Tesla’s (NASDAQ:TSLA) third-quarter earnings call comes on the heels of an impressive quarter that saw the electric car maker posting $8.771 billion in revenue and $809M GAAP operating income, beating Wall Street’s estimates once more. With these results, Tesla has now posted five consecutive profitable quarters.

As revealed in the company’s Q3 2020 Update Letter, Tesla currently sits on $5.9 billion in cash. This is despite the company’s simultaneous construction of Gigafactory Shanghai, Gigafactory Berlin, and Gigafactory Texas. Impressively enough, Model 3 and Model Y production have reached a run-rate of 500,000 vehicles per year at the Fremont factory. This, together with the facility’s capability to produce 90,000 Model S and Model X annually, as well as Gigafactory Shanghai’s current 250,000-per-year capacity, allows Tesla to take a definitive step towards a run-rate of 1 million cars per year.

For today’s earnings call, Tesla executives are expected to address questions surrounding the company’s plans for the coming quarters, particularly its battery cell production strategy. Updates on future projects such as the Cybertruck, Semi, and Roadster may also be mentioned, as well as more details on the third quarter’s surprising Tesla Energy results.

The following are live updates from Tesla’s Q3 2020 earnings call. I will be updating this article in real-time, so please keep refreshing the page to view the latest updates on this story. The first entry starts at the bottom of the page.

15:35 PT: And that’s it for the Q3 2020 earnings call! Thanks so much for staying with us for yet another live blog. We will see you in the next one.

15:34 PT: Final question from Philippe Houchois from Jefferies, who asks about Tesla’s business model for stationary storage. Johnson notes that Tesla is already seeing how energy prices are already seeing benefits from products like the Megapack and Powerwall. Using the hardware and software platform in the form of Autobidder, Tesla Energy has tons of potential.

The analyst also asks about Tesla’s skateboard design, which Musk confirmed will be obsolete in the long term. Musk notes that Tesla is looking to make its vehicles kind of like the way a toy car is made, with large casts and few parts. Using batteries as part of the vehicle’s structure is used in aircraft and rockets, so this approach would likely work for cars too. With such a strategy, Tesla is literally borrowing from orbital-class rocket design philosophy.

“You wouldn’t want to put a box in a box,” Musk noted. He did state that the transition away from the skateboard design won’t happen overnight, but it is bound to happen.

15:30 PT: Ben Kallo of Baird asks about OEMs and how they can get their act together. Elon notes that there will definitely be other car companies even after the EV age. He notes that Tesla designs and builds so much more of its cars than traditional OEMs. “It’s not very adventurous, and all the parts end up looking the same since they go to the same suppliers,” he said. “We’re probably an order of magnitude more vertically-integrated than other companies,” he adds.

Tesla is working on several parties to ensure that the Semi will have a legitimate charging infrastructure on the vehicle. “We’re not working in isolation,” Guillen noted.

Musk adds that the Semi consumes about 5-6x the cells of conventional cars. “We need to solve cell constraints,” the CEO states. When asked if the Semi and autonomy could be a material business, Musk stated that there is no doubt. Guillen added that the tech that Tesla is putting on the Semi is identical to the tech the company is putting on its other vehicles.

As a follow-up, Levy asked about Tesla’s strategy with pricing, especially with regards to Berlin-made vehicles. Kirkhorn explains that this is affected by different factors, though Tesla is trying to move production higher to optimize pricing.

15:20 PT: Pierre Ferragu of New Street Research asks about the Cybertruck and its ramp. Musk notes that he and the Tesla team are working hard on making sure that the Cybertruck will be better than the prototype that was unveiled last year. “We want the car we deliver to be better than the car we unveiled.” Musk notes that there are a “lot of small improvements” that have been made to the vehicle, making it better than its already-impressive prototype. “I think it’s going to be better than what we showed. It will be made in Austin,” he added.

Musk reiterates that the Cybertruck’s hard exoskeleton will likely present some challenges with the vehicle’s manufacturing. “But nevertheless, “if all goes well, we can do some Cybertruck deliveries towards the end of next year.” Musk predicts lots of deliveries in 2022 and the year after.

