Shares of General Motors (NYSE: GM) have risen by 7.07 percent over the past week and nearly 22 percent over the past month as competitive offerings from other automakers increased in price and federal electric vehicle incentives point toward positive repercussions for the Detroit-based automaker.

Over the past five days, GM’s stock has appreciated by over 7 percent, with the biggest gains coming on Wednesday when shares closed up over 4%. Today, shares are up another 1.13 percent as of 3:30 p.m. ET. Analysts are pointing to a variety of reasons that are pushing the stock higher, including news of new EV incentives that could include many of the company’s current and future models and the news that Ford has increased F-150 Lightning prices.

The Motley Fool points out two primary forces on the stock. Most notably, Ford’s price increase for the F-150 Lighting makes the vehicle far more expensive at the base price than the upcoming Chevy Silverado EV that still advertises itself at a base price of $39,990 without a “destination charge.” As the transaction values of electric vehicles have increased by over 18 percent in the past year, it is unclear whether GM will increase the Silverado EV’s introductory pricing.

Full-size trucks have always been a close competition between the two brands, especially in terms of price. It is unclear if Ford will continue to sell the Lightning at the increased price if GM is able to sell the Silverado EV at the sub-$40,000 price tag, or if GM will be forced to raise prices, matching Ford’s offering.

The second force the Motley Fool notes is the details surrounding the upcoming EV tax incentives. This revised incentive plan includes many stipulations that could prevent foreign manufacturers and even some domestic models from recieving incentives. Foremost is the requirement of domestic assembly, but other requirements include amounts of battery materials and parts being domestically sourced and price and income limitations for models and buyers, respectively. These new requirements could mean that some GM products could receive a federal incentive when they hit the market.

However, GM does have significant hurdles to cross as they enter the EV market more substantially. They lag behind Ford and Rivian in truck sales and will face ramping production issues and recalls as they introduce multiple new models (much like other legacy manufacturers). As consumers wait for the Chevy Silverado EV, Blazer EV, and Equinox EV, they still lack a commercial electric van offering, a market Ford now dominates. Finally, they will likely face a bottleneck, not in their production but sourcing many battery components domestically as many manufacturers look to do the same.

Nonetheless, many investors are optimistic that GM will be able to solve these issues, hence the recent stock appreciation. It would also not be the first time GM defied the odds. The company was a leader with its introduction of the Chevy Bolt in 2015, and it could once again lead the market in affordable EV offerings.

Disclosure: William Johnson has no ownership of $GM stock.

What do you think of the article? Do you have any comments, questions, or concerns? Shoot me an email at william@teslarati.com. You can also reach me on Twitter @WilliamWritin. If you have news tips, email us at tips@teslarati.com!

News

Tesla makes latest move to remove Model S and Model X from its lineup

Tesla’s latest decisive step toward phasing out its flagship sedan and SUV was quietly removing the Model S and Model X from its U.S. referral program earlier this week.

Tesla has made its latest move that indicates the Model S and Model X are being removed from the company’s lineup, an action that was confirmed by the company earlier this quarter, that the two flagship vehicles would no longer be produced.

Tesla has ultimately started phasing out the Model S and Model X in several ways, as it recently indicated it had sold out of a paint color for the two vehicles.

Now, the company is making even more moves that show its plans for the two vehicles are being eliminated slowly but surely.

Tesla’s latest decisive step toward phasing out its flagship sedan and SUV was quietly removing the Model S and Model X from its U.S. referral program earlier this week.

The change eliminates the $1,000 referral discount previously available to new buyers of these vehicles. Existing Tesla owners purchasing a new Model S or Model X will now only receive a halved loyalty discount of $500, down from $1,000.

The updates extend beyond the two flagship vehicles. New Cybertruck buyers using a referral code on Premium AWD or Cyberbeast configurations will no longer get $1,000 off. Instead, both referrer and buyer receive three months of Full Self-Driving (Supervised).

The loyalty discount for Cybertruck purchases, excluding the new Dual Motor AWD trim level, has also been cut to $500.

NEWS: Tesla has removed the Model S and Model X from the referral program.

New owners also no longer get a $1,000 referral discount on a new Cybertruck Premium AWD or Cyberbeast. Instead, you now get 3 months of FSD (Supervised).

