Amidst a major auto industry shift to electric vehicles (EVs) and software-driven mobility, a new survey shows that almost all drivers want to have ownership over their own vehicle data—though consumer awareness on data privacy and ownership are still lacking.

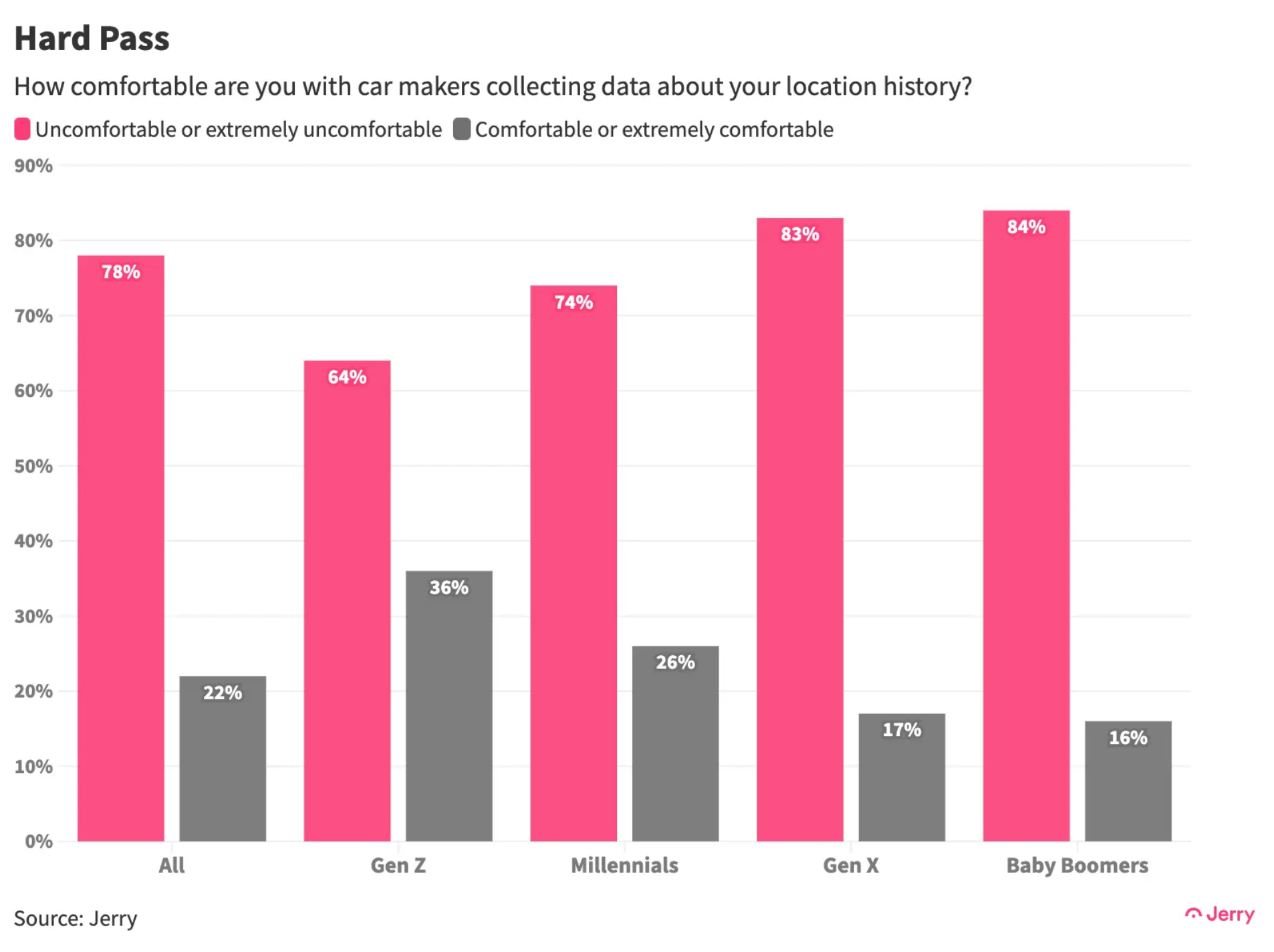

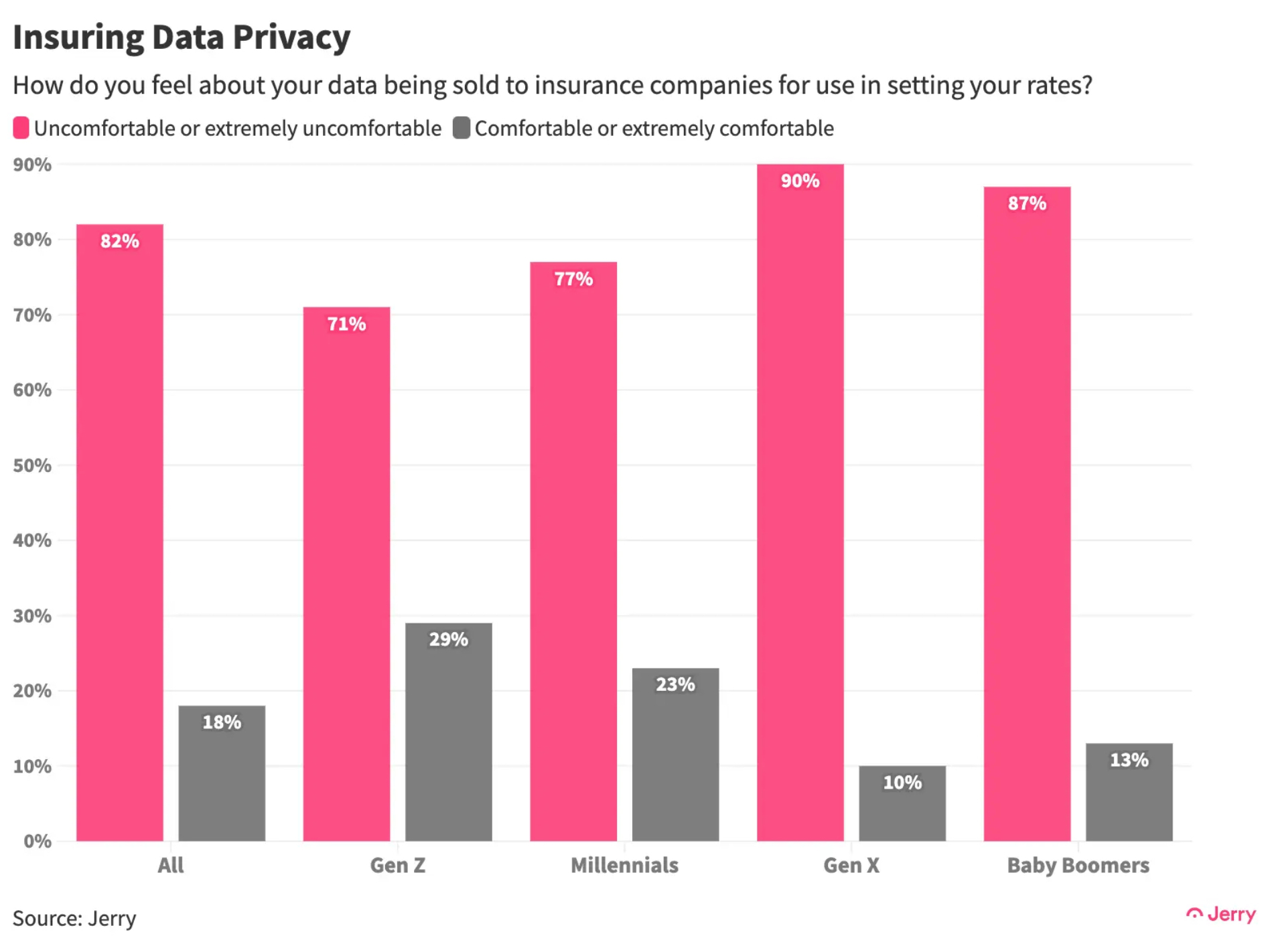

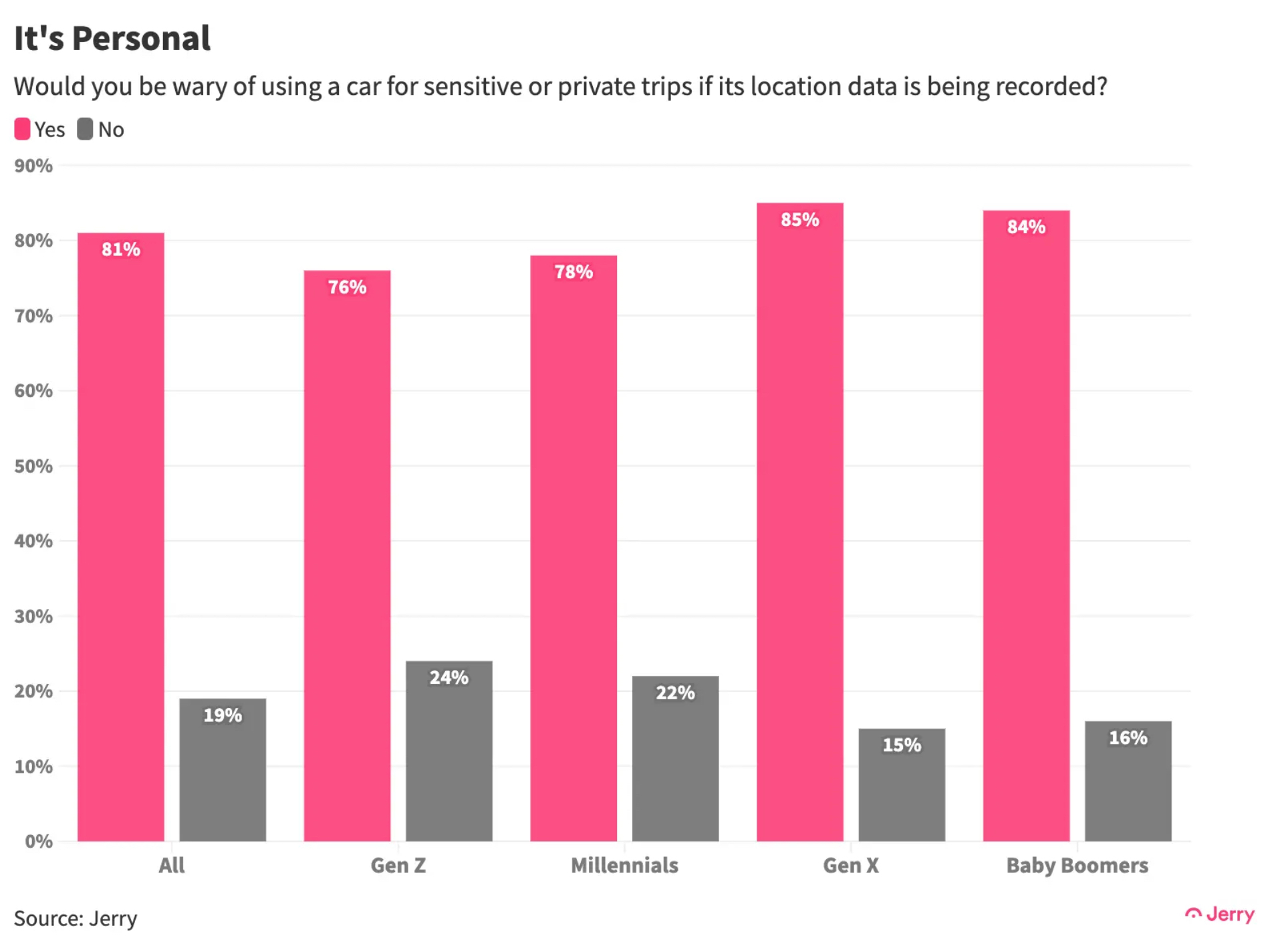

As part of a survey of over 1,300 adults who lease or own vehicles that they drive at least once a week, car insurance app Jerry reported last month that 96 percent of respondents said they should be able to own any data generated by their vehicles. Similarly, 78 percent of those surveyed reported that they were either uncomfortable or extremely uncomfortable with having their data collected by automakers already.

