News

ViaSat asks FCC to halt SpaceX Starlink launches because it can’t compete

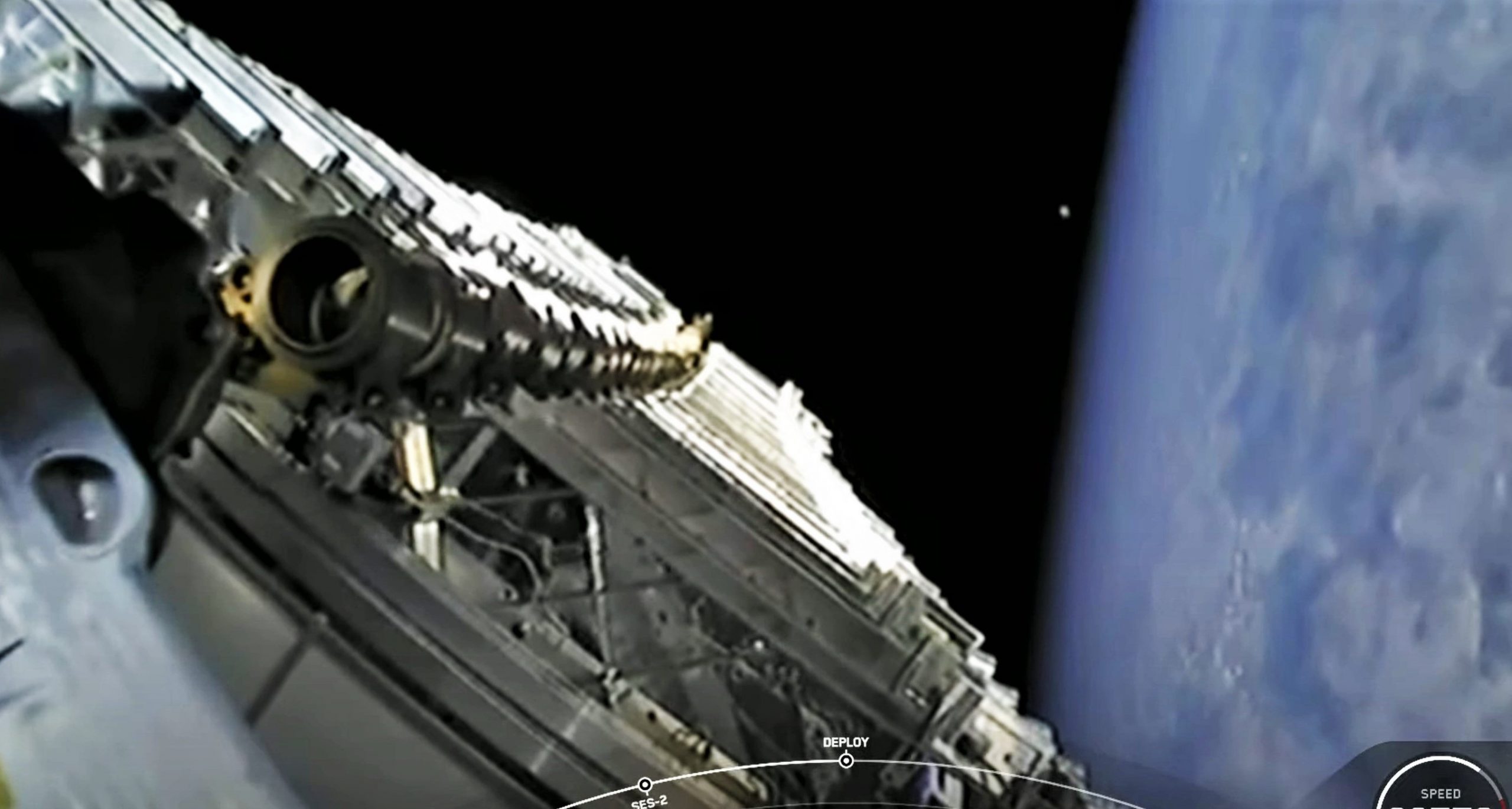

Under the hollow pretense of concern for the environment, Starlink satellite internet competitor ViaSat has asked the Federal Communication Commission (FCC) to force SpaceX to stop Starlink launches and threatened to take the matter to court if it doesn’t get its way.