Additionally, Tesla has reduced the loyalty… pic.twitter.com/IgIY8Hi2WJ

— Sawyer Merritt (@SawyerMerritt) March 6, 2026

These adjustments apply only in the United States, and reflect Tesla’s broader strategy to optimize margins while boosting adoption of its autonomous driving software.

The timing is no coincidence. Tesla confirmed earlier this year that Model S and Model X production will end in the second quarter of 2026, roughly June, as the company reallocates factory capacity toward its Optimus humanoid robot and next-generation vehicles.

With annual sales of the low-volume flagships already declining (just 53,900 units in 2025), incentives are no longer needed to drive demand. Production is winding down, and Tesla expects strong remaining interest without subsidies.

Industry observers see this as the clearest sign yet of an “end-of-life” phase for the vehicles that once defined Tesla’s luxury segment. Community reactions on X range from nostalgia, “Rest in power S and X”, to frustration among long-time owners who feel perks are eroding just as the models approach discontinuation.

Some buyers are rushing orders to lock in final discounts before they vanish entirely.

Doug DeMuro names Tesla Model S the Most Important Car of the last 30 years

For Tesla, the move prioritizes efficiency: fewer discounts on outgoing models, a stronger push for FSD subscriptions, and a focus on high-margin Cybertruck trims amid surging orders.

Loyalists still have a narrow window to purchase a refreshed Plaid or Long Range model with remaining incentives, but the message is clear: Tesla’s lineup is evolving, and the era of the original flagships is drawing to a close.

News

Tesla Australia confirms six-seat Model Y L launch in 2026

Compared with the standard five-seat Model Y, the Model Y L features a longer body and extended wheelbase to accommodate an additional row of seating.

Tesla has confirmed that the larger six-seat Model Y L will launch in Australia and New Zealand in 2026.

The confirmation was shared by techAU through a media release from Tesla Australia and New Zealand.

The Model Y L expands the Model Y lineup by offering additional seating capacity for customers seeking a larger electric SUV. Compared with the standard five-seat Model Y, the Model Y L features a longer body and extended wheelbase to accommodate an additional row of seating.

The Model Y L is already being produced at Tesla’s Gigafactory Shanghai for the Chinese market, though the vehicle will be manufactured in right-hand-drive configuration for markets such as Australia and New Zealand.

Tesla Australia and New Zealand confirmed the vehicle will feature seating for six passengers.

“As shown in pictures from its launch in China, Model Y L will have a new seating configuration providing room for 6 occupants,” Tesla Australia and New Zealand said in comments shared with techAU.

Instead of a traditional seven-seat arrangement, the Model Y L uses a 2-2-2 layout. The middle row features two individual seats, allowing easier access to the third row while providing additional space for passengers.

Tesla Australia and New Zealand also confirmed that the Model Y L will be covered by the company’s updated warranty structure beginning in 2026.

“As with all new Tesla Vehicles from the start of 2026, the Model Y L will come with a 5-year unlimited km vehicle warranty and 8 years for the battery,” the company said.

The updated policy increases Tesla’s vehicle warranty from the previous four-year or 80,000-kilometer coverage.

Battery and drive unit warranties remain unchanged depending on the variant. Rear-wheel-drive models carry an eight-year or 160,000-kilometer warranty, while Long Range and Performance variants are covered for eight years or 192,000 kilometers.

Tesla has not yet announced official pricing or range figures for the Model Y L in Australia.

