News

Tesla, Elon Musk seek dismissal in lawsuit alleging fraud and defamation

Tesla and Elon Musk, jointly named as Defendants with Omar Qazi of the former @tesla_truth Twitter account, have filed a Motion to Dismiss an ongoing lawsuit brought by Plainsite.com owner Aaron Greenspan.

Greenspan, a Tesla short seller often associated with the online “$TSLAQ” community, is seeking an injunction and damages from alleged libelous activity by both Qazi and Musk. He also claims fraudulent communications by Musk and Tesla executives have lead to inflated company stock prices, thereby injuring his financial portfolio via stock purchases made and sold based on those communications. Tesla’s and Musk’s motion for dismissal was made as a separate action from the allegations against Qazi.

The Complaint, initially filed May 20, 2020, and later amended on July 2, 2020, is being litigated in the US Northern District of California, San Francisco Division under docket number 3:20-cv-03426-JD. The Motion to Dismiss was filed on July 31, 2020.

“Plaintiff’s allegations against the Tesla Defendants are not new. Plaintiff has been making the

same unsubstantiated and incendiary accusations—on Twitter, in purported online exposés, and in public and private communications—for years. What is new is Plaintiff’s attempt to transform his conspiracy theories, baseless suspicions, and Internet “research” into a federal lawsuit,” Tesla’s Motion argues against Greenspan’s claims. “Also new is Plaintiff’s apparent view that people should not use hyperbolic language or return his insults on the Internet, and Plaintiff’s claim that Mr. Musk’s dismissive commentary to and about him somehow damaged his reputation.”

The Complaint partly seeks to hold Musk liable for several statements made by Qazi during publicly-aired disagreements with Greenspan, characterizing the CEO’s positive replies to some of Qazi’s online posts as part of a “tag team” effort to discredit him. However, Tesla argues that liability would require a formal agent-type relationship between Qazi and Musk to hold legal weight. “While the [First Amended Complaint] speculates about ties between Mr. Qazi and Mr. Musk, Plaintiff tacitly admits he is not aware of such a relationship, other than alleged interactions on Twitter and in the media,” the Motion argues. Greenspan also cites Qazi’s attendance at a private Tesla event as evidence of an implied connection or common purpose with Musk.

Regarding any defamation claims, substantiated by Greenspan using email replies from Musk as well as Twitter comments in reply to a published article wherein derogatory remarks were made about Greenspan, Tesla’s Motion argues such comments are constitutionally protected opinions. Of particular note in the Complaint’s allegations is a supportive email to Twitter CEO Jack Dorsey sent by Musk purportedly in support of restoring Qazi’s suspended accounts.

“Jack, what Omar is saying is accurate to the best of my knowledge. There has been an

orchestrated and sophisticated attempt to drive down Tesla stock through social media,

particularly Twitter,” Musk wrote.” This always increases around our earnings call, which is this

afternoon. Aaron Greenspan in particular has major issues. He’s the same nut but that claimed he was the founder of Facebook and sued Zuckerberg, among many other things. Never seen anything like it.”

In reference to this cited correspondence, Tesla argues, “As with his other statements, Mr. Musk’s reference to Plaintiff as a “nut but” with “major issues” is nonactionable opinion.”

Most of the all-electric carmaker’s reply in the Motion, though, was focused on a legal defense against the most prevalent claims the Tesla short seller community is most vocal about: The company’s stock prices are artificially inflated due to fraudulent communication regarding their activities.

“As numerous courts have recognized, however, short sellers like Plaintiff…[sell] short because he believes the price of a stock overestimates its true value…whereas the premise of the fraud-on-the-market presumption is that investors rely on the market to reflect a stock’s true value,” Tesla states in their dismissal petition. “Plaintiff does not and could not claim that he relied on any alleged false statements because he believed that Tesla was engaged in fraud during the entire time he was betting against the Tesla stock… Even if Plaintiff could invoke the fraud-on-the market presumption, it would be conclusively rebutted because the Plaintiff plainly…would have bought or sold the stock even had he been aware that the stock’s price was tainted by fraud.”

Ultimately, Greenspan is seeking a declaratory judgment holding Qazi in contempt of court, a permanent injunction preventing further libelous statements against Greenspan in any published medium (written or oral), damages from Defendants’ alleged fraudulent actions to be assessed at time of trial, statutory damages from copyright infringements (over personal photos used as described in the suit), and punitive damages for alleged law breaking. Tesla and Musk, for their part, are seeking to have the case dismissed permanently, i.e., “with prejudice.”

