News

Tesla Model 3 gets penalized in Europe despite top scores in vehicle assistance and safety

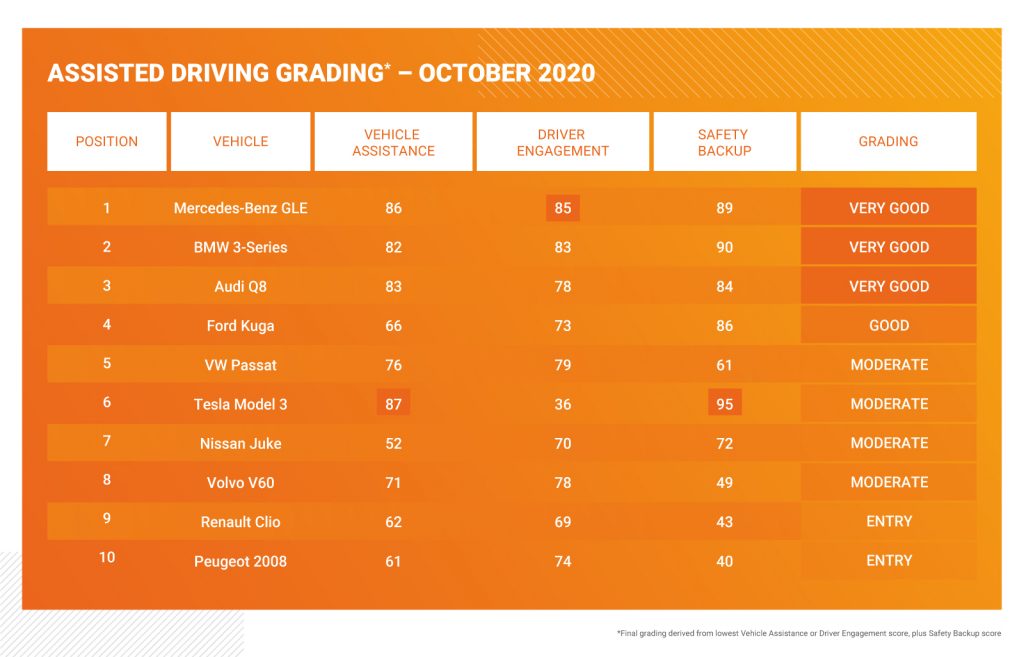

In collaboration with Thatcham Research, the Euro NCAP has launched the world’s first Assisted Driving Grading system, a new set of metrics that are specifically designed to evaluate the driver-assist systems of cars available on the market today. For its first batch of vehicles, the firms evaluated 10 cars, from premium SUVs like the Mercedes-Benz GLE to affordable hatchbacks like the Renault Clio to all-electric vehicles like the Tesla Model 3.

As noted by Thatcham Research Director of Insurance Research Matthew Avery in a video outlining the results of the Assisted Driving Grading system’s first tests, vehicles would be graded on three metrics: the level of vehicle assistance that they provide, the level of driver engagement that they offer, and the effectiveness of their safety backup systems. The results of these tests, especially on the Tesla Model 3’s part, were rather peculiar, to say the least.

Out of 10 vehicles that were evaluated, the Tesla Model 3 ranked 6th with a “Moderate” grade, falling behind the Mercedes-Benz GLE, BMW 3-Series, and Audi Q8, which were graded as “Very Good,” and the Ford Kuga, which received a “Good” rating. This was despite the Tesla Model 3 receiving the top scores in the “Vehicle Assistance” and “Safety Backup” metrics.

The study, for example, dubbed the Model 3 as outstanding in terms of steering assistance, with the vehicle steering itself exceptionally well through an S-shaped curve at speeds of 80, 100, and 120 km/h. Tesla’s lane change systems were also satisfactory, despite the system’s limitations in Europe. Distance control was dominated by the Model 3 as well, with the evaluators stating that Tesla’s adaptive cruise control featured a “high level of technical maturity.” From a score of 100, Tesla’s vehicle assistance received a score of 87, the highest among the cars tested.

The Model 3’s safety backup systems were also a league above its competition. As noted in a post from the Allgemeiner Deutscher Automobil-Club e.V. (ADAC), Tesla demonstrated its strengths with the Model 3’s collision avoidance systems. The all-electric sedan earned a perfect score in the firms’ tests, outperforming its premium German competition. Overall, the Model 3 received an impressive score of 95 in the Assisted Driving Grading system’s “Safety Backup” metric.

