News

SpaceX debuts converted Falcon Heavy booster on spectacular Italian satellite launch

For the first time, SpaceX has converted a flight-proven Falcon Heavy side core into a Falcon 9 booster and successfully launched the reborn rocket, carrying an Italian Earth observation satellite to orbit with one of the most visually spectacular Falcon launches in recent memory.

After a tortured campaign of four scrubbed or aborted launch attempts between January 27th and 30th, Falcon 9 finally lifted off from SpaceX’s Cape Canaveral Space Force Station (CCSFS) LC-40 pad at 6:11 pm EST (23:11 UTC) on Monday, January 31st. The converted Falcon Heavy booster performed perfectly on its first solo mission, successfully carrying a Falcon upper stage and Italy’s CSG-2 synthetic aperture radar (SAR) Earth observation satellite to an altitude of 70 km (~45 mi) and a velocity of ~1.7 km/s (Mach 5) – effectively the edge of space.

Thanks to near-perfect weather and the timing of the launch about 15 minutes after sunset, Falcon Heavy side core B1052’s first mission as a Falcon 9 booster wound up producing some of the best views of a SpaceX launch in the company’s history. As the rocket ascended, the sky continued to darken for local ground observers. It wasn’t long before Falcon 9’s shiny, white airframe ascended into direct sunlight, which created some extraordinary contrast against the darkening sky for tracking cameras near the launch site.

Thanks to the near-perfect conditions and the skill of one particular camera operator, webcast viewers were left with some of the best remote views of booster main engine cutoff (MECO), stage separation, and second stage startup ever recorded – let alone broadcast live. Additionally, the timing of the launch worked out such that the dusk Florida sky was still lit up when booster B1052 touched down at SpaceX’s Cape Canaveral Landing Zone (LZ-1) for the third time.

Almost exactly an hour after liftoff, Falcon 9’s upper stage successfully deployed CSG-2 into a polar sun-synchronous orbit (SSO) around 600 km (375 mi) above Earth’s surface, capping off SpaceX’s fourth launch this year. Known as Starlink 4-7, SpaceX’s next launch could occur as early as 1:56 pm EST (18:56 UTC) on Tuesday, February 1st – potentially less than 20 hours after CSG-2. Just ~25 hours after that Another Falcon 9 rocket is scheduled to attempt to launch the United States’ NROL-87 spy satellite(s) from SpaceX’s West Coast launch site around 12:18 pm PST (20:18 UTC), Wednesday, February 2nd. A third Falcon 9 mission – Starlink 4-7 – is also expected to launch sometime later this week.

Elon Musk

Tesla showcases Optimus humanoid robot at AWE 2026 in Shanghai

Tesla’s humanoid robot was presented as part of the company’s exhibit at the Shanghai electronics show.

Tesla showcased its Optimus humanoid robot at the 2026 Appliance & Electronics World Expo (AWE 2026) in Shanghai. The event opened Thursday and featured several Tesla products, including the company’s humanoid robot and the Cybertruck.

The display was reported by CNEV Post, citing information from local media outlet Cailian and on-site staff at the exhibition.

Tesla’s humanoid robot was presented as part of the company’s exhibit at the Shanghai electronics show. On-site staff reportedly stated that mass production of the robot could begin by the end of 2026.

Tesla previously indicated that it plans to manufacture its humanoid robots at scale once production begins, with its initial production line in the Fremont Factory reaching up to 1 million units annually. An Optimus production line at Gigafactory Texas is expected to produce 10 million units per year.

Tesla China previously shared a teaser image on Weibo showing a pair of highly detailed robotic hands believed to belong to Optimus. The image suggests a design with finger proportions and structures that closely resemble those of a human hand.

Robotic hands are widely considered one of the most difficult engineering challenges in humanoid robotics. For a system like Optimus to perform complex real-world tasks, from factory work to household activities, the robot would require highly advanced dexterity.

Elon Musk has previously stated that Optimus has the capability to eventually become the first real-world example of a Von Neumann machine, a self-replicating system capable of building copies of itself, even on other planets. “Optimus will be the first Von Neumann machine, capable of building civilization by itself on any viable planet,” Musk wrote in a post on X.

