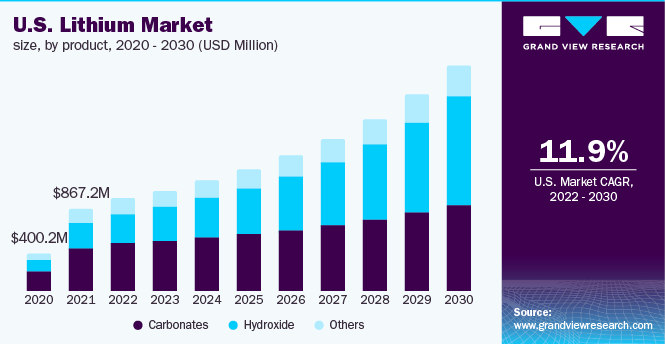

The high demand for electric vehicles is accelerating the growth of the global lithium market and is projected to continue to do so for some time.

According to a new report by Grand View Research, the lithium market has already doubled in size compared with 2020. In 2021 the global lithium market was valued at $6.83 billion.

And the lithium market is projected to grow at a compound annual growth rate (CAGR) of 12% from 2022 to 2030.

Demand for EVs in 2022

This year has been a remarkable year for EV growth. June was a record-breaking month for EV sales despite several global markets entering a recession.

Rivian recently reported that it had around 98,000 R1 net preorders for the first half of 2022 and noted that it was fully ramping up to meet the strong demand for its products.

Ford reported an EV sales growth of over 168% in July. Deliveries of the Ford F150 Lightning began in late May 2022. Ford is also cutting 8,000 jobs from its internal combustion engine productions to focus on EVs.

Tesla delivered 254,695 vehicles in the second quarter of 2022 despite the challenges affecting the supply chain and the factory shutdowns in China.

EVs accelerating the growth of the global lithium market

According to the report, the electrification of vehicles is projected to boost the volume of lithium-ion batteries which will accelerate the market growth. In particular, the automotive sector is at the center of growth during the forecast period.

The driving force is the stringent regulations for legacy automakers imposed by governments to reduce the carbon dioxide emissions from their vehicles; encouraging them to focus more on EVs. In addition, government subsidies for EVs and investments in the EV space will also boost the growth of the market.

The U.S. is a top consumer of lithium and has a lot of reserves. The U.S. Geological Survey noted that lithium resources from brines and minerals account for 7.9 million tons in the U.S. Despite having such a high amount of lithium, the U.S. only mines around 1% of the total demand in the world.

You can read the key points from the report here.

Disclaimer: Johnna is long Tesla.

I’d love to hear from you! If you have any comments, concerns, or see a typo, you can email me at johnna@teslarati.com. You can also reach me on Twitter @JohnnaCrider1

News

Ford is charging for a basic EV feature on the Mustang Mach-E

When ordering a new Ford Mustang Mach-E, you’ll now be hit with an additional fee for one basic EV feature: the frunk.

Ford is charging an additional fee for a basic EV feature on its Mustang Mach-E, its most popular electric vehicle offering.

Ford has shuttered its initial Model e program, but is venturing into a more controlled and refined effort, and it is abandoning the F-150 Lightning in favor of a new pickup that is currently under design, but appears to have some favorable features.

However, ordering a new Mustang Mach-E now comes with an additional fee for one basic EV feature: the frunk.

The frunk is the front trunk, and due to the lack of a large engine in the front of an electric vehicle, OEMs are able to offer additional storage space under the hood. There’s one problem, though, and that is that companies appear to be recognizing that they can remove it for free while offering the function for a fee.

Ford is now charging $495 on the Mustang Mach-E frunk (front trunk). What are your thoughts on that? pic.twitter.com/EOzZe3z9ZQ

— Alan of TesCalendar 📆⚡️ (@TesCalendar1) February 24, 2026

Ford is charging $495 for the frunk.

Interestingly, the frunk size varies by vehicle, but the Mustang Mach-E features a 4.7 to 4.8 cubic-foot-sized frunk, which measures approximately 9 inches deep, 26 inches wide, and 14 inches high.

When the vehicle was first released, Ford marketed the frunk as the ultimate tailgating feature, showing it off as a perfect place to store and serve cold shrimp cocktail.