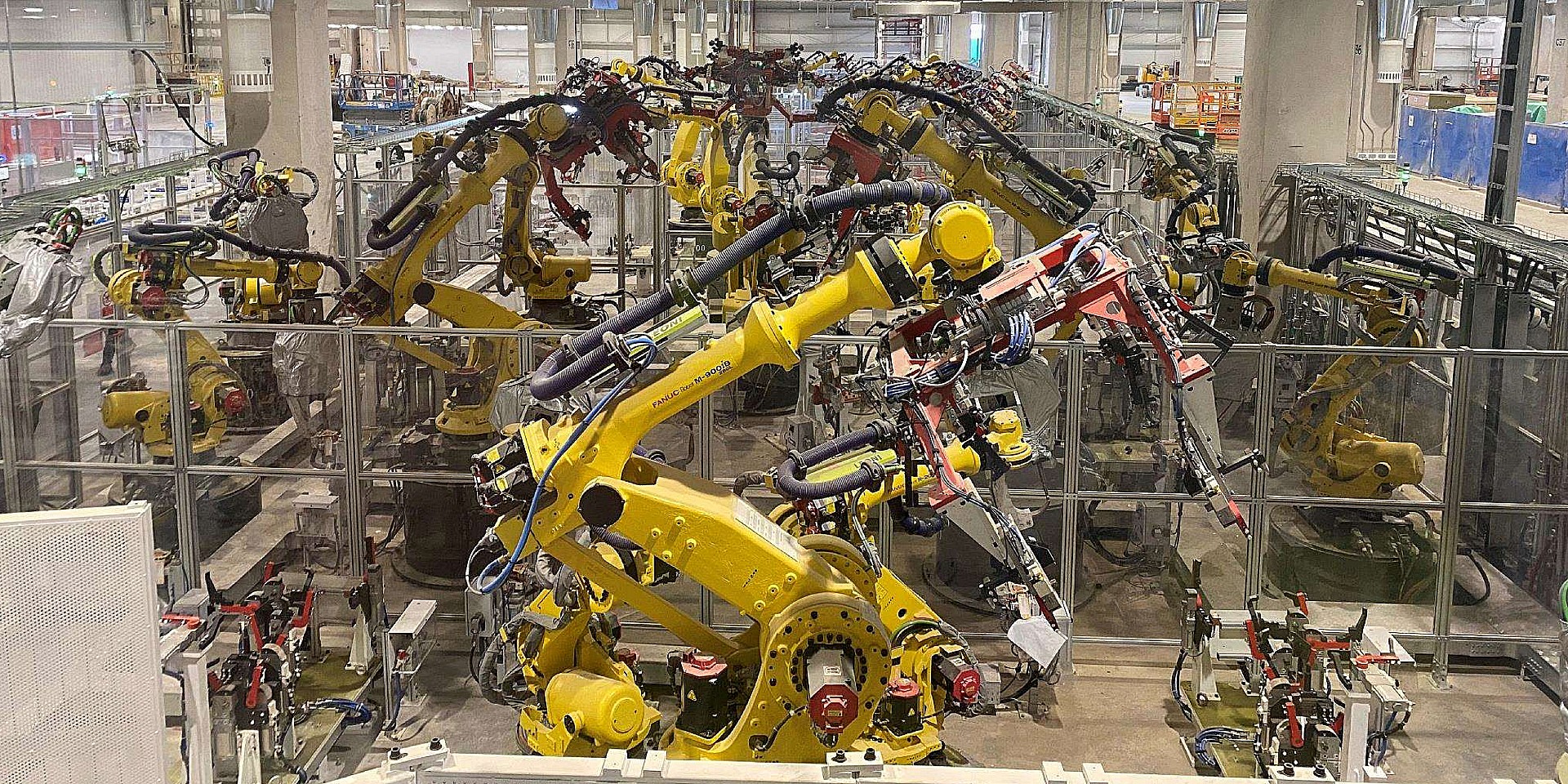

15:15 PT: Colin Rusch of Oppenheimer asks about Tesla’s processes and operations/equipment that are coming in-house. Musk notes that Tesla is “absurdly vertically integrated.” Tesla literally designs the machine, then the company makes the machine. “We made the machine that made the machine that made the machine. We’d like to outsource less,” Musk remarked. “This makes it quite difficult to copy Tesla,” he added. Musk admits that he’s not sure if insane vertical integration is a smart move, but so far, it appears that it is.

Musk is then asked about Tesla’s balance sheet, and how the company is looking to operate in the near future. “We’re trying to spend money at the fastest rate without wasting any of it,” Musk noted.

