News

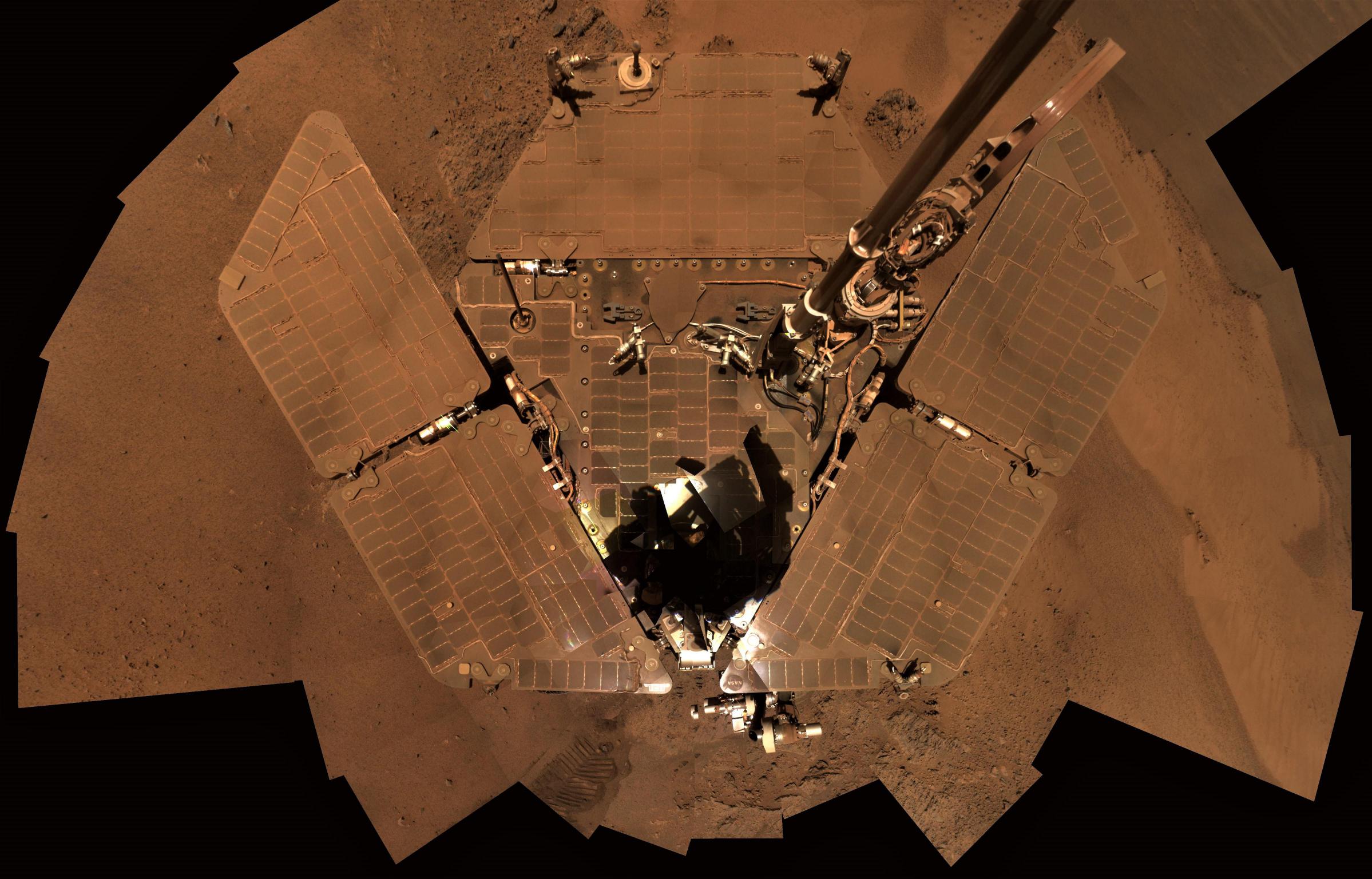

NASA may prematurely kill long-lived Mars rover with arbitrary wake-up deadline

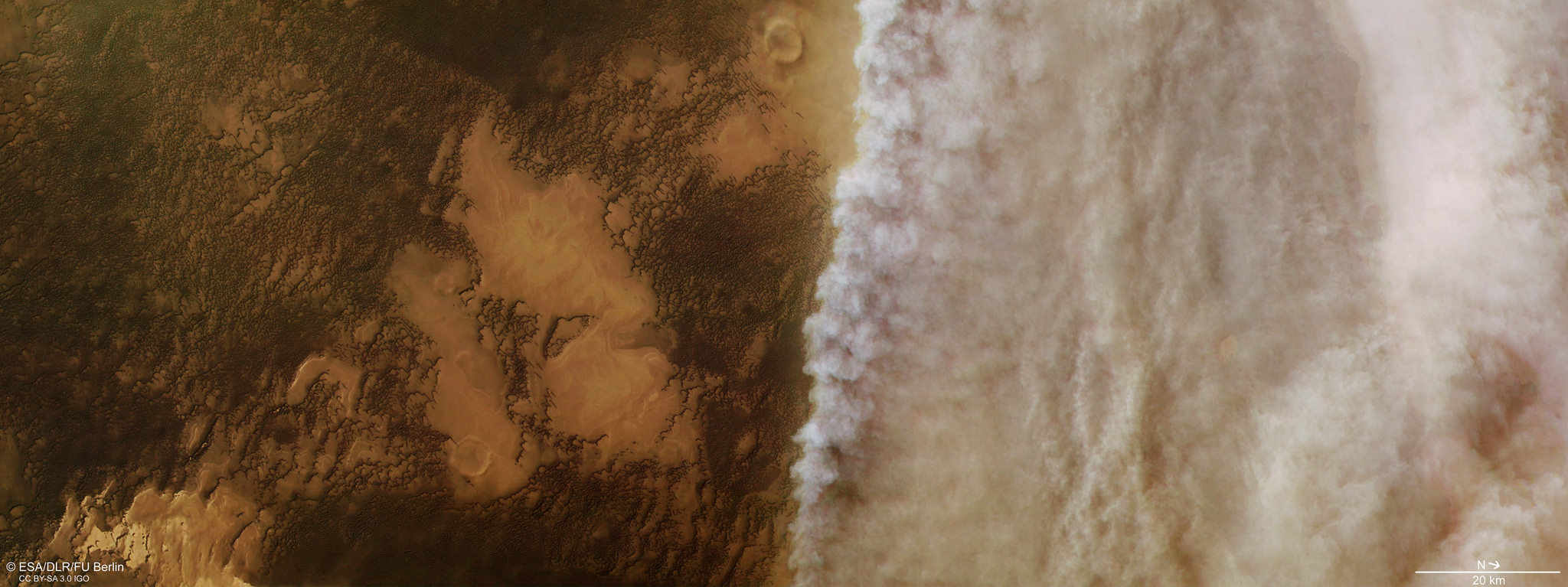

In a decision with no obvious empirical explanation, JPL’s Opportunity Mars rover project manager John Callas was quoted in an August 30th press release saying that the NASA field center would be “forced to conclude” that the dust storm-stricken rover was effectively beyond saving if it fails to come back to life 45 days after 2018’s massive dust storm can be said to have officially ended.

Below the upbeat-sounding title of this press release is the scarier fact that after tau clears below 1.5, the rover has 45 days to wake up before NASA stops actively trying to revive it. Come on, #WakeUpOppy https://t.co/piCQLeaCEO

— Emily Lakdawalla (@elakdawalla) August 30, 2018

Over the course of that press release, Callas made a number of points that may technically hold at least a few grains of truth, but entirely fail to add up to any satisfactory explanation for the choices described therein. This is underscored in one critical and extended quote:

