Investor's Corner

Wall Street’s reaction to Tesla’s proposed buyout of SolarCity

Since the proposed deal of Tesla to acquire SolarCity in a stock exchange with no cash involved was announced, a flurry of reports flooded the Internet, pretty much with many Wall Street reporters and pundits decrying the proposed deal as “crazy”, “not a no-brainer”, an “eclipse”, “plot of video game”, “sounds nuts”, but also with a few noting that Elon was “creating a clean energy empire” or “offering a one-stop shop.”

At the same time, the after-market reaction was swift: TSLA stock plunged 12% and SCTY stock rose 18%. This action was predictable. Since the Tesla – SolarCity deal is an exchange of stock, no cash deal, when adding about 12 million new shares, an 8% dilution of TSLA stock will occur. This dilution covers the majority of TSLA stock drop. Another negative factor is going from $2 billion of TSLA cash flow losses to $4.8 billion of cash flow losses of the combined companies, an increase of over 130%. Thirdly, TSLA debt will double after the deal. So a 12% drop should not leave anyone surprised.

Similarly, the assured “premium of approximately 21% to 30% over the closing price of SolarCity’s shares,” as stated in the letter to Lyndon Rive, pretty much matches the 29 percent rise of SCTY in extended trading, also matching SolarCity’s average 12-month price target of $29.82 among analysts surveyed by Bloomberg. So the stock action of both TSLA and SCTY was completely predictable.

Looking at the reporters / pundits comments, Bloomberg was the outlet with the most reports, 4 in all.

Tom Randell of Bloomberg reported in “Musk Buys Musk: Tesla’s SolarCity Deal by the Numbers”, that “ either Musk is bailing out a beleaguered company that’s run by his cousin, Lyndon Rive, or he’s consolidating a clean-energy empire at rock-bottom prices. Or both.”

Tom is one of the most bullish on the deal, saying that “It allows Musk to integrate the three-legged stool of clean energy in a way the world has never seen: electric cars, solar power, and grid battery storage all in one place. If so inclined, you could provide for all of your energy needs without ever leaving the Tesla family.”

Chris Martin of Bloomberg reported in “In SolarCity Bid, Tesla’s Musk Targets Customer Who Wants It All” that “Tesla Motors Inc.’s offer to buy SolarCity Corp. would combine two already deeply linked companies to offer clean energy enthusiasts a one-stop shop” and that “the challenge I see around this for both companies is that they’re kind of strapped for cash,” quoting Hugh Bromley, an analyst for Bloomberg New Energy Finance in New York. “They both need cash injections to fuel their growth.”

Dana Hull of Bloomberg reported in “Tesla Takeover of SolarCity Not a ‘No-Brainer’ for Investors” that “Oppenheimer & Co. analysts including Colin Rusch downgraded Tesla to perform from outperform in a research note published late Tuesday, saying they expect “a robust shareholder fight over this acquisition centered on corporate governance” and that “Credit Suisse Group AG analysts including Patrick Jobin said in a separate note that they expect “resistance from Tesla shareholders” and warned of “many corporate governance challenges.”

Lastly Liam Denning of Bloomberg reported in “Tesla’s SolarCity Eclipse” that “the timing is odd, to say the least. Tesla’s all-stock offer is pitched as providing SolarCity’s investors with a premium of 21 to 30 percent, based on a proposed valuation band that’s subject to completing due diligence (itself an unusual proposal)” and “Tesla is jumping in as SolarCity’s entire business model is being openly questioned amid rapid cash burn and stubbornly high overheads.”

Ominously he also reported that “Tuesday evening, not long after news of the offer broke, Tesla’s valuation had dropped by $3.8 billion in after-hours trading — 1.8 times the entire market capitalization of SolarCity before the announcement. Awkward, much?”

Ary Levi of CNBC reported in “Elon buying Elon: Sounds a lot like the plot of a video game” that this was “potential deal in which one of the country’s best-known tech billionaires will effectively transfer cash from one of his pockets to another – sounds nuts.” and joked about that “even if we all exist in a simulation, as Musk suggested at the Code Conference this month, he still has to obey securities laws.”

Christine Wang of CNBC reported in “Bid for SolarCity may mean Elon Musk doesn’t see Tesla as an auto company” quoting trader Karen Finerman saying that “Tesla’s offer, valued up to $28.50 per share, doesn’t seem like a gigantic price for a company that was trading significantly higher not that long ago.”

Charley Grant and Spencer Jakab of The Wall Street Journal reported in “Tesla Buying SolarCity: This Deal Defies Common Sense” that “just a day after Tesla boss Elon Musk made the odd boast that one of its cars “floats well enough to turn into a boat,” he did something even odder. Tesla’s bid for solar panel installation firm SolarCity on Tuesday afternoon is the sort of move that, even for the most Panglossian Silicon Valley investor, stretches the bounds of industrial logic” and that “as Mr. Musk warned about his amphibious wonder car, such harebrained schemes can only float “for short periods of time.”

