News

SpaceX board member says Starlink prototype satellites “are working wonderfully”

Speaking in a Satellite Innovation 2018 keynote, long-time SpaceX investor and board member Steve Jurvetson made a quiet but significant comment about the company’s Starlink satellite constellation efforts, stating that the first two prototype spacecraft – currently in orbit – “are working wonderfully.”

Standing in contrast to recent speculation that SpaceX’s Starlink project had experienced major failures with on-orbit hardware, Jurvetson may be a biased source but still has a major vested interest in SpaceX’s long-term success – supporting billions dumped into a satellite constellation with no real returns in sight would serve to seriously harm his significant investments in the company.

He would say that? Maybe, but @dfjsteve Jurvetson, early @SpaceX & @planet investor, told Satellite Innovation conference Oct 10, regarding SpaceX's two Starlink test sats launched in February: pic.twitter.com/WHzJlPUEPA

— Peter B. de Selding (@pbdes) October 12, 2018

Perhaps the most trustworthy source of SpaceX information outside of the company itself, Jurvetson expressed considerable confidence in SpaceX’s Starlink achievements thus far.

“I personally think SpaceX is in the lead [with Ku- and Ka-band phased arrays that could make (global LEO satellite broadband) possible] … Tintin 1 and 2 [are working wonderfully].” – Steve Jurvetson, Satellite Innovation 2018