News

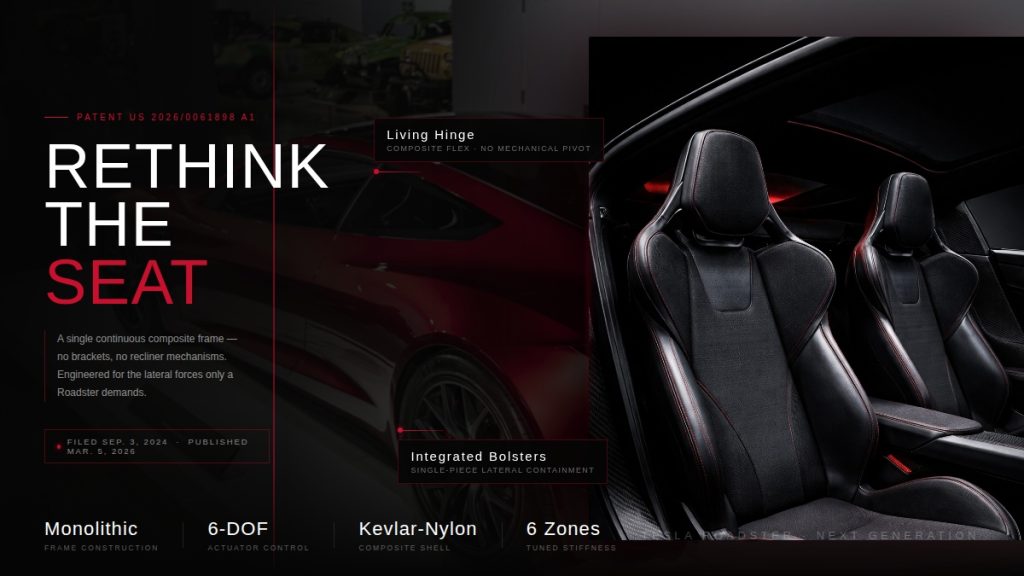

Tesla Roadster patent hints at radical seat redesign ahead of reveal

A newly published Tesla patent could offer one of the clearest signals yet that the long-awaited next-generation Roadster is nearly ready for its public debut.

