News

NVIDIA says Tesla raised the bar for self-driving tech, car makers must deliver

NVIDIA, a prominent and highly successful leader in computer chip design, says that Tesla has raised the bar in autonomous driving software, and other car makers will have to deliver similar performance if they want to compete in the long-term future of the auto industry, according to a recent NVIDIA company blog.

“It’s financially insane to buy anything other than a Tesla,” CEO Elon Musk stated during the company’s Autonomy Day event. He then compared the purchase of any other car as equivalent to buying a horse for one’s transportation purposes. NVIDIA, for its part, agrees with Musk and Tesla’s sentiments about the future of self-driving and the need for powerful computers to push its progress.

“Self-driving cars—which are key to new levels of safety, efficiency, and convenience—are the future of the industry. And they require massive amounts of computing performance… This is the way forward. Every other automaker will need to deliver this level of performance,” the chip maker wrote.

The type of autonomous driving technology Tesla is pushing is predicted to be the inevitable standard, and the company’s lead in the arena will likely increase even further as more of their vehicles take to the road. “By end of this quarter, about half a million Teslas will have full self-driving hardware (pending computer swap) & we will make another half million FSD cars by mid next year,” Musk tweeted, emphasizing this point and echoing what he’d explained the day prior.

Exactly. By end of this quarter, about half a million Teslas will have full self-driving hardware (pending computer swap) & we will make another half million FSD cars by mid next year.

