Energy

‘Buy Tesla’: Goldman Sachs defines investments as the Age of Oil closes

Goldman Sachs is preparing for the lapse of the Age of Oil, predicting big gains for the companies that continue to help expand the footprint of sustainable energy. As the world begins to move away from petrol-based fuels and favor renewable sources of energy, Goldman Sachs is allowing investors to look at some of the companies that are leading the charge in specific sectors, especially automotive, where Tesla has established itself as one of the more favorable investment opportunities for those who want to support electrification in ways outside of simply purchasing products. However, Tesla isn’t the only car company that is listed, and cars are not the only topic that Goldman analysts are bullish on as the Age of Oil begins its imminent demise.

“We remain above consensus on oil demand forecasts through 2025, and we still do not forecast peak oil demand this decade, though we expect oil demand growth beyond 2025 to be anemic, mainly due to electrification,” a team of Goldman Sachs analysts wrote in the sixth installment of the Future of Energy Demand Series. “We now expect transport oil to peak in 2026, but we see robust growth for petrochemicals and jet fuel offsetting declines in transport demand in 2025-2030.”

Goldman Sachs on The Future of Energy Demand ??

“Buy Tesla”$TSLA pic.twitter.com/H8lXZGwnyV

— David Tayar (@davidtayar5) April 14, 2021

Likely expected, commercial travel is going to be the largest hoop to jump through in the fight to decrease the usage of fossil fuels. Global logistics, travel, and business all currently depend on fossil fuels to keep things moving globally. Still, some companies are attempting to reduce their carbon footprint by experimenting with small-scale projects. UPS, for example, recently purchased all-electric Vertical Takeoff and Landing (eVTOL) drones that can help with deliveries. The BETA aircraft that UPS is experimenting with is capable of carrying 1,400 pounds of cargo with 250 miles of range. “This is all about innovation with a focus on returns for our business, our customers, and the environment,” Juan Perez, UPS Chief Information and Engineering Officer said.

The biggest disruptions for the global oil and petrol market come where electrification is becoming a more favorable option. The largest disruptions occur in the passenger vehicle market, where companies like Tesla and Volkswagen are Goldman’s biggest picks. The analysts see growing profit pools for the EV value change in these companies over the long term, especially as they are currently the two most-talked-about forces in the global electric car sector. Tesla’s Model 3 and Model Y are continuing to be two of the world’s most popular electric vehicles, while Volkswagen is rolling out its ID. family of vehicles that have been highly effective for many, despite some complaints about software.

Interestingly, Tesla’s energy side is still a relatively unmentioned player in the solar sector. It is rarely mentioned when analysts break down price targets for the company, even though its solar, battery, and energy storage products are among the most effective and affordable in the United States. Chamath Palihapitiya says some of the biggest gains in Tesla’s stock could come through its energy business.

Tesla Energy gets optimistic outlook from board member Kimbal Musk

“There are trillions of dollars of bonds, of CAPEX, of value sitting inside the energy generation infrastructure of the world, that is going to go upside down. When that goes pear-shaped, Tesla will double and triple again,” Palihapitiya said in January.

Nevertheless, the Age of Oil is slowly but surely coming to a close. The companies that continue to push their sustainable forms of energy are expected to come out as big winners, leaving fossil fuel and petrol-dependent companies on the backburner for the next several decades.

Disclosure: Joey Klender is a TSLA Shareholder.

Energy

Tesla Megapack Megafactory in Texas advances with major property sale

Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet.

Tesla’s planned Megapack factory in Brookshire, Texas has taken a significant step forward, as two massive industrial buildings fully leased to the company were sold to an institutional investor.

In a press release, Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet. The properties are 100% leased to Tesla under a long-term agreement and were acquired by BGO on behalf of an institutional investor.

The two facilities, located at 100 Empire Boulevard in Brookshire, Texas, will serve as Tesla’s new Megafactory dedicated to manufacturing Megapack battery systems.

According to local filings previously reported, Tesla plans to invest nearly $200 million into the site. The investment includes approximately $44 million in facility upgrades such as electrical, utility, and HVAC improvements, along with roughly $150 million in manufacturing equipment.

