SpaceX

SpaceX given the go-ahead for Crew Dragon’s first journey into Earth orbit

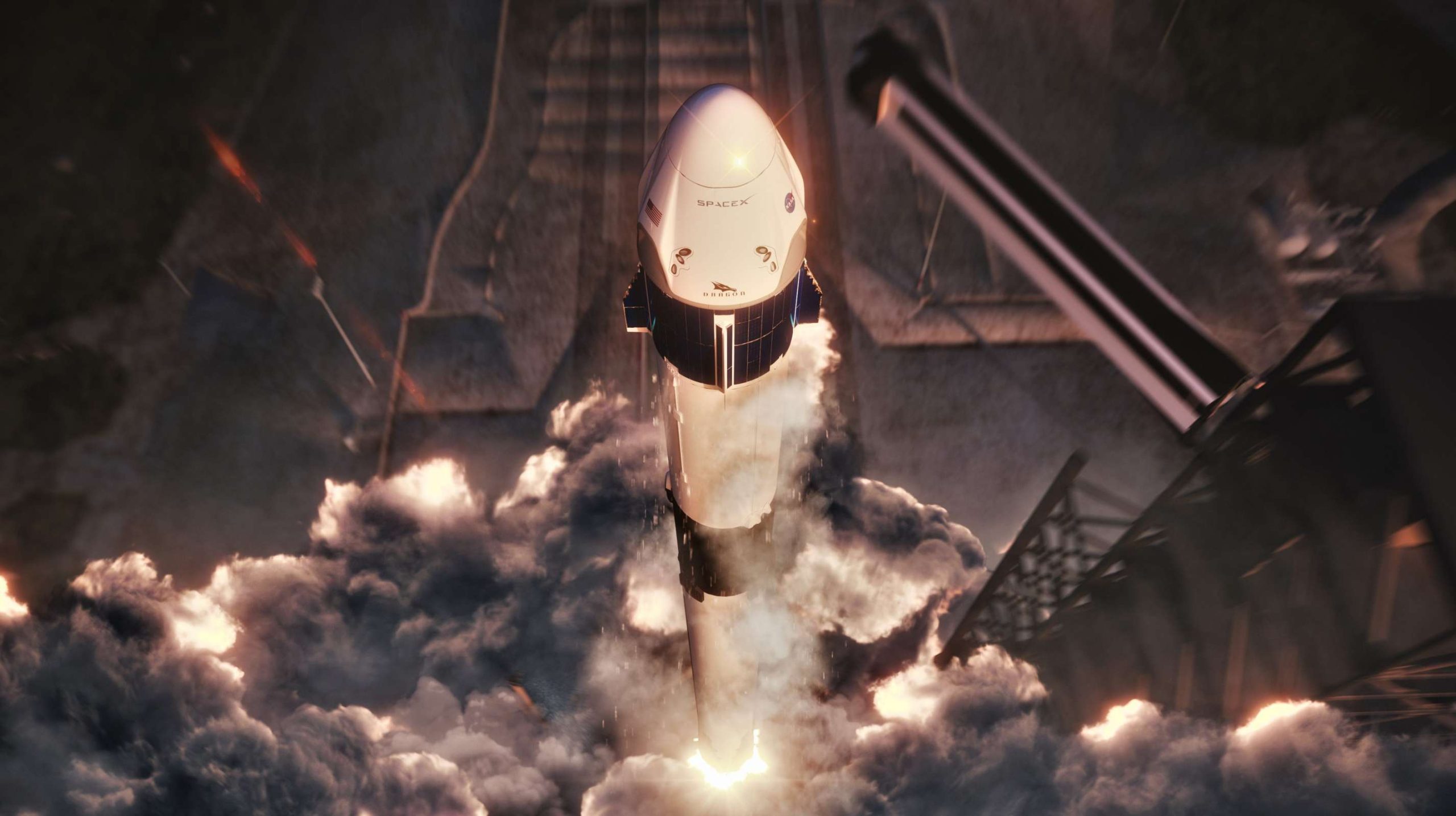

NASA and SpaceX officials announced on Friday that the company is ready to conduct the first orbital launch of Crew Dragon as early as March 2nd, a demonstration that will directly precede the first crewed launch on a US rocket in more eight years.

Shortly after the news broke, NASA hosted what can only be described as an effusive press conference in which typically reserved officials like Bill Gerstenmaier and Kathy Lueders discussed the Commercial Crew Program milestone. Above all else, they reported no glaring concerns and rather unequivocally echoed the affirmation that SpaceX, NASA, Falcon 9, and Crew Dragon are all ready and eager to get to orbit. SpaceX now aims to roll the spacecraft and rocket out to the launch pad – Kennedy Space Center’s Pad 39A – on Thursday, February 28th, roughly 48 hours before T-0.

