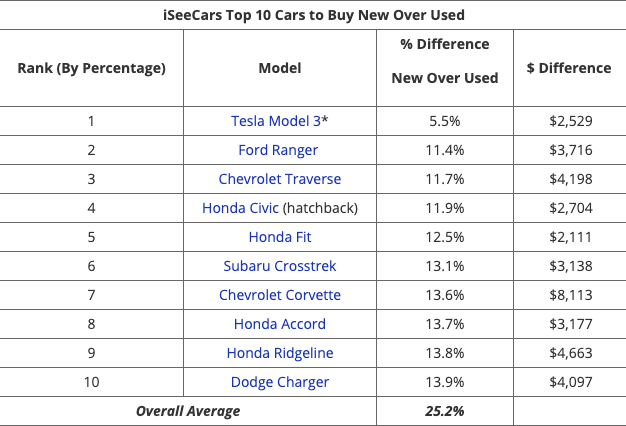

The Tesla Model 3 was ranked number 1 on a new study that analyzed the value retention of vehicles on the market. The Model 3 only showed a depreciation of 5.5% compared to the price of a new unit. That’s half the depreciation compared of the second-ranked vehicle on the study’s Top 10 list, the incredibly popular Ford Ranger pickup truck.

The study from iSeeCars.com noted the difference in value between two Model 3s manufactured a year apart was only $2,529. That’s just roughly the price of a few options from Tesla’s online configurator, like paint and white seats. With prices this close, there will likely be very little incentive for prospective EV buyers to opt for a second-hand Model 3.

One of the key motivations for buyers of second-hand cars is the supposed low price of the used vehicles themselves. Cars are notorious for losing a significant part of their value as soon as they are driven off the lot, and generally, electric vehicles see an even steeper depreciation. But for Tesla buyers, the high value retention of the company’s vehicles means that most of the time, it becomes far more practical to acquire a brand new Model 3 from the electric car maker.

This is something that was highlighted by iSeeCars CEO Phong Ly in a statement. “Instead of buying a car that’s already been driven for one year, consumers can buy the new version of select vehicles with a purchase price of just a few thousand dollars more to avoid the uncertainties that come with purchasing a used vehicle,” he said.

The iSeeCars CEO has valid points. There are notable uncertainties when one purchases an electric car. A second-hand car whose previous owner was careless may be prone to more issues compared to a new vehicle, for example. Apart from this, purchasing new cars offer a lot of benefits to consumers, since buyers will have full control on what their cars will be equipped with, from its interior to software-based features such as the Full Self-Driving suite.

The benefits of new Teslas extend beyond the cars’ buyers as well. The electric car maker benefits from operating a fleet of vehicles that are comprised of mostly new cars. Tesla is known for incrementally improving its vehicles to an almost obsessive degree. This means that when it comes to Teslas, it is always in the best interest of consumers to purchase the latest cars to make sure that they are getting the best tech and features available.

Does this mean that there is no place for Teslas in the second hand market? Definitely not. Second-hand Teslas will likely play a valuable role in the years to come, considering that the company is still expanding its presence across the globe and is yet to enter some large markets like India. Tesla is on a path towards a future where it could eventually produce millions of cars every year. Once this happens, Teslas will likely become ubiquitous enough that the second-hand market for the company’s electric cars will be friendlier to buyers.

Second-hand Teslas can also play a huge role in the company’s Robotaxi Network, which will utilize vehicles for ride-hailing services. For owners who wish to operate several Robotaxis, even the small savings offered by pre-owned vehicles will go a long way to ensure that their return of investment is quick. For now, though, and as long as Tesla is demand constrained, buyers can expect the Model 3 to resiliently retain its value years after it is purchased.

If there is anything shown in iSeeCars’ recent study, it is that Tesla is breaking stereotypes once more. A separate study from the firm showed that electric vehicles depreciate by 56.6% in three years, significantly more than 38.2% average depreciation across most petrol vehicles. Tesla has bucked this trend, however, with its entire lineup of vehicles like the Model 3, Model S, and Model X.

News

Lucid unveils Lunar Robotaxi in bid to challenge Tesla’s Cybercab in the autonomous ride hailing race

Lucid’s Lunar robotaxi is gunning for Tesla’s Cybercab in the autonomous ride hailing race

![Lucid Lunar robotaxi concept [Credit: Rendering by TESLARATI]](https://www.teslarati.com/wp-content/uploads/2026/03/lucid-lunar-robotaxi-concept-teslarati-rendering.jpg)

Lucid Group pulled back the curtain on its purpose-built autonomous robotaxi platform dubbed the Lunar Concept. Announced at its New York investor day event, Lunar is arguably the company’s most ambitious concept yet, and a direct line of sight toward the autonomous ride haling market that Tesla looks to control.

At Lucid Investor Day 2026, the company introduced Lunar, a purpose-built robotaxi concept based on the Midsize platform.

A comparison to Tesla’s Cybercab is unavoidable. The concept of a Tesla robotaxi was first introduced by Elon Musk back in April 2019 during an event dubbed “Autonomy Day,” where he envisioned a network of self-driving Tesla vehicles transporting passengers while not in use by their owners. That vision took another major step in October 2024 when, Musk unveiled the Cybercab at the Tesla “We, Robot” event held at Warner Bros. Studios in Burbank, California, where 20 concept Cybercabs autonomously drove around the studio lot giving rides to attendees.