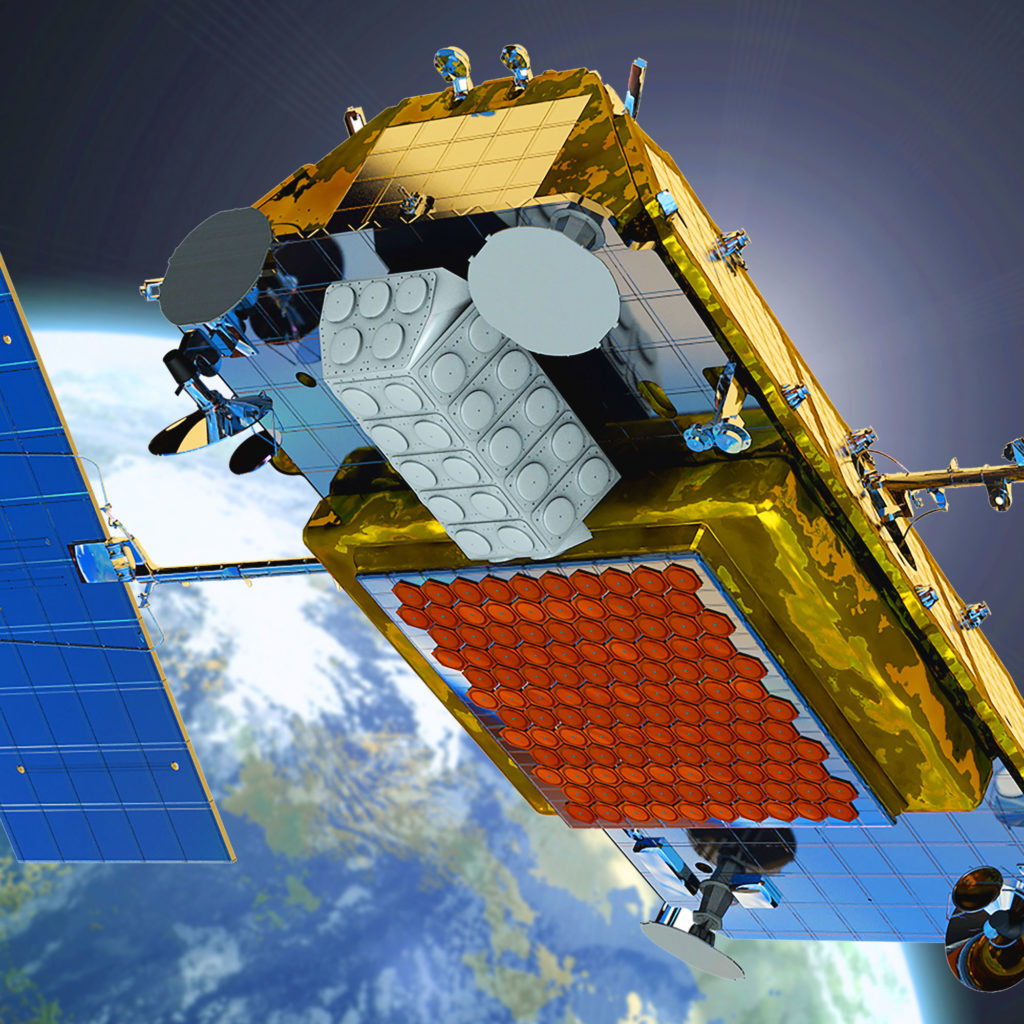

Previously discussed on Teslarati, SpaceX’s growing experience with phased array antennas is undoubtedly a boon for the company’s proposed Starlink internet constellation, just one of several companies actively pursuing the increasingly competitive low Earth orbit (LEO) satellite broadband market. Fundamentally, phased array antennas will eventually take over nearly all multipurpose orbital communications thanks to the sheer simplicity and potential technical superiority of the technology.

Phased array antennas get their name from the fact that they have no moving parts – rather than moving a physical dish or angling dedicated ‘beams’, phased arrays actively use signal interference to very precisely shape, direct, and regulate line-of-sight communications beams. Currently quite immature, the draw of the technology is the sheer simplicity and reliability of antennas that require no moving parts, eliminating a major mode of failure and the inherent physical limitations of current antenna tech. Without something like phased arrays, LEO communications satellites would struggle to accurately and reliably track ground stations and gateways while traveling multiple kilometers per second.

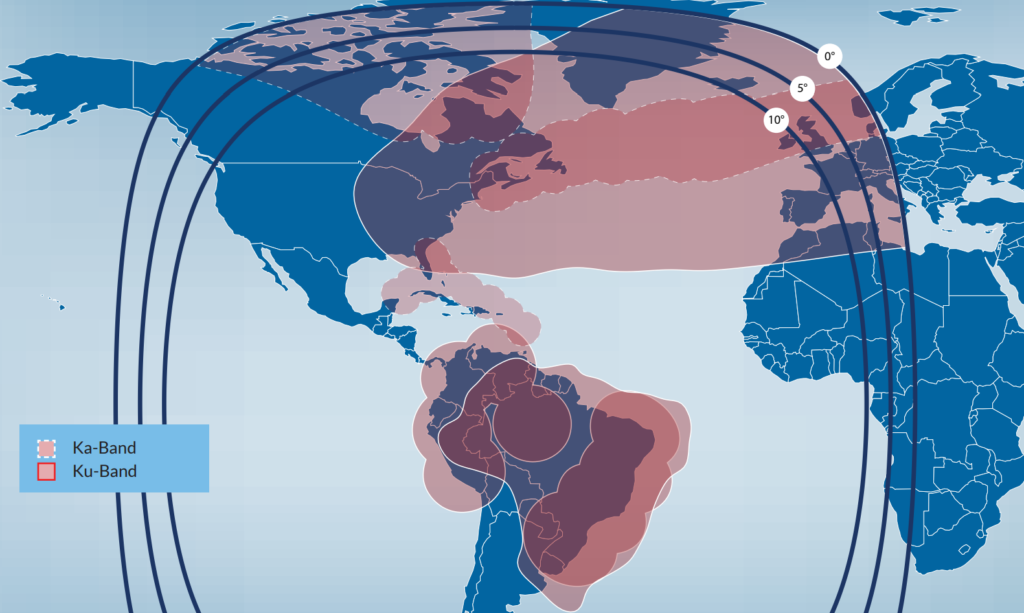

- Traditional geostationary commsats like Telstar 19V feature dish-style antennas. The weird lumps and bumps on each dish are there by design, enabling the oddly specific coverage footprints seen to the right. (Telstar)

- Telstar 19V’s coverage map. Each coverage blob is there by design and is accomplished by physically shaping the antenna dish.

