News

SpaceX completes vast Mr Steven arm upgrades for quadruple-sized net

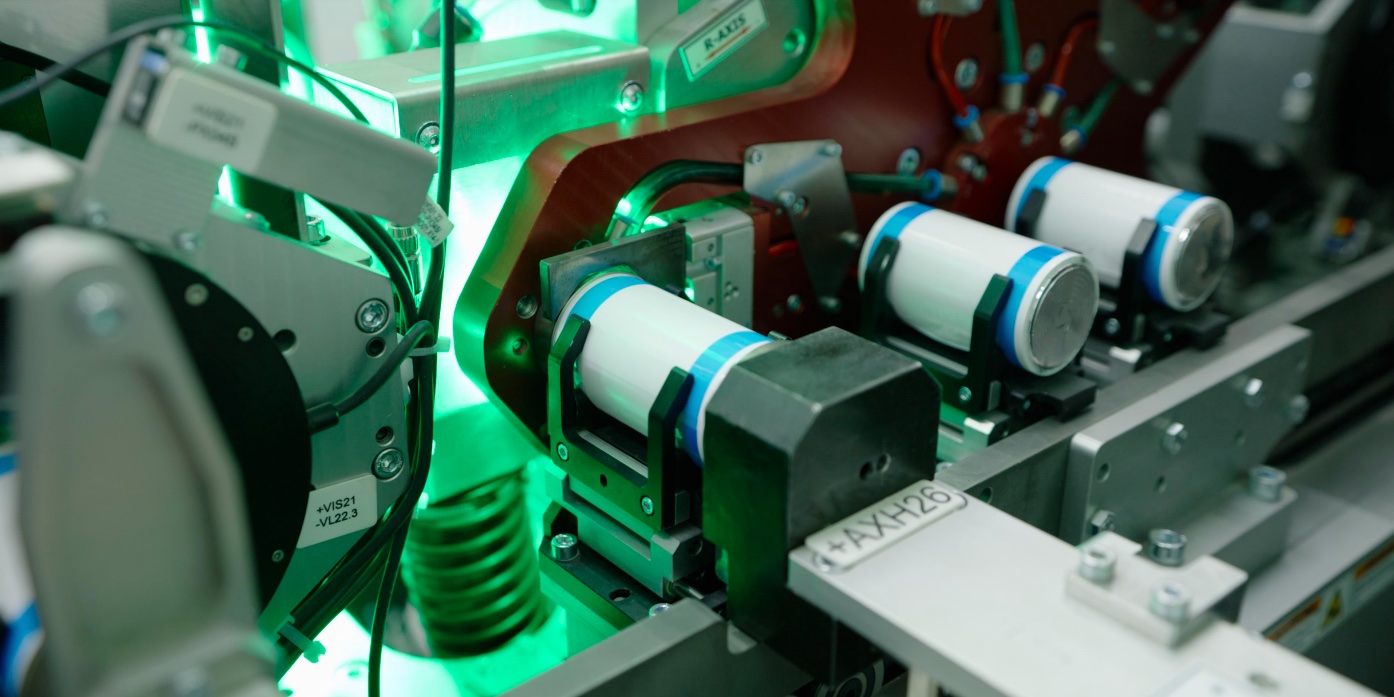

Scarcely 48 hours after they began, SpaceX technicians have already completed installation of all four of Falcon fairing recovery vessel Mr Steven’s new and dramatically larger arms, as well as eight giant struts. All that remains to be installed is an upgraded net, said by CEO Elon Musk to have four times the area of its predecessor.

Put simply, it’s difficult to express how large these upgraded arms really are, and photos still only give a partial sense of their scale. SpaceX technicians busy installing the new arms on July 10th nevertheless offer a fleeting appreciation of the true size of this new payload fairing recovery apparatus, which will hopefully see its first operational debut in just two weeks with a fairing recovery attempt after the Iridium-7 Falcon 9 mission, July 25th.

- A few SpaceX technicians examine one of Mr Steven’s newly-attached arms and struts. (Pauline Acalin)

- Mr Steven and the ever mysterious inflatable ring now floating at Berth 240, July 10. (Pauline Acalin)

All arms on deck

While it’s difficult to estimate from photos alone, it appears that Mr Steven’s new arms are minimum of roughly 65 meters squared, assuming a square aspect ratio. In other words, the vessel’s next and newest net could have an area as large as 3600 square meters (~40,000 square feet, ~0.85 acres), easily more than quadruple the size of Mr Steven’s previous net. For comparison, the massive autonomous spaceport drone ships (ASDS) SpaceX often recovers its Falcon 9 and Heavy boosters aboard have a usable landing area of roughly 45,000 square feet, a little more than 10% larger than Mr Steven’s new net.

With these vast new arms, struts, and (soon enough) net, SpaceX is likely as close as they have ever been to successfully catching a Falcon 9 fairing, an achievement that would likely allow the company to begin reusing the large carbon fiber-composite shrouds almost immediately. Critically, although SpaceX appears to have begun attaching recovery hardware to both fairing halves in recent West Coast attempts, it remains to be seen whether Mr Steven’s new claw apparatus will be able to catch both halves, thus closing the gap on fairing recovery without necessitating the leasing and modification of perhaps three additional copies of the vessel.