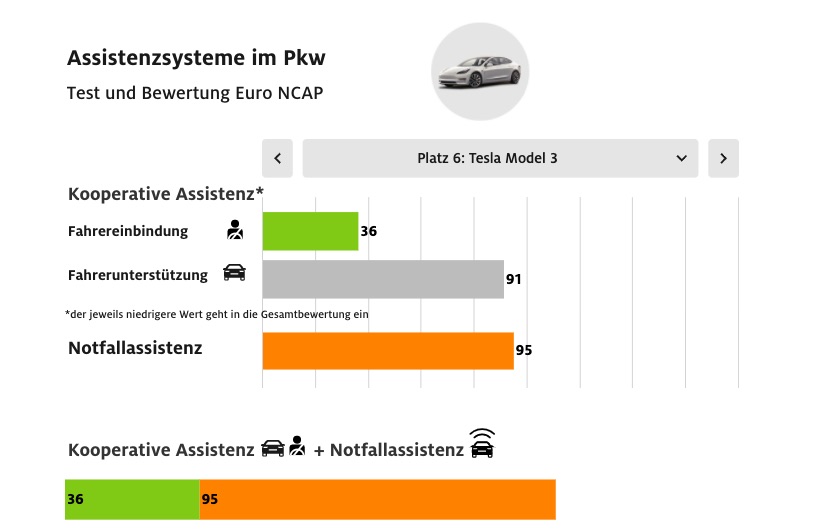

Considering these scores, one might wonder why the Model 3 ended up ranked 6th among the 10 vehicles tested by the Euro NCAP and Thatcham Research. As it turned out, this was because of the Model 3’s poor scores in the “Driver Engagement” metric, where the vehicle only earned a score of 35 out of 100. So poor was the Model 3’s scores in this metric that it was ranked last among the 10 vehicles that were evaluated.

A look at the reasons behind the Model 3’s poor scores in “Driver Engagement” includes a number of interesting insights from Thatcham Research and the Euro NCAP. When testing the vehicles’ steering override functions, for example, the evaluators stated that the Model 3 resisted steering overrides from its driver. These issues were explained in the ADAC’s post.

“Should the driver make a steering movement in order to avoid an object or a pothole in the roadway, the steering assistant should allow this without resistance. In the Tesla Model 3, for example, this is not the case. Apparently, Tesla trusts the system more than its driver. The necessary cooperative assistance is not given. Instead, the Tesla system prevents its driver from attempting to intervene – it mustn’t be,” the ADAC remarked in its post.

Even more interesting is that part of the Model 3’s poor “Driver Engagement” scores was due to the term “Autopilot,” which Tesla uses to describe its driver-assist suite. The evaluators argued that the term “Autopilot” was misleading and irresponsible on Tesla’s part, and this was heavily taken against the Model 3’s rankings in the Assisted Driving Grading system.

“When it comes to the first test criterion – consumer information – the Tesla Model 3 in particular fails. The assistance systems are referred to as “Autopilot” in the operating instructions for the Model 3 as well as in the sales brochures and in marketing. However, the term suggests capabilities that the system does not have in sufficient measure. It tempts the driver to rely on the capabilities of the system – which is currently not allowed by the legislature anyway. Due to its good quick-start operating aid, the Tesla Model 3 still receives 10 points,” the evaluators noted.

Ultimately, these complaints about Autopilot’s branding ended up pulling down the Model 3’s scores to the point where the all-electric sedan was ranked below the Ford Kuga. Thatcham Research Director of Insurance Research Matthew Avery explained this in a video released about the evaluation. “The Tesla Model 3 was the best for safety backup and vehicle assistance but lost ground for misleading consumers about the capability of its Autopilot system and actively discouraging drivers from engaging when behind the wheel,” Avery said.

As noted by Avery, it is pertinent for vehicles to exhibit a balance to score very well in the Assisted Driving Grading system. This was not achieved by the Model 3 despite its industry-leading backup safety systems and actual vehicle assistance tech. ADAC explained it best when outlining why the Tesla Model 3 lost to four other vehicles despite being equipped with what is noticeably the most advanced driver-assist system.

“When analyzing the test results, it is noticeable that the Tesla Model 3 has the most advanced assistance systems. With 95 points for emergency assistance (Safety Backup) and 91 points for technical assistance, it doesn’t beat the Mercedes GLE by far, but at least 11 points… Because Euro NCAP removes the many points in the area of driver support from the Tesla, because on the one hand it does not sufficiently comply with the driver’s request for a steering correction. On the other hand, because Tesla is irresponsible about the term autopilot – an even more serious reason. With only 36 points from the test area driver integration, the Tesla falls back to sixth place in the final bill,” the ADAC noted.

Thatcham Research’s overall findings could be viewed in the video below.

News

Ford is charging for a basic EV feature on the Mustang Mach-E

When ordering a new Ford Mustang Mach-E, you’ll now be hit with an additional fee for one basic EV feature: the frunk.

Ford is charging an additional fee for a basic EV feature on its Mustang Mach-E, its most popular electric vehicle offering.

Ford has shuttered its initial Model e program, but is venturing into a more controlled and refined effort, and it is abandoning the F-150 Lightning in favor of a new pickup that is currently under design, but appears to have some favorable features.

However, ordering a new Mustang Mach-E now comes with an additional fee for one basic EV feature: the frunk.

The frunk is the front trunk, and due to the lack of a large engine in the front of an electric vehicle, OEMs are able to offer additional storage space under the hood. There’s one problem, though, and that is that companies appear to be recognizing that they can remove it for free while offering the function for a fee.