For the average Tesla fan, owner, or stock holder, lawsuits may seem like something to avoid at (nearly) all costs, but Musk does not give the impression he has the same hesitation. The eccentric CEO makes his opinion of short sellers like Greenspan known quite often, and he has even humorously merchandised his ongoing battle by selling bright red “Short Shorts” donning the Tesla logo on the company web store.

With Tesla stocks recently haven risen to a high of $1643 per share, the tensions between the camps will perhaps only continue to rise.

Tesla Motion to Dismiss, Aaron Greenspan by Teslarati on Scribd

Elon Musk

Tesla Supercharger Diner food menu gets a sneak peek as construction closes out

What are you ordering at the Tesla Diner?

The Tesla Supercharger Diner in Los Angeles is nearing completion as construction appears to be winding down significantly. However, the more minor details, such as what the company will serve at its 50s-style diner for food, are starting to be revealed.

Tesla’s Supercharger Diner is set to open soon, seven years after CEO Elon Musk first drafted the idea in a post on X in 2018. Musk has largely come through on most of what he envisioned for the project: the diner, the massive movie screens, and the intended vibe are all present, thanks to the aerial and ground footage shared on social media.

We already know the Diner will be open 24/7, based on decals placed on the front door of the restaurant that were shared earlier this week. We assume that Tesla Optimus will come into play for these long and uninterrupted hours.

The Tesla Diner is basically finished—here’s what it looks like

As far as the food, Tesla does have an email also printed on the front door of the Diner, but we did not receive any response back (yet) about what cuisine it will be offering. We figured it would be nothing fancy and it would be typical diner staples: burgers, fries, wings, milkshakes, etc.

According to pictures taken by @Tesla_lighting_, which were shared by Not a Tesla App, the food will be just that: quick and affordable meals that diners do well. It’s nothing crazy, just typical staples you’d find at any diner, just with a Tesla twist:

Tesla Diner food:

• Burgers

• Fries

• Chicken Wings

• Hot Dogs

• Hand-spun milkshakes

• And more https://t.co/kzFf20YZQq pic.twitter.com/aRv02TzouY— Sawyer Merritt (@SawyerMerritt) July 17, 2025

As the food menu is finalized, we will be sure to share any details Tesla provides, including a full list of what will be served and its prices.

Additionally, the entire property appears to be nearing its final construction stages, and it seems it may even be nearing completion. The movie screens are already up and showing videos of things like SpaceX launches.

There are many cars already using the Superchargers at the restaurant, and employees inside the facility look to be putting the finishing touches on the interior.

🚨 Boots on the ground at the Tesla Diner:

— TESLARATI (@Teslarati) July 17, 2025

It’s almost reminiscent of a Tesla version of a Buc-ee’s, a southern staple convenience store that offers much more than a traditional gas station. Of course, Tesla’s version is futuristic and more catered to the company’s image, but the idea is the same.

It’s a one-stop shop for anything you’d need to recharge as a Tesla owner. Los Angeles building permits have not yet revealed the date for the restaurant’s initial operation, but Tesla may have its eye on a target date that will likely be announced during next week’s Earnings Call.

News

Tesla’s longer Model Y did not scale back requests for this vehicle type from fans

Tesla fans are happy with the new Model Y, but they’re still vocal about the need for something else.

Tesla launched a slightly longer version of the Model Y all-electric crossover in China, and with it being extremely likely that the vehicle will make its way to other markets, including the United States, fans are still looking for something more.

The new Model Y L in China boasts a slightly larger wheelbase than its original version, giving slightly more interior room with a sixth seat, thanks to a third row.

Tesla exec hints at useful and potentially killer Model Y L feature

Tesla has said throughout the past year that it would focus on developing its affordable, compact models, which were set to begin production in the first half of the year. The company has not indicated whether it met that timeline or not, but many are hoping to see unveilings of those designs potentially during the Q3 earnings call.

However, the modifications to the Model Y, which have not yet been officially announced for any markets outside of China, still don’t seem to be what owners and fans are looking forward to. Instead, they are hoping for something larger.

A few months ago, I reported on the overall consensus within the Tesla community that the company needs a full-size SUV, minivan, or even a cargo van that would be ideal for camping or business use.