You can see a few insights from the survey below, or check out the full report here.

Credit: Jerry Credit: Jerry Credit: Jerry

“People were nearly unanimous” in “thinking that they should own the data that is generated by their cars,” said Henry Hoenig, Jerry data journalist, in a statement to Automotive News.

The results come as many companies plan to use vehicle data as a consistent revenue stream, including manufacturers, insurance providers, and data brokers. On the consumer side, many may not be fully aware of how their vehicles are being connected to the internet, nor how their data is being used.

Data Collection in Modern Cars and Consumer Awareness

Teslarati spoke with Andy Chatham, co-founder of the connected vehicle platform Digital Infrastructure for Moving Objects (DIMO), about vehicle data ownership and privacy. He notes that modern cars include substantial amounts of data collection, such as Tesla’s 360-degree camera view around the cars as just one example. However, he also says that consumers are less likely to be aware of their vehicles’ data collection practices than they are with their cell phones.

“Generally, your vehicle is the most expensive or the second most expensive asset that you own, and traditionally people are very aware that their phones and their computers are connected to the internet,” Chatham said. “But especially with modern cars, it’s not always obvious that the car is also connected to the internet.”

Chatham says that most automakers aren’t generally following best practices surrounding cybersecurity, noting that many let third-party sub-contractors make those decisions for them, alongside other companies in the supply chain.

“Generally, [automakers are] not following best practices when it comes to how the vehicles are networked and how cybersecurity practices are implemented,” Chatham adds.

“I see a pretty big transition from the world of buying a phone and understanding that this is a device that has a lot of data collection going on, and buying a car and maybe acknowledging that once at the beginning, but never really understanding what that actually means.”

Chatham also says companies should open up their APIs for other developers to create applications using that data, and let vehicle owners access their own vehicle data and toggle permissions directly from their cars—not unlike what Tesla is currently doing.

However, even Tesla’s approach to vehicle data may leave a few things to be desired, and the company is one of many automakers to have faced legal action over the matter. Still, the DIMO co-founder estimates that Tesla is roughly three to five years ahead of the industry, perhaps except for Rivian.

Chatham also notes that as applications for car data improve more and more, and perhaps even offer certain data monetization options for consumers, owners will become more aware of vehicle connectedness. Still, the transition to this new public paradigm could be tricky for both consumers and developers.

“In order for that to even exist in the first place, there’s a chicken and egg problem, because developers don’t want to go cut separate deals with 10 different OEMs and get them to like agree to certain terms and use different APIs. They just won’t,” Chatham adds. “They just want to build to one thing, which is what they’re used to with both. It’s honestly a big enough pain in the ass to get developers to build an iOS and Android app and deal with two separate terms of service.”

“In the car world, Toyota is the biggest automaker and they’re, what, like 15 percent of cars? So it’s not the same dynamic, and then choice is the biggest thing that allows people to protect their own privacy because a lot of consumers don’t care.”

Automakers and the Use of Vehicle Data

Earlier this year, General Motors (GM) reported ceasing a partnership with one data broker, after discovering that the company had been selling customer data to insurance companies without gaining their consent. Public backlash ensued, and affected consumers said they witnessed inexplicable increases for their monthly insurance premiums, which were ultimately traced back to the telemetry program that had shared their data.

Ford and Progressive Insurance were involved in a similar case that brought data ownership and privacy to light in 2022. Last year, Mozilla said that all 25 car companies it examined as part of a study on privacy collected more personal data than necessary, even calling them “privacy nightmares.”

Unlike some companies, Tesla doesn’t sell or rent consumer data to third-party companies, though it does collect driver information on a fleet scale for its own purposes, as the company explains on its website.

“We’re committed to protecting you anytime you get behind the wheel of a Tesla vehicle. That commitment extends to your data privacy,” Tesla writes on its web page dedicated to the topic of privacy. “Our privacy protections aim to go beyond industry standards, ensuring your personal data is never sold, tracked or shared without your permission or knowledge.”

Tesla Insurance data has driven changes to vehicle design: Elon Musk

What are your thoughts? Let me know at zach@teslarati.com, find me on X at @zacharyvisconti, or send us tips at tips@teslarati.com.