15:10 PT: Analyst questions begin. Wolfe Research is up first, asking about the targets that were announced during Battery Day. Elon noted that it’s difficult to predict Tesla’s actual output, but 20 million vehicles is a good number, representing 1% of the vehicles that are produced this year. Tesla has a mission to accelerate the advent of sustainability after all, and it needs volume to do that.

When asked about Tesla’s cell production, Musk noted that Tesla could and will change all aspects of the company’s battery cells. “We will change all aspects of the cell,” he said. Tesla will be exploring varying chemistries for its batteries over time. This is classic Tesla, in a way, as the electric car maker is still showing its tendency to continuously innovate.

15:05 PT: Elon highlights why making Tesla’s cars affordable is pivotal. “All of these margins will look comically small when you factor in Autonomy,” Musk said. Adding to the CEO’s statement, Kirkhorn stated that Tesla is moving full speed ahead with as much volume as possible. He adds that Tesla has grown volume and margins even with all the price reductions of Tesla’s vehicle lineup. In addition to reducing costs, the cars get better, and this becomes a reason for more consumers to purchase the company’s cars.

15:00 PT: A question from an institutional investor is brought up about Tesla’s HVAC plan, especially in light of the Model Y’s heat pump. Drew Baglino notes that the Model Y’s heat pump does provide Tesla with some background in this sense, and Elon Musk noted that the company has tech that should allow for home products to be developed.

14:58 PT: Shareholder questions begin with a question about the company’s 4680 cells and if they will be produced at the same time as vehicle ramp in Berlin, which Drew Baglino confirms will indeed be the case. As for the idea of FSD being carried over from one vehicle to the next, Elon Musk noted that Tesla will “give it some thought.”

An inquiry about Solar Roof installation constraints was also asked. According to Johnson, the main constraint today lies in the installers themselves. It is pertinent for Tesla to ensure that the Solar Roof is easy to install, and so far, the response from third-party installers have been positive. Elon Musk notes that Solar Roof’s true potential would likely be very evident next year.

In response to a question about the idea of one of Tesla’s businesses spinning off into its own company, Musk discusses how Tesla is essentially a series of startups. “Every major product line is a startup. Every big new plant is a startup. And frankly, sometimes we have to learn a lesson a few times before it sinks in,” Musk remarked. He also noted that “Tesla is not dependent on enterprise software,” implying that Tesla develops all of its operational software internally.

No plans to spin anything out yet though. “It just adds complexity,” Musk said.

14:50 PT: RJ Johnson of Tesla Energy takes the stage. He discusses how Tesla Energy is ramping. “We have more demand than supply through 2021,” he said. Megapack is seeing more demand over the following year. He notes that as costs go lower, sustainable technologies are poised to replace fossil fuel-powered solutions. Other Tesla Energy products such as Autobidder and Powerwall continue to find more adoption as well.

Solar Roof is exciting as the company is gaining more experience in installing the product quickly. Solar Roof installation’s record now stands at 1.5 days.

14:45 PT: To conclude, Musk thanks Tesla’s employees and suppliers. He also extends thanks to investors who have stuck with the company through thick and thin. “I’ve never felt more optimistic about Tesla than I do today,” Musk said.

Zach Kirkhorn takes the stage. He mentions how Tesla now has five profitable quarter. The company’s regulatory credit sales continue to be strong. And despite expenses being higher due to Elon Musk’s payout from his compensation plan, the company was able to keep its numbers strong just the same. Manufacturing and operational costs continue to decrease, as per the CFO.

14:41 PT: The CEO also highlights that the Autopilot rewrite is a generalized approach to FSD, meaning that there are no specialized sensors needed for the vehicles to operate themselves.

In terms of capacity, Elon mentions the expansion of Gigafactory Shanghai, Gigafactory Berlin, and Gigafactory Texas. “We’re making progress on three major factories,” he said, adding that “always impressed by how much the Tesla China team makes.” Musk also notes that Giga Berlin, due to the ramp of new technology, the production of the facility will start slow, and then ramp to greater outputs over time. Giga Berlin could take about 12-24 months to reach full production capacity.

14:36 PT: Elon talks about how Q3 is a record quarter for Tesla. Full Stop. “Q3 was our best quarter in history,” he said. The CEO also discusses Battery Day, the culmination of years’ worth of work by the company. Musk notes that in a few years, batteries could cost half as much with cheaper production costs.