A long-time satellite internet provider notorious for offering expensive, mediocre service with strict bandwidth restrictions, ViaSat has also been engaged in a years-long attempt to disrupt, slow down, and even kill SpaceX’s Starlink constellation by any means necessary. That includes fabricating nonsensical protests, petitioning the FCC dozens of times, and – most recently – threatening to sue the agency and federal government as the company becomes increasingly desperate.

The reason is simple: even compared to SpaceX’s finicky, often-unreliable Starlink Beta service, ViaSat’s satellite internet is almost insultingly bad. With a focus on serving the underserved and unserved, SpaceX’s Starlink beta users – many of which were already relying on ViaSat or HughesNet internet – have overwhelmingly described the differences as night and day.

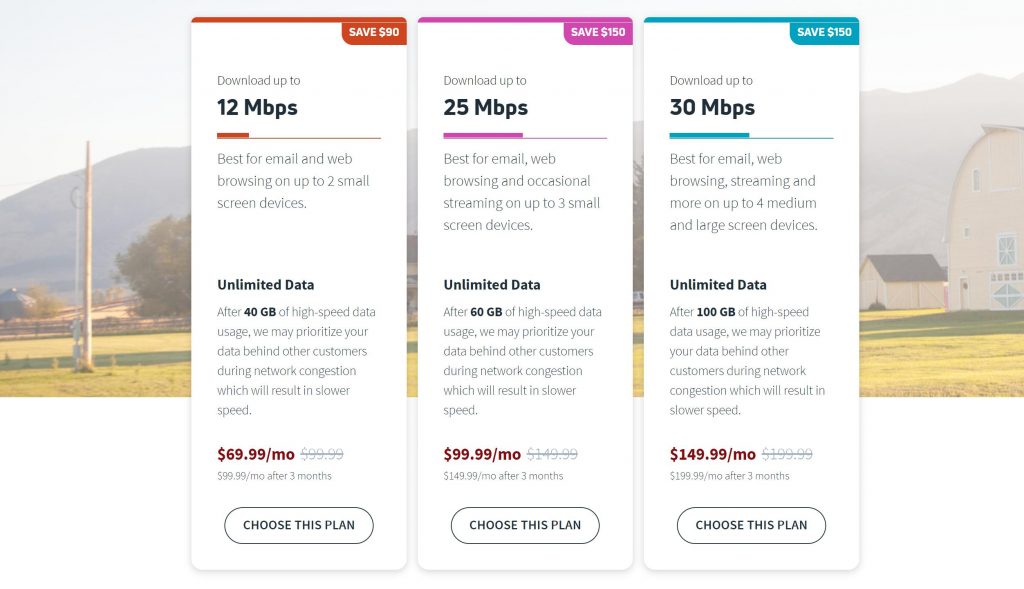

In simple terms, if given the option, it’s extraordinarily unlikely that a single public ViaSat subscriber would choose the company’s internet over SpaceX’s Starlink. While Starlink currently requires subscribers to pay a substantial upfront cost – ~$500 – for the dish used to access the satellite network, ViaSat internet costs at least as much per month. Currently, new subscribers would pay a bare minimum of ~$113 per month for speeds up to 12 Mbps (akin to DSL) and an insultingly small 40GB data cap. For a 60GB cap and 25 Mbps, subscribers will pay more than $160 per month after a three-month promotion.

With a fixed cost of $99 per month, truly unlimited data, and uncapped speeds that vary from 50 to 200+ Mbps, any ViaSat “silver” subscriber would receive far better service by switching to Starlink and save enough money to pay off the $500 dish in less than a year. While Starlink is currently in beta and often unstable and unreliable as a result, users continue to notice major improvements in speeds and uptime as SpaceX works to continuously improve the network.