- LEO communications satellites like Iridium’s NEXT constellation feature totally flat panels of phased array antennas, capable of forming beams digitally. (Harris)

Large communications satellites in geostationary orbit do not face this problem. Thanks to their inherently fixed positions over ground targets (hence “geostationary“), designers and manufacturers have learned to quite literally mold each satellite’s on-orbit antennas to explicitly prioritize certain areas on the ground. This process tends to involve a prior determination of markets where demand for satellite communications is or will be highest, while also avoiding wasted coverage over areas with no need for it. However, once the antenna is launched, its beams are almost completely permanent. If markets change, the satellite simply cannot adapt.

Phased arrays, on the other hand, can almost entirely change where their many beams are directed, how much bandwidth is dedicated to certain locations, and all while accurately tracking moving targets with very few limitations. As a result, satellites with phased array antennas are sort of the communications jacks of all trades, capable of offering high-bandwidth connectivity to stationary user terminals, large ground stations, and moving vehicles simultaneously from with the same antenna array.

- SpaceX’s first two Starlink prototype satellites are pictured here before their inaugural launch, showing off a thoroughly utilitarian bus and several advanced components. (SpaceX)

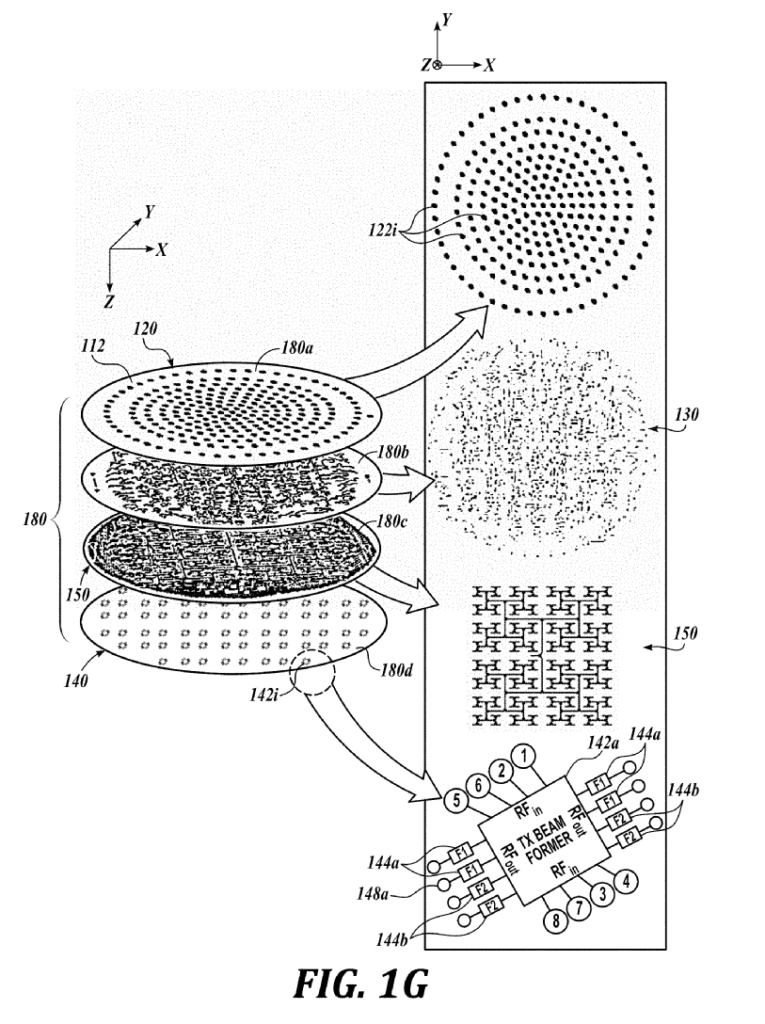

- Patent diagrams like this show various subcomponents of a sandwiched phased array antenna, comprised of multiple printed circuit boards. (SpaceX)