— Elon Musk (@elonmusk) April 23, 2019

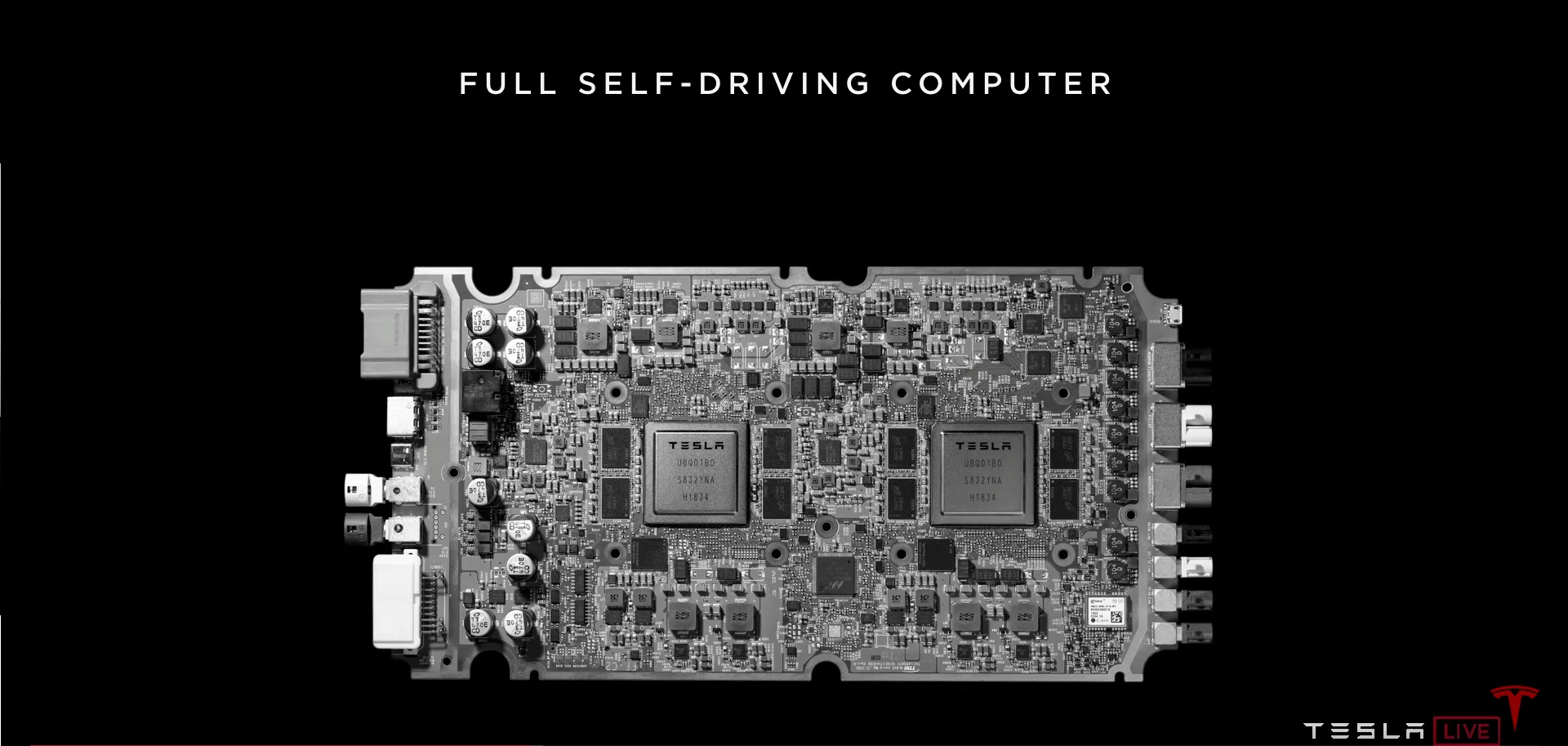

Tesla’s recent Autonomy Day presentation drew comparisons between the all-electric car maker’s Full Self-Driving (FSD) computer chip and those produced by NVIDIA, the only computer processing unit maker delivering performance in line with Tesla’s. NVIDIA currently has two self-driving chips in the works: the Xavier SoC (system on a chip) for assisted driving AutoPilot features, and the DRIVE AGX Pegasus computer for full self-driving. The comparisons in Tesla’s presentation were directed at the Xavier in a single-chip configuration.

The technical performance specifications required to run powerful artificial intelligence (AI) neural networks (NN) for autonomous driving require operations performed per second to be measured in the trillions – abbreviated as TOPS (tera operations per second). Tesla’s FSD computer chip can perform at a rate of 72 TOPS (x2 chips in the computer for 144 TOPS total), and the Xavier does 30 TOPS (mistakenly claimed to be 21 TOPS at Tesla’s event, per NVIDIA’s blog).

NVIDIA also expressed in the blog piece its opinion that the match between FSD and Xavier wasn’t quite an apples-to-apples comparison, given the purposes of the two chips. The chip designer prefers its DRIVE AGX Pegasus for the line-up, a computer intended for fully autonomous driving and capable of 320 TOPS. Tesla is assumingly aware of this product and obviously acknowledges the high level of technology developed by NVIDIA given that Hardware 2.5, the computer currently running Tesla’s Autopilot features, was made by the company.

A Tesla with driver features “deleted” under the Tesla Network. | Image: Tesla

A Tesla with driver features “deleted” under the Tesla Network. | Image: Tesla

There are additional specifications such as power consumption that further differentiate FSD from NVIDIA’s products with a more similar purpose to Tesla’s latest computer. Thus, a different product match may not have mattered towards the overall point being made in the presentation. Either way, a more important distinction between the two companies is the current status of their technologies.

Tesla’s chip was crowned as “objectively the best in the world” by Musk, and this looks to be true, given the fact that all Tesla Model S, 3, and X vehicles being produced now have the hardware installed and will add to the already accruing real world self-driving data the company’s cars provide. NVIDIA has partnered with other car manufacturers to develop its products, but they are not incorporated in production vehicles the way Tesla’s FSD has been yet.

The performance Tesla has achieved in its FSD computer is impressive, and that was and continues to be the point. “[Autonomy] is basically our entire expense structure,” Musk told an investor inquiring about where the California-based company was incurring the most cost. Tesla is hedging its fiscal future on the success of autonomous driving in the marketplace, and the company is doing so with bullish energy driven by its famous top executive.

Musk expects Tesla’s Full Self-Driving software to be complete by the end of this year and fully operational by the second quarter of next year.

Energy

Tesla Energy gains UK license to sell electricity to homes and businesses

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

Tesla Energy has received a license to supply electricity in the United Kingdom, opening the door for the company to serve homes and businesses in the country.

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

According to Ofgem, the license took effect at 6 p.m. local time on Wednesday and applies to Great Britain.

The approval allows Tesla’s energy business to sell electricity directly to customers in the region, as noted in a Bloomberg News report.

Tesla has already expanded similar services in the United States. In Texas, the company offers electricity plans that allow Tesla owners to charge their vehicles at a lower cost while also feeding excess electricity back into the grid.

Tesla already has a sizable presence in the UK market. According to price comparison website U-switch, there are more than 250,000 Tesla electric vehicles in the country and thousands of Tesla home energy storage systems.