Elon Musk

Tesla Cybercab production line is targeting hundreds of vehicles weekly: report

According to the report, Tesla has been adding staff and installing new equipment at its Austin factory as it prepares to begin Cybercab production.

Tesla is reportedly designing its Cybercab production line to manufacture hundreds of the autonomous vehicles each week once mass production begins. The effort is underway at Gigafactory Texas in Austin as the company prepares to start building the Robotaxi at scale.

The details were reported by The Wall Street Journal, citing people reportedly familiar with the matter.

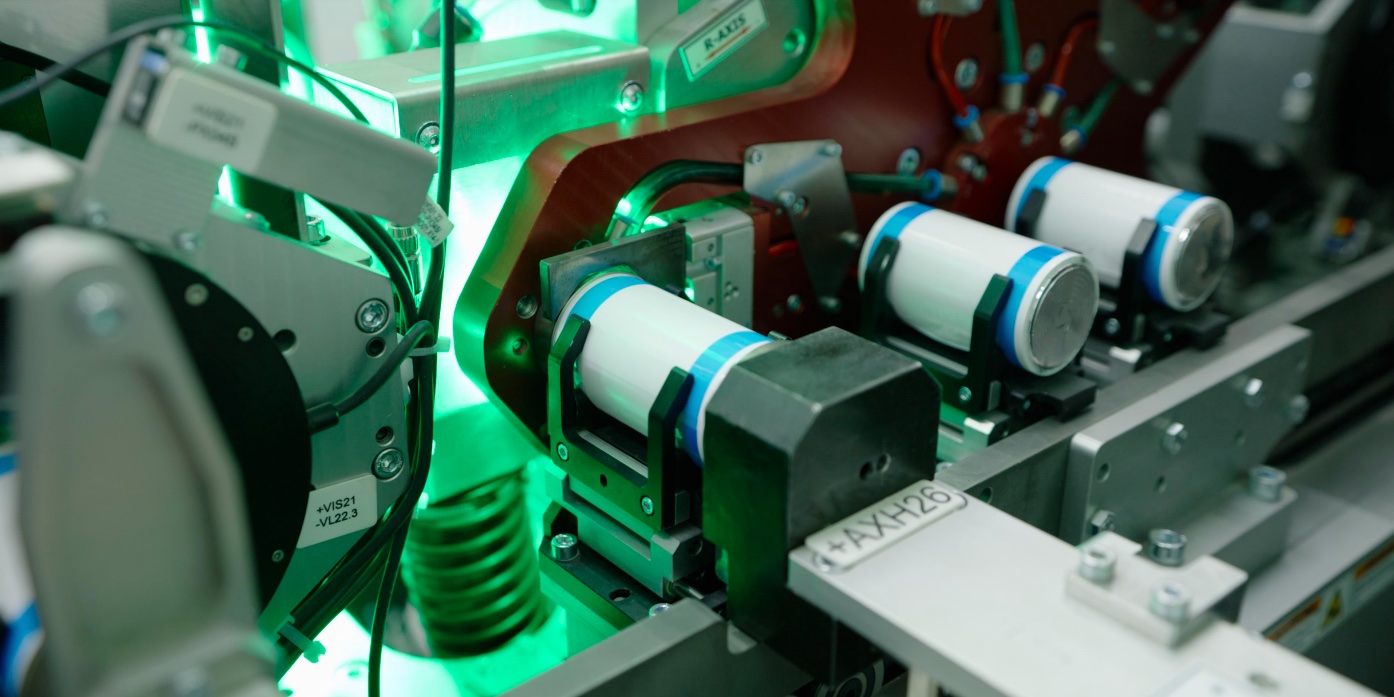

According to the report, Tesla has been adding staff and installing new equipment at its Austin factory as it prepares to begin Cybercab production.

People reportedly familiar with Tesla’s plans stated that the company has been growing its staff and bringing in new equipment to start the mass production of the Cybercab this April.

The Cybercab is Tesla’s upcoming fully autonomous two-seat vehicle designed without a steering wheel or pedals. The vehicle is intended to operate primarily as part of Tesla’s planned Robotaxi ride-hailing network.

“There’s no fallback mechanism here. Like this car either drives itself or it does not drive,” Musk stated during Tesla’s previous earnings call.

