News

SpaceX’s next Falcon 9 launch delayed until November as lull drags on

For unknown reasons, SpaceX’s next Falcon 9 rocket launch has slipped from October to November, extending an already record-breaking lull in commercial US launch activity.

Depending on when SpaceX finally returns to flight, the company could have easily spent more than a quarter of 2019 between launches.

On August 7th, SpaceX successfully completed its most recent launch – orbiting Spacecom’s AMOS-17 communications satellite – and the company’s tenth orbital launch of 2019. Aside from two spectacular back-to-back Falcon Heavy launches in April and June and SpaceX’s first dedicated Starlink launch in May, 2019 has be a relatively normal year for SpaceX’s commercial launch business.

Shifting satellite sands

A comment made in September by SpaceX COO and President Gwynne Shotwell was nevertheless spot-on – 2019 has been a bit quieter than 2017 and 2018 and a large chunk of that slowdown can be reportedly explained by the lack of customer readiness. The satellites SpaceX’s paying customers have contracted launches for simply aren’t ready for flight.

In short, after finding its stride over the last two and a half years, SpaceX’s orbital launch capacity has grown to the point that it’s nearly outpacing the world’s commercial satellite manufacturing capabilities: SpaceX can launch them faster than the established industry can build them.

Although SpaceX’s unexpected 2019 launch lull is likely more of a perfect storm and coincidence than anything, it may still be a sign of things to come in the next decade and beyond. Annual orders for large geostationary communications satellites – representing a substantial share of the global launch market – reached their lowest levels ever in 2017 and 2018, a trend that appears likely to continue almost indefinitely.

Those often massive satellites tend to cost nine figures ($100M+), weigh at least several metric tons, and are designed with a failure-is-not-an-option attitude that has inflated their complexity and price tags to dysfunctional levels.

The Small-ening

SpaceX is undeniably aware of this trend, caused in large part by the growing commercial aversion (at least for new entrants) of putting all one’s eggs in an incredibly large and expensive satellite basket. Smaller satellites – be it in low Earth orbit, geostationary orbits, or even interplanetary space – are now largely viewed as the way forward for companies interested in commercializing spaceflight. Large spacecraft certainly still have their place and many industry stalwarts are extremely reluctant to part ways with the established standard of big communications satellites, but small is almost unequivocally the future.

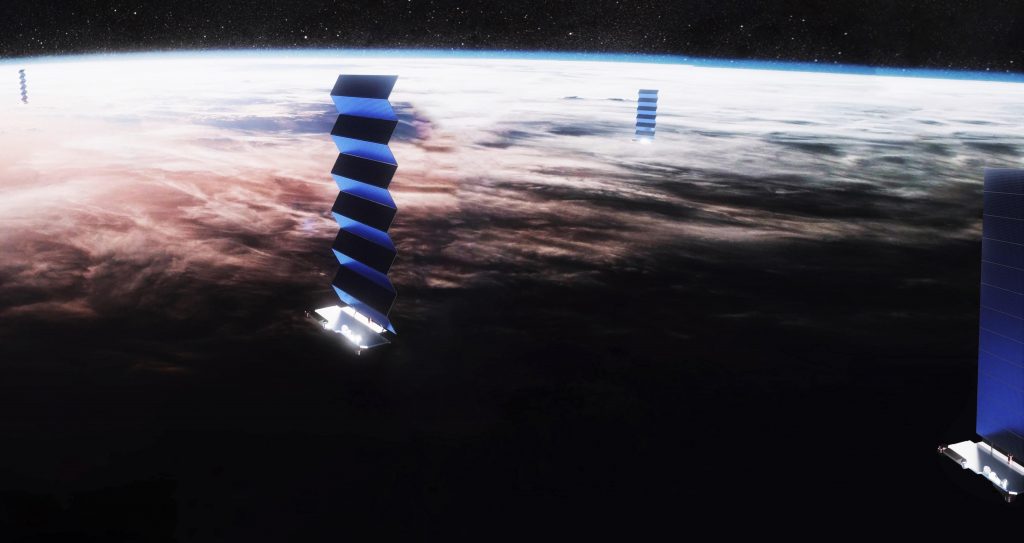

SpaceX is clearly onboard and has become the only launch services company in history to pursue plans to build, launch, and operate its own satellite constellation, known as Starlink. In a beta test at an unprecedented scale, SpaceX launched its first 60 Starlink satellite prototypes in May and has since been working to finalize designs and aggressively ramp up production.

SpaceX’s current plans for Starlink involve a constellation of nearly 12,000 satellites, potentially growing to 40,000+ well down the road. SpaceX much launch approximately half of those satellites by November 2023 and all of them by November 2027, a feat that will require the company to build and launch spacecraft at a rate unprecedented in the history of commercial space.

