News

Elon Musk says SpaceX could soon face bankruptcy – here’s why that’s unlikely

In a new leaked email, SpaceX CEO Elon Musk says that the company could go bankrupt if, by the end of 2022, it can’t achieve Starship and Starlink milestones that are by all practical appearances out of reach.

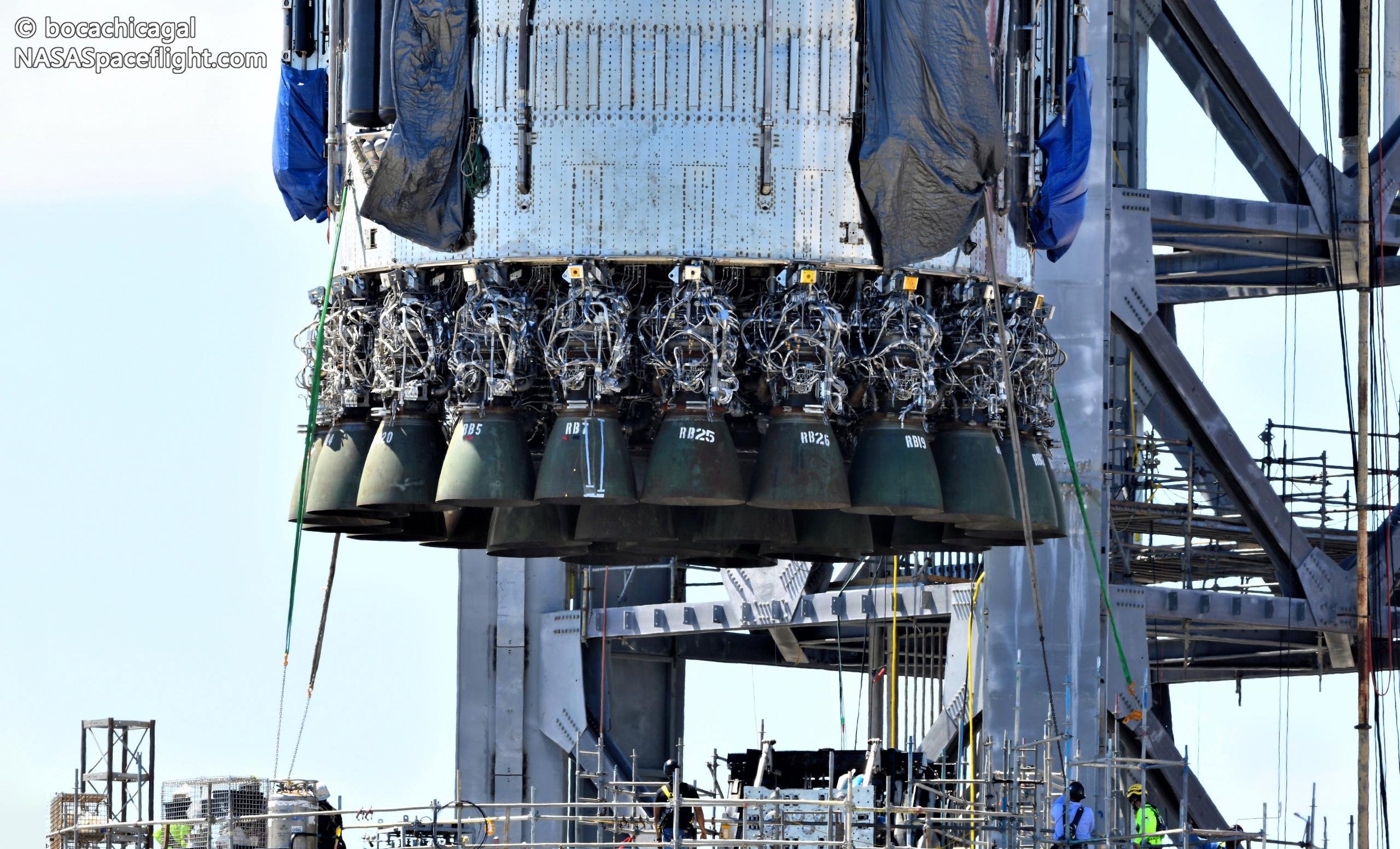

The news – first broken by SpaceExplored – comes about a week after CNBC reported that Musk was “shaking up” SpaceX’s leadership by effectively firing its vice president of propulsion due to “a lack of progress” in the development of Starship’s Raptor engine. Now, apparently after taking his first good look ‘under the hood’ in a while, Musk says that “the Raptor production crisis is much worse than it seemed a few weeks ago.” Worse, the CEO has implied that if it “can’t get enough reliable Raptors made [by the end of 2022]…[SpaceX will] face a genuine risk of bankruptcy.”

The email raises both skepticism and several major questions.

First and foremost, can there be any truth to Musk’s claim that SpaceX could go bankrupt because of an unspecified “Raptor production crisis [and disaster]?” Put simply, not really. Musk’s argument is simple enough. According to his estimations, the first-generation (V1) Starlink satellite internet constellation is “financially weak by itself,” which has led SpaceX to develop a much larger, more advanced second-generation (V2) Starlink satellite and constellation that the company’s existing “Falcon [rockets have] neither the [payload] volume nor mass to orbit” to launch. To efficiently launch the Starlink V2 constellation, then, Musk says SpaceX needs Starship to be operational.