Elon Musk

Tesla Supercharger Diner food menu gets a sneak peek as construction closes out

What are you ordering at the Tesla Diner?

The Tesla Supercharger Diner in Los Angeles is nearing completion as construction appears to be winding down significantly. However, the more minor details, such as what the company will serve at its 50s-style diner for food, are starting to be revealed.

Tesla’s Supercharger Diner is set to open soon, seven years after CEO Elon Musk first drafted the idea in a post on X in 2018. Musk has largely come through on most of what he envisioned for the project: the diner, the massive movie screens, and the intended vibe are all present, thanks to the aerial and ground footage shared on social media.

We already know the Diner will be open 24/7, based on decals placed on the front door of the restaurant that were shared earlier this week. We assume that Tesla Optimus will come into play for these long and uninterrupted hours.

The Tesla Diner is basically finished—here’s what it looks like

As far as the food, Tesla does have an email also printed on the front door of the Diner, but we did not receive any response back (yet) about what cuisine it will be offering. We figured it would be nothing fancy and it would be typical diner staples: burgers, fries, wings, milkshakes, etc.

According to pictures taken by @Tesla_lighting_, which were shared by Not a Tesla App, the food will be just that: quick and affordable meals that diners do well. It’s nothing crazy, just typical staples you’d find at any diner, just with a Tesla twist:

Tesla Diner food:

• Burgers

• Fries

• Chicken Wings

• Hot Dogs

• Hand-spun milkshakes

• And more https://t.co/kzFf20YZQq pic.twitter.com/aRv02TzouY— Sawyer Merritt (@SawyerMerritt) July 17, 2025

As the food menu is finalized, we will be sure to share any details Tesla provides, including a full list of what will be served and its prices.

Additionally, the entire property appears to be nearing its final construction stages, and it seems it may even be nearing completion. The movie screens are already up and showing videos of things like SpaceX launches.

There are many cars already using the Superchargers at the restaurant, and employees inside the facility look to be putting the finishing touches on the interior.

🚨 Boots on the ground at the Tesla Diner:

— TESLARATI (@Teslarati) July 17, 2025

It’s almost reminiscent of a Tesla version of a Buc-ee’s, a southern staple convenience store that offers much more than a traditional gas station. Of course, Tesla’s version is futuristic and more catered to the company’s image, but the idea is the same.

It’s a one-stop shop for anything you’d need to recharge as a Tesla owner. Los Angeles building permits have not yet revealed the date for the restaurant’s initial operation, but Tesla may have its eye on a target date that will likely be announced during next week’s Earnings Call.

News

Tesla’s longer Model Y did not scale back requests for this vehicle type from fans

Tesla fans are happy with the new Model Y, but they’re still vocal about the need for something else.

Tesla launched a slightly longer version of the Model Y all-electric crossover in China, and with it being extremely likely that the vehicle will make its way to other markets, including the United States, fans are still looking for something more.

The new Model Y L in China boasts a slightly larger wheelbase than its original version, giving slightly more interior room with a sixth seat, thanks to a third row.

Tesla exec hints at useful and potentially killer Model Y L feature

Tesla has said throughout the past year that it would focus on developing its affordable, compact models, which were set to begin production in the first half of the year. The company has not indicated whether it met that timeline or not, but many are hoping to see unveilings of those designs potentially during the Q3 earnings call.

However, the modifications to the Model Y, which have not yet been officially announced for any markets outside of China, still don’t seem to be what owners and fans are looking forward to. Instead, they are hoping for something larger.

A few months ago, I reported on the overall consensus within the Tesla community that the company needs a full-size SUV, minivan, or even a cargo van that would be ideal for camping or business use.

Tesla is missing one type of vehicle in its lineup and fans want it fast

That mentality still seems very present amongst fans and owners, who state that a full-size SUV with enough seating for a larger family, more capability in terms of cargo space for camping or business operation, and something to compete with gas cars like the Chevrolet Tahoe, Ford Expedition, or electric ones like the Volkswagen ID.BUZZ.