- A before and after comparison of Mr Steven’s old and new arms. (Pauline Acalin)

- Even at this zoom, the human workers are difficult to make out. (Pauline Acalin)

- E N H A N C E. (Pauline Acalin)

Adding three recovery-critical ships (two for West Coast missions, two for East Coast missions) to SpaceX’s already massive blue-water fleet could significantly raise the operating costs of each recovery attempt, as well as generally adding considerable complexity to the orchestration of those fleets come launch time. Perhaps not. Still, if Mr Steven sees success with his 4Xed net and arms, chances are very good that SpaceX will lease and modify another Fast Supply Vessel – if they already haven’t done so – to provide the company’s higher-volume East Coast launch facilities with their own, dedicated fairing catcher. Mrs Steven awaits…

- A few more arm and strut glamour shots, July 10. (Pauline Acalin)

- A few more arm and strut glamour shots, July 10. (Pauline Acalin)

- Port of San Pedro or an Andrew Pollock painting? You be the judge. (Pauline Acalin)

Zeroing in on Falcon fairings

Worth noting, SpaceX may have already halved the error margin officially advertised for the parafoil guidance units it procured from Canadian supplier MMIST, apparently missing Mr Steven by about 50 meters while MMIST suggests a 50% chance of successfully landing a payload in a 100-meter sphere. Given the significant expense likely incurred by designing, building, installing, and testing two distinct net and arm systems aboard Mr Steven, it’s safe to say that SpaceX engineers and technicians believe there is a very strong chance that the newest solution will successfully close the fairing recovery gap, said by CEO Elon Musk to be a rather literal 50 meters between the vessel’s old net and the unforgiving ocean surface.

With an additional 30 meters (~100 feet) of reach in both axes, the new net alone may be able to shrink that error margin by ~60%. Perhaps the fact that it also appears to cover (and thus protect) Mr Steven’s wheelhouse will allow the vessel more leeway to aggressively maneuver as the fairing nears touchdown, providing that final 20-meter leap to slip his net under the fall halves.

In the meantime, we will ponder who exactly SpaceX is procuring a 40,000 square foot net from.

Incredibly, this artist rendering of a much larger net installed on Mr Steven was perhaps two or more times smaller than the solution now installed on the vessel. (Reese Wilson)

Follow us for live updates, peeks behind the scenes, and photos from Teslarati’s East and West Coast photographers.

Teslarati – Instagram – Twitter

Tom Cross – Twitter

Pauline Acalin – Twitter

Eric Ralph – Twitter

Elon Musk

Tesla Cybercab production line is targeting hundreds of vehicles weekly: report

According to the report, Tesla has been adding staff and installing new equipment at its Austin factory as it prepares to begin Cybercab production.

Tesla is reportedly designing its Cybercab production line to manufacture hundreds of the autonomous vehicles each week once mass production begins. The effort is underway at Gigafactory Texas in Austin as the company prepares to start building the Robotaxi at scale.

The details were reported by The Wall Street Journal, citing people reportedly familiar with the matter.

According to the report, Tesla has been adding staff and installing new equipment at its Austin factory as it prepares to begin Cybercab production.

People reportedly familiar with Tesla’s plans stated that the company has been growing its staff and bringing in new equipment to start the mass production of the Cybercab this April.

The Cybercab is Tesla’s upcoming fully autonomous two-seat vehicle designed without a steering wheel or pedals. The vehicle is intended to operate primarily as part of Tesla’s planned Robotaxi ride-hailing network.

“There’s no fallback mechanism here. Like this car either drives itself or it does not drive,” Musk stated during Tesla’s previous earnings call.

Tesla has indicated that Cybercab production could begin as soon as April, though Elon Musk has noted that early production will likely be slow before ramping over time. Musk has stated that the Cybercab’s slow ramp is due in no small part to the fact that it is a completely new vehicle platform.

Tesla’s Cybercab is designed to work with the company’s Full Self-Driving (FSD) system and support its planned autonomous ride-hailing service. The company has suggested that the vehicle could cost under $30,000, making it one of Tesla’s most affordable models if produced at scale. Musk has confirmed in a previous X post that the vehicle will indeed be offered to regular consumers at a price below $30,000.

Musk has previously stated that Tesla could eventually produce millions of Cybercabs annually if demand and production capacity scale as planned.

News

Tesla VP explains latest updates in trade secret theft case

Tesla reportedly caught Matthews copying the tech into machines that were sold to competitors, claiming they lied about doing so for three years, and continued to ship it. That is when Tesla chose to sue Matthews in July 2024 in Federal court, demanding over $1 billion in damages due to trade secret theft.

Tesla Vice President Bonne Eggleston explained the latest updates in a trade secret theft case the company has against a former manufacturing equipment supplier, Matthews International.