“If we do not hear back [from Opportunity] after 45 days, the team will be forced to conclude that the Sun-blocking dust and the Martian cold have conspired to cause some type of fault from which the rover will more than likely not recover. At that point, our active phase of reaching out to Opportunity will be at an end. However, in the unlikely chance that there is a large amount of dust sitting on the solar arrays that is blocking the Sun’s energy, we will continue passive listening efforts for several months.” – John Calwell, JPL

Scott Maxwell, a former JPL engineer who led drive planning for rovers Spirit and Opportunity, solidly explained the differences between active and passive recovery attempts:

Because it's a FAQ … "active listening" has two parts: (1) forcing Opportunity's radio, if she's listening, to a particular frequency (because it can drift), and (2) a command to talk to us. Pretty much guaranteed to work if she's awake with her radio on. https://t.co/iaHbHXFKqm

— 🇺🇦ScottMaxwell @marsroverdriver@deepspace.social (@marsroverdriver) August 31, 2018

The JPL press release offers exactly zero explanation for the “45-day” deadline, starting the moment that dust clears from Martian skies near Opportunity to a certain degree, likely to happen within the next few weeks. Nor does it explain why “active” recovery attempts would stop at that point, despite the fact that the PR happens to directly acknowledge the fact that the best time to attempt to actively restore contact Opportunity might be after Mars’ windy season is given a chance to blow accumulated dust off of the rover’s solar arrays.

In fact, while all points Callas/the press release makes may theoretically be valid, the experiences of the actual engineers that have been operating Opportunity and MER sister rover Spirit for nearly two decades suggest that his explanations are utterly shallow and fail even the most cursory comparison with real data.

Thanks largely to a number of comments collected by The Atlantic from past, present, and anonymous employees involved with Opportunity, it would seem that there is no truly empirical way to properly estimate the amount of dust that may or may not be on the rover’s solar arrays, no rational engineering-side explanation for the 45-day ultimatum, no clear excuse for how incredibly short that time-frame is, and essentially zero communication between whoever this decision originates from and the engineers tasked with operating and restoring communications with the forlorn, 15-year old rover.

Most tellingly, this exact impromptu dust-storm-triggered hibernation already occurred several times in the past, and even resulted in the demise of Opportunity’s sister rover Spirit in 2010. The Atlantic notes that when a dust storm forced that rover into hibernation in 2010, JPL mission engineers spent a full ten months actively attempting to resuscitate Spirit, followed by another five months of passive listening before the rescue effort was called off.

Given that Opportunity’s engineers appear to believe that there is every reason to expect that the rover can, has, and should survive 2018’s exceptional Martian dust storm, the only plausible explanation for the arbitrary countdown and potentially premature silencing of one of just two active rovers on Mars is purely political and financial. While it requires VERY little money to operate scientific spacecraft when compared with manufacturing and launch costs, the several millions of dollars needed to fund operations engineers and technicians (roughly $15 million per year for Opportunity) could technically be funneled elsewhere or the employees in question could be redirected to newer programs.

For example, the ~$200 million spent operating the rover from 2004 to 2018 could instead fund considerably less than 20% of the original cost of building and launching both Opportunity and Spirit. This is to say that that cutting operation of functioning spacecraft to save money can be quite fairly compared with throwing an iPhone in the trash because the charging cable ripped because $10 could instead be put towards buying a new phone months or years down the line.

Ultimately, all we can do is hope that Opportunity manages to successfully wake up over the course of the next two or three months. If the rover is unable to do so, chances are sadly high that it will be lost forever once active communications restoration efforts come to an end. With an extraordinarily productive 15 years of exploration nearly under its belt, Opportunity – originally designed with an expected lifespan of ~90 days – would leave behind a legacy that would fail to disappoint even the most ardent cynic. Still, if life may yet remain in the rover, every effort ought to be made to keep the intrepid craft alive.

For prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket recovery fleet check out our brand new LaunchPad and LandingZone newsletters!