Up to that point, nothing in Musk’s email implies that a “Raptor production crisis” could pose any serious harm to SpaceX beyond annoying delays. More than two years ago, Musk believed that Raptor V1.0 already cost less than $1M to produce. As of 2021, SpaceX (again per Musk) is completing an average of one Raptor engine every two days and currently has 35 functional engines installed on Starship and Super Heavy booster prototypes in Boca Chica, Texas. Already, at a rate of one engine every 48 hours, SpaceX’s Raptor production capabilities are theoretically strong enough to fully outfit a significant Starship fleet.

Both stages of Starship are designed to be rapidly and fully reusable and absolutely need to be to efficiently and rapidly launch SpaceX’s Starlink V2 constellation. In theory, a production capacity of ~180 Raptors per year should allow SpaceX to outfit a fleet of three Super Heavies (99 engines) and 13 Starships (72 engines). Even if Super Heavy booster reuse is initially no faster than Falcon (~1 launch per month) and Starship reuse is no faster than Dragon (~3 launches per year), that fleet would be able to launch at least 36 times per years. Even if SpaceX’s former propulsion executives somehow pulled the wool over Musk’s eyes, tricking him into seeing engines that just weren’t there and hiding hundreds of millions of dollars in secret cost overruns from the company’s own accountants, an annual run rate of 100 Raptor engines at a cost of $5 million each would still be able to power a fleet of six reusable ships and two boosters capable of ~20 launches per year.

Musk says that SpaceX will only face the risk of bankruptcy if it “cannot achieve a Starship flight rate of at least once every two weeks next year” – equivalent to 26 launches annually. Again, being deceived for years would be a terrible look but nothing described above appears to have any chance of bankrupting SpaceX. However, the CEO also says that SpaceX “is spooling up” one or several factories to produce “several million” Starlink user terminals (dishes) per year in a process that “will consume massive capital [and assumes] that [Starlink V2 satellites] will be on orbit to handle the bandwidth demand.” He even goes as far as to say that those millions of terminals “will be useless otherwise.”

Once again, while what he describes is an undeniable hurdle for SpaceX, the company is making a choice to “consume massive capital” to “spool up” Starlink dish factories before the constellation capacity needed to take advantage of those dishes has been secured. SpaceX doesn’t need to make such a massive investment so quickly when it could instead split that money with Starship, ensure that Starship and Raptor and Starlink V2.0 satellites are ready or close to ready for routine launches, and then invest heavily in dish production.

For example, just this month, SpaceX raised almost $350M from investors that have a practically bottomless appetite for SpaceX investments. Combined, by the end of the year, SpaceX will have likely raised more than $2.3B in 2021 alone. Valued at more than $100 billion, the company could – as a last resort – feasibly raise double-digit billions in one fell swoop with an IPO. Put simply, the only way SpaceX could ever go bankrupt in the near term would be by consciously letting itself drown in a sea of life preservers.

This is not to say that SpaceX doesn’t have numerous massive challenges ahead of it, nor is it to say that its fundraising potential is truly limitless. Investors could eventually become disillusioned. It’s entirely possible that it will take SpaceX years longer than Musk expects to begin routine Starlink V2.0 launches with Starship. Environmental approvals alone could easily preclude more than five orbital Starship launches in 2022 and potentially prevent regular (i.e. biweekly) launches well into 2023. But the fact of the matter is that unless Elon Musk is telegraphing signs that the rest of the company’s finances are a house of cards, the odds of SpaceX actually going bankrupt anytime soon are vanishingly small. In reality, he’s likely just attempting to (for better or worse) instill some amount of fear and panic in SpaceX employees to encourage them to work more hours and take fewer days off.

Update: Musk has tweeted a brief public comment confirming that he believes bankruptcy is actually an unlikely – but not impossible – outcome for SpaceX.

If a severe global recession were to dry up capital availability / liquidity while SpaceX was losing billions on Starlink & Starship, then bankruptcy, while still unlikely, is not impossible.

GM & Chrysler went BK last recession.

“Only the paranoid survive.” – Grove— Elon Musk (@elonmusk) November 30, 2021

News

Tesla is making two big upgrades to the Model 3, coding shows

According to coding found in the European and Chinese configurators, Tesla is planning to make two big upgrades: Black Headliner offerings and a new 16-inch QHD display, similar to that on the Model Y Performance.

Tesla is making two big upgrades to the Model 3, one of which is widely requested by owners and fans, and another that it has already started to make on some trim levels of other models within the lineup.

The changes appear to be taking effect in the European and Chinese markets, but these are expected to come to the United States based on what Tesla has done with the Model Y.

According to coding found in the European and Chinese configurators, Tesla is planning to make two big upgrades: Black Headliner offerings and a new 16-inch QHD display, similar to that on the Model Y Performance.