Musk also discusses updates to the rollout of Full Self-Driving. He specifically extends his thanks to the Autopilot team, which has been working like crazy to release the highly-anticipated rewrite. Musk states that the Autopilot rewrite could roll out to more drivers this weekend, with wide release by the end of the year.

14:34 PT: And we’re off! Tesla Investor Relations’ Martin Viecha takes the floor. Just like previous calls, CEO Elon Musk and CFO Zachary Kirkhorn are present, as well as other Tesla executives. Here’s Elon’s opening remarks.

14:32 PT: Then again, Tesla posted $809M GAAP operating income in Q3. That’s more than enough to justify a little delay, I guess.

14:30 PT: And… It’s starting! Here we go, folks… Wait, scratch that. It’s back to classical music.

14:25 PT: I gotta admit, this classical music is getting more and more relaxing by the quarter.

14:20 PT: It is time once more for Tesla’s quarterly earnings report! This makes five consecutive profitable quarters for Tesla now, which is something that definitely did not seem to be on the horizon in early 2019. Back then, it seemed like TSLA was the punching bag of every bear and critic out there. But since Q3 2019, things have changed, a whole lot. Needless to say, this earnings call will definitely be interesting.

Investor's Corner

Tesla gets tip of the hat from major Wall Street firm on self-driving prowess

“Tesla is at the forefront of autonomous driving, supported by a camera-only approach that is technically harder but much cheaper than the multi-sensor systems widely used in the industry. This strategy should allow Tesla to scale more profitably compared to Robotaxi competitors, helped by a growing data engine from its existing fleet,” BoA wrote.

Tesla received a tip of the hat from major Wall Street firm Bank of America on Wednesday, as it reinitiated coverage on Tesla shares with a bullish stance that comes with a ‘Buy’ rating and a $460 price target.

In a new note that marks a sharp reversal from its neutral position earlier in 2025, the bank declared Tesla’s Full Self-Driving (FSD) technology the “leading consumer autonomy solution.”

Analysts highlighted Tesla’s camera-only architecture, known as Tesla Vision, as a strategic masterstroke. While technically more challenging than the multi-sensor setups favored by rivals, the vision-based approach is dramatically cheaper to produce and maintain.

This cost edge, combined with Tesla’s rapidly expanding real-world data engine, positions the company to scale robotaxis far more profitably than competitors, BofA argues in the new note:

“Tesla is at the forefront of autonomous driving, supported by a camera-only approach that is technically harder but much cheaper than the multi-sensor systems widely used in the industry. This strategy should allow Tesla to scale more profitably compared to Robotaxi competitors, helped by a growing data engine from its existing fleet.”

The bank now attributes roughly 52% of Tesla’s total valuation to its Robotaxi ambitions. It also flagged meaningful upside from the Optimus humanoid robot program and the fast-growing energy storage business, suggesting the auto segment’s recent headwinds, including expired incentives, are being eclipsed by these higher-margin opportunities.

Tesla’s own data underscores exactly why Wall Street is waking up to FSD’s potential. According to Tesla’s official safety reporting page, the FSD Supervised fleet has now surpassed 8.4 billion cumulative miles driven.

Tesla FSD (Supervised) fleet passes 8.4 billion cumulative miles

That total ballooned from just 6 million miles in 2021 to 80 million in 2022, 670 million in 2023, 2.25 billion in 2024, and a staggering 4.25 billion in 2025 alone. In the first 50 days of 2026, owners added another 1 billion miles — averaging more than 20 million miles per day.

This avalanche of real-world, camera-captured footage, much of it on complex city streets, gives Tesla an unmatched training dataset. Every mile feeds its neural networks, accelerating improvement cycles that lidar-dependent rivals simply cannot match at scale.

Tesla owners themselves will tell you the suite gets better with every release, bringing new features and improvements to its self-driving project.

The $460 target implies roughly 15 percent upside from recent trading levels around $400. While regulatory and safety hurdles remain, BofA’s endorsement signals growing institutional conviction that Tesla’s data advantage is not hype; it’s a tangible moat already delivering billions of miles of proof.

Elon Musk

SpaceX IPO could push Elon Musk’s net worth past $1 trillion: Polymarket

The estimates were shared by the official Polymarket Money account on social media platform X.