Shotwell indicated at the same September 2019 conference that SpaceX’s goal was to launch as many Starlink missions as possible while attempting to avoid disrupting the schedules of its commercial launch customers. In fact, the launch expected to end SpaceX’s 2019 launch lull was and still is a Starlink mission, the first flight of 60 finalized ‘v1.0’ satellites.

For unknown reasons probably related SpaceX’s relatively recent entrance into satellite manufacturing, that ‘Starlink-1’ launch (and 1-3 more expected to occur in quick succession) has slipped from a relatively firm October 17th planning date to late-October, and now has a tentative launch target sometime in November. Pending mission success, a second launch (‘Starlink-2’) could follow as early as November or December, while SpaceX also plans to launch Crew Dragon’s In-Flight Abort (IFA) as early as late-November, Cargo Dragon’s CRS-19 mission NET December 4th, and the Kacific-1 communications satellite in mid-December.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

News

Lucid unveils Lunar Robotaxi in bid to challenge Tesla’s Cybercab in the autonomous ride hailing race

Lucid’s Lunar robotaxi is gunning for Tesla’s Cybercab in the autonomous ride hailing race

![Lucid Lunar robotaxi concept [Credit: Rendering by TESLARATI]](https://www.teslarati.com/wp-content/uploads/2026/03/lucid-lunar-robotaxi-concept-teslarati-rendering.jpg)

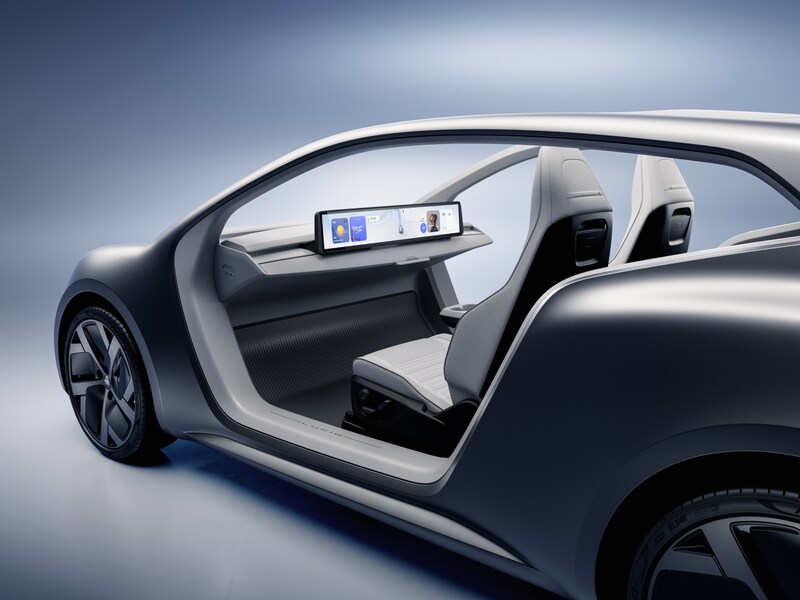

Lucid Group pulled back the curtain on its purpose-built autonomous robotaxi platform dubbed the Lunar Concept. Announced at its New York investor day event, Lunar is arguably the company’s most ambitious concept yet, and a direct line of sight toward the autonomous ride haling market that Tesla looks to control.

At Lucid Investor Day 2026, the company introduced Lunar, a purpose-built robotaxi concept based on the Midsize platform.

A comparison to Tesla’s Cybercab is unavoidable. The concept of a Tesla robotaxi was first introduced by Elon Musk back in April 2019 during an event dubbed “Autonomy Day,” where he envisioned a network of self-driving Tesla vehicles transporting passengers while not in use by their owners. That vision took another major step in October 2024 when, Musk unveiled the Cybercab at the Tesla “We, Robot” event held at Warner Bros. Studios in Burbank, California, where 20 concept Cybercabs autonomously drove around the studio lot giving rides to attendees.

Fast forward to today, and Tesla’s ambitions are finally materializing, but not without friction. As we recently reported, the Cybercab is being spotted with increasing frequency on public roads and across the grounds of Gigafactory Texas, suggesting that the company’s road testing and validation program is ramping meaningfully ahead of mass production. Tesla already operates a small scale robotaxi service in Austin using supervised Model Ys, but the Cybercab is designed from the ground up for high-volume, low-cost production, with Musk stating an eventual goal of producing one vehicle every 10 seconds.

At Lucid Investor Day 2026, the company introduced Lunar, a purpose-built robotaxi concept based on the Midsize platform.

Into this landscape steps Lucid’s Lunar. Built on the company’s all-new Midsize EV platform, which will also underpin consumer SUVs starting below $50,000. The Lunar mirrors the Cybercab’s core philosophy of having two seats, no driver controls, and a focus on fleet economics. The platform introduces Lucid’s redesigned Atlas electric drive unit, engineered to be smaller, lighter, and cheaper to manufacture at scale.