Mike Ramsey, Lynn Cook and Mike Spector of The Wall Street Journal reported in “Tesla Offers to Acquire SolarCity”, quoting Elon saying that “the acquisition aims to create a company employing nearly 30,000 people with all products renamed “Tesla” that will package electric cars, batteries and solar panels for customers.” They also warned that “it would also add to the growing complexity and vertical integration of Tesla and add an unprofitable operation to its already-strained finances.”

Nichola Groom and Paul Lienert of Reuters reported in “Tesla offers $2.8 billion for SolarCity in ‘no brainer’ deal for Musk”, quoting Elon saying that that “instead of making three trips to a house to put in a car charger and solar panels and battery pack, you can integrate that into a single visit. It’s an obvious thing to do.” But they noticed that “Tesla investors punished the company’s shares, however.”

Elon Musk

Tesla analyst issues stern warning to investors: forget Trump-Musk feud

A Tesla analyst today said that investors should not lose sight of what is truly important in the grand scheme of being a shareholder, and that any near-term drama between CEO Elon Musk and U.S. President Donald Trump should not outshine the progress made by the company.

Gene Munster of Deepwater Management said that Tesla’s progress in autonomy is a much larger influence and a significantly bigger part of the company’s story than any disagreement between political policies.

Munster appeared on CNBC‘s “Closing Bell” yesterday to reiterate this point:

“One thing that is critical for Tesla investors to remember is that what’s going on with the business, with autonomy, the progress that they’re making, albeit early, is much bigger than any feud that is going to happen week-to-week between the President and Elon. So, I understand the reaction, but ultimately, I think that cooler heads will prevail. If they don’t, autonomy is still coming, one way or the other.”

BREAKING: GENE MUNSTER SAYS — $TSLA AUTONOMY IS “MUCH BIGGER” THAN ANY FEUD 👀

He says robotaxis are coming regardless ! pic.twitter.com/ytpPcwUTFy

— TheSonOfWalkley (@TheSonOfWalkley) July 2, 2025

This is a point that other analysts like Dan Ives of Wedbush and Cathie Wood of ARK Invest also made yesterday.

On two occasions over the past month, Musk and President Trump have gotten involved in a very public disagreement over the “Big Beautiful Bill,” which officially passed through the Senate yesterday and is making its way to the House of Representatives.

Musk is upset with the spending in the bill, while President Trump continues to reiterate that the Tesla CEO is only frustrated with the removal of an “EV mandate,” which does not exist federally, nor is it something Musk has expressed any frustration with.

In fact, Musk has pushed back against keeping federal subsidies for EVs, as long as gas and oil subsidies are also removed.

Nevertheless, Ives and Wood both said yesterday that they believe the political hardship between Musk and President Trump will pass because both realize the world is a better place with them on the same team.

Munster’s perspective is that, even though Musk’s feud with President Trump could apply near-term pressure to the stock, the company’s progress in autonomy is an indication that, in the long term, Tesla is set up to succeed.

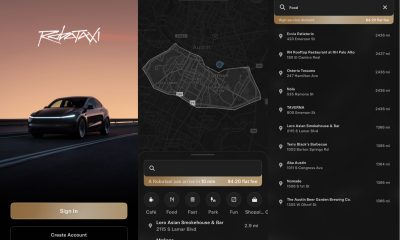

Tesla launched its Robotaxi platform in Austin on June 22 and is expanding access to more members of the public. Austin residents are now reporting that they have been invited to join the program.

Elon Musk

Tesla surges following better-than-expected delivery report

Tesla saw some positive momentum during trading hours as it reported its deliveries for Q2.

Tesla (NASDAQ: TSLA) surged over four percent on Wednesday morning after the company reported better-than-expected deliveries. It was nearly right on consensus estimations, as Wall Street predicted the company would deliver 385,000 cars in Q2.

Tesla reported that it delivered 384,122 vehicles in Q2. Many, including those inside the Tesla community, were anticipating deliveries in the 340,000 to 360,000 range, while Wall Street seemed to get it just right.

Tesla delivers 384,000 vehicles in Q2 2025, deploys 9.6 GWh in energy storage

Despite Tesla meeting consensus estimations, there were real concerns about what the company would report for Q2.

There were reportedly brief pauses in production at Gigafactory Texas during the quarter and the ramp of the new Model Y configuration across the globe were expected to provide headwinds for the EV maker during the quarter.

At noon on the East Coast, Tesla shares were up about 4.5 percent.

It is expected that Tesla will likely equal the number of deliveries it completed in both of the past two years.

