SpaceX

DeepSpace: A critical juncture for SpaceX, Blue Origin, ULA, other players

This is a free preview of DeepSpace, Teslarati’s new member-only weekly newsletter. Each week, I’ll be taking a deep-dive into the most exciting developments in commercial space, from satellites and rockets to everything in between. Sign up for Teslarati’s newsletters here to receive a preview of our membership program.

A high-pressure competition between all four major US launch providers – SpaceX, ULA, Blue Origin, and Orbital ATK (now NGIS) – is about to head into its most critical stage, a period of 60 days allotted for interested parties to submit their completed proposals. According to the US Air Force (USAF), the final request for proposals (RFP) could come as early as March 29th, giving the four aforementioned companies until May 28th to complete their proposals.

All things considered, the growing pressure and some of the USAF’s strategy behind the program – known as Launch Service Procurement (LSP) Phase 2 – has raised significant questions that remain largely unanswered and lead to a few mild bouts of strife or unhappiness from contract competitors. Most notably, Blue Origin – having just won a USAF development contract worth $500M – has repeatedly requested that the USAF and Department of Defense (DoD) delay the RFP and contract awards until 2021, according to Space News’ Sandra Erwin. Meanwhile, a lack of clarification from the USAF means that it’s unclear whether the strategy behind launch contract awards (LSP) will end up contradicting or undermining a partially connected development program known as Launch Service Agreements (LSA) that saw the USAF award ~$2B to three providers (excluding SpaceX) between 2018 and 2024.

Battle of the Acronyms: LSP vs. LSA

- Recently rebranded by the US military as the National Security Space Launch (NSSL) program, LSP Phase 1 and 2 and LSA are the latest major procurement initiatives begun under the Evolved Expendable Launch Vehicle (EELV) program, spun up in the 1990s to provide a firmer foundation for the commercial launch of military spacecraft after the 1986 Shuttle Challenger disaster pushed most satellites off of the platform.

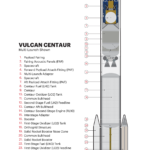

- Phase 2 of the EELV program has been ongoing for several years and will culminate with the procurement of 25+ launch contracts (LSP) from two providers no earlier than 2020. The USAF’s Launch Service Agreements are also a major strategic feature of Phase 2, nominally seeing the military branch contribute major funding to assist in the development of three separate launch vehicles (New Glenn, Vulcan, and Omega) with the intention of ultimately certifying those rockets for EELV (now NSSL) launches.

- LSA also saw the USAF award several tens of millions to SpaceX, Blue Origin, and Aerojet Rocketdyne to develop capabilities centered around advanced, new rocket engines (BE-4, AR-1, and Raptor), but the latest phase of LSA is valued at least several times higher than its earlier engine-specific awards.

-

- Oddly, the purpose of LSA was – at least on the cover – to effectively ensure that the Air Force had multiple (more than two) providers and thus preserve a healthy, competitive military launch market. A senior leader specifically stated that “the goal of [LSA] is to make sure [the US military has] a competitive industrial base.”

- Aside from an initial $181M awarded to Blue Origin, ULA, and Orbital ATK (now Northrop Grumman Innovation Systems, NGIS) in 2018 and 2019, the remaining funding – up to $320M for Blue Origin’s New Glenn, $610M for NGIS’ Omega, and $785M for ULA’s Vulcan – would be dispersed to each provider between 2020 and 2024.

- However, an odd and controversial bit of language behind the coming five-year launch services procurement (LSP) initiative would completely cut off funding to LSA awardees in the event that they fail to be awarded launches from the latest LSP.

- Additionally, the LSP awards are strictly meant – apparently very intentionally – to be distrubuted among two launch providers, despite a minimum at least four being able (SpaceX) or required (ULA, Blue, NGIS) to enter a bid.

- In other words, this guarantees that either one or two of the three LSA awardees would have the vast majority of their supposedly awarded development funding cut off after FY2020, four years early.

- Oddly, the purpose of LSA was – at least on the cover – to effectively ensure that the Air Force had multiple (more than two) providers and thus preserve a healthy, competitive military launch market. A senior leader specifically stated that “the goal of [LSA] is to make sure [the US military has] a competitive industrial base.”

- Despite continued protests from a number of stakeholders, the USAF has refused to budge from its decision to simultaneously A) create a duopoly, B) defeat the purpose of LSA awards, and C) mass-award ~25 launch contracts to two providers in 2020, anywhere from 12-24 months prior to the planned inaugural launches of all three LSA-funded rockets.

- Without cost-sharing development funds from the USAF and a chance of winning more than a handful of US military launch contracts between now and the late 2020s, it can be all but guaranteed that an LSA funding cutoff will either indefinitely pause or slow to a crawl a given provider’s development of their proposed launch vehicle.