Tesla has indicated that Cybercab production could begin as soon as April, though Elon Musk has noted that early production will likely be slow before ramping over time. Musk has stated that the Cybercab’s slow ramp is due in no small part to the fact that it is a completely new vehicle platform.

Tesla’s Cybercab is designed to work with the company’s Full Self-Driving (FSD) system and support its planned autonomous ride-hailing service. The company has suggested that the vehicle could cost under $30,000, making it one of Tesla’s most affordable models if produced at scale. Musk has confirmed in a previous X post that the vehicle will indeed be offered to regular consumers at a price below $30,000.

Musk has previously stated that Tesla could eventually produce millions of Cybercabs annually if demand and production capacity scale as planned.

News

Tesla VP explains latest updates in trade secret theft case

Tesla reportedly caught Matthews copying the tech into machines that were sold to competitors, claiming they lied about doing so for three years, and continued to ship it. That is when Tesla chose to sue Matthews in July 2024 in Federal court, demanding over $1 billion in damages due to trade secret theft.

Tesla Vice President Bonne Eggleston explained the latest updates in a trade secret theft case the company has against a former manufacturing equipment supplier, Matthews International.

Back in 2024, Tesla had filed a lawsuit against Matthews International, alleging that the firm stole trade secrets about battery manufacturing and shared those details with some of Tesla’s competitors.

Early last year, a U.S. District Court Judge denied Tesla’s request to block Matthews International from selling its dry battery electrode (DBE) technology across the world. The judge, Edward Davila, said that the patent for the tech was due to Matthews’ “extensive research and development.”

The two companies’ relationship began back in 2019, as Tesla hired Matthews to help build the equipment for its 4680 battery cell. Tesla shared confidential software, designs, and know-how under strict secrecy rules.

Fast forward a few years, and Tesla reportedly caught Matthews copying the tech into machines that were sold to competitors, claiming they lied about doing so for three years, and continued to ship it. That is when Tesla chose to sue Matthews in July 2024 in Federal court, demanding over $1 billion in damages due to trade secret theft.

Now, the latest twist, as this month, a Judge issued a permanent injunction—a court order banning Matthews from using certain stolen Tesla parts or designs in their machines. Matthews is also officially “liable” for damages. The exact amount would still to be calculated later.

Bonne Eggleston, a VP for Tesla, said on X today that Matthews is a supplier who “exploited customer IP through theft or deception,” and has no place in Tesla’s ecosystem:

Buyer beware: Matthews International stole Tesla’s DBE technology and is now subject to an injunction and liable for damages.

During our work with Matthews, we caught them red-handed copying our technology—including proprietary software and sensitive mechanical designs—into… https://t.co/Toc8ilakeM

— Bonne Eggleston (@BonneEggleston) March 10, 2026

Tesla calls this a big win and warns other companies: “Buyer beware—don’t buy from thieves.”

Matthews hit back with a press release claiming victory. They say an arbitrator ruled they can keep selling their own DBE equipment to anyone and rejected Tesla’s request for a total sales ban. They call Tesla’s claims “nonsense” and insist their 20-year-old tech is independent. Both sides are spinning the same narrow ruling: Matthews can sell their version, but they’re blocked from using Tesla’s specific secrets.

What are Tesla’s Current Legal Options

The case isn’t over—it’s moving to the damages phase. Tesla can:

- Push forward in court or arbitration to calculate and collect huge financial penalties (potentially $1 billion+ if willful theft is proven).

- Enforce the permanent injunction with contempt charges, fines, or even jail time if Matthews violates it.

- Challenge Matthews’ new patents that allegedly copy Tesla’s work, asking courts to invalidate them or add Tesla as co-inventor.

- Seek extra damages, lawyer fees, and possibly punitive awards under the federal Defend Trade Secrets Act and California law.

Tesla could also refer evidence to federal prosecutors for possible criminal trade-secret charges (rare but serious). Settlement is always possible, but Tesla’s fiery public response suggests they want full accountability.

This isn’t just corporate drama. It shows why trade secrets matter even when Tesla open-sources some patents, confidential know-how shared in trust must stay protected. For the EV industry, it’s a reminder: steal from your biggest customer, and you risk losing everything.