Recent projections have outlined how a potential $1.75 trillion SpaceX IPO could generate historic returns for early investors. The projections suggest the offering would not only become the largest IPO in history but could also result in unprecedented windfalls for some of the company’s key investors.

The estimates were shared by the official Polymarket Money account on social media platform X.

As noted in a Polymarket Money analysis, Elon Musk invested $100 million into SpaceX in 2002 and currently owns approximately 42% of the company. At a $1.75 trillion valuation following SpaceX’s potential $1.75 trillion IPO, that stake would be worth roughly $735 billion.

Such a figure would dramatically expand Musk’s net worth. When combined with his holdings in Tesla Inc. and other ventures, a public debut at that level could position him as the world’s first trillionaire, depending on market conditions at the time of listing.

The Bloomberg Billionaires Index currently lists Elon Musk with a net worth of $666 billion, though a notable portion of this is tied to his TSLA stock. Tesla currently holds a market cap of $1.51 trillion, and Elon Musk’s currently holds about 13% to 15% of the company’s outstanding common stock.

Founders Fund, co-founded by Peter Thiel, invested $20 million in SpaceX in 2008. Polymarket Money estimates the firm owns between 1.5% and 3% of the private space company. At a $1.75 trillion valuation, that range would translate to approximately $26.25 billion to $52.5 billion in value.

That return would represent one of the most significant venture capital outcomes in modern Silicon Valley history, with a growth of 131,150% to 262,400%.

Alphabet Inc., Google’s parent company, invested $900 million into SpaceX in 2015 and is estimated to hold between 6% and 7% of the private space firm. At the projected IPO valuation, that stake could be worth between $105 billion and $122.5 billion. That’s a growth of 11,566% to 14,455%.

Other major backers highlighted in the post include Fidelity Investments, Baillie Gifford, Valor Equity Partners, Bank of America, and Andreessen Horowitz, each potentially sitting on multibillion-dollar gains.

Elon Musk

Elon Musk hints Tesla investors will be rewarded heavily

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet,” Musk said.

Elon Musk recently hinted that he believes Tesla investors will be rewarded heavily if they continue to hold onto their shares, and he reiterated that in a new interview that the company released on its social accounts this week.

Musk is one of the most successful CEOs in the modern era and has mammothed competitors on the Forbes Net Worth List over the past year as his holdings in his various companies have continued to swell.

Tesla investors, especially those who have been holding shares for several years, have also felt substantial gains in their portfolios. Over the past five years, the stock is up over 78 percent. Since February 2019, nearly seven years ago to the day, the stock is up over 1,800 percent.

Musk said in the interview:

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet.”

Elon Musk in new interview: “Hold on to your $TSLA stock. It’s going to be worth a lot, I think. That’s my bet.” pic.twitter.com/cucirBuhq0

— Sawyer Merritt (@SawyerMerritt) February 26, 2026

It’s no secret Musk has been extremely bullish on his own companies, but Tesla in particular, because it is publicly traded.

However, the company has so many amazing projects that have an opportunity to revolutionize their respective industries. There is certainly a path to major growth on Wall Street for Tesla through its various future projects, including Optimus, Cybercab, Semi, and Unsupervised FSD.

- Optimus (Tesla’s humanoid robot): Musk has discussed its potential for tasks like childcare, walking dogs, or assisting elderly parents, positioning it as a massive long-term driver of company value.

- Cybercab (Tesla’s robotaxi/autonomous ride-hailing vehicle): a fully autonomous vehicle geared specifically for Tesla’s ride-sharing ambitions.

- Semi (Tesla’s electric truck, with mentions of expansion, like in Europe): brings Tesla into the commercial logistics sector.

- Unsupervised FSD (Full Self-Driving software achieving full autonomy without human supervision): turns every Tesla owner’s vehicle into a fully-autonomous vehicle upon release

These projects specifically are some of the highest-growth pillars Tesla has ever attempted to develop, especially in Musk’s eyes, as he has said Optimus will be the best-selling product of all-time.

Many analysts agree, but the bullish ones, like Cathie Wood of ARK Invest, are perhaps the one who believes Tesla has incredible potential on Wall Street, predicting a $2,600 price target for 2030, but this is not even including Optimus.

She told Bloomberg last March that she believes that the project will present a potential additive if Tesla can scale faster than anticipated.