In the US, ViaSat has less than 600,000 household internet subscribers, all of which are almost certainly liable to switch to better alternatives. Short of local and state governments actually standing up for their citizens and forcing monopolistic ground-based internet service providers (ISPs) to fairly serve rural customers, Starlink is currently the only real hope for rural Americans who are tired of settling for second-class internet service.

ViaSat began its latest push to hamstring a looming competitor with regulation when it asked the FCC to perform an environmental review of Starlink’s impact last December. The FCC unsurprisingly failed to heed the company’s spurious, nakedly self-serving demands. Since then, the FCC approved a long-standing SpaceX request to modify its Starlink constellation by lowering thousands of satellites, thus improving service and drastically decreasing the debris risk posed by satellite failures, which would take a few years to reenter from 550 kilometers instead of decades for spacecraft orbiting at 1000+ kilometers.

To a very small extent, there are some real questions worth asking about the environmental impact of megaconstellations. A few recent studies have begun to do so, though it’s such a new field of inquiry that virtually nothing is known with any confidence. However, ViaSat is transparently disinterested in the actual environmental impact given that its petition for the FCC to immediately halt all Starlink launches focuses on Starlink alone and not competitor OneWeb – also in the process of launching satellites – or prospective constellations being developed by Telesat and Amazon.

What ViaSat actually wants is for the FCC to catastrophically hamstring Starlink, thus saving the profit-focused company from having to actually work to compete with an internet service provider that is all but guaranteed to capture most of its subscribers on an even playing field. Incredibly, ViaSat actually removes its greenwashing mask in the very same FCC request [PDF], stating that it “will suffer competitive injury” if Starlink is allowed to “compete directly with Viasat in the market for satellite broadband services.”

News

Tesla opens first public Tesla Semi Megacharger site in Los Angeles

The development was highlighted in a post on social media platform X by the official Tesla Semi account.

Tesla has opened its first public Tesla Semi Megacharger site in Los Angeles. The station reportedly offers up to 750 kW charging speeds and is open to Tesla Semi customers.

The development was highlighted in a post on social media platform X by the official Tesla Semi account.

Tesla Semi Megachargers

The Los Angeles site seems to be the first public Tesla Semi Megacharger that is not located at a Tesla factory. It is also the third Megacharger site currently visible on Tesla’s map.

The Megacharger system is designed specifically for the Tesla Semi and is capable of delivering extremely high charging speeds to support long-haul trucking operations. Infrastructure such as this will likely play a key role in making the Semi competitive with diesel-powered transport trucks.

Tesla’s progress with the Semi has also drawn attention in recent days after Elon Musk biographer Ashlee Vance shared photos from inside the Tesla Semi factory near Giga Nevada. The images suggested that preparations for higher production volumes may be underway, hinting that a broader ramp of the Tesla Semi’s production indeed be approaching.

New deployment strategies

Tesla has continued expanding its broader charging network through several new strategies aimed at accelerating infrastructure deployment. One of these initiatives is the Supercharger for Business program, which allows third parties to purchase Tesla Supercharger equipment and deploy charging stations while still integrating with Tesla’s network.

The program recently marked a milestone in Alpharetta, Georgia, where the city deployed four 325 kW city-branded Superchargers near the Alpharetta Department of Public Safety on Old Milton Parkway. The chargers support the city’s Tesla Model Y police vehicles while also remaining accessible to the public.

As per a report from EVwire, the project was designed not only to support fleet charging but also to generate economic returns that could offset the city’s investment. Tesla’s Supercharger for Business program has already attracted several participants, including businesses and charging providers such as Suncoast Charging, Pie Safe bakery in Idaho, Francis Energy in Oklahoma, and Wawa convenience stores.

Elon Musk

The Boring Company’s Vegas Loop moves 82k riders during CONEXPO

The Loop’s feat was highlighted by The Boring Company in a post on its official account on social media platform X.

The Boring Company said its Vegas Loop system transported roughly 82,000 passengers during the recent CONEXPO-CON/AGG construction trade show in Las Vegas. The event was held at the Las Vegas Convention Center (LVCC) from March 3-7, 2026.

