Energy

Analysts and Energy Experts Weigh in on Tesla’s Powerwall

“Data wins” is the zeitgeist of today’s tech culture and number crunching is now being done by energy experts and analysts around Tesla’s new Powerwall products. Numerous analysts are focusing on the prodigious sums of capital being spent by Tesla in many product areas lately and now want to see if battery revenue will come sooner or later for the company.

According to Bidness ETC post, “UBS,the financial services firm, predicts that the 7kWh version of the Powerwall will have a payback in six years for the consumer, and will also deliver an Internal Rate of Return (IRR) of about 9%” in Australia for Tesla. UBS concludes a payback in little as six years will be very attractive in Australia and, if the project is reaping such a return, it means that the Powerwall will be adopted by the mass-market sooner than expected.”

The reason for the bullish prediction is due to Australia’s “massive solar penetration,” and total cost for the system at approximately $5,175 (U.S.), according to UBS.

Aug 30, TeslaEnergy event: Elon Musk describing the commercial-grade Tesla PowerPack’s ability to power entire cities.

Musk mentioned in the most recent conference call that the 7kWh battery pack would be ideal for countries outside the US. This seems to the be the case according to UBS and maybe Germany, too.

A recent post at the Catalytic Engineering blog examines the 7kWh powerwall product for Germany and how it could be a perfect fit due the frugal use of energy by consumers—partially due to its high cost in the country. According to the site, Germans average energy around 3,000-4,000 kWh /household/year, which works out to 8-11 kWh/day.”

The site ran a test case for Germany and see the summary below:

That means the baseline case, where you already have the solar panel, but don’t buy the Powerwall. As a result, you sell that surplus solar power directly to the grid at the $0.12 rate. After currency exchange and this earns a net present value of $2,911 over 10 years (again, in constant 2015 dollars).

The difference is so small with these assumptions, that buying the Powerwall basically breaks even versus not buying one. As prices come down and installers compete to install the product, it looks to be even more viable on a purely economic basis.

Also included in the post is an online calculator and the ability to determine whether your own solar panel setup is suited for a battery storage solution.

Data and context wins the day in the scenario above and past research by Navigant shows a great desire for green power (solar) by electric car owners. The only fly in the ointment is the death-to-solar agenda by utilities, such as WE Energy in Wisconsin and Arizona utilities (See Solar City’s letter). These utilities are attaching substantial fees to solar owners that negate or slow down a quicker return on investment.

So for the time being, it looks like data for battery storage is holding its own and flys in the face of Bloomberg’s Powerwall analysis from earlier this month.

Now if data would win in state capitols and in Congress, we could really be doing something.