Unlike Tesla’s strategy of building its own ride hailing network from scratch, Lucid is partnering with Uber. The companies are said to be in advanced discussions to deploy Midsize platform vehicles at large scale, with Uber CEO Dara Khosrowshahi publicly backing Lucid’s engineering credentials and autonomous-ready architecture.

In the investor day event, Lucid also outlined a recurring software revenue model, with an in-vehicle AI assistant and monthly autonomous driving subscriptions priced between $69 and $199. This can be seen as a nod to the software revenue stream that Tesla has long championed with its Full Self-Driving subscription.

Tesla’s Cybercab is targeting a price point below $30k and with operating costs as low as 20 cents per mile. But with regulatory hurdles still ahead, the window for competition is open. Lucid’s Lunar may not have a launch date yet, but it arrives at a pivotal moment, and when the robotaxi race is no longer viewed as hypothetical. Rather, every serious EV player needs to come to bat on the same plate that Tesla has had countless practice swings on over the last seven years.

Elon Musk

Brazil Supreme Court orders Elon Musk and X investigation closed

The decision was issued by Supreme Court Justice Alexandre de Moraes following a recommendation from Brazil’s Prosecutor-General Paulo Gonet.

Brazil’s Supreme Federal Court has ordered the closure of an investigation involving Elon Musk and social media platform X. The inquiry had been pending for about two years and examined whether the platform was used to coordinate attacks against members of the judiciary.

The decision was issued by Supreme Court Justice Alexandre de Moraes following a recommendation from Brazil’s Prosecutor-General Paulo Gonet.

According to a report from Agencia Brasil, the investigation conducted by the Federal Police did not find evidence that X deliberately attempted to attack the judiciary or circumvent court orders.

Prosecutor-General Paulo Gonet concluded that the irregularities identified during the probe did not indicate fraudulent intent.

Justice Moraes accepted the prosecutor’s recommendation and ruled that the investigation should be closed. Under the ruling, the case will remain closed unless new evidence emerges.

The inquiry stemmed from concerns that content on X may have enabled online attacks against Supreme Court justices or violated rulings requiring the suspension of certain accounts under investigation.

Justice Moraes had previously taken several enforcement actions related to the platform during the broader dispute involving social media regulation in Brazil.

These included ordering a nationwide block of the platform, freezing Starlink accounts, and imposing fines on X totaling about $5.2 million. Authorities also froze financial assets linked to X and SpaceX through Starlink to collect unpaid penalties and seized roughly $3.3 million from the companies’ accounts.

Moraes also imposed daily fines of up to R$5 million, about $920,000, for alleged evasion of the X ban and established penalties of R$50,000 per day for VPN users who attempted to bypass the restriction.

Brazil remains an important market for X, with roughly 17 million users, making it one of the platform’s larger user bases globally.

The country is also a major market for Starlink, SpaceX’s satellite internet service, which has surpassed one million subscribers in Brazil.

Elon Musk

FCC chair criticizes Amazon over opposition to SpaceX satellite plan

Carr made the remarks in a post on social media platform X.

U.S. Federal Communications Commission (FCC) Chairman Brendan Carr criticized Amazon after the company opposed SpaceX’s proposal to launch a large satellite constellation that could function as an orbital data center network.

Carr made the remarks in a post on social media platform X.

Amazon recently urged the FCC to reject SpaceX’s application to deploy a constellation of up to 1 million low Earth orbit satellites that could serve as artificial intelligence data centers in space.

The company described the proposal as a “lofty ambition rather than a real plan,” arguing that SpaceX had not provided sufficient details about how the system would operate.

Carr responded by pointing to Amazon’s own satellite deployment progress.

“Amazon should focus on the fact that it will fall roughly 1,000 satellites short of meeting its upcoming deployment milestone, rather than spending their time and resources filing petitions against companies that are putting thousands of satellites in orbit,” Carr wrote on X.

Amazon has declined to comment on the statement.

Amazon has been working to deploy its Project Kuiper satellite network, which is intended to compete with SpaceX’s Starlink service. The company has invested more than $10 billion in the program and has launched more than 200 satellites since April of last year.

Amazon has also asked the FCC for a 24-month extension, until July 2028, to meet a requirement to deploy roughly 1,600 satellites by July 2026, as noted in a CNBC report.

SpaceX’s Starlink network currently has nearly 10,000 satellites in orbit and serves roughly 10 million customers. The FCC has also authorized SpaceX to deploy 7,500 additional satellites as the company continues expanding its global satellite internet network.

![Lucid Lunar robotaxi concept [Credit: Rendering by TESLARATI]](https://www.teslarati.com/wp-content/uploads/2026/03/lucid-lunar-robotaxi-concept-teslarati-rendering-80x80.jpg)