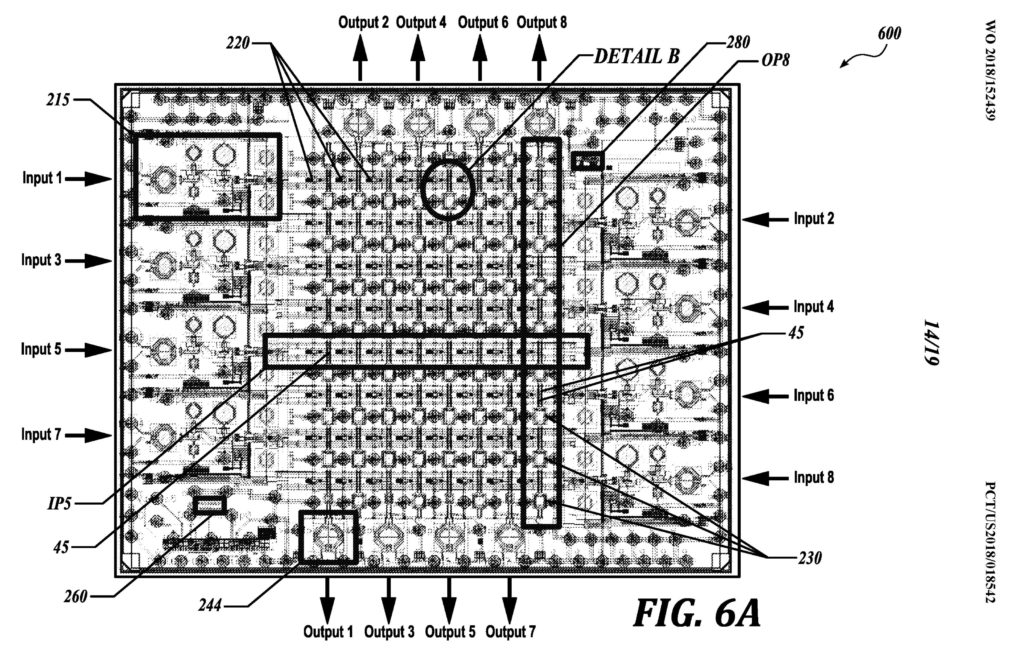

- The technical term for this is “science rectangle.” In all seriousness, this is actually an extraordinary glimpse at custom silicon developed in-house at SpaceX, in this case a semiconductor die. (SpaceX)

- One of the first two prototype Starlink satellites separates from Falcon 9’s upper stage in February 2018. (SpaceX)

If SpaceX can perfect this, they will be the only company in the world to have done so on-orbit, while other satellite operators like Iridium have managed to build and launch low-bandwidth phased arrays but have yet to attempt to do so with the bands optimal for broadband internet or at a scale that might work for constellations of hundreds or even thousands of satellites. If Jurvetson is to be believed, SpaceX’s first foray into dedicated communications satellites and specialized hardware design and manufacturing has been a major success.

Even if the orbits of Tintin A and B do suggest that some difficulties were had with at least one satellite’s electric propulsion thrusters, it’s obvious that the experience and data derived from testing the vast majority of each satellite’s non-propulsion-related systems were invaluable and well worth the effort. Another group of prototypes will likely be launched according to Elon Musk, but that’s simply how SpaceX develops complex systems – build, launch, learn, and repeat.

For prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket recovery fleet check out our brand new LaunchPad and LandingZone newsletters!

Elon Musk

Brazil Supreme Court orders Elon Musk and X investigation closed

The decision was issued by Supreme Court Justice Alexandre de Moraes following a recommendation from Brazil’s Prosecutor-General Paulo Gonet.

Brazil’s Supreme Federal Court has ordered the closure of an investigation involving Elon Musk and social media platform X. The inquiry had been pending for about two years and examined whether the platform was used to coordinate attacks against members of the judiciary.

The decision was issued by Supreme Court Justice Alexandre de Moraes following a recommendation from Brazil’s Prosecutor-General Paulo Gonet.

According to a report from Agencia Brasil, the investigation conducted by the Federal Police did not find evidence that X deliberately attempted to attack the judiciary or circumvent court orders.

Prosecutor-General Paulo Gonet concluded that the irregularities identified during the probe did not indicate fraudulent intent.