Ford Mach-E frunk is perfect for chowders and chicken wings, and we’re not even joking

It appears the decision to charge for what is a simple advantage of an EV is not going over well, as even Ford loyal customers say the frunk is a “basic expectation” of an EV. Without it, it seems as if fans feel the company is nickel-and-diming its customers.

It will be pretty interesting to see the Mach-E without a frunk, and while it should not be enough to turn people away from potentially buying the vehicle, it seems the decision to add an additional charge to include one will definitely annoy some customers.

News

Tesla to improve one of its best features, coding shows

According to the update, Tesla will work on improving the headlights when coming into contact with highly reflective objects, including road signs, traffic signs, and street lights. Additionally, pixel-level dimming will happen in two stages, whereas it currently performs with just one, meaning on or off.

Tesla is looking to upgrade its Matrix Headlights, a unique and high-tech feature that is available on several of its vehicles. The headlights aim to maximize visibility for Tesla drivers while being considerate of oncoming traffic.

The Matrix Headlights Tesla offers utilize dimming of individual light pixels to ensure that visibility stays high for those behind the wheel, while also being considerate of other cars by decreasing the brightness in areas where other cars are traveling.

Here’s what they look like in action:

- Credit: u/ObjectiveScratch | Reddit

- Credit: u/ObjectiveScratch | Reddit

As you can see, the Matrix headlight system intentionally dims the area where oncoming cars would be impacted by high beams. This keeps visibility at a maximum for everyone on the road, including those who could be hit with bright lights in their eyes.

There are still a handful of complaints from owners, however, but Tesla appears to be looking to resolve these with the coming updates in a Software Version that is currently labeled 2026.2.xxx. The coding was spotted by X user BERKANT:

🚨 Tesla is quietly upgrading Matrix headlights.

Software https://t.co/pXEklQiXSq reveals a hidden feature:

matrix_two_stage_reflection_dip

This is a major step beyond current adaptive high beams.

What it means:

• The car detects highly reflective objects

Road signs,… pic.twitter.com/m5UpQJFA2n— BERKANT (@Tesla_NL_TR) February 24, 2026

According to the update, Tesla will work on improving the headlights when coming into contact with highly reflective objects, including road signs, traffic signs, and street lights. Additionally, pixel-level dimming will happen in two stages, whereas it currently performs with just one, meaning on or off.

Finally, the new system will prevent the high beams from glaring back at the driver. The system is made to dim when it recognizes oncoming cars, but not necessarily objects that could produce glaring issues back at the driver.

Tesla’s revolutionary Matrix headlights are coming to the U.S.

This upgrade is software-focused, so there will not need to be any physical changes or upgrades made to Tesla vehicles that utilize the Matrix headlights currently.

Elon Musk

xAI’s Grok approved for Pentagon classified systems: report

Under the agreement, Grok can be deployed in systems handling classified intelligence analysis, weapons development, and battlefield operations.

Elon Musk’s xAI has signed an agreement with the United States Department of Defense (DoD) to allow Grok to be used in classified military systems.

Previously, Anthropic’s Claude had been the only AI system approved for the most sensitive military work, but a dispute over usage safeguards has reportedly prompted the Pentagon to broaden its options, as noted in a report from Axios.

Under the agreement, Grok can be deployed in systems handling classified intelligence analysis, weapons development, and battlefield operations.

The publication reported that xAI agreed to the Pentagon’s requirement that its technology be usable for “all lawful purposes,” a standard Anthropic has reportedly resisted due to alleged ethical restrictions tied to mass surveillance and autonomous weapons use.

Defense Secretary Pete Hegseth is scheduled to meet with Anthropic CEO Dario Amodei in what sources expect to be a tense meeting, with the publication hinting that the Pentagon could designate Anthropic a “supply chain risk” if the company does not lift its safeguards.

Axios stated that replacing Claude fully might be technically challenging even if xAI or other alternative AI systems take its place. That being said, other AI systems are already in use by the DoD.

Grok already operates in the Pentagon’s unclassified systems alongside Google’s Gemini and OpenAI’s ChatGPT. Google is reportedly close to an agreement that will result in Gemini being used for classified use, while OpenAI’s progress toward classified deployment is described as slower but still feasible.

The publication noted that the Pentagon continues talks with several AI companies as it prepares for potential changes in classified AI sourcing.