News

Tesla’s most wanted Model Y heads to new region with no sign of U.S. entry

Unlike the standard Model Y, the “L” stretches the wheelbase by roughly 150 mm and the overall length by about 177 mm to 4,976 mm. The result is a genuine 2-2-2 seating layout that gives six adults proper legroom and cargo space — a true family hauler without the cramped third-row compromises of many three-row SUVs.

Tesla’s most wanted Model Y configuration is heading to a new region, and although U.S. fans and owners have requested the vehicle since its release last year, it appears the company has no plans to bring it to the market.

According to fresh regulatory filings, the six-seat Model Y L is coming to South Korea with signs indicating an imminent launch. The extended-wheelbase configuration, already a hit in China, just cleared energy-efficiency certification from the Korea Energy Agency, paving the way for deliveries as early as the first half of 2026.

The vehicle is already built at Tesla’s Giga Shanghai facility in China, making it an ideal candidate for the Asian market, as well as the European one, as the factory has been known as a bit of an export hub in the past.

$TSLA

BREAKING: The official launch of Tesla Model Y L in S.Korea seems to be quite imminent.Additional credentials related to Model YL were released today.

✅ Battery Manufacturer: LG Energy Solutions

✅ Number of passengers: 6 people

✅ Total battery capacity: 97.25 kWh… pic.twitter.com/hmy64XYi80— Tsla Chan (@Tslachan) March 6, 2026

It seems like Tesla was prepping for this release anyway, as the timing was no accident. A camouflaged Model Y L prototype was spotted testing on Korean highways the same day the certification dropped. Tesla has already secured similar approvals for Australia and New Zealand, with both markets expecting the larger Model Y in 2026.

Unlike the standard Model Y, the “L” stretches the wheelbase by roughly 150 mm and the overall length by about 177 mm to 4,976 mm. The result is a genuine 2-2-2 seating layout that gives six adults proper legroom and cargo space — a true family hauler without the cramped third-row compromises of many three-row SUVs.

South Korean filings list it as an all-wheel-drive imported electric passenger vehicle with a 97.25 kWh total battery capacity supplied by LG Energy Solution. Local tests show an impressive 543 km (337 miles) combined range at room temperature and 454 km (282 miles) in colder conditions, easing one of the biggest concerns for Korean EV buyers.

Tesla Model Y lineup expansion signals an uncomfortable reality for consumers

But for U.S. fans, things are not looking good for a launch in the market.

CEO Elon Musk has been blunt. The six-seater “wouldn’t arrive in the U.S. until late 2026, if ever,” he said, pointing to the company’s heavy bet on unsupervised Full Self-Driving and robotaxi platforms like the Cybercab. With the Model X slated for discontinuation, many families hoped the stretched Model Y would slide into the lineup as an affordable three-row bridge. So far, that hope remains unfulfilled.

For now, South Korean drivers will be among the first buyers outside China to enjoy the spacious, efficient Model Y L. Tesla continues its global rollout strategy, tailoring vehicles to regional tastes while North American customers keep refreshing their apps and crossing their fingers.

The Model Y L proves the appetite for practical, family-sized electric SUVs is stronger than ever. Hopefully, Tesla will listen to its fans and bring the vehicle to the U.S. where it would likely sell well.

Elon Musk

Tesla is ramping up its advertising strategy on social media

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

Tesla seems to be ramping up its advertising strategy on social media once again. Marketing and advertising have not been a major focus of Tesla’s, something that has brought some criticism to the company from its fans.

However, the company looks to be making adjustments to that narrative, as it has at times in the past, as ads were spotted on several different platforms over the past few days.

On Facebook and YouTube, ads were spotted that were evidently placed by Tesla. On Facebook, Tesla was advertising Full Self-Driving, and on YouTube, an ad for its Energy Division was spotted:

Tesla also threw up some ads on YouTube for Energy https://t.co/19DGQMjBsA pic.twitter.com/XQRfgaDKxY

— TESLARATI (@Teslarati) March 9, 2026

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

In 2022, Tesla’s U.S. ad spend was roughly $152,000, a rounding error compared to General Motors’ $3.6 billion the following year.