Justice Moraes accepted the prosecutor’s recommendation and ruled that the investigation should be closed. Under the ruling, the case will remain closed unless new evidence emerges.

The inquiry stemmed from concerns that content on X may have enabled online attacks against Supreme Court justices or violated rulings requiring the suspension of certain accounts under investigation.

Justice Moraes had previously taken several enforcement actions related to the platform during the broader dispute involving social media regulation in Brazil.

These included ordering a nationwide block of the platform, freezing Starlink accounts, and imposing fines on X totaling about $5.2 million. Authorities also froze financial assets linked to X and SpaceX through Starlink to collect unpaid penalties and seized roughly $3.3 million from the companies’ accounts.

Moraes also imposed daily fines of up to R$5 million, about $920,000, for alleged evasion of the X ban and established penalties of R$50,000 per day for VPN users who attempted to bypass the restriction.

Brazil remains an important market for X, with roughly 17 million users, making it one of the platform’s larger user bases globally.

The country is also a major market for Starlink, SpaceX’s satellite internet service, which has surpassed one million subscribers in Brazil.

Elon Musk

FCC chair criticizes Amazon over opposition to SpaceX satellite plan

Carr made the remarks in a post on social media platform X.

U.S. Federal Communications Commission (FCC) Chairman Brendan Carr criticized Amazon after the company opposed SpaceX’s proposal to launch a large satellite constellation that could function as an orbital data center network.

Carr made the remarks in a post on social media platform X.

Amazon recently urged the FCC to reject SpaceX’s application to deploy a constellation of up to 1 million low Earth orbit satellites that could serve as artificial intelligence data centers in space.

The company described the proposal as a “lofty ambition rather than a real plan,” arguing that SpaceX had not provided sufficient details about how the system would operate.

Carr responded by pointing to Amazon’s own satellite deployment progress.

“Amazon should focus on the fact that it will fall roughly 1,000 satellites short of meeting its upcoming deployment milestone, rather than spending their time and resources filing petitions against companies that are putting thousands of satellites in orbit,” Carr wrote on X.

Amazon has declined to comment on the statement.

Amazon has been working to deploy its Project Kuiper satellite network, which is intended to compete with SpaceX’s Starlink service. The company has invested more than $10 billion in the program and has launched more than 200 satellites since April of last year.

Amazon has also asked the FCC for a 24-month extension, until July 2028, to meet a requirement to deploy roughly 1,600 satellites by July 2026, as noted in a CNBC report.

SpaceX’s Starlink network currently has nearly 10,000 satellites in orbit and serves roughly 10 million customers. The FCC has also authorized SpaceX to deploy 7,500 additional satellites as the company continues expanding its global satellite internet network.

Energy

Tesla Energy gains UK license to sell electricity to homes and businesses

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

Tesla Energy has received a license to supply electricity in the United Kingdom, opening the door for the company to serve homes and businesses in the country.

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

According to Ofgem, the license took effect at 6 p.m. local time on Wednesday and applies to Great Britain.

The approval allows Tesla’s energy business to sell electricity directly to customers in the region, as noted in a Bloomberg News report.

Tesla has already expanded similar services in the United States. In Texas, the company offers electricity plans that allow Tesla owners to charge their vehicles at a lower cost while also feeding excess electricity back into the grid.

Tesla already has a sizable presence in the UK market. According to price comparison website U-switch, there are more than 250,000 Tesla electric vehicles in the country and thousands of Tesla home energy storage systems.

Ofgem also noted that Tesla Motors Ltd., a separate entity incorporated in England and Wales, received an electricity generation license in June 2020.

The new UK license arrives as Tesla continues expanding its global energy business.

Last year, Tesla Energy retained the top position in the global battery energy storage system (BESS) integrator market for the second consecutive year. According to Wood Mackenzie’s latest rankings, Tesla held about 15% of global market share in 2024.

The company also maintained a dominant position in North America, where it captured roughly 39% market share in the region.

At the same time, competition in the energy storage sector is increasing. Chinese companies such as Sungrow have been expanding their presence globally, particularly in Europe.