Tesla is missing one type of vehicle in its lineup and fans want it fast

That mentality still seems very present amongst fans and owners, who state that a full-size SUV with enough seating for a larger family, more capability in terms of cargo space for camping or business operation, and something to compete with gas cars like the Chevrolet Tahoe, Ford Expedition, or electric ones like the Volkswagen ID.BUZZ.

We asked the question on X, and Tesla fans were nearly unanimously in support of a larger SUV or minivan-type vehicle for the company’s lineup:

🚨 More and more people are *still* saying that, despite this new, longer Model Y, Tesla still needs a true three-row SUV

Do you agree? https://t.co/QmbRDcCE08 pic.twitter.com/p6m5zB4sDZ

— TESLARATI (@Teslarati) July 16, 2025

Here’s what some of the respondents said:

100% agree, we need a larger vehicle.

Our model Y is quickly getting too small for our family of 5 as the kids grow. A slightly longer Y with an extra seat is nice but it’s not enough if you’re looking to take it on road trips/vacations/ kids sports gear etc.

Unfortunately we…

— Anthony Hunter (@_LiarsDice_) July 17, 2025

Had to buy a Kia Carnival Hybrid because Tesla doesn’t have a true 3 row vehicle with proper space and respectable range. pic.twitter.com/pzwFyHU8Gi

— Neil, like the astronaut (@Neileeyo) July 17, 2025

Agreed! I’m not sure who created this but I liked it enough to save it. pic.twitter.com/Sof5nMehjS

— 🦉Wise Words of Wisdom – Inspirational Quotes (IQ) (@WiseWordsIQ) July 16, 2025

Tesla is certainly aware that many of its owners would like the company to develop something larger that competes with the large SUVs on the market.

However, it has not stated that anything like that is in the current plans for future vehicles, as it has made a concerted effort to develop Robotaxi alongside the affordable, compact models that it claims are in development.

It has already unveiled the Robovan, a people-mover that can seat up to 20 passengers in a lounge-like interior.

The Robovan will be completely driverless, so it’s unlikely we will see it before the release of a fully autonomous Full Self-Driving suite from Tesla.