Energy

Tesla launches first Virtual Power Plant in UK – get paid to use solar

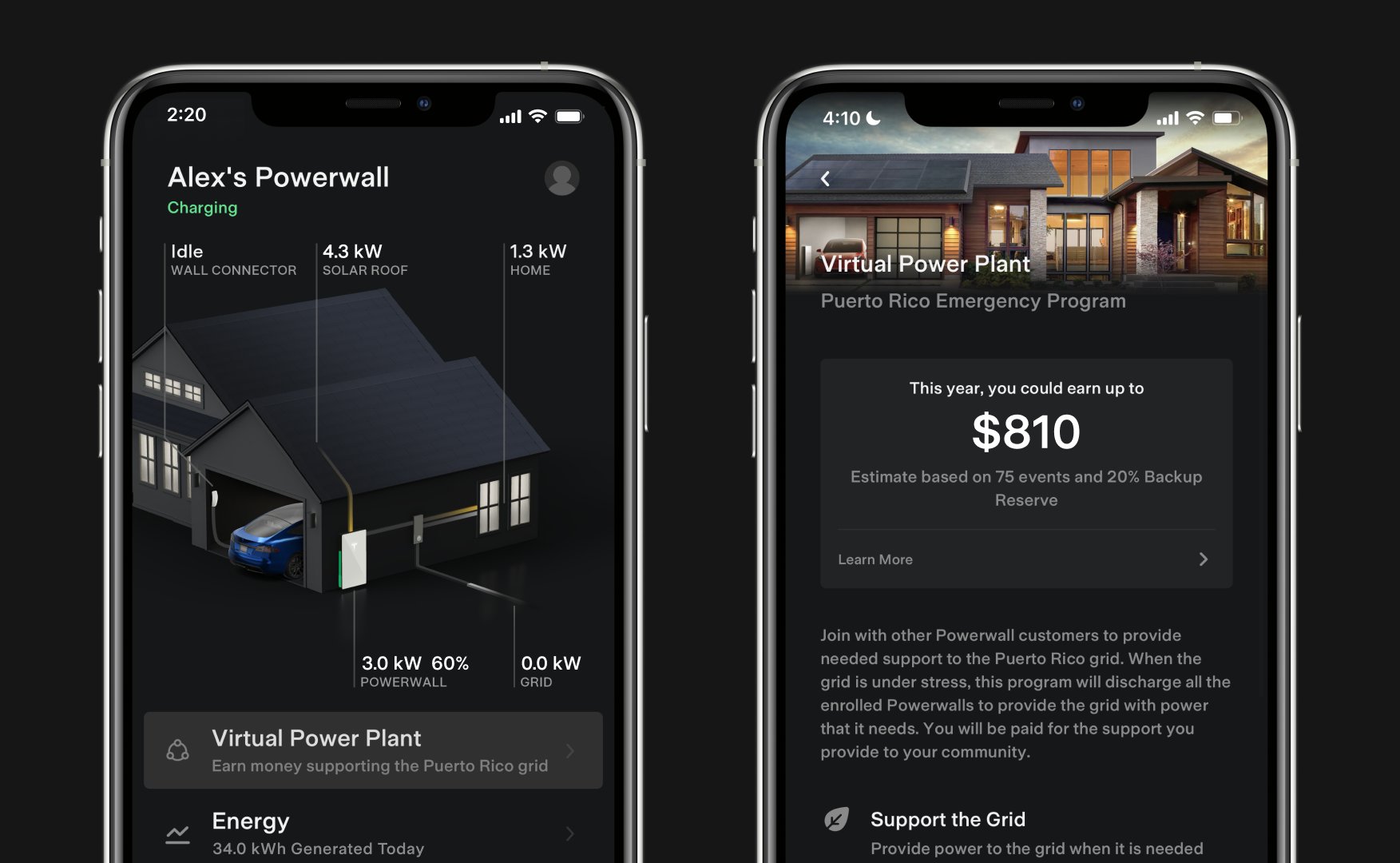

Tesla has launched its first-ever Virtual Power Plant program in the United Kingdom.

Tesla has launched its first-ever Virtual Power Plant program in the United Kingdom. This feature enables users of solar panels and energy storage systems to sell their excess energy back to the grid.

Tesla is utilizing Octopus Energy, a British renewable energy company that operates in multiple markets, including the UK, France, Germany, Italy, Spain, Australia, Japan, New Zealand, and the United States, as the provider for the VPP launch in the region.

The company states that those who enroll in the program can earn up to £300 per month.

Tesla has operated several VPP programs worldwide, most notably in California, Texas, Connecticut, and the U.S. territory of Puerto Rico. This is not the first time Tesla has operated a VPP outside the United States, as there are programs in Australia, Japan, and New Zealand.

This is its first in the UK:

Our first VPP in the UK

You can get paid to share your energy – store excess energy in your Powerwall & sell it back to the grid

You’re making £££ and the community is powered by clean energy

Win-win pic.twitter.com/evhMtJpgy1

— Tesla UK (@tesla_uk) July 17, 2025

Tesla is not the only company that is working with Octopus Energy in the UK for the VPP, as it joins SolarEdge, GivEnergy, and Enphase as other companies that utilize the Octopus platform for their project operations.

It has been six years since Tesla launched its first VPP, as it started its first in Australia back in 2019. In 2024, Tesla paid out over $10 million to those participating in the program.

Participating in the VPP program that Tesla offers not only provides enrolled individuals with the opportunity to earn money, but it also contributes to grid stabilization by supporting local energy grids.

Energy

Tesla Lathrop Megafactory celebrates massive Megapack battery milestone

The Tesla Megapack is the backbone of Tesla Energy’s battery deployments.

The Tesla Lathrop Megafactory recently achieved a new milestone. As per the official Tesla Megapack account on X, the Lathrop Megafactory has produced its 15,000th Megapack 2 XL battery.

15,000 Megapack Batteries

Tesla celebrated the milestone with a photo of the Lathrop Megafactory team posing with a freshly produced Megapack battery. To commemorate the event, the team held balloons that spelled out “15,000” as they posed for the photo.

The Tesla Megapack is the backbone of Tesla Energy’s battery deployments. Designed for grid-scale applications, each Megapack offers 3.9 MWh of energy and 1.9 MW of power. The battery is extremely scalable, making it perfect for massive energy storage projects.