The Demo-1 Flight Readiness Review has concluded. The Board set March 2 at 2:48 a.m. EST as the official launch date for @SpaceX's flight to @Space_Station. #LaunchAmerica https://t.co/2DIJ99guG2 pic.twitter.com/86lV29gVNS

— NASA Commercial Crew (@Commercial_Crew) February 22, 2019

Relative to any number of recent NASA press conferences, the mood in the conference hall following the joint NASA-SpaceX Flight Readiness Review (FRR) was one of obvious relief and elation, marked particularly by heaps of praise and rare personal segues from Mr. Gerstenmaier (associate NASA administrator of Human Exploration and Operations) and Ms. Lueders, NASA’s Commercial Crew Program manager.

“We’re go for launch, we’re go for docking, and we’ll work through [one minor ISS partner concern] next week. But again, just a phenomenal review today … It’s great being back here again [and] starting to get that feeling of launching again and getting ready to go fly.” – Bill Gerstenmaier, NASA HEOMD, 02/22/19

“Right now, [we] do not have any open, joint risks [present on] this mission. It’s been part of our FRR process, and it was the reason why I could tell Mr. Gerstenmaier … that we [are] ready to go fly.” – Kathy Lueders, NASA CCP, 02/22/19

SpaceX Vice President of Build and Flight Reliability Hans Koenigsmann was equally enthusiastic about the completed review, describing his firm belief that – regardless of any delays it may have caused – the Crew Dragon spacecraft and its Falcon 9 rocket would ultimately be the best they could be as a result of the constant back-and-forth between NASA and SpaceX engineers and analysts.

The main mission objectives for DM-1: pic.twitter.com/i5rCKSQEDP

— SpaceXUpdates (@SpaceXUpdates) February 22, 2019

Aside from the encouraging FRR and follow-up press conference, SpaceX and NASA are reportedly planning on making the hosted webcast of Crew Dragon’s inaugural launch something fairly spectacular. While no specifics were given, this would come as no surprise knowing SpaceX’s past history of exceptional launch webcasts combined with CEO Elon Musk’s equal affinity to spectacular events. According to Koenigsmann, Crew Dragon will be outfitted with a mannequin (effectively an aerospace-grade crash test dummy) dressed in one of SpaceX’s in-house spacesuits, a globally-recognizable icon thanks to the widespread popularity of Falcon Heavy’s launch debut and special payload.

“The only work between now and launch is what we would consider standard work and [the] standard close-out of activities moving forward. So that shows you that we’re fully ready to go do this DM-1 flight next Saturday.” – Bill Gerstenmaier, NASA HEOMD, 02/22/19

The spacecraft will also apparently be nearly identical to DM-2’s Crew Dragon, the first vehicle that will fly with astronauts onboard. As such, it will presumably be outfitted with everything a crew of astronauts would need, including seats, a functioning control panel/display, lighting, and the general fit and finish of an interior ready to support a human presence for multiple days straight. Live camera views of both Starmannequin and out of Crew Dragon’s windows will thus be par for the course, among many other unique perspectives. SpaceX will also offer a rare hosted webcast for Crew Dragon’s arrival and docking at the International Space Station, scheduled roughly 24 hours after launch, an event that could potentially include exceptionally rare feeds from Dragon’s own onboard cameras.

Regardless, this is an event you do not want to miss. If all goes well during the Feb. 27 launch readiness review (LRR) and Falcon 9’s subsequent roll-out to Pad 39A, SpaceX will attempt its first Crew Dragon launch at 2:49 am EST (07:49 UTC) March 2nd.

Check out Teslarati’s newsletters for prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket launch and recovery processes!

Elon Musk

Elon Musk shares updated Starship V3 maiden launch target date

The comment was posted on Musk’s official account on social media platform X.

SpaceX CEO Elon Musk shared a brief Starship V3 update in a post on social media platform X, stating the next launch attempt of the spacecraft could take place in about four weeks.

The comment was posted on Musk’s official account on social media platform X.

Musk’s update suggests that Starship Flight 12 could target a launch around early April, though the schedule will depend on several remaining milestones at SpaceX’s Starbase launch facility in Texas.

Among the key steps is testing and certification of the site’s new launch tower, launch mount, and tank farm systems. These upgrades will support the next generation of Starship vehicles.

Booster 19 is expected to roll to the launch site and be placed on the launch mount before returning to the production facility to receive its 33 Raptor engines. The booster would then return for a static fire test, which could mark the first time a Super Heavy booster equipped with Raptor V3 engines is fired on the pad.