Ford is now charging $495 on the Mustang Mach-E frunk (front trunk). What are your thoughts on that? pic.twitter.com/EOzZe3z9ZQ

— Alan of TesCalendar 📆⚡️ (@TesCalendar1) February 24, 2026

Ford is charging $495 for the frunk.

Interestingly, the frunk size varies by vehicle, but the Mustang Mach-E features a 4.7 to 4.8 cubic-foot-sized frunk, which measures approximately 9 inches deep, 26 inches wide, and 14 inches high.

When the vehicle was first released, Ford marketed the frunk as the ultimate tailgating feature, showing it off as a perfect place to store and serve cold shrimp cocktail.

Ford Mach-E frunk is perfect for chowders and chicken wings, and we’re not even joking

It appears the decision to charge for what is a simple advantage of an EV is not going over well, as even Ford loyal customers say the frunk is a “basic expectation” of an EV. Without it, it seems as if fans feel the company is nickel-and-diming its customers.

It will be pretty interesting to see the Mach-E without a frunk, and while it should not be enough to turn people away from potentially buying the vehicle, it seems the decision to add an additional charge to include one will definitely annoy some customers.

News

Tesla to improve one of its best features, coding shows

According to the update, Tesla will work on improving the headlights when coming into contact with highly reflective objects, including road signs, traffic signs, and street lights. Additionally, pixel-level dimming will happen in two stages, whereas it currently performs with just one, meaning on or off.

Tesla is looking to upgrade its Matrix Headlights, a unique and high-tech feature that is available on several of its vehicles. The headlights aim to maximize visibility for Tesla drivers while being considerate of oncoming traffic.

The Matrix Headlights Tesla offers utilize dimming of individual light pixels to ensure that visibility stays high for those behind the wheel, while also being considerate of other cars by decreasing the brightness in areas where other cars are traveling.

Here’s what they look like in action:

- Credit: u/ObjectiveScratch | Reddit

- Credit: u/ObjectiveScratch | Reddit

As you can see, the Matrix headlight system intentionally dims the area where oncoming cars would be impacted by high beams. This keeps visibility at a maximum for everyone on the road, including those who could be hit with bright lights in their eyes.

There are still a handful of complaints from owners, however, but Tesla appears to be looking to resolve these with the coming updates in a Software Version that is currently labeled 2026.2.xxx. The coding was spotted by X user BERKANT:

🚨 Tesla is quietly upgrading Matrix headlights.

Software https://t.co/pXEklQiXSq reveals a hidden feature:

matrix_two_stage_reflection_dip

This is a major step beyond current adaptive high beams.

What it means:

• The car detects highly reflective objects

Road signs,… pic.twitter.com/m5UpQJFA2n— BERKANT (@Tesla_NL_TR) February 24, 2026

According to the update, Tesla will work on improving the headlights when coming into contact with highly reflective objects, including road signs, traffic signs, and street lights. Additionally, pixel-level dimming will happen in two stages, whereas it currently performs with just one, meaning on or off.

Finally, the new system will prevent the high beams from glaring back at the driver. The system is made to dim when it recognizes oncoming cars, but not necessarily objects that could produce glaring issues back at the driver.

Tesla’s revolutionary Matrix headlights are coming to the U.S.

This upgrade is software-focused, so there will not need to be any physical changes or upgrades made to Tesla vehicles that utilize the Matrix headlights currently.

Elon Musk

xAI’s Grok approved for Pentagon classified systems: report

Under the agreement, Grok can be deployed in systems handling classified intelligence analysis, weapons development, and battlefield operations.

Elon Musk’s xAI has signed an agreement with the United States Department of Defense (DoD) to allow Grok to be used in classified military systems.

Previously, Anthropic’s Claude had been the only AI system approved for the most sensitive military work, but a dispute over usage safeguards has reportedly prompted the Pentagon to broaden its options, as noted in a report from Axios.

Under the agreement, Grok can be deployed in systems handling classified intelligence analysis, weapons development, and battlefield operations.

The publication reported that xAI agreed to the Pentagon’s requirement that its technology be usable for “all lawful purposes,” a standard Anthropic has reportedly resisted due to alleged ethical restrictions tied to mass surveillance and autonomous weapons use.

Defense Secretary Pete Hegseth is scheduled to meet with Anthropic CEO Dario Amodei in what sources expect to be a tense meeting, with the publication hinting that the Pentagon could designate Anthropic a “supply chain risk” if the company does not lift its safeguards.

Axios stated that replacing Claude fully might be technically challenging even if xAI or other alternative AI systems take its place. That being said, other AI systems are already in use by the DoD.

Grok already operates in the Pentagon’s unclassified systems alongside Google’s Gemini and OpenAI’s ChatGPT. Google is reportedly close to an agreement that will result in Gemini being used for classified use, while OpenAI’s progress toward classified deployment is described as slower but still feasible.

The publication noted that the Pentagon continues talks with several AI companies as it prepares for potential changes in classified AI sourcing.