Energy

UK energy storage startup takes on Tesla Powerwall 2 in home battery market

Tesla, Inc.’s CEO Elon Musk has made his company’s mission to help the world to transition away from reliance on fossil fuels and toward the embrace of sustainable energy sources. Now a U.K. energy-storage startup called Powervault is now in competition with Tesla, Inc. to outfit homes with affordable backup battery power across the pond.

Why is solar power and storage the key to the world’s energy independence?

Solar photovoltaic (PV) power generation is at the heart of a transformation that will revolutionize the world’s electricity systems, letting consumers produce power for their own needs and feed surplus energy into the grid. Solar power is becoming ubiquitous: from large-scale utilities to micro-grids; from billion-dollar corporate HQs to rural rooftops; and from urban sprawl areas to small islands and isolated communities. We see solar next to airports, along highways, in fields, powering road signs, even at local small businesses like breweries.

- Brewing company integrates Tesla Powerpack and solar with beer-making

- North Carolina creates state’s first microgrid laboratory, using Tesla Powerpacks

Energy storage is an essential link needed to make intermittent solar energy reliable. Batteries installed inside homes can store excess energy produced by panels during peak hours of operation. When combined with smart meters and digital technologies, batteries can help utilities regulate the grid by providing power reserves which can be tapped and transmitted on demand.

As prices have dropped, solar PV generation uptake by households and local communities has increased dramatically. In 2015, around 30% of solar PV capacity installed worldwide involved systems of of less than 100 kW. This is gradually changing the face of power system ownership. Two companies — U.K.’s Powervault and the U.S. Tesla — are helping consumers to make the shift to solar installations combined with battery energy storage and a chance at energy independence.

Powervault

Founded in 2012 with money from the U.K. government and private investors, Powervault has made a mission of reducing the cost of batteries in order to make them affordable to more homes. Powervault stores electricity in a home using either Lithium-ion Phosphate cells or Lead Acid batteries.

Powervault’s Lead Acid version is for customers who want a product with a low up-front cost and the prospect of upgrading to Lithium-ion technology when their Lead Acid batteries reach the end of their useful life in three to seven years. With Lithium-ion technology forecast to fall dramatically in cost over the next five years, customers can benefit from a low-cost Powervault using Lead Acid batteries now, then replace its batteries later. A Powervault lead battery that can store 3 kWh of power sells for 2,500 pounds ($3,117) a unit, or, about $1,039 for each kWh of electricity stored. That price is about 12 percent cheaper than the $1,175/kWh average price in the industry, according to Bloomberg New Energy Finance.

Powervault’s Lithium-ion Phosphate cells can store 2kWh – 6kWh of usable (AC) energy. Powervault’s Lithium-ion version is for customers who want a product with battery technology that is long-lasting and efficient; the Lithium-ion Phosphate cells are estimated to have a lifetime of eleven to thirteen years and can cycle more than once per day.

Depending on the battery technology and storage capacity a homeowner requires, the dimensions of the Powervault unit vary. The standard G200 unit accommodates all available battery capacities and technologies; the slim-line, G200-S unit , available starting in March, 2017 will only accommodate 2kWh or 4kWh of Lithium-ion Phosphate cells.

The company anticipates prices for Powervault’s batteries, which can cover about half an average British home’s daily power consumption, will be even cheaper going forward. Powervault is planning to expand internationally in the next few years with an initial focus on Europe, according to Powervault’s Managing Director Joe Warren, who said some units have already been sold in Spain. “We’ve been very careful to design them to be universally compatible. We want them to be easy to install and use everywhere in the world.”

Tesla Powerwall 2

Powerwall 2 stories are becoming commonplace, in which a consumer captures energy during daylight off-peak hours with SolarCity photovoltaic solar panels stored in a Powerwall home battery unit. When energy rates are higher during evening hours, the consumer powers the home with energy stored captured earlier in the day.