A rocket and a hard place

- This sticky situation thus offers up a few potential ways that this badly-designed (or entirely dishonest) military launch development and procurement strategy will end up by the end of 2020. One way or another, the current strategy as it stands will end up providing two (or one, given that SpaceX will not receive LSA funding) companies with several years of development funding and at least five years of bountiful, guaranteed launch contracts.

- The four providers and two LSP slots available offer a set range of possible alternate realities, limited by political barriers that would, say, almost invariably prevent the USAF from severely harming ULA by cutting off the vast majority of the company’s only real source of income for 5+ years.

- ULA and SpaceX win: This maintains the status quo, wholly invalidating the point of using LSA funds to ensure “a competitive industrial base.” NGIS likely cancels/freezes all Omega development with no chance of competing in commercial markets. Blue Origin owner Jeff Bezos could significantly delay New Glenn’s readiness for military missions if he fails to invest an additional $500M in infrastructure. Likeliest result: a marginally competitive duopoly.

- ULA wins, SpaceX loses: Having just certified Falcon 9 – and nearly Falcon Heavy – for high-value military launches and awarded SpaceX a total of 10 launch contracts (9 yet to be completed), the USAF could effectively spit in SpaceX’s face and award ULA and Blue Origin or NGIS LSP’s 25+ launch contracts.

- It’s hard to exaggerate just how much of a slight this would be perceived as by SpaceX and its executives, CEO Elon Musk in particular. The USAF would be risking the creation of a major political enemy, one which has already demonstrated a willingness to take the federal government to court and win. The USAF/DoD would effectively be hedging their bets against an assumption that SpaceX’s nine present military launch contracts will sate the company and ensure that SpaceX indefinitely remains a certified EELV/NSSL provider.

- In this eventuality, either Blue Origin or NGIS would lose LSA funding and the prospect of almost any military launch contracts until the late 2020s. For NGIS, this would likely kill Omega.

- At the end of the day, it’s sadly conceivable that the USAF/DoD may end up awarding LSP contracts to ULA (effectively a politically-forced hand) and NGIS, the latter assuring Omega’s survival. The military would thus be assuming that the political fallout created with SpaceX and Blue Origin would not be enough to severely harm their relationships, while also assuming that their much stronger commercial prospects and independent funding sources would ensure that each provider remains certified and willing to compete for future NSSL/EELV launches.

Regardless of what happens, the contradictory ways the USAF/DoD have structured their LSA and LSP programs seems bizarrely intent on creating major headaches and potential problems where that could easily be avoided with extraordinarily simple changes, namely removing the inexplicable cap and allowing three or more companies to win some of the ~25 LSP launch contracts).

Mission Updates

- The second launch of Falcon Heavy – the rocket’s commercial debut – is still scheduled to occur as early as April 7th.

- After Falcon Heavy, Cargo Dragon’s CRS-17 resupply mission is firmly scheduled for April (April 25th), while the first dedicated Starlink launch is now NET May 2019.

Photo of the Week:

SpaceX CEO Elon Musk offered a glimpse of a 1650 Kelvin (2500ºF/1400ºC) test of Starship’s metallic heat shield, simulating mid-range temperatures such a shield’s windward side might experience during an orbital-velocity reentry.(c. Elon Musk/SpaceX)

News

SpaceX President Gwynne Shotwell details xAI power pledge at White House event

The commitment was announced during an event with United States President Donald Trump.

SpaceX President Gwynne Shotwell stated that xAI will develop 1.2 gigawatts of power at its Memphis-area AI supercomputer site as part of the White House’s new “Ratepayer Protection Pledge.”

The commitment was announced during an event with United States President Donald Trump.

During the White House event, Shotwell stated that xAI’s AI data center near Memphis would include a major energy installation designed to support the facility’s power needs.

“As you know, xAI builds huge supercomputers and data centers and we build them fast. Currently, we’re building one on the Tennessee-Mississippi state line. As part of today’s commitment, we will take extensive additional steps to continue to reduce the costs of electricity for our neighbors…

“xAI will therefore commit to develop 1.2 GW of power as our supercomputer’s primary power source. That will be for every additional data center as well. We will expand what is already the largest global Megapack power installation in the world,” Shotwell said.

She added that the system would provide significant backup power capacity.

“The installation will provide enough backup power to power the city of Memphis, and more than sufficient energy to power the town of Southaven, Mississippi where the data center resides. We will build new substations and invest in electrical infrastructure to provide stability to the area’s grid.”

Shotwell also noted that xAI will be supporting the area’s water supply as well.