Building 9, spanning roughly 1 million square feet, will function as the primary manufacturing floor where Megapacks are assembled. Building 10, covering approximately 600,000 square feet, will be dedicated to warehousing and logistics operations, supporting storage and distribution of completed battery systems.

Waller County Commissioners have approved a 10-year tax abatement agreement with Tesla, offering up to a 60% property-tax reduction if the company meets hiring and investment targets. Tesla has committed to employing at least 375 people by the end of 2026, increasing to 1,500 by the end of 2028, as noted in an Austin County News Online report.

The Brookshire Megafactory will complement Tesla’s Lathrop Megafactory in California and expand U.S. production capacity for the utility-scale energy storage unit. Megapacks are designed to support grid stabilization and renewable-energy integration, a segment that has become one of Tesla’s fastest-growing businesses.

Energy

Tesla meets Giga New York’s Buffalo job target amid political pressures

Giga New York reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease.

Tesla has surpassed its job commitments at Giga New York in Buffalo, easing pressure from lawmakers who threatened the company with fines, subsidy clawbacks, and dealership license revocations last year.

The company reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease at the state-built facility.

As per an employment report reviewed by local media, Tesla employed 2,399 full-time workers at Gigafactory New York and 1,060 additional employees across the state at the end of 2025. Part-time roles pushed the total headcount of Tesla’s New York staff above the 3,460-job target.

The gains stemmed in part from a new Long Island service center, a Buffalo warehouse, and additional showrooms in White Plains and Staten Island. Tesla also said it has invested $350 million in supercomputing infrastructure at the site and has begun manufacturing solar panels.

Empire State Development CEO Hope Knight said the agency was “very happy” with Giga New York’s progress, as noted in a WXXI report. The current lease runs through 2029, and negotiations over updated terms have included potential adjustments to job requirements and future rent payments.

Some lawmakers remain skeptical, however. Assemblymember Pat Burke questioned whether the reported job figures have been fully verified. State Sen. Patricia Fahy has also continued to sponsor legislation that would revoke Tesla’s company-owned dealership licenses in New York. John Kaehny of Reinvent Albany has argued that the project has not delivered the manufacturing impact originally promised as well.

Knight, for her part, maintained that Empire State Development has been making the best of a difficult situation.

“(Empire State Development) has tried to make the best of a very difficult situation. There hasn’t been another use that has come forward that would replace this one, and so to the extent that we’re in this place, the fact that 2,000 families at (Giga New York) are being supported through the activity of this employer. It’s the best that we can have happen,” the CEO noted.

Energy

Tesla launches Cybertruck vehicle-to-grid program in Texas

The initiative was announced by the official Tesla Energy account on social media platform X.