Back in 2024, Tesla had filed a lawsuit against Matthews International, alleging that the firm stole trade secrets about battery manufacturing and shared those details with some of Tesla’s competitors.

Early last year, a U.S. District Court Judge denied Tesla’s request to block Matthews International from selling its dry battery electrode (DBE) technology across the world. The judge, Edward Davila, said that the patent for the tech was due to Matthews’ “extensive research and development.”

The two companies’ relationship began back in 2019, as Tesla hired Matthews to help build the equipment for its 4680 battery cell. Tesla shared confidential software, designs, and know-how under strict secrecy rules.

Fast forward a few years, and Tesla reportedly caught Matthews copying the tech into machines that were sold to competitors, claiming they lied about doing so for three years, and continued to ship it. That is when Tesla chose to sue Matthews in July 2024 in Federal court, demanding over $1 billion in damages due to trade secret theft.

Now, the latest twist, as this month, a Judge issued a permanent injunction—a court order banning Matthews from using certain stolen Tesla parts or designs in their machines. Matthews is also officially “liable” for damages. The exact amount would still to be calculated later.

Bonne Eggleston, a VP for Tesla, said on X today that Matthews is a supplier who “exploited customer IP through theft or deception,” and has no place in Tesla’s ecosystem:

Buyer beware: Matthews International stole Tesla’s DBE technology and is now subject to an injunction and liable for damages.

During our work with Matthews, we caught them red-handed copying our technology—including proprietary software and sensitive mechanical designs—into… https://t.co/Toc8ilakeM

— Bonne Eggleston (@BonneEggleston) March 10, 2026

Tesla calls this a big win and warns other companies: “Buyer beware—don’t buy from thieves.”

Matthews hit back with a press release claiming victory. They say an arbitrator ruled they can keep selling their own DBE equipment to anyone and rejected Tesla’s request for a total sales ban. They call Tesla’s claims “nonsense” and insist their 20-year-old tech is independent. Both sides are spinning the same narrow ruling: Matthews can sell their version, but they’re blocked from using Tesla’s specific secrets.

What are Tesla’s Current Legal Options

The case isn’t over—it’s moving to the damages phase. Tesla can:

- Push forward in court or arbitration to calculate and collect huge financial penalties (potentially $1 billion+ if willful theft is proven).

- Enforce the permanent injunction with contempt charges, fines, or even jail time if Matthews violates it.

- Challenge Matthews’ new patents that allegedly copy Tesla’s work, asking courts to invalidate them or add Tesla as co-inventor.

- Seek extra damages, lawyer fees, and possibly punitive awards under the federal Defend Trade Secrets Act and California law.

Tesla could also refer evidence to federal prosecutors for possible criminal trade-secret charges (rare but serious). Settlement is always possible, but Tesla’s fiery public response suggests they want full accountability.

This isn’t just corporate drama. It shows why trade secrets matter even when Tesla open-sources some patents, confidential know-how shared in trust must stay protected. For the EV industry, it’s a reminder: steal from your biggest customer, and you risk losing everything.

News

Tesla Cybercab includes this small but significant feature

The Cybercab is Tesla’s big plan to introduce fully autonomous ride-sharing in a seamless fashion. In fact, the Full Self-Driving suite was geared toward alleviating the need to manually drive vehicles.

Tesla Cybercab manufacturing is strikingly close, as the company is still aiming for an April start date. But small and significant features are still being identified for the first time as production units appear all over the country for testing and for regulatory events, like one yesterday in Washington, D.C.

The Cybercab is Tesla’s big plan to introduce fully autonomous ride-sharing in a seamless fashion. In fact, the Full Self-Driving suite was geared toward alleviating the need to manually drive vehicles.

This was for everyone, including the disabled, who are widely reliant on ride-sharing platforms, family members, and medical shuttles for transportation of any kind. Cybercab aims to change that, and Tesla evidently put a focus on those riders while developing the vehicle, evident in a small but significant feature revealed during its appearance in the Nation’s Capital.

Tesla Cybercab display highlights interior wizardry in the small two-seater

Tesla has implemented Braille within the Cybercab to make it easier for blind passengers to utilize the vehicle. On both the ‘Stop/Hazard Lights’ button and the Door Releases, Tesla has placed Braille so that blind passengers can navigate their way through the vehicle:

The hazard lights button will be used as an emergency stop. Smart pic.twitter.com/vkYBioqmKm

— Whole Mars Catalog (@wholemars) March 10, 2026

We have braille on the interior door releases as well

— Eric (@EricETesla) March 11, 2026

This is a great addition to the Cybercab, especially as Full Self-Driving has been partially pointed at as a solution for those with disabilities that would keep them from driving themselves from place to place.

It truly is a great addition and just another way that Tesla is showing they are making this massive product inclusive for everyone out there, including those who have not been able to drive due to not having vision.

The Cybercab is set to enter mass production sometime in April, and it will be responsible for launching Tesla’s massive plans for an autonomous ride-sharing program.