“We haven’t talked about it yet, but this is actually quite important. We will build state-of-the-art water recycling plants that will protect approximately 4.7 billion gallons of water from the Memphis aquifer each year. And we will employ thousands of American workers from around the city of Memphis on both sides of the TN-MS border,” she noted.

The Ratepayer Protection Pledge was introduced as part of the federal government’s effort to address concerns about rising electricity costs tied to large AI data centers, as noted in an Insider report. Under the agreement, companies developing major AI infrastructure projects committed to covering their own power generation needs and avoiding additional costs for local ratepayers.

Elon Musk

SpaceX to launch Starlink V2 satellites on Starship starting 2027

The update was shared by SpaceX President Gwynne Shotwell and Starlink Vice President Mike Nicolls.

SpaceX is looking to start launching its next-generation Starlink V2 satellites in mid-2027 using Starship.

The update was shared by SpaceX President Gwynne Shotwell and Starlink Vice President Mike Nicolls during remarks at Mobile World Congress (MWC) in Barcelona, Spain.

“With Starship, we’ll be able to deploy the constellation very quickly,” Nicolls stated. “Our goal is to deploy a constellation capable of providing global and contiguous coverage within six months, and that’s roughly 1,200 satellites.”

Nicolls added that once Starship is operational, it will be capable of launching approximately 50 of the larger, more powerful Starlink satellites at a time, as noted in a Bloomberg News report.

The initial deployment of roughly 1,200 next-generation satellites is intended to establish global and contiguous coverage. After that phase, SpaceX plans to continue expanding the system to reach “truly global coverage, including the polar regions,” Nicolls said.

Currently, all Starlink satellites are launched on SpaceX’s Falcon 9 rocket. The next-generation fleet will rely on Starship, which remains in development following a series of test flights in 2025. SpaceX is targeting its next Starship test flight, featuring an upgraded version of the rocket, as soon as this month.

Starlink is currently the largest satellite network in orbit, with nearly 10,000 satellites deployed. Bloomberg Intelligence estimates the business could generate approximately $9 billion in revenue for SpaceX in 2026.

Nicolls also confirmed that SpaceX is rebranding its direct-to-cell service as Starlink Mobile.

The service currently operates with 650 satellites capable of connecting directly to smartphones and has approximately 10 million monthly active users. SpaceX expects that figure to exceed 25 million monthly active users by the end of 2026.

Elon Musk

Starlink V2 to bring satellite-to-phone service to Deutsche Telekom in Europe

Starlink stated that the system is designed to deliver 5G speeds directly to compatible smartphones in remote areas.

Starlink is partnering with Deutsche Telekom to roll out satellite-to-mobile connectivity across Europe, extending coverage to more than 140 million subscribers across 10 countries.

The service, planned for launch in 2028 in several Telekom markets, including Germany, will use Starlink’s next-generation V2 satellites and Mobile Satellite Service (MSS) spectrum to enable direct-to-device connectivity.

In a post on X, the official Starlink account stated that the agreement will be the first in Europe to deploy its V2 next-generation satellite-to-mobile technology using new MSS spectrum. The company added that the system is designed to deliver 5G speeds directly to compatible smartphones in remote areas.

Abdu Mudesir, Board Member for Product and Technology at Deutsche Telekom, shared his excitement for the partnership in a press release. “We provide our customers with the best mobile network. And we continue to invest heavily in expanding our infrastructure. At the same time, there are regions where expansion is especially complex due to topographical conditions or official constraints,” he said.

“We want to ensure reliable connectivity for our customers in those areas as well. That is why we are strategically complementing our network with satellite-to-mobile connectivity. For us, it is clear: connectivity creates security and trust. And we deliver. Everywhere.”

Under the partnership, compatible smartphones will automatically switch to Starlink’s satellite network when terrestrial coverage is unavailable, enabling access to data, voice, video, and messaging services.

Telekom reports 5G geographic coverage approaching 90% in Germany, with LTE exceeding 92% and voice coverage reaching up to 99%. Starlink’s satellite layer is intended to extend connectivity beyond those terrestrial limits, particularly in topographically challenging or infrastructure-constrained areas.

Stephanie Bednarek, VP of Starlink Sales, also shared her thoughts on the partnership. “We’re so pleased to bring reliable satellite-to-mobile connectivity to millions of people across 10 countries in partnership with Deutsche Telekom. This agreement will be the first-of-its-kind in Europe to launch Starlink’s V2 next-generation technology that will expand on data, voice and messaging by providing broadband directly to mobile phones,” she said.

Starlink’s V2 constellation is designed to expand bandwidth and capacity compared to its predecessor. If implemented as outlined, the 2028 launch would mark one of the first large-scale European deployments of integrated satellite-to-phone connectivity by a major telecom operator.