The Loop’s feat was highlighted by The Boring Company in a post on its official account on social media platform X.

CONEXPO-CON/AGG 2026

CONEXPO-CON/AGG is one of the largest construction trade shows in North America. This year’s event was quite impressive, attracting more than 140,000 construction professionals from 128 countries across the world.

Considering the number of this year’s attendees, the LVCC Loop seemed to have proven itself to be a very useful transportation solution. A video posted by The Boring Company on its official X account featured attendees expressing their enthusiasm for the underground transport system, with some stating that they would like to see similar tunnels across Las Vegas.

The LVCC Loop is only part of the greater Vegas Loop network, which is actively under construction.

New Vegas Loop extensions

One of the newest additions is a station at the Fontainebleau Las Vegas resort on the Strip. The station is located on level V-1 of the resort’s south valet area, according to a report from the Las Vegas Review-Journal. From the Fontainebleau, passengers can travel free of charge to stations serving the Las Vegas Convention Center, as well as to Loop stations at Encore and Westgate.

The system is also expanding beyond the Strip corridor. In December, The Boring Company began offering Vegas Loop rides to and from Harry Reid International Airport. These trips include a limited above-ground segment after receiving approval from the Nevada Transportation Authority to allow surface street travel tied to Loop operations.

The Boring Company President Steve Davis previously told the Review-Journal that the University Center Loop segment, which is currently under construction, is expected to open in the first quarter of 2026. The extension would allow Loop vehicles to travel beneath Paradise Road between the convention center and the airport, with a planned station just north of Tropicana Avenue.

News

Tesla preps to build its most massive Supercharger yet: 400+ V4 stalls

The project will be an expansion of the current Eddie World Supercharger in Yermo, California, and will take place in several stages.

Tesla is preparing to build its most massive Supercharger yet, as it recently submitted plans for an over 400-stall Supercharging station in California, which would dwarf its massive 168-stall location in Lost Hills, California.

The project will be an expansion of the current Eddie World Supercharger in Yermo, California, and will take place in several stages.

The expansion, adjacent to the existing Eddie World Supercharger, which is currently comprised of 22 older V2 and V3 stalls limited to 150 kW, unfolds across six phases.

Construction on Phase 1 begins later this year with 72 V4 stalls. Subsequent stages will progressively add hundreds more, culminating in over 400 next-generation chargers. Site plans label expansive parking arrays across Phases 1–5 along Calico Boulevard, with Phase 6 design still to be determined.

Tesla is planning an absolutely massive Supercharger expansion in Yermo, California!!

Over the course of 6 phases, Tesla is set to add over 400 V4 stalls in a commercial development known as Eddie World 2.

The first phase, which should begin construction sometime this year,… pic.twitter.com/ks5Y5dE8lR

— MarcoRP (@MarcoRPi1) March 6, 2026

The project was first flagged by MarcoRP, a notable Tesla Supercharger watcher.

Strategically located midway on I-15 between Los Angeles and Las Vegas, the station targets heavy EV traffic on this high-demand corridor.

The surrounding 20-mile stretch already hosts over 200 high-power stalls (including 40 at 250 kW, 120 at 325 kW, and more), plus 96 in nearby Baker—yet bottlenecks persist during peak travel.

In scale, it eclipses all existing Tesla Superchargers. The current record holder, the solar- and Megapack-powered “Project Oasis” in Lost Hills, California, offers 164 stalls. Barstow’s former leader had 120. Eddie World 2 will be more than double that size, cementing Tesla’s dominance in ultra-high-capacity charging.

Tesla finishes its biggest Supercharger ever with 168 stalls

Development blends charging with convenience. Architectural drawings show integrated retail: a 10,100 square foot Cracker Barrel, a 4,300 square foot McDonald’s, a 3,800 square foot convenience store, additional restaurants, drive-thrus, outdoor dining, and lease space.

EV-centric features include pull-through bays for Cybertrucks and trailers, ensuring accessibility for larger vehicles and future Semi trucks.