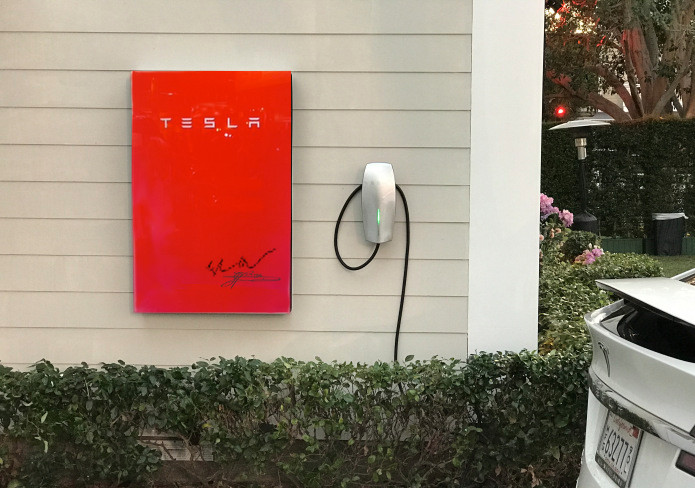

Artists rendition of a Red Founders Series Tesla Powerwall 2.0 hand signed by Elon Musk

Powerwall uses an internal inverter to convert DC energy to the AC energy required for a home or small business. A liquid thermal control system regulates Powerwall’s internal temperature to maximize battery performance in any climate. The most affordable home battery in terms of cost per kWh, the company argues that the Powerwall economically meets the daily energy needs of most homes. With usable capacity of 13.5 kWh, the Powerwall system has a 100% depth of discharge and 7kW peak / 5kW continuous power. Floor or wall mounted, indoor or outdoor, the Powerwall has a ten year warranty and is scalable up to nine Powerwalls. Its operating temperature ranges from -4° to 122°F / -20°C to 50°C. The system is certified to meet North American and international standards.

One 14 kWh Powerwall battery costs $5,500, with installation and supporting hardware adding $1,500, or a total estimate $7,000. U.S. installations are beginning in February, 2017, according to company data.

There’s no doubt Elon Musk sees solar as the future for electricity generation, just as he views electric cars as the future of transportation. “The primary means of energy generation is going to solar,” he said in 2015 prior to the merger with SolarCity, in which the issue of utility-based versus independent energy generation still seemed futuristic. “It will at least be a plurality, and probably be a slight majority in the long term.”

The forecast for solar in the U.K. and U.S.

The London-based Powervault company is targeting sales of 50,000 units a year by 2020, up from about 1,000 this year. Powervault is entering the home storage market just as Tesla is readying its Nevada-based Gigafactory for Model 3 production. Musk expects the plant will double the global production of lithium-ion batteries next year, so that, by 2018, the Gigafactory will reach full capacity and produce more lithium ion batteries annually than were produced worldwide in 2013.

Solar PV deployment at the consumer level alongside battery storage is putting pressure on network operators and the way national electricity systems are traditionally managed and governed. This is brought about by new developments in electricity storage, electric, vehicles and smart appliances. Solar PV already accounts for about 2% of global electricity in 2016, but could reach as much as 13% by 2030. In order for this to happen, solar PV capacity additions must double in 14 years, with Tesla leading the way and companies like Powervault joining the march.

Interested in solar? Get a solar cost estimate and find out how much a solar system would cost for your home or business.

Energy

Tesla Powerwall distribution expands in Australia

Inventory is expected to arrive in late February and official sales are expected to start mid-March 2026.

Supply Partners Group has secured a distribution agreement for the Tesla Powerwall in Australia, with inventory expected to arrive in late February and official sales beginning in mid-March 2026.

Under the new agreement, Supply Partners will distribute Tesla Powerwall units and related accessories across its national footprint, as noted in an ecogeneration report. The company said the addition strengthens its position as a distributor focused on premium, established brands.

“We are proud to officially welcome Tesla Powerwall into the Supply Partners portfolio,” Lliam Ricketts, Co-Founder and Director of Innovation at Supply Partners Group, stated.

“Tesla sets a high bar, and we’ve worked hard to earn the opportunity to represent a brand that customers actively ask for. This partnership reflects the strength of our logistics, technical services and customer experience, and it’s a win for installers who want premium options they can trust.”