Ofgem also noted that Tesla Motors Ltd., a separate entity incorporated in England and Wales, received an electricity generation license in June 2020.

The new UK license arrives as Tesla continues expanding its global energy business.

Last year, Tesla Energy retained the top position in the global battery energy storage system (BESS) integrator market for the second consecutive year. According to Wood Mackenzie’s latest rankings, Tesla held about 15% of global market share in 2024.

The company also maintained a dominant position in North America, where it captured roughly 39% market share in the region.

At the same time, competition in the energy storage sector is increasing. Chinese companies such as Sungrow have been expanding their presence globally, particularly in Europe.

Elon Musk

Elon Musk shares big Tesla Optimus 3 production update

According to Musk, Tesla is in the final stages of completing Optimus 3, which he described as one of the world’s most advanced humanoid robots.

Tesla CEO Elon Musk has stated that production of Optimus 3 could begin this summer. Musk shared the update in his interview at the Abundance Summit.

According to Musk, Tesla is in the final stages of completing Optimus 3, which he described as one of the world’s most advanced humanoid robots.

“We’re in the final stages of completion of Optimus 3, which is really going to be by far the most advanced robot in the world. Nothing’s even close. In fact, I haven’t even seen demos of robots that are as good as Optimus 3,” Musk said.

He also set expectations on the pace of Optimus 3’s production ramp, stating that the initial volumes of the humanoid robot will likely be very low. Musk did, however, also state that high production rates for Optimus 3 should be possible in 2027.

“I think we’ll start production on Optimus 3 this summer, but very slow at first, like sort of this classic S-curve ramp of manufacturing units versus time. And then, probably reach high volume production around summer next year,” he said.

Interestingly enough, the CEO hinted that Tesla is looking to iterate on the robot quickly, potentially releasing a new Optimus design every year.

“We’ll have Optimus 4 design complete next year. We’ll try to release a new robot design every year,” Musk stated.

Tesla has already outlined broader plans for scaling Optimus production beyond its first manufacturing line. Musk previously stated that Optimus 4 will be built at Gigafactory Texas at significantly higher production volumes.

Initial production lines for the robot are expected to be located at Tesla’s Fremont Factory, where the company plans to establish a line capable of producing up to 1 million robots per year.

A larger production ramp is expected to occur at Gigafactory Texas, where Musk has previously suggested could eventually support production of up to 10 million robots per year.

“We’re going to launch on the fastest production ramp of any product of any large complex manufactured product ever, starting with building a one-million-unit production line in Fremont. And that’s Line one. And then a ten million unit per year production line here,” Musk said previously.

The comments suggest that while Optimus 3 will likely begin production at Fremont, Tesla’s larger-scale manufacturing push could arrive with Optimus 4 at Gigafactory Texas.

Elon Musk

Tesla showcases Optimus humanoid robot at AWE 2026 in Shanghai

Tesla’s humanoid robot was presented as part of the company’s exhibit at the Shanghai electronics show.

Tesla showcased its Optimus humanoid robot at the 2026 Appliance & Electronics World Expo (AWE 2026) in Shanghai. The event opened Thursday and featured several Tesla products, including the company’s humanoid robot and the Cybertruck.

The display was reported by CNEV Post, citing information from local media outlet Cailian and on-site staff at the exhibition.

Tesla’s humanoid robot was presented as part of the company’s exhibit at the Shanghai electronics show. On-site staff reportedly stated that mass production of the robot could begin by the end of 2026.

Tesla previously indicated that it plans to manufacture its humanoid robots at scale once production begins, with its initial production line in the Fremont Factory reaching up to 1 million units annually. An Optimus production line at Gigafactory Texas is expected to produce 10 million units per year.

Tesla China previously shared a teaser image on Weibo showing a pair of highly detailed robotic hands believed to belong to Optimus. The image suggests a design with finger proportions and structures that closely resemble those of a human hand.

Robotic hands are widely considered one of the most difficult engineering challenges in humanoid robotics. For a system like Optimus to perform complex real-world tasks, from factory work to household activities, the robot would require highly advanced dexterity.

Elon Musk has previously stated that Optimus has the capability to eventually become the first real-world example of a Von Neumann machine, a self-replicating system capable of building copies of itself, even on other planets. “Optimus will be the first Von Neumann machine, capable of building civilization by itself on any viable planet,” Musk wrote in a post on X.