We asked the question on X, and Tesla fans were nearly unanimously in support of a larger SUV or minivan-type vehicle for the company’s lineup:

🚨 More and more people are *still* saying that, despite this new, longer Model Y, Tesla still needs a true three-row SUV

Do you agree? https://t.co/QmbRDcCE08 pic.twitter.com/p6m5zB4sDZ

— TESLARATI (@Teslarati) July 16, 2025

Here’s what some of the respondents said:

100% agree, we need a larger vehicle.

Our model Y is quickly getting too small for our family of 5 as the kids grow. A slightly longer Y with an extra seat is nice but it’s not enough if you’re looking to take it on road trips/vacations/ kids sports gear etc.

Unfortunately we…

— Anthony Hunter (@_LiarsDice_) July 17, 2025

Had to buy a Kia Carnival Hybrid because Tesla doesn’t have a true 3 row vehicle with proper space and respectable range. pic.twitter.com/pzwFyHU8Gi

— Neil, like the astronaut (@Neileeyo) July 17, 2025

Agreed! I’m not sure who created this but I liked it enough to save it. pic.twitter.com/Sof5nMehjS

— 🦉Wise Words of Wisdom – Inspirational Quotes (IQ) (@WiseWordsIQ) July 16, 2025

Tesla is certainly aware that many of its owners would like the company to develop something larger that competes with the large SUVs on the market.

However, it has not stated that anything like that is in the current plans for future vehicles, as it has made a concerted effort to develop Robotaxi alongside the affordable, compact models that it claims are in development.

It has already unveiled the Robovan, a people-mover that can seat up to 20 passengers in a lounge-like interior.

The Robovan will be completely driverless, so it’s unlikely we will see it before the release of a fully autonomous Full Self-Driving suite from Tesla.