Energy

Tesla launches first Virtual Power Plant in UK – get paid to use solar

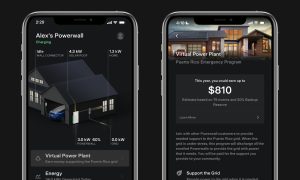

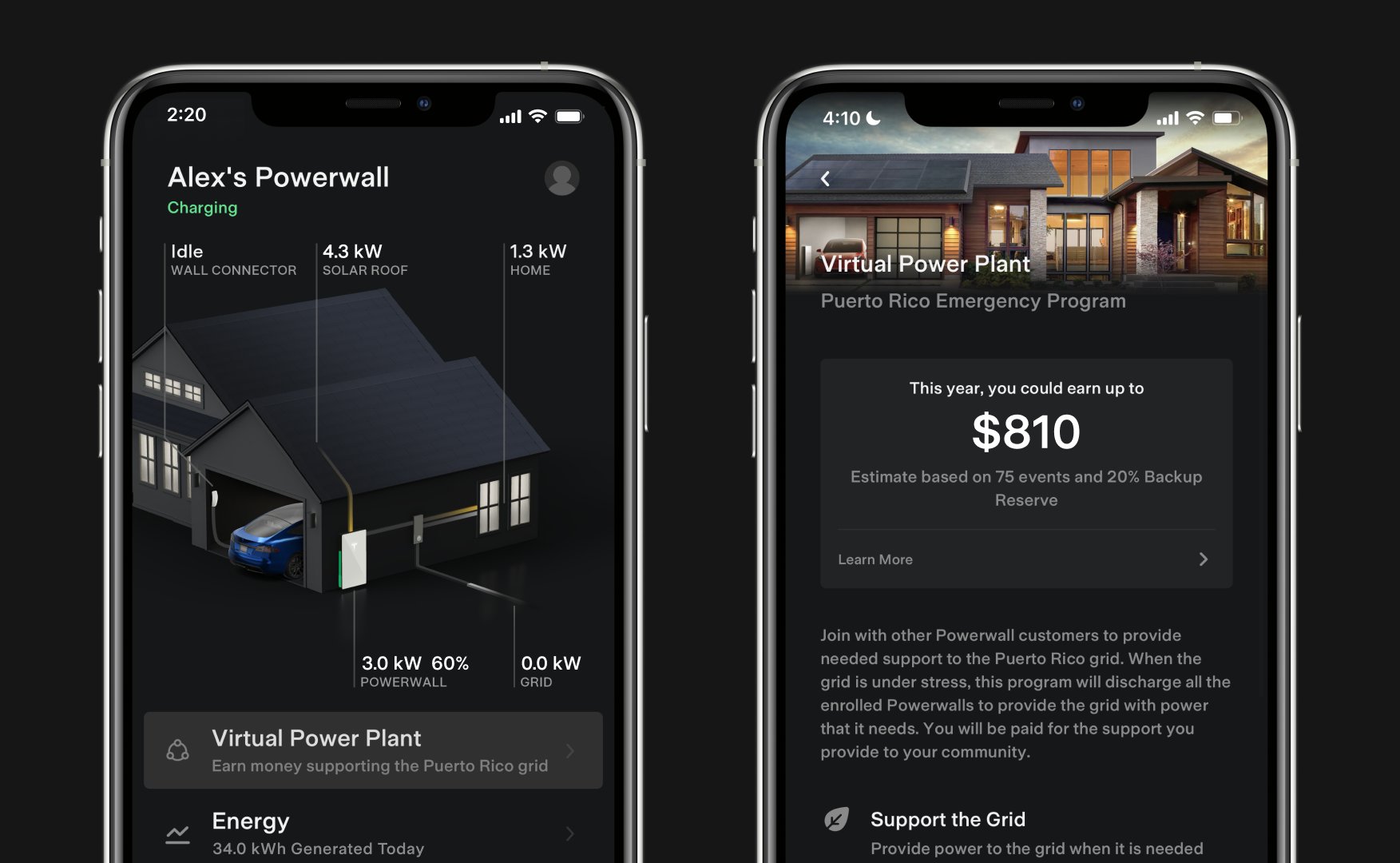

Tesla has launched its first-ever Virtual Power Plant program in the United Kingdom.

Tesla has launched its first-ever Virtual Power Plant program in the United Kingdom. This feature enables users of solar panels and energy storage systems to sell their excess energy back to the grid.

Tesla is utilizing Octopus Energy, a British renewable energy company that operates in multiple markets, including the UK, France, Germany, Italy, Spain, Australia, Japan, New Zealand, and the United States, as the provider for the VPP launch in the region.

The company states that those who enroll in the program can earn up to £300 per month.

Tesla has operated several VPP programs worldwide, most notably in California, Texas, Connecticut, and the U.S. territory of Puerto Rico. This is not the first time Tesla has operated a VPP outside the United States, as there are programs in Australia, Japan, and New Zealand.

This is its first in the UK:

Our first VPP in the UK

You can get paid to share your energy – store excess energy in your Powerwall & sell it back to the grid

You’re making £££ and the community is powered by clean energy

Win-win pic.twitter.com/evhMtJpgy1

— Tesla UK (@tesla_uk) July 17, 2025

Tesla is not the only company that is working with Octopus Energy in the UK for the VPP, as it joins SolarEdge, GivEnergy, and Enphase as other companies that utilize the Octopus platform for their project operations.

It has been six years since Tesla launched its first VPP, as it started its first in Australia back in 2019. In 2024, Tesla paid out over $10 million to those participating in the program.

Participating in the VPP program that Tesla offers not only provides enrolled individuals with the opportunity to earn money, but it also contributes to grid stabilization by supporting local energy grids.

-

Elon Musk1 day ago

Elon Musk1 day agoWaymo responds to Tesla’s Robotaxi expansion in Austin with bold statement

-

News1 day ago

News1 day agoTesla exec hints at useful and potentially killer Model Y L feature

-

Elon Musk2 days ago

Elon Musk2 days agoElon Musk reveals SpaceX’s target for Starship’s 10th launch

-

Elon Musk3 days ago

Elon Musk3 days agoTesla ups Robotaxi fare price to another comical figure with service area expansion

-

News1 day ago

News1 day agoTesla’s longer Model Y did not scale back requests for this vehicle type from fans

-

News1 day ago

News1 day ago“Worthy of respect:” Six-seat Model Y L acknowledged by Tesla China’s biggest rivals

-

News2 days ago

News2 days agoFirst glimpse of Tesla Model Y with six seats and extended wheelbase

-

Elon Musk2 days ago

Elon Musk2 days agoElon Musk confirms Tesla is already rolling out a new feature for in-car Grok