Supply Partners noted that initial Tesla Powerwall stock will be warehoused locally before full commercial rollout in March. The distributor stated that the timing aligns with renewed growth momentum for the Powerwall, supported by competitive installer pricing, consumer rebates, and continued product and software updates.

“Powerwall is already a category-defining product, and what’s ahead makes it even more compelling,” Ricketts stated. “As pricing sharpens and capability expands, we see a clear runway for installers to confidently spec Powerwall for premium residential installs, backed by Supply Partners’ national distribution footprint and service model.”

Supply Partners noted that a joint go-to-market launch is planned, including Tesla-led training for its sales and technical teams to support installers during the home battery system’s domestic rollout.

Energy

Tesla Megapack Megafactory in Texas advances with major property sale

Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet.

Tesla’s planned Megapack factory in Brookshire, Texas has taken a significant step forward, as two massive industrial buildings fully leased to the company were sold to an institutional investor.

In a press release, Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet. The properties are 100% leased to Tesla under a long-term agreement and were acquired by BGO on behalf of an institutional investor.

The two facilities, located at 100 Empire Boulevard in Brookshire, Texas, will serve as Tesla’s new Megafactory dedicated to manufacturing Megapack battery systems.

According to local filings previously reported, Tesla plans to invest nearly $200 million into the site. The investment includes approximately $44 million in facility upgrades such as electrical, utility, and HVAC improvements, along with roughly $150 million in manufacturing equipment.

Building 9, spanning roughly 1 million square feet, will function as the primary manufacturing floor where Megapacks are assembled. Building 10, covering approximately 600,000 square feet, will be dedicated to warehousing and logistics operations, supporting storage and distribution of completed battery systems.

Waller County Commissioners have approved a 10-year tax abatement agreement with Tesla, offering up to a 60% property-tax reduction if the company meets hiring and investment targets. Tesla has committed to employing at least 375 people by the end of 2026, increasing to 1,500 by the end of 2028, as noted in an Austin County News Online report.

The Brookshire Megafactory will complement Tesla’s Lathrop Megafactory in California and expand U.S. production capacity for the utility-scale energy storage unit. Megapacks are designed to support grid stabilization and renewable-energy integration, a segment that has become one of Tesla’s fastest-growing businesses.

Energy

Tesla meets Giga New York’s Buffalo job target amid political pressures

Giga New York reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease.

Tesla has surpassed its job commitments at Giga New York in Buffalo, easing pressure from lawmakers who threatened the company with fines, subsidy clawbacks, and dealership license revocations last year.

The company reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease at the state-built facility.

As per an employment report reviewed by local media, Tesla employed 2,399 full-time workers at Gigafactory New York and 1,060 additional employees across the state at the end of 2025. Part-time roles pushed the total headcount of Tesla’s New York staff above the 3,460-job target.

The gains stemmed in part from a new Long Island service center, a Buffalo warehouse, and additional showrooms in White Plains and Staten Island. Tesla also said it has invested $350 million in supercomputing infrastructure at the site and has begun manufacturing solar panels.

Empire State Development CEO Hope Knight said the agency was “very happy” with Giga New York’s progress, as noted in a WXXI report. The current lease runs through 2029, and negotiations over updated terms have included potential adjustments to job requirements and future rent payments.

Some lawmakers remain skeptical, however. Assemblymember Pat Burke questioned whether the reported job figures have been fully verified. State Sen. Patricia Fahy has also continued to sponsor legislation that would revoke Tesla’s company-owned dealership licenses in New York. John Kaehny of Reinvent Albany has argued that the project has not delivered the manufacturing impact originally promised as well.

Knight, for her part, maintained that Empire State Development has been making the best of a difficult situation.

“(Empire State Development) has tried to make the best of a very difficult situation. There hasn’t been another use that has come forward that would replace this one, and so to the extent that we’re in this place, the fact that 2,000 families at (Giga New York) are being supported through the activity of this employer. It’s the best that we can have happen,” the CEO noted.