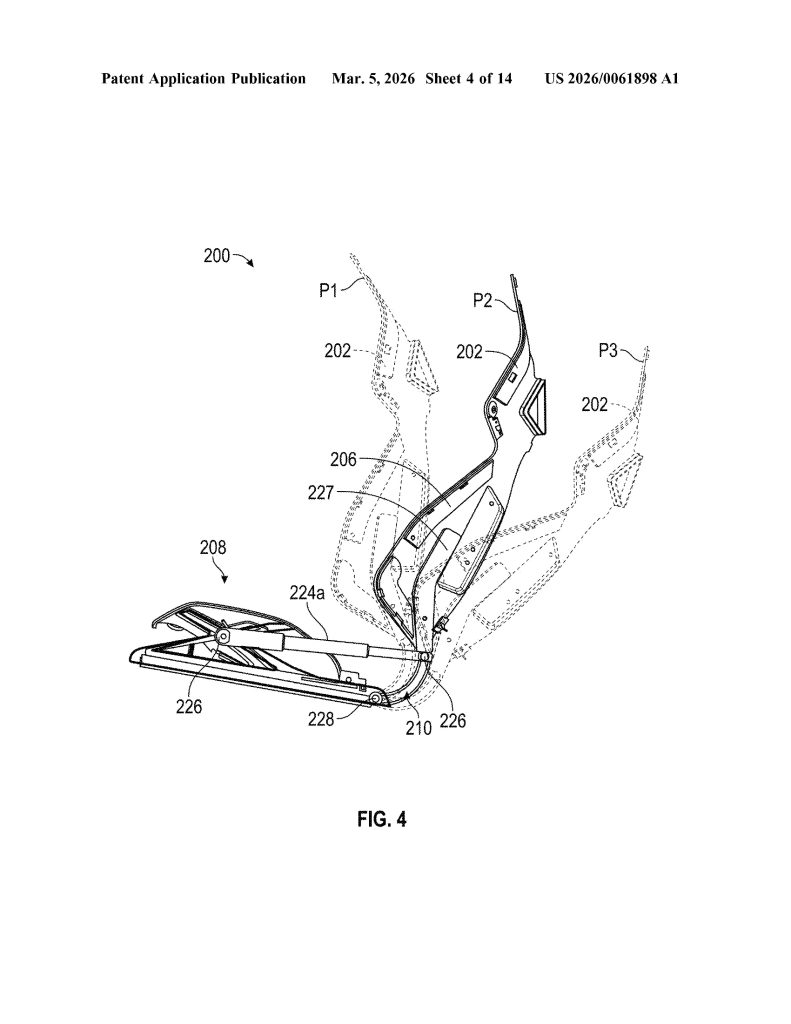

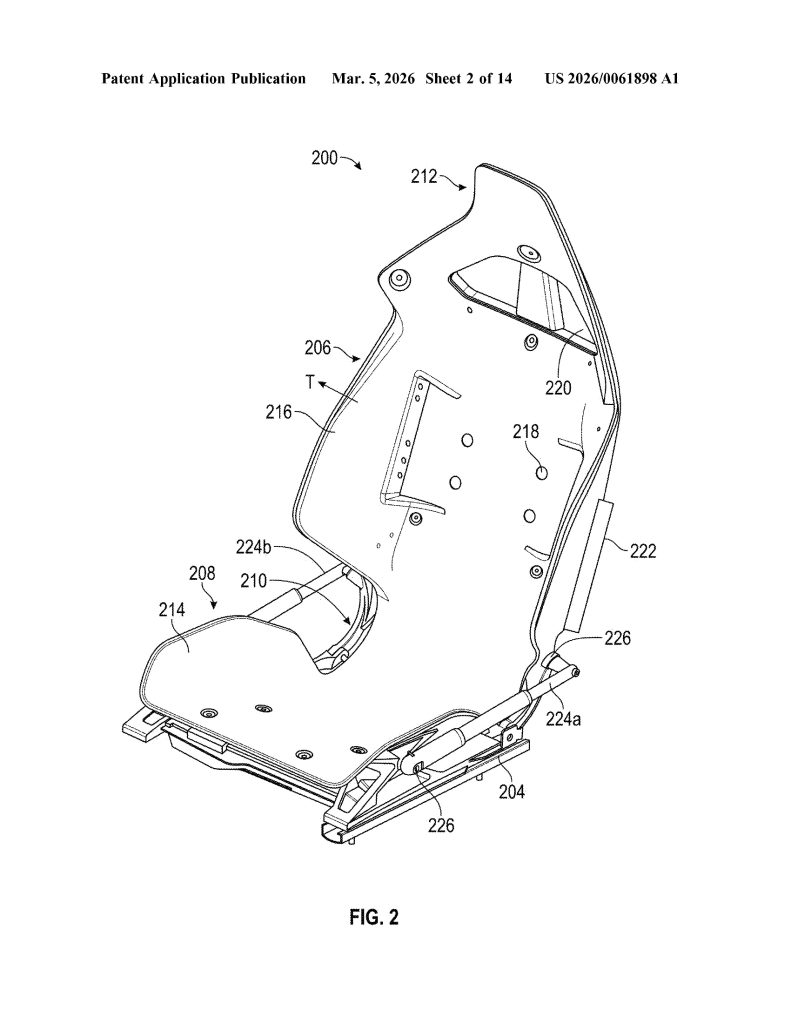

Patent No. US 20260061898 A1, published on March 5, 2026, describes a “vehicle seat system” built around a single continuous composite frame – a dramatic departure from the dozens of metal brackets, recliner mechanisms, and rivets that make up a traditional car seat. Tesla is calling it a monolithic structure, with the seat portion, backrest, headrest, and bolsters all thermoformed as one unified piece.

The approach mirrors Tesla’s broader manufacturing philosophy. The same company that pioneered massive aluminum castings to eliminate hundreds of body components is now applying that logic to the cabin. Fewer parts means fewer potential failure points, less weight, and a cleaner assembly process overall.

Tesla ramps hiring for Roadster as latest unveiling approaches

The timing of the filing is difficult to ignore. Elon Musk has publicly targeted April 1, 2026 as the date for an “unforgettable” Roadster design reveal, and two new Roadster trademarks were filed just last month. A patent describing a seat architecture suited for a hypercar, and one that Tesla has promised will hit 60 mph in under two seconds.

The Roadster, originally unveiled in 2017, has been one of Tesla’s most anticipated yet most delayed products. With a target price around $200,000 and engineering ambitions to match, it is being positioned as the ultimate showcase for what Tesla’s technology can do.

The patent was first flagged by @seti_park on X.

Tesla Roadster Monolithic Seat: Feature Highlights via US Patent 20260061898 A1

- Single Continuous Frame (Monolithic Construction). The core invention is a seat assembly built from one continuous frame that integrates the seat portion, backrest portion, and hinge into a single component — eliminating the need for separate structural parts and mechanical joints typical in conventional seats.