These changes in the coding were spotted by X user BERKANT, who shared the findings on the social media platform this morning:

🚨 Model 3 changes spotted in Tesla backend

• New interior code: IN3PB (Interior 3 Premium Black)

• Linked to Alcantara-style black headliner

• Mapped to 2026 Model 3 Performance and Premium VINs• EPC now shows: “Display_16_QHD”

• Multiple 2026 builds marked with… pic.twitter.com/OkDM5EdbTu— BERKANT (@Tesla_NL_TR) February 23, 2026

It appears these new upgrades will roll out with the Model 3 Performance and Tesla’s Premium trim levels of the all-electric sedan.

The changes are welcome. Tesla fans have been requesting that its Model 3 and Model Y offerings receive a black headliner, as even with the black interior options, the headliner is grey.

Tesla recently upgraded Model Y vehicles to this black headliner option, even in the United States, so it seems as if the Model 3 will get the same treatment as it appears to be getting in the Eastern hemisphere.

Tesla has been basically accentuating the Model 3 and Model Y with small upgrades that owners have been wanting, and it has been a focal point of the company’s future plans as it phases out other vehicles like the Model S and Model X.

Additionally, Tesla offered an excellent 0.99% APR last week on the Model 3, hoping to push more units out the door to support a strong Q1 delivery figure at the beginning of April.

Elon Musk

SpaceX secures FAA approval for 44 annual Starship launches in Florida

The FAA’s environmental review covers up to 44 launches annually, along with 44 Super Heavy booster landings and 44 upper-stage landings.

SpaceX has received environmental approval from the Federal Aviation Administration (FAA) to conduct up to 44 Starship-Super Heavy launches per year from Kennedy Space Center Launch Complex 39A in Florida.

The decision allows the company to proceed with plans tied to its next-generation launch system and future satellite deployments.

The FAA’s environmental review covers up to 44 launches annually, along with 44 Super Heavy booster landings and 44 upper-stage landings. The approval concludes the agency’s public comment period and outlines required mitigation measures related to noise, emissions, wildlife, and airspace management.

Construction of Starship infrastructure at Launch Complex 39A is nearing completion. The site, previously used for Apollo and space shuttle missions, is transitioning to support Starship operations, as noted in a Florida Today report.

If fully deployed across Kennedy Space Center and nearby Cape Canaveral Space Force Station, Starship activity on the Space Coast could exceed 120 launches annually, excluding tests. Separately, the U.S. Air Force has authorized repurposing Space Launch Complex 37 for potential additional Starship activity, pending further FAA airspace analysis.

The approval supports SpaceX’s long-term strategy, which includes deploying a large constellation of satellites intended to power space-based artificial intelligence data infrastructure. The company has previously indicated that expanded Starship capacity will be central to that effort.

The FAA review identified likely impacts from increased noise, nitrogen oxide emissions, and temporary airspace closures. Commercial flights may experience periodic delays during launch windows. The agency, however, determined these effects would be intermittent and manageable through scheduling, public notification, and worker safety protocols.

Wildlife protections are required under the approval, Florida Today noted. These include lighting controls to protect sea turtles, seasonal monitoring of scrub jays and beach mice, and restrictions on offshore landings to avoid coral reefs and right whale critical habitat. Recovery vessels must also carry trained observers to prevent collisions with protected marine species.

Elon Musk

Texas township wants The Boring Company to build it a Loop system

The township’s board unanimously approved an application to The Boring Company’s “Tunnel Vision Challenge.”

The Woodlands Township, Texas, has formally entered The Boring Company’s tunneling sweepstakes.

The township’s board unanimously approved an application to The Boring Company’s “Tunnel Vision Challenge,” which offers up to one mile of tunnel construction at no cost to a selected community.

The Woodlands’ proposal, dubbed “The Current,” features two parallel 12-foot-diameter tunnels beneath the Town Center corridor near The Waterway. Teslas would shuttle passengers between Waterway Square, Cynthia Woods Mitchell Pavilion, Town Green Park and nearby hotels during concerts and large-scale events, as noted in a Chron report.

Township officials framed the tunnel as a solution for the township’s traffic congestion issues. The Pavilion alone hosts more than 60 shows each year and can accommodate crowds of up to 16,500, often straining Lake Robbins Drive and surrounding intersections.

“We know we have traffic impacts and pedestrian movement challenges, especially in the Town Center area,” Chris Nunes, chief operating officer of The Woodlands Township, stated during the meeting.

“The Current” mirrors the Loop system operating beneath the Las Vegas Convention Center, where Tesla vehicles transport passengers through underground tunnels between venues and resorts.

The Boring Company issued its request for proposals (RFP) in mid-January, inviting cities and districts to pitch local uses for its tunneling technology. The Woodlands must submit its application by Feb. 23, though no timeline has been provided for when a winning community will be announced.

Nunes confirmed that the board has authorized a submission for “The Current’s” proposal, though he emphasized that the project is still in its preliminary stages.

“The Woodlands Township Board of Directors has authorized staff to submit an application to The Boring Company, which has issued an RFP for communities interested in leveraging their technology to address community challenges,” he said in a statement.

“The Board believes that an underground tunnel would provide a safe and efficient means to transport people to and from various high-use community amenities in our Town Center.”