Energy

Tesla launches first Virtual Power Plant in UK – get paid to use solar

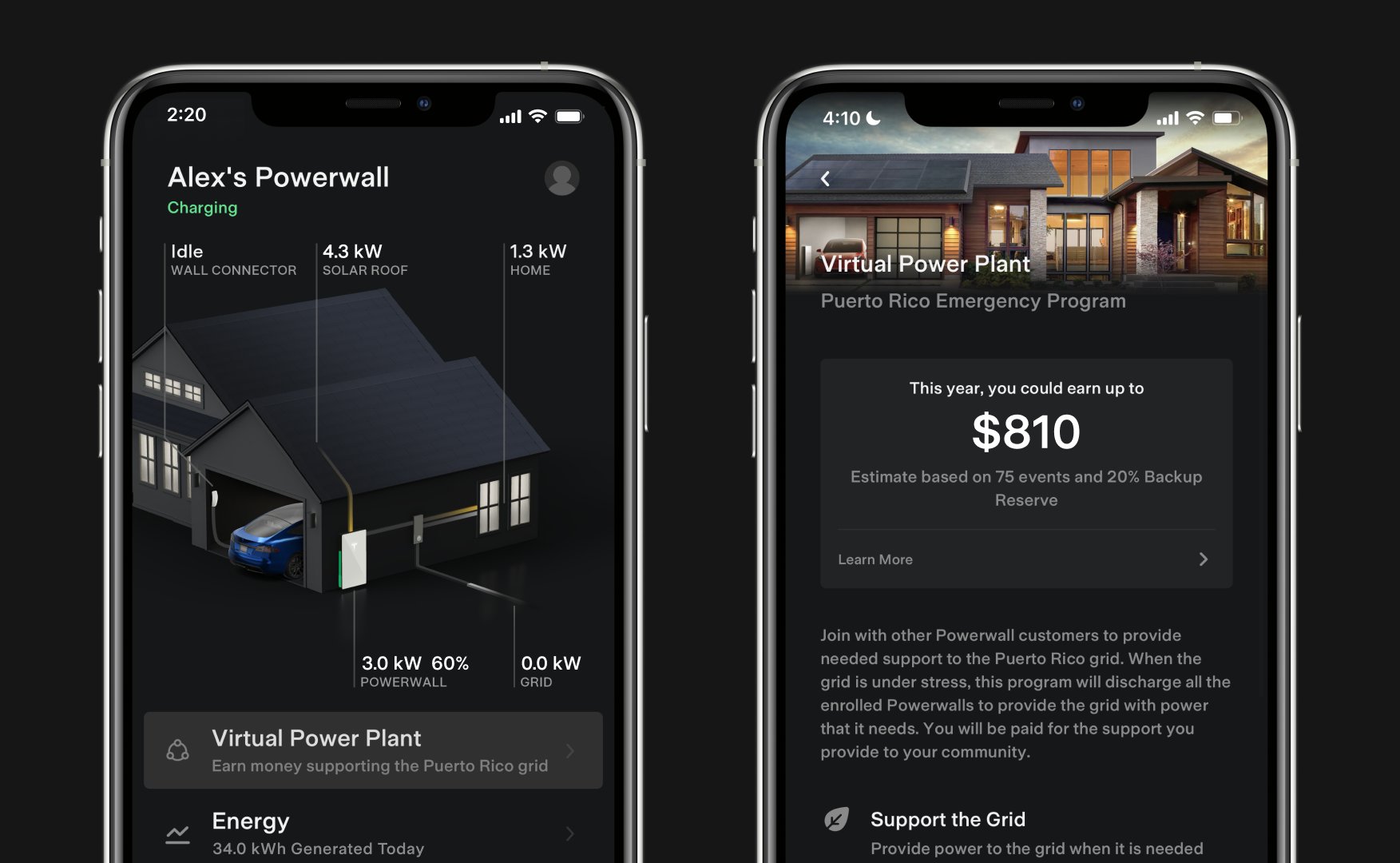

Tesla has launched its first-ever Virtual Power Plant program in the United Kingdom.

Tesla has launched its first-ever Virtual Power Plant program in the United Kingdom. This feature enables users of solar panels and energy storage systems to sell their excess energy back to the grid.

Tesla is utilizing Octopus Energy, a British renewable energy company that operates in multiple markets, including the UK, France, Germany, Italy, Spain, Australia, Japan, New Zealand, and the United States, as the provider for the VPP launch in the region.

The company states that those who enroll in the program can earn up to £300 per month.

Tesla has operated several VPP programs worldwide, most notably in California, Texas, Connecticut, and the U.S. territory of Puerto Rico. This is not the first time Tesla has operated a VPP outside the United States, as there are programs in Australia, Japan, and New Zealand.

This is its first in the UK:

Our first VPP in the UK

You can get paid to share your energy – store excess energy in your Powerwall & sell it back to the grid

You’re making £££ and the community is powered by clean energy

Win-win pic.twitter.com/evhMtJpgy1

— Tesla UK (@tesla_uk) July 17, 2025

Tesla is not the only company that is working with Octopus Energy in the UK for the VPP, as it joins SolarEdge, GivEnergy, and Enphase as other companies that utilize the Octopus platform for their project operations.

It has been six years since Tesla launched its first VPP, as it started its first in Australia back in 2019. In 2024, Tesla paid out over $10 million to those participating in the program.

Participating in the VPP program that Tesla offers not only provides enrolled individuals with the opportunity to earn money, but it also contributes to grid stabilization by supporting local energy grids.

-

Elon Musk1 day ago

Elon Musk1 day agoWaymo responds to Tesla’s Robotaxi expansion in Austin with bold statement

-

News1 day ago

News1 day agoTesla exec hints at useful and potentially killer Model Y L feature

-

Elon Musk2 days ago

Elon Musk2 days agoElon Musk reveals SpaceX’s target for Starship’s 10th launch

-

Elon Musk3 days ago

Elon Musk3 days agoTesla ups Robotaxi fare price to another comical figure with service area expansion

-

News1 day ago

News1 day agoTesla’s longer Model Y did not scale back requests for this vehicle type from fans

-

News1 day ago

News1 day ago“Worthy of respect:” Six-seat Model Y L acknowledged by Tesla China’s biggest rivals

-

News2 days ago

News2 days agoFirst glimpse of Tesla Model Y with six seats and extended wheelbase

-

Elon Musk2 days ago

Elon Musk2 days agoElon Musk confirms Tesla is already rolling out a new feature for in-car Grok