More Megafactories

The Lathrop Megafactory is Tesla’s first dedicated facility for its flagship battery storage system. It currently stands as the largest utility-scale battery factory in North America. The facility is capable of producing 10,000 Megapack batteries every year, equal to 40 GWh of clean energy storage.

Thanks to the success of the Megapack, Tesla has expanded its energy business by building and launching the Shanghai Megafactory, which is also expected to produce 40 GWh of energy storage per year. The ramp of the Shanghai Megafactory is quite impressive, with Tesla noting in its Q1 2025 Update Letter that the Shanghai Megafactory managed to produce over 100 Megapack batteries in the first quarter alone.

Tesla Energy’s Potential

During the first quarter earnings call, CEO Elon Musk stated that the Megapack is extremely valuable to the energy industry.

“The Megapack enables utility companies to output far more total energy than would otherwise be the case… This is a massive unlock on total energy output of any given grid over the course of a year. And utility companies are beginning to realize this and are buying in our Megapacks at scale,” Musk said.

Energy

Tesla Megapacks powers the xAI Colossus supercomputer

Tesla Megapacks step in to stabilize xAI’s Colossus supercomputer, replacing natural gas turbines. Musk’s ventures keep intertwining.

Tesla Megapack batteries will power the xAI Colossus supercomputer in Memphis to ensure power stability. The collaboration between Tesla and xAI highlights the synergy among Elon Musk’s ventures.

The artificial intelligence startup has integrated Tesla Megapacks to manage outages and demand surges, bolstering the facility’s reliability. The Greater Memphis Chamber announced that Colossus, recently connected to a new 150-megawatt electric substation, is completing its first construction phase. This transition addresses criticism from environmental justice groups over the initial use of natural gas turbines.

“The temporary natural gas turbines that were being used to power the Phase I GPUs prior to grid connection are now being demobilized and will be removed from the site over the next two months.

“About half of the operating turbines will remain operating to power Phase II GPUs of xAI until a second substation (#22) already in construction is completed and connected to the electric grid, which is planned for the Fall of 2025, at which time the remaining turbines will be relegated to a backup power role,” the Chamber stated.

xAI’s rapid development of Colossus reflects its ambition to advance AI capabilities, but the project has faced scrutiny for environmental impacts. The shift to Megapacks and grid power aims to mitigate these concerns while ensuring operational continuity.

The Megapack deployment underscores the collaboration among Musk’s companies, including Tesla, SpaceX, Neuralink, and The Boring Company. Tesla appears to be the common link between all of Musk’s companies. For example, The Boring Company built a tunnel in Giga, Texas. In addition, Musk has hinted at a potential collaboration between the Tesla Optimus Bot and Neuralink. And from January 2024 to February 2025, xAI invested $230 million in Megapacks, per a Tesla filing.

Tesla Energy reported a 156% year-over-year increase in Q1 2025, deploying 10.4 GWh of storage products, including Megapacks and Powerwalls. Tesla’s plans for a new Megapack factory in Waller County, Texas, which is expected to create 1,500 jobs in the area, further signal its commitment to scaling energy solutions.

As xAI leverages Tesla’s Megapacks to power Colossus, the integration showcases Musk’s interconnected business ecosystem. The supercomputer’s enhanced stability positions xAI to drive AI innovation, while Tesla’s energy solutions gain prominence, setting the stage for broader technological and economic impacts.

-

Elon Musk1 day ago

Elon Musk1 day agoWaymo responds to Tesla’s Robotaxi expansion in Austin with bold statement

-

News1 day ago

News1 day agoTesla exec hints at useful and potentially killer Model Y L feature

-

Elon Musk2 days ago

Elon Musk2 days agoElon Musk reveals SpaceX’s target for Starship’s 10th launch

-

Elon Musk3 days ago

Elon Musk3 days agoTesla ups Robotaxi fare price to another comical figure with service area expansion

-

News1 day ago

News1 day agoTesla’s longer Model Y did not scale back requests for this vehicle type from fans

-

News1 day ago

News1 day ago“Worthy of respect:” Six-seat Model Y L acknowledged by Tesla China’s biggest rivals

-

News2 days ago

News2 days agoFirst glimpse of Tesla Model Y with six seats and extended wheelbase

-

Elon Musk2 days ago

Elon Musk2 days agoElon Musk confirms Tesla is already rolling out a new feature for in-car Grok