It has hovered at the 1.8 million mark since 2023, and it seems it is right on pace to match that once again. Early last year, Tesla said that annual growth would be “notably lower” than expected due to its development of a new vehicle platform, which will enable more affordable models to be offered to the public.

These cars are expected to be unveiled at some point this year, as Tesla said they were “on track” to be produced in the first half of the year. Tesla has yet to unveil these vehicle designs to the public.

Dan Ives of Wedbush said in a note to investors this morning that the company’s rebound in China in June reflects good things to come, especially given the Model Y and its ramp across the world.

He also said that Musk’s commitment to the company and return from politics played a major role in the company’s performance in Q2:

“If Musk continues to lead and remain in the driver’s seat, we believe Tesla is on a path to an accelerated growth path over the coming years with deliveries expected to ramp in the back-half of 2025 following the Model Y refresh cycle.”

Ives maintained his $500 price target and the ‘Outperform’ rating he held on the stock:

“Tesla’s future is in many ways the brightest it’s ever been in our view given autonomous, FSD, robotics, and many other technology innovations now on the horizon with 90% of the valuation being driven by autonomous and robotics over the coming years but Musk needs to focus on driving Tesla and not putting his political views first. We maintain our OUTPERFORM and $500 PT.”

Moving forward, investors will look to see some gradual growth over the next few quarters. At worst, Tesla should look to match 2023 and 2024 full-year delivery figures, which could be beaten if the automaker can offer those affordable models by the end of the year.

Investor's Corner

Tesla delivers 384,000 vehicles in Q2 2025, deploys 9.6 GWh in energy storage

The quarter’s 9.6 GWh energy storage deployment marks one of Tesla’s highest to date.

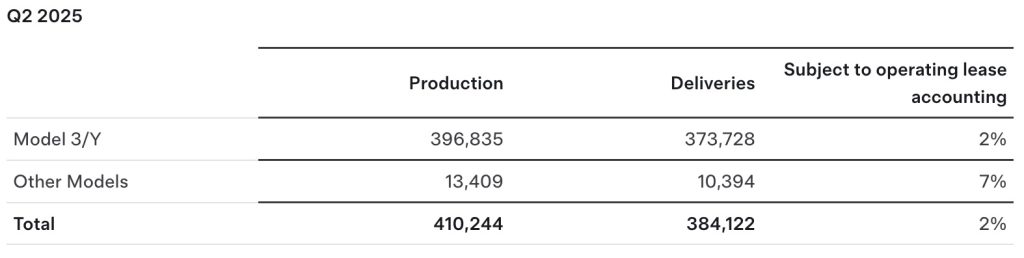

Tesla (NASDAQ: TSLA) has released its Q2 2025 vehicle delivery and production report. As per the report, the company delivered over 384,000 vehicles in the second quarter of 2025, while deploying 9.6 GWh in energy storage. Vehicle production also reached 410,244 units for the quarter.

Model 3/Y dominates output, ahead of earnings call

Of the 410,244 vehicles produced during the quarter, 396,835 were Model 3 and Model Y units, while 13,409 were attributed to Tesla’s other models, which includes the Cybertruck and Model S/X variants. Deliveries followed a similar pattern, with 373,728 Model 3/Ys delivered and 10,394 from other models, totaling 384,122.

The quarter’s 9.6 GWh energy storage deployment marks one of Tesla’s highest to date, signaling continued strength in the Megapack and Powerwall segments.

Year-on-year deliveries edge down, but energy shows resilience

Tesla will share its full Q2 2025 earnings results after the market closes on Wednesday, July 23, 2025, with a live earnings call scheduled for 4:30 p.m. CT / 5:30 p.m. ET. The company will publish its quarterly update at ir.tesla.com, followed by a Q&A webcast featuring company leadership. Executives such as CEO Elon Musk are expected to be in attendance.

Tesla investors are expected to inquire about several of the company’s ongoing projects in the upcoming Q2 2025 earnings call. Expected topics include the new Model Y ramp across the United States, China, and Germany, as well as the ramp of FSD in territories outside the US and China. Questions about the company’s Robotaxi business, as well as the long-referenced but yet to be announced affordable models are also expected.

-

Elon Musk5 days ago

Elon Musk5 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News1 week ago

News1 week agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoFirst Look at Tesla’s Robotaxi App: features, design, and more

-

News2 weeks ago

News2 weeks agoSpaceX and Elon Musk share insights on Starship Ship 36’s RUD

-

News2 weeks ago

News2 weeks agoWatch Tesla’s first driverless public Robotaxi rides in Texas

-

News1 week ago

News1 week agoWatch the first true Tesla Robotaxi intervention by safety monitor

-

News2 weeks ago

News2 weeks agoTesla has started rolling out initial round of Robotaxi invites

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla to launch in India in July with vehicles already arriving: report