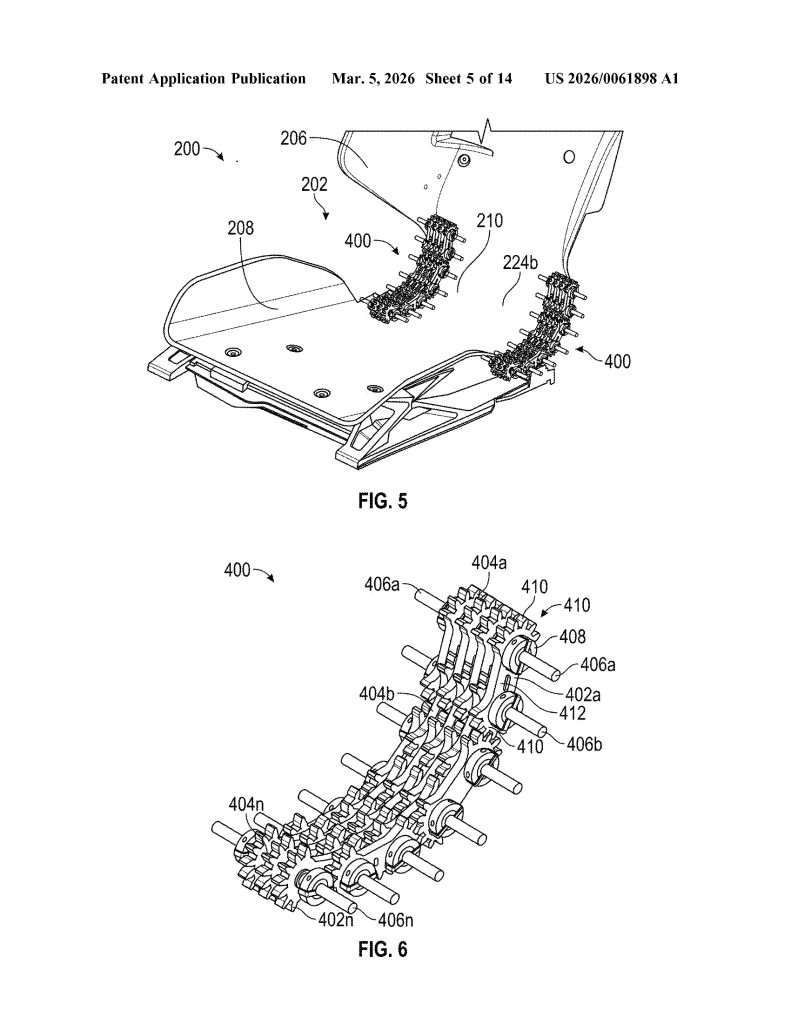

- Integrated Flexible Hinge. Rather than a traditional mechanical recliner, the hinge is built directly into the continuous frame and is designed to flex, and allowing the backrest to move relative to the seat portion. The hinge can be implemented as a fiber composite leaf spring or an assembly of rigid linkages.

- Thermoformed Anisotropic Composite Material. The continuous frame is manufactured via thermoforming from anisotropic composite materials, including fiberglass-nylon, fiberglass-polymer, nylon carbon composite, Kevlar-nylon, or Kevlar-polymer composites, enabling a molded-to-shape monolithic structure.

- Regionally Tuned Stiffness Zones. The frame is engineered with up to six distinct stiffness regions (R1–R6) across the seat, backrest, hinge, headrest, and bolsters. Each zone can have a different stiffness, allowing precise ergonomic and structural tuning without adding separate components.

- Linkage Assembly Hinge Mechanism. The hinge incorporates one or more linkage assemblies consisting of multiple interlocking links with gears, connected by rods. When driven by motors or actuators, these linkages act as a flexible member to control backrest movement along a precise, ergonomically optimized trajectory.

- Multi-Actuator Six-Degree-of-Freedom Positioning System. The seat uses four distinct actuator pairs, all controlled by a central controller. These actuators work in coordinated combinations to achieve fore/aft, height, cushion tilt, and backrest rotation adjustments simultaneously.

- ECU-Based Controller Architecture. An Electronic Control Unit (ECU) and programmable controller manage all seat actuators, receive user input via a user interface (touchscreen, buttons, or switches), and incorporate sensor feedback to confirm and maintain desired seat positions, essentially making this a software-driven seat system.

- Airbag-Integrated Bolster Deployment System. The backrest bolsters (216) are geometrically shaped and sized to guide airbag deployment along a specific, pre-configured trajectory. Left and right bolsters can have different shapes so that each guides its respective airbag along a distinct trajectory, improving occupant protection.

- Ventilation Holes Formed into the Backrest. The continuous frame includes one or more ventilation holes formed directly into the backrest portion, configured to either receive airflow into or deliver airflow from the seat frame — enabling passive or active thermal comfort without requiring separate ventilation components.

- Soft Trim Recess for Tool-Free Integration. The headrest and backrest portions together define a molded recess, specifically designed to receive and secure a soft trim component (foam, fabric, or cushioning) directly into the continuous frame, eliminating the need for separate attachment hardware and simplifying final assembly.