Bloomberg reports that SpaceX has approached Goldman Sachs in hopes of arranging a $500M leveraged loan, potentially opening up an entirely new avenue of capital for the company as it approaches inflection points in its two largest development programs, the Starlink internet satellite constellation and its next-generation BFR rocket and spaceship.

In the United States, the market for leveraged loans (a form of debt capital) has experienced unprecedented growth in 2018, soaring past $1.3 trillion total. Unlike borrowers typically pursuing leveraged loans, SpaceX has little to no debt to speak of and is likely either financially stable or even healthily profitable.

The fact that SpaceX is not already heavily leveraged (i.e. lots of debt) indicates that the company’s interest in this type of loan – versus something more like traditional equity sales – arises from the need for capital to fund major one-time investments that are likely to peak within the next 2-3 years, if not sooner. Leveraged loans are typically classified as riskier investments due to the tendency for borrowers to already have plenty of debt: in the case of SpaceX, it’s clear that that risk derives more from the fundamentally risky nature of space-related endeavors.

Success is not guaranteed even if SpaceX has plenty of funds to invest in satellite constellation or rocket R&D, while major one-time expenditures like the construction of a new launch pad and test facility for BFR also carry the risk of potentially catastrophic destruction in the event of a vehicle failure during testing or launch, one case that was proven out during the September 2016 on-pad failure of a Falcon 9 rocket, multiple times smaller than BFR. Leveraged loans still are likely to work in SpaceX’s favor, drawing in investors already willing to accept that inherent risk when the potential rewards of success are immense.

“The benefits of this maiden voyage [into leveraged loan borrowing] are clear: SpaceX should have ample funding needs for many years to come as it keeps Mars in its sights. Crucially for Musk, loans are more private than most other forms of capital raising — and very hard to short.”

Starlink

While the exact status of SpaceX’s major development programs is not public, it can be reasonably intuited that the company’s Starlink constellation is likely in the process of restructuring an R&D-centered experimental wing into something closer to a factory. Such a factory will be an absolute necessity if SpaceX intends to mass-produce high-performance smallsats at a truly unprecedented scale: ~4500 satellites make up the first wave of the constellation alone, while nearly ~7500 more would eventually follow to allow Starlink to truly blanket the world with fast internet access.

- SpaceX’s first two Starlink prototype satellites are pictured here before their inaugural Feb. 2018 launch, showing off a utilitarian design. (SpaceX)

- One of the first two prototype Starlink satellites separates from Falcon 9’s upper stage, February 2018. (SpaceX)