Traditional automakers averaged about $495 per vehicle on ads; Tesla spent $0. CEOElon Musk’s stance was explicit: “Tesla does not advertise or pay for endorsements,” he posted on X in 2019. “Instead, we use that money to make the product great.”

The strategy relied on word-of-mouth from delighted owners, Elon’s massive X following, viral product launches, media frenzy, and customer referrals. A great product, Musk argued, sells itself. It does not need Super Bowl spots or billboards. Resources poured into R&D instead, with Tesla investing nearly $3,000 per car, far more than rivals.

Tesla counters jab at lack of advertising with perfect response

This reluctance wasn’t arrogance; it was philosophy, and Musk made it clear that the money was better spent on the product. Heavy spending on ads was seen as wasteful when innovation and authenticity drove organic demand. Shareholder calls for marketing budgets were ignored.

The current shift, paid Facebook ads promoting Full Self-Driving (Supervised) and YouTube Shorts offering up to $1,000 back on Powerwall batteries, marks a pragmatic evolution.

These targeted campaigns coincide with the end of one-time FSD purchases and a March 31 deadline for FSD transfer eligibility on new vehicles.

This move likely signals Tesla adapting to scale, as well as a more concerted effort to stop misinformation regarding its platform. As EV competition intensifies and the company bets big on robotaxis and energy storage, pure organic buzz may not suffice to hit adoption targets. Selective digital ads allow precise, cost-effective reach without abandoning core principles.

If successful, it could foreshadow measured expansion into marketing, boosting high-margin software and home energy revenue while preserving Tesla’s innovative edge. But, it’s nice to see the strategy return, especially as Tesla has been reluctant to change its mind in the past.

News

Tesla Model Y outsells everything in three states, but Ford dominates

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

The Tesla Model Y was the best-selling vehicle in three different states in the U.S. last year, according to new data that shows the all-electric crossover outsold every other car in a few places. However, Ford widely dominated the sales figures with its popular F-Series of pickups.

According to new vehicle registration data compiled by Edmunds and visualized by Visual Capitalist, the Ford F-Series, encompassing models like the F-150, F-250, F-350, and F-450, claimed the title of best-selling vehicle in 29 states.

This dominance underscores the pickup truck’s unbreakable appeal across much of the country, particularly in rural, Midwestern, Southern, and Western states, where towing capacity, durability, and utility for work or recreation remain top priorities.

The Tesla Model Y is the best-selling vehicle in California, Washington, and Nevada

How many states will it dominate next year? https://t.co/ERyoyce42D

— TESLARATI (@Teslarati) March 9, 2026

The F-Series has held the crown as America’s overall best-selling vehicle for decades, a streak that continued strong into 2025 despite broader market shifts.

Yet, amid this truck-heavy reality, Tesla made a notable breakthrough. The Model Y emerged as the top-selling vehicle, not just the leading EV, but the outright best-seller in three key states: California, Nevada, and Washington.

These West Coast strongholds reflect regions with robust EV infrastructure, high environmental awareness, generous incentives, and tech-savvy populations. In California alone, nearly 50 percent of new vehicle registrations were electrified, far outpacing the national average of around 25 percent.

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

Elon Musk: Tesla Model Y is world’s best-selling car for 3rd year in a row

Elsewhere, Japanese crossovers filled many gaps: Toyota’s RAV4 and Honda’s CR-V topped charts in several urban and densely populated Northeastern and Midwestern states, where fuel efficiency, reliability, and family-friendly features win out over larger trucks.

While Ford’s broad reach shows traditional preferences persist, at least for now, Tesla’s Model Y victories in high-population, influential states signal a gradual but undeniable transition toward electrification. As charging networks expand and battery technology improves, more states could follow the West Coast’s lead in the coming years.

This 2025 map captures a pivotal moment: pickup trucks still rule the majority, but EVs are carving out meaningful territory where consumer priorities align with sustainability and innovation. The road ahead promises continued competition between legacy giants and electric disruptors.