Ship 39 is expected to undergo a similar preparation process. The vehicle will likely return to the production site to receive its six engines before heading to Massey’s test site for static fire testing.

Once both stages are prepared, the booster and ship will roll out to the launch site for the first full stack of a V3 Super Heavy and V3 Starship. A full wet dress rehearsal is expected to follow before any launch attempt.

Elon Musk has previously shared how SpaceX plans to eventually recover Starship’s upper stage using the launch tower’s robotic arms. Musk noted that the company will only attempt to catch the Starship spacecraft after two successful soft landings in the ocean. The approach is intended to reduce risk before attempting a recovery over land.

“Should note that SpaceX will only try to catch the ship with the tower after two perfect soft landings in the ocean. The risk of the ship breaking up over land needs to be very low,” Musk wrote in a post on X.

Such a milestone would represent a major step toward the full reuse of the Starship system, which remains a central goal for SpaceX’s long-term launch strategy.

News

SpaceX President Gwynne Shotwell details xAI power pledge at White House event

The commitment was announced during an event with United States President Donald Trump.

SpaceX President Gwynne Shotwell stated that xAI will develop 1.2 gigawatts of power at its Memphis-area AI supercomputer site as part of the White House’s new “Ratepayer Protection Pledge.”

The commitment was announced during an event with United States President Donald Trump.

During the White House event, Shotwell stated that xAI’s AI data center near Memphis would include a major energy installation designed to support the facility’s power needs.

“As you know, xAI builds huge supercomputers and data centers and we build them fast. Currently, we’re building one on the Tennessee-Mississippi state line. As part of today’s commitment, we will take extensive additional steps to continue to reduce the costs of electricity for our neighbors…

“xAI will therefore commit to develop 1.2 GW of power as our supercomputer’s primary power source. That will be for every additional data center as well. We will expand what is already the largest global Megapack power installation in the world,” Shotwell said.

She added that the system would provide significant backup power capacity.

“The installation will provide enough backup power to power the city of Memphis, and more than sufficient energy to power the town of Southaven, Mississippi where the data center resides. We will build new substations and invest in electrical infrastructure to provide stability to the area’s grid.”

Shotwell also noted that xAI will be supporting the area’s water supply as well.

“We haven’t talked about it yet, but this is actually quite important. We will build state-of-the-art water recycling plants that will protect approximately 4.7 billion gallons of water from the Memphis aquifer each year. And we will employ thousands of American workers from around the city of Memphis on both sides of the TN-MS border,” she noted.

The Ratepayer Protection Pledge was introduced as part of the federal government’s effort to address concerns about rising electricity costs tied to large AI data centers, as noted in an Insider report. Under the agreement, companies developing major AI infrastructure projects committed to covering their own power generation needs and avoiding additional costs for local ratepayers.

Elon Musk

SpaceX to launch Starlink V2 satellites on Starship starting 2027

The update was shared by SpaceX President Gwynne Shotwell and Starlink Vice President Mike Nicolls.

SpaceX is looking to start launching its next-generation Starlink V2 satellites in mid-2027 using Starship.

The update was shared by SpaceX President Gwynne Shotwell and Starlink Vice President Mike Nicolls during remarks at Mobile World Congress (MWC) in Barcelona, Spain.

“With Starship, we’ll be able to deploy the constellation very quickly,” Nicolls stated. “Our goal is to deploy a constellation capable of providing global and contiguous coverage within six months, and that’s roughly 1,200 satellites.”

Nicolls added that once Starship is operational, it will be capable of launching approximately 50 of the larger, more powerful Starlink satellites at a time, as noted in a Bloomberg News report.

The initial deployment of roughly 1,200 next-generation satellites is intended to establish global and contiguous coverage. After that phase, SpaceX plans to continue expanding the system to reach “truly global coverage, including the polar regions,” Nicolls said.

Currently, all Starlink satellites are launched on SpaceX’s Falcon 9 rocket. The next-generation fleet will rely on Starship, which remains in development following a series of test flights in 2025. SpaceX is targeting its next Starship test flight, featuring an upgraded version of the rocket, as soon as this month.

Starlink is currently the largest satellite network in orbit, with nearly 10,000 satellites deployed. Bloomberg Intelligence estimates the business could generate approximately $9 billion in revenue for SpaceX in 2026.

Nicolls also confirmed that SpaceX is rebranding its direct-to-cell service as Starlink Mobile.

The service currently operates with 650 satellites capable of connecting directly to smartphones and has approximately 10 million monthly active users. SpaceX expects that figure to exceed 25 million monthly active users by the end of 2026.