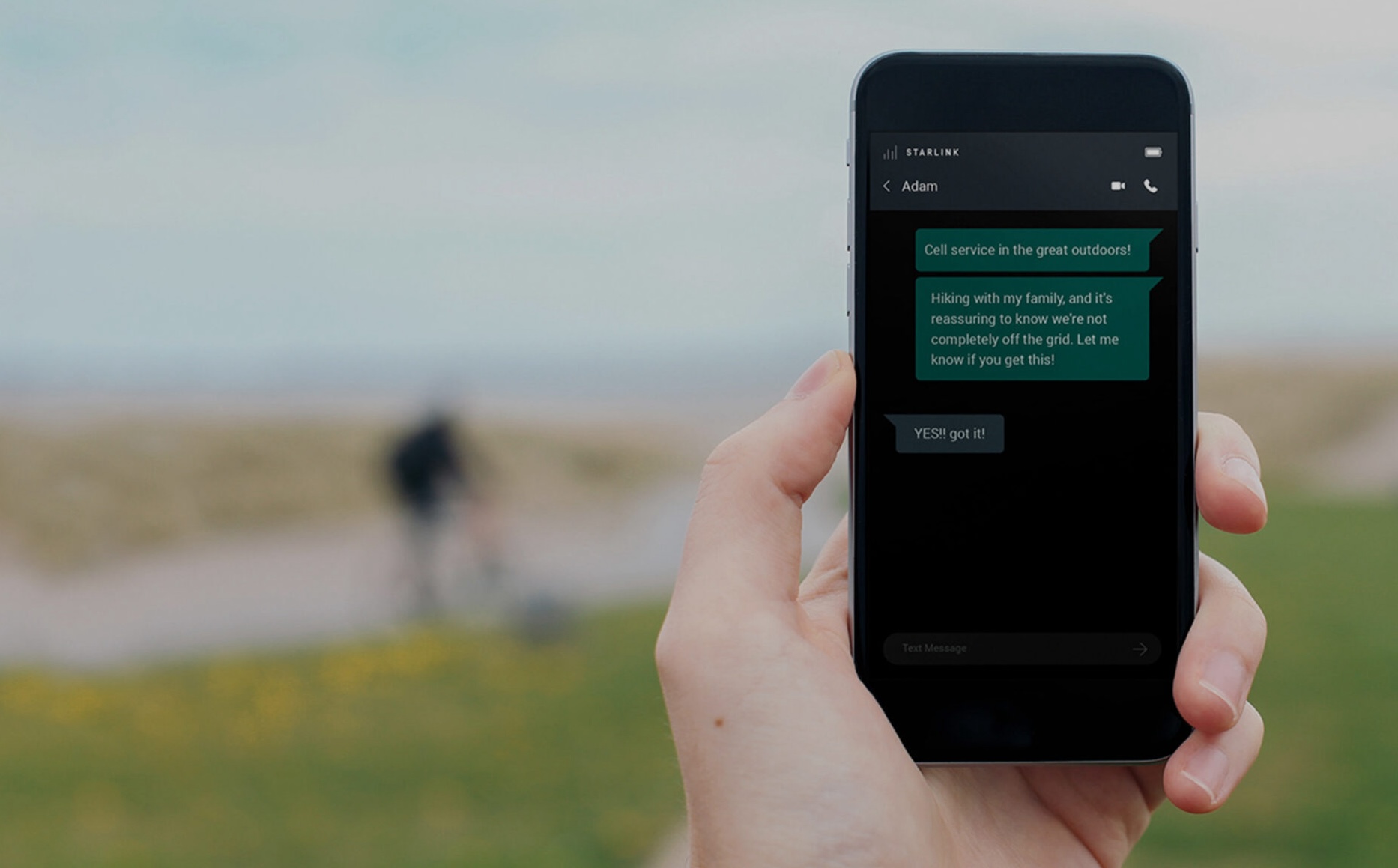

Starlink powers Europe’s first satellite-to-phone service with O2 partnership

The service initially supports text messaging along with apps such as WhatsApp, Facebook Messenger, Google Maps and weather tools.

Starlink is now powering Europe’s first commercial satellite-to-smartphone service, as Virgin Media O2 launches a space-based mobile data offering across the UK.

The new O2 Satellite service uses Starlink’s low-Earth orbit network to connect regular smartphones in areas without terrestrial coverage, expanding O2’s reach from 89% to 95% of Britain’s landmass.

Under the rollout, compatible Samsung devices automatically connect to Starlink satellites when users move beyond traditional mobile coverage, according to Reuters.

The service initially supports text messaging along with apps such as WhatsApp, Facebook Messenger, Google Maps and weather tools. O2 is pricing the add-on at £3 per month.

By leveraging Starlink’s satellite infrastructure, O2 can deliver connectivity in remote and rural regions without building additional ground towers. The move represents another step in Starlink’s push beyond fixed broadband and into direct-to-device mobile services.

Virgin Media O2 chief executive Lutz Schuler shared his thoughts about the Starlink partnership. “By launching O2 Satellite, we’ve become the first operator in Europe to launch a space-based mobile data service that, overnight, has brought new mobile coverage to an area around two-thirds the size of Wales for the first time,” he said.

Satellite-based mobile connectivity is gaining traction globally. In the U.S., T-Mobile has launched a similar satellite-to-cell offering. Meanwhile, Vodafone has conducted satellite video call tests through its partnership with AST SpaceMobile last year.

For Starlink, the O2 agreement highlights how its network is increasingly being integrated into national telecom systems, enabling standard smartphones to connect directly to satellites without specialized hardware.