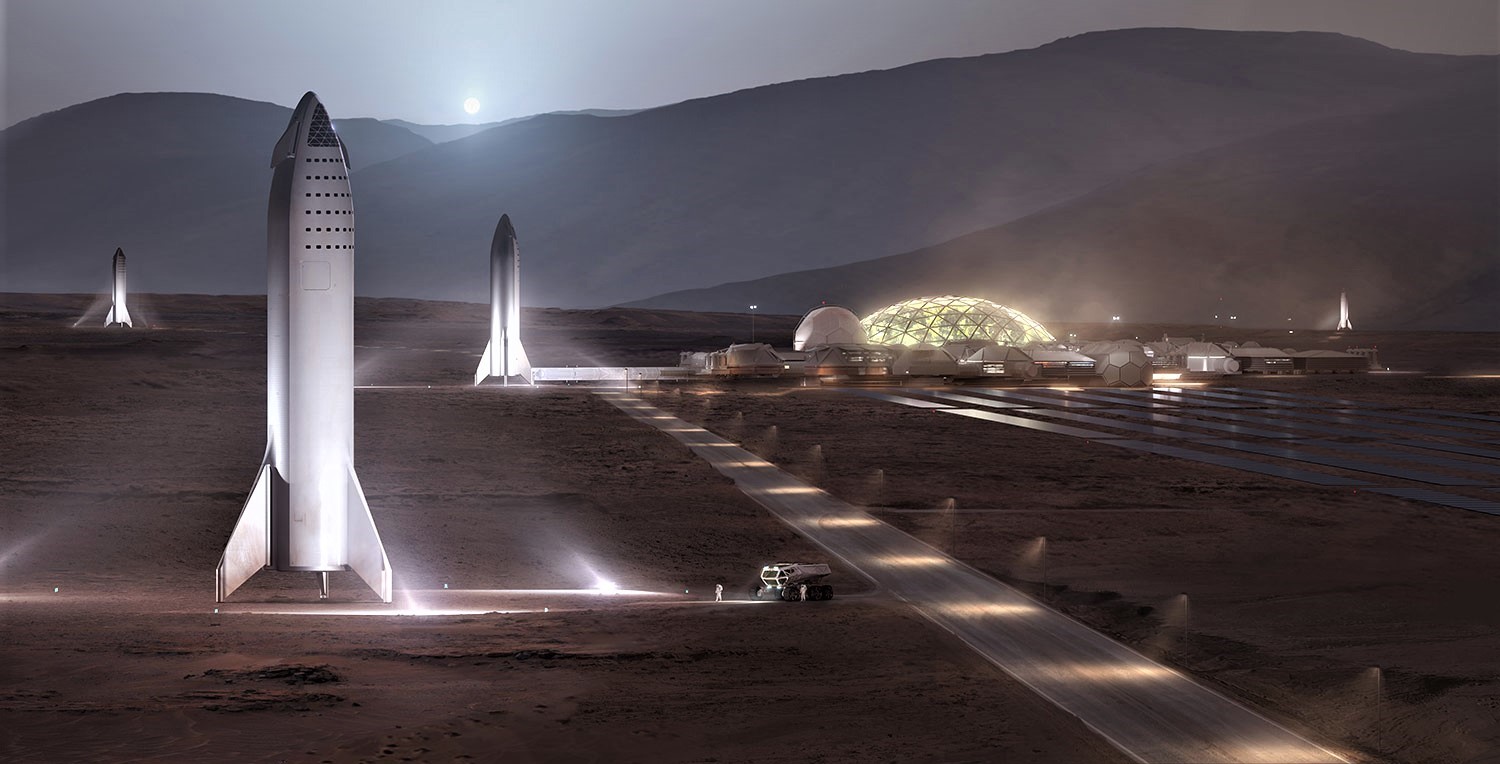

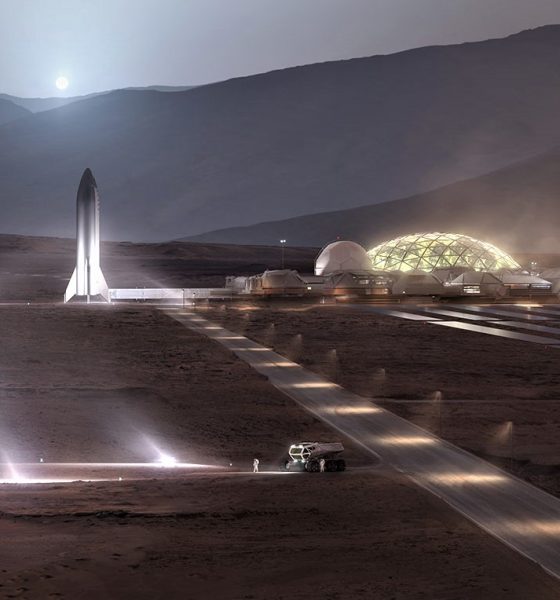

BFR

SpaceX’s Big F____ Rocket – deemed Big Falcon Rocket (BFR) in public statements – is no less capital-hungry. Aside from major investments in tooling and the lengthy and return-free process of designing such a large, complex, and advanced launch vehicle, SpaceX is in the process of preparing a site for a dedicated BFR factory at Port of Los Angeles. Currently housed in a huge temporary tent, it’s already clear that spaceship prototype fabrication could benefit greatly from workspace expansions and a more controlled environment. Long-term, such a factory will be a basic necessity for SpaceX to begin true serial production of BFR boosters and spaceships.

In South Texas, SpaceX is also beginning the expensive process of constructing some combination of a launch pad and testing facility dedicated to the BFR program. Most recently, two massive propellant storage tanks have arrived at a nearby facility at the same time as construction is beginning in earnest on the circa-2014 site of SpaceX’s proposed launch pad.

- SpaceX’s initial BFR work is being performed in a giant temporary tent located at Port of LA. (Pauline Acalin)

- Yusaku Maezawa stands on the first BFR composite tank/fuselage section prior to his Sept. 17 announcement. (Yusaku Maezawa)

- SpaceX’s massive BFR mandrel, used to mold its composite structures. (SpaceX)

Ultimately, the company could benefit immensely from an infusion of free capital, if for no other reason than to expedite critical infrastructure investments that will become the foundation for Starlink and BFR.

For prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket recovery fleet check out our brand new LaunchPad and LandingZone newsletters!

Energy

Tesla Energy gains UK license to sell electricity to homes and businesses

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

Tesla Energy has received a license to supply electricity in the United Kingdom, opening the door for the company to serve homes and businesses in the country.

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

According to Ofgem, the license took effect at 6 p.m. local time on Wednesday and applies to Great Britain.

The approval allows Tesla’s energy business to sell electricity directly to customers in the region, as noted in a Bloomberg News report.