Fast forward to today, and Tesla’s ambitions are finally materializing, but not without friction. As we recently reported, the Cybercab is being spotted with increasing frequency on public roads and across the grounds of Gigafactory Texas, suggesting that the company’s road testing and validation program is ramping meaningfully ahead of mass production. Tesla already operates a small scale robotaxi service in Austin using supervised Model Ys, but the Cybercab is designed from the ground up for high-volume, low-cost production, with Musk stating an eventual goal of producing one vehicle every 10 seconds.

At Lucid Investor Day 2026, the company introduced Lunar, a purpose-built robotaxi concept based on the Midsize platform.

Into this landscape steps Lucid’s Lunar. Built on the company’s all-new Midsize EV platform, which will also underpin consumer SUVs starting below $50,000. The Lunar mirrors the Cybercab’s core philosophy of having two seats, no driver controls, and a focus on fleet economics. The platform introduces Lucid’s redesigned Atlas electric drive unit, engineered to be smaller, lighter, and cheaper to manufacture at scale.

Unlike Tesla’s strategy of building its own ride hailing network from scratch, Lucid is partnering with Uber. The companies are said to be in advanced discussions to deploy Midsize platform vehicles at large scale, with Uber CEO Dara Khosrowshahi publicly backing Lucid’s engineering credentials and autonomous-ready architecture.

In the investor day event, Lucid also outlined a recurring software revenue model, with an in-vehicle AI assistant and monthly autonomous driving subscriptions priced between $69 and $199. This can be seen as a nod to the software revenue stream that Tesla has long championed with its Full Self-Driving subscription.

Tesla’s Cybercab is targeting a price point below $30k and with operating costs as low as 20 cents per mile. But with regulatory hurdles still ahead, the window for competition is open. Lucid’s Lunar may not have a launch date yet, but it arrives at a pivotal moment, and when the robotaxi race is no longer viewed as hypothetical. Rather, every serious EV player needs to come to bat on the same plate that Tesla has had countless practice swings on over the last seven years.

Elon Musk

Brazil Supreme Court orders Elon Musk and X investigation closed

The decision was issued by Supreme Court Justice Alexandre de Moraes following a recommendation from Brazil’s Prosecutor-General Paulo Gonet.

Brazil’s Supreme Federal Court has ordered the closure of an investigation involving Elon Musk and social media platform X. The inquiry had been pending for about two years and examined whether the platform was used to coordinate attacks against members of the judiciary.

The decision was issued by Supreme Court Justice Alexandre de Moraes following a recommendation from Brazil’s Prosecutor-General Paulo Gonet.

According to a report from Agencia Brasil, the investigation conducted by the Federal Police did not find evidence that X deliberately attempted to attack the judiciary or circumvent court orders.

Prosecutor-General Paulo Gonet concluded that the irregularities identified during the probe did not indicate fraudulent intent.

Justice Moraes accepted the prosecutor’s recommendation and ruled that the investigation should be closed. Under the ruling, the case will remain closed unless new evidence emerges.

The inquiry stemmed from concerns that content on X may have enabled online attacks against Supreme Court justices or violated rulings requiring the suspension of certain accounts under investigation.

Justice Moraes had previously taken several enforcement actions related to the platform during the broader dispute involving social media regulation in Brazil.

These included ordering a nationwide block of the platform, freezing Starlink accounts, and imposing fines on X totaling about $5.2 million. Authorities also froze financial assets linked to X and SpaceX through Starlink to collect unpaid penalties and seized roughly $3.3 million from the companies’ accounts.

Moraes also imposed daily fines of up to R$5 million, about $920,000, for alleged evasion of the X ban and established penalties of R$50,000 per day for VPN users who attempted to bypass the restriction.

Brazil remains an important market for X, with roughly 17 million users, making it one of the platform’s larger user bases globally.

The country is also a major market for Starlink, SpaceX’s satellite internet service, which has surpassed one million subscribers in Brazil.

Elon Musk

FCC chair criticizes Amazon over opposition to SpaceX satellite plan

Carr made the remarks in a post on social media platform X.

U.S. Federal Communications Commission (FCC) Chairman Brendan Carr criticized Amazon after the company opposed SpaceX’s proposal to launch a large satellite constellation that could function as an orbital data center network.

Carr made the remarks in a post on social media platform X.

Amazon recently urged the FCC to reject SpaceX’s application to deploy a constellation of up to 1 million low Earth orbit satellites that could serve as artificial intelligence data centers in space.

The company described the proposal as a “lofty ambition rather than a real plan,” arguing that SpaceX had not provided sufficient details about how the system would operate.

Carr responded by pointing to Amazon’s own satellite deployment progress.

“Amazon should focus on the fact that it will fall roughly 1,000 satellites short of meeting its upcoming deployment milestone, rather than spending their time and resources filing petitions against companies that are putting thousands of satellites in orbit,” Carr wrote on X.

Amazon has declined to comment on the statement.

Amazon has been working to deploy its Project Kuiper satellite network, which is intended to compete with SpaceX’s Starlink service. The company has invested more than $10 billion in the program and has launched more than 200 satellites since April of last year.

Amazon has also asked the FCC for a 24-month extension, until July 2028, to meet a requirement to deploy roughly 1,600 satellites by July 2026, as noted in a CNBC report.

SpaceX’s Starlink network currently has nearly 10,000 satellites in orbit and serves roughly 10 million customers. The FCC has also authorized SpaceX to deploy 7,500 additional satellites as the company continues expanding its global satellite internet network.

![Lucid Lunar robotaxi concept [Credit: Rendering by TESLARATI]](https://www.teslarati.com/wp-content/uploads/2026/03/lucid-lunar-robotaxi-concept-teslarati-rendering-80x80.jpg)