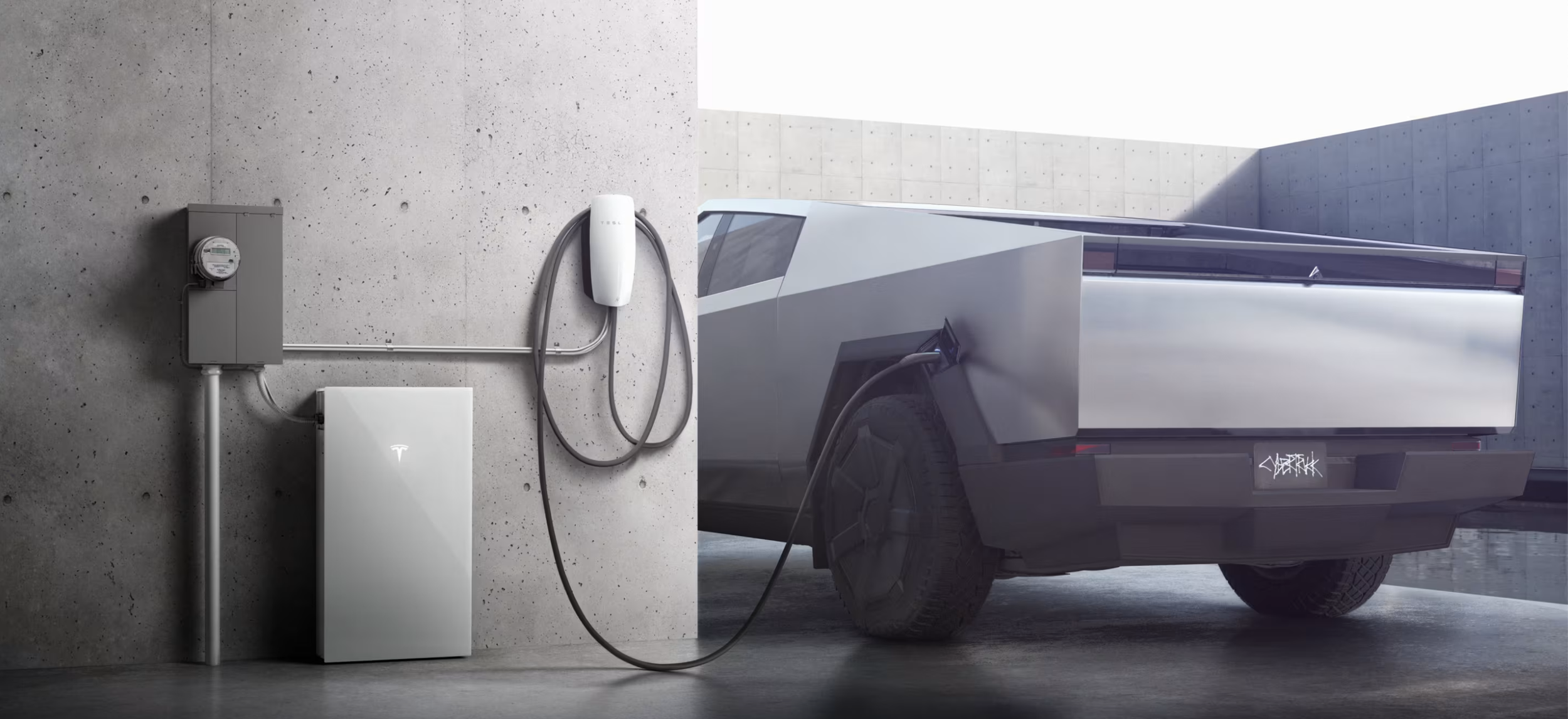

Tesla has launched a vehicle-to-grid (V2G) program in Texas, allowing eligible Cybertruck owners to send energy back to the grid during high-demand events and receive compensation on their utility bills.

The initiative, dubbed Powershare Grid Support, was announced by the official Tesla Energy account on social media platform X.

Texas’ Cybertruck V2G program

In its post on X, Tesla Energy confirmed that vehicle-to-grid functionality is “coming soon,” starting with select Texas markets. Under the new Powershare Grid Support program, owners of the Cybertruck equipped with Powershare home backup hardware can opt in through the Tesla app and participate in short-notice grid stress events.

During these events, the Cybertruck automatically discharges excess energy back to the grid, supporting local utilities such as CenterPoint Energy and Oncor. In return, participants receive compensation in the form of bill credits. Tesla noted that the program is currently invitation-only as part of an early adopter rollout.

The launch builds on the Cybertruck’s existing Powershare capability, which allows the vehicle to provide up to 11.5 kW of power for home backup. Tesla added that the program is expected to expand to California next, with eligibility tied to utilities such as PG&E, SCE, and SDG&E.

Powershare Grid Support

To participate in Texas, Cybertruck owners must live in areas served by CenterPoint Energy or Oncor, have Powershare equipment installed, enroll in the Tesla Electric Drive plan, and opt in through the Tesla app. Once enrolled, vehicles would be able to contribute power during high-demand events, helping stabilize the grid.

Tesla noted that events may occur with little notice, so participants are encouraged to keep their Cybertrucks plugged in when at home and to manage their discharge limits based on personal needs. Compensation varies depending on the electricity plan, similar to how Powerwall owners in some regions have earned substantial credits by participating in Virtual Power Plant (VPP) programs.