Tesla has already expanded similar services in the United States. In Texas, the company offers electricity plans that allow Tesla owners to charge their vehicles at a lower cost while also feeding excess electricity back into the grid.

Tesla already has a sizable presence in the UK market. According to price comparison website U-switch, there are more than 250,000 Tesla electric vehicles in the country and thousands of Tesla home energy storage systems.

Ofgem also noted that Tesla Motors Ltd., a separate entity incorporated in England and Wales, received an electricity generation license in June 2020.

The new UK license arrives as Tesla continues expanding its global energy business.

Last year, Tesla Energy retained the top position in the global battery energy storage system (BESS) integrator market for the second consecutive year. According to Wood Mackenzie’s latest rankings, Tesla held about 15% of global market share in 2024.

The company also maintained a dominant position in North America, where it captured roughly 39% market share in the region.

At the same time, competition in the energy storage sector is increasing. Chinese companies such as Sungrow have been expanding their presence globally, particularly in Europe.

Elon Musk

Elon Musk shares big Tesla Optimus 3 production update

According to Musk, Tesla is in the final stages of completing Optimus 3, which he described as one of the world’s most advanced humanoid robots.

Tesla CEO Elon Musk has stated that production of Optimus 3 could begin this summer. Musk shared the update in his interview at the Abundance Summit.

According to Musk, Tesla is in the final stages of completing Optimus 3, which he described as one of the world’s most advanced humanoid robots.

“We’re in the final stages of completion of Optimus 3, which is really going to be by far the most advanced robot in the world. Nothing’s even close. In fact, I haven’t even seen demos of robots that are as good as Optimus 3,” Musk said.

He also set expectations on the pace of Optimus 3’s production ramp, stating that the initial volumes of the humanoid robot will likely be very low. Musk did, however, also state that high production rates for Optimus 3 should be possible in 2027.

“I think we’ll start production on Optimus 3 this summer, but very slow at first, like sort of this classic S-curve ramp of manufacturing units versus time. And then, probably reach high volume production around summer next year,” he said.

Interestingly enough, the CEO hinted that Tesla is looking to iterate on the robot quickly, potentially releasing a new Optimus design every year.

“We’ll have Optimus 4 design complete next year. We’ll try to release a new robot design every year,” Musk stated.

Tesla has already outlined broader plans for scaling Optimus production beyond its first manufacturing line. Musk previously stated that Optimus 4 will be built at Gigafactory Texas at significantly higher production volumes.

Initial production lines for the robot are expected to be located at Tesla’s Fremont Factory, where the company plans to establish a line capable of producing up to 1 million robots per year.

A larger production ramp is expected to occur at Gigafactory Texas, where Musk has previously suggested could eventually support production of up to 10 million robots per year.

“We’re going to launch on the fastest production ramp of any product of any large complex manufactured product ever, starting with building a one-million-unit production line in Fremont. And that’s Line one. And then a ten million unit per year production line here,” Musk said previously.

The comments suggest that while Optimus 3 will likely begin production at Fremont, Tesla’s larger-scale manufacturing push could arrive with Optimus 4 at Gigafactory Texas.

Elon Musk

Tesla showcases Optimus humanoid robot at AWE 2026 in Shanghai

Tesla’s humanoid robot was presented as part of the company’s exhibit at the Shanghai electronics show.

Tesla showcased its Optimus humanoid robot at the 2026 Appliance & Electronics World Expo (AWE 2026) in Shanghai. The event opened Thursday and featured several Tesla products, including the company’s humanoid robot and the Cybertruck.

The display was reported by CNEV Post, citing information from local media outlet Cailian and on-site staff at the exhibition.

Tesla’s humanoid robot was presented as part of the company’s exhibit at the Shanghai electronics show. On-site staff reportedly stated that mass production of the robot could begin by the end of 2026.

Tesla previously indicated that it plans to manufacture its humanoid robots at scale once production begins, with its initial production line in the Fremont Factory reaching up to 1 million units annually. An Optimus production line at Gigafactory Texas is expected to produce 10 million units per year.

Tesla China previously shared a teaser image on Weibo showing a pair of highly detailed robotic hands believed to belong to Optimus. The image suggests a design with finger proportions and structures that closely resemble those of a human hand.

Robotic hands are widely considered one of the most difficult engineering challenges in humanoid robotics. For a system like Optimus to perform complex real-world tasks, from factory work to household activities, the robot would require highly advanced dexterity.

Elon Musk has previously stated that Optimus has the capability to eventually become the first real-world example of a Von Neumann machine, a self-replicating system capable of building copies of itself, even on other planets. “Optimus will be the first Von Neumann machine, capable of building civilization by itself on any viable planet,” Musk wrote in a post on X.