News

Indiana is back with another bill to ban Tesla’s direct sales model

If a proposed Indiana House bill is passed, manufacturers of “all-electric vehicles” would be banned from selling directly to consumers. The bill does not direct any specific language to Tesla Motors, Inc., but the innovative vehicle manufacturer is clearly the target of the legislation. Add Indiana into the mix of Tesla’s long list of court cases pending in which car dealers and automakers claim that they, as intermediaries, have sole right to sell vehicles to consumers.

Indiana House Bill 1592

Indiana automakers have traditionally used an established network of dealers who negotiate with buyers and provide automotive repair services. These automakers are part of a large umbrella of politically influential groups. They argue that Tesla’s model allows the company to evade laws, which confers an unfair advantage to Tesla and provides no accountability to its buyers.

Here is the synopsis of the Indiana House Bill 1592.

Automobile sales requirements. Provides that a manufacturer may engage in sales directly to the public only if the manufacturer meets certain requirements. Provides that a manufacturer can no longer engage in sales directly to the public after the earlier of: (1) reaching 1,000 units in cumulative annual sales; or (2) six years after the initial dealer’s license is granted.

Additionally, Sec. 20. of the bill reads:

A manufacturer licensed under this article may engage in sales directly to the general public only if the manufacturer (1) has exclusively offered for sale to the general public in Indiana all-electric vehicles on a continuous basis since July 15, 2015; (2) has never offered for sale to the general public in Indiana a line make of new motor vehicles through a franchised motor vehicle dealer.

Tesla is the only vehicle manufacturer which meets these particular criteria. Tesla sells its electric vehicles directly to consumers, while other manufacturers like General Motors, Ford, Subaru, and Toyota sell through Indiana dealerships. If passed, the bill would severely limit Tesla’s ability as a manufacturer to sell to the public:

Subject to the expiration schedule under IC 9-32-11-12.5, a manufacturer can no longer sell to the public after the earlier of the following: (1) A manufacturer described in this section reaches cumulative annual sales of one thousand (1,000) units to the general public from its licensed location in Indiana.

The author of the bill, Rep. Edmond Soliday, a Republican, has authored or co-authored several transportation bills, including transportation infrastructure funding, automated traffic enforcement, vehicle excise taxes, and department of transportation property matters. He defeated Midwest Environmental Systems CEO Pamela Fish in the November, 2016 elections. House Bill 1592 will be heard by the Roads and Transportation committee.

Last year another Republican, Rep. Kevin Mahan, supported a similar bill that would have forced manufacturers to sell their vehicles through a dealership. “For the average Hoosier, purchasing an automobile can be daunting and a big investment,” Mahan said. “A greater variety of vehicles are now available and can be brought directly to consumers virtually anywhere in the country. In the event of a recall or malfunction, consumers should be protected.”

Arguments against limiting manufacturer sales

Tesla Motors, Inc.’s Vice President of Corporate and Business Development Diarmuid O’Connell testified against House Bill 1592. “Tesla does not operate through some kind of loophole in Indiana law,” O’Connell said. “The current law is explicit in Tesla’s ability to sell directly and, as written today, it is not broken.” O’Connell’s remarks point to current Indiana law in which an auto manufacturer is not allowed to open a store in direct competition with an affiliated franchised dealer. Tesla has no direct competition franchise dealers in Indiana and has always sold directly to consumers. O’Connell added that Tesla’s presence in Indiana has “brought only good to the consumer welfare without harming anyone — not even the dealers.”

At stake is more than a corporate tug-of-war between automakers. Tesla’s electric vehicles are at the heart of that vision for tomorrow’s consumer domestic transportation and will continue to flourish and change the way automakers in the U.S. and abroad have conducted business as usual.

If “you’re interested in promoting competition and free market principles … you recognize direct distribution, particularly for a company like Tesla, is critically important,” said Todd Maron, the company’s chief counsel, during remarks at a 2016 Federal Trade Commission event. “We don’t simply believe that [electric vehicles] represent a nice complement to gas powered cars. We believe that it’s imperative that they are replaced entirely by electric vehicles.” An end to franchising laws would advance that goal and place low-mileage gas-powered vehicles at risk of obsolescence.

Arguments in favor of limiting manufacturer sales

A coalition of free market groups, led by Americans for Tax Reform President Grover Norquist, argues that ending or restricting automotive franchising would actually decrease consumer choice. Norquist believes that reducing competition among dealers selling the same car brands hurts consumers. Franchising laws were actually created by anti-trust efforts at the Federal Trade Commission and “they sustain market competition rather than undermine it.” Last year, the group accused federal regulators of ignoring evidence that would undermine proposed measures governing automotive sales that stand to enrich what they saw as a “politically-powerful company” at consumers’ expense.

Harry Tepe, owner of Tom Tepe Auto Center in Milan, Indiana, supports legislation that would further protect consumers in the auto industry. “We just want to make sure there are protections in place for the consumers,” Tepe said. “The issue at hand is that the loophole is still open that allows any manufacturer to come in and market a vehicle and sell directly to the public without having any protections in place for the consumer.” He takes the position that dealerships are responsible for being a liaison between the consumer and the manufacturer.

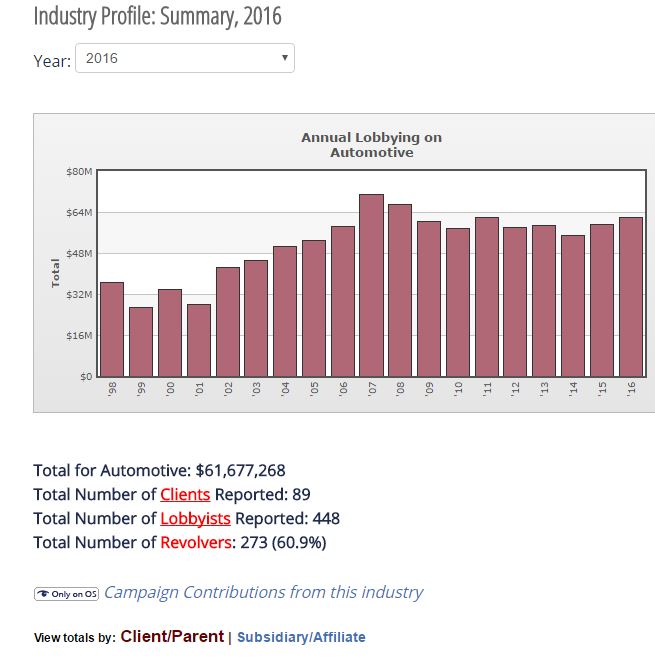

Lobbying on behalf of the automotive industry

Proponents and opponents of Indiana House Bill 1592 are, in many cases, influenced by a powerful automotive lobby in the U.S. Automotive industry lobbyists use a combination of strategies to gain influence. They do a lot of research, sit down with lawmakers one-on-one, deliver messages in writing, and call Congressmen and members of the administration on the phone.

“If you’re a big company, like a carmaker, and you’re lobbying lawmakers, you’re almost like a pro sports team. You want to get the big names, the most talented, most knowledgeable people,” said David Levinthal, communications director for the Center for Responsive Politics, a non-partisan research group that tracks the money spent in the U.S. political system and its effect on elections and public policy. “So, these big companies, in the major industries, hire former Congressmen and top Congressional staffers and other high-ranking government officials to be their lobbyists, because those are the folks who know who all the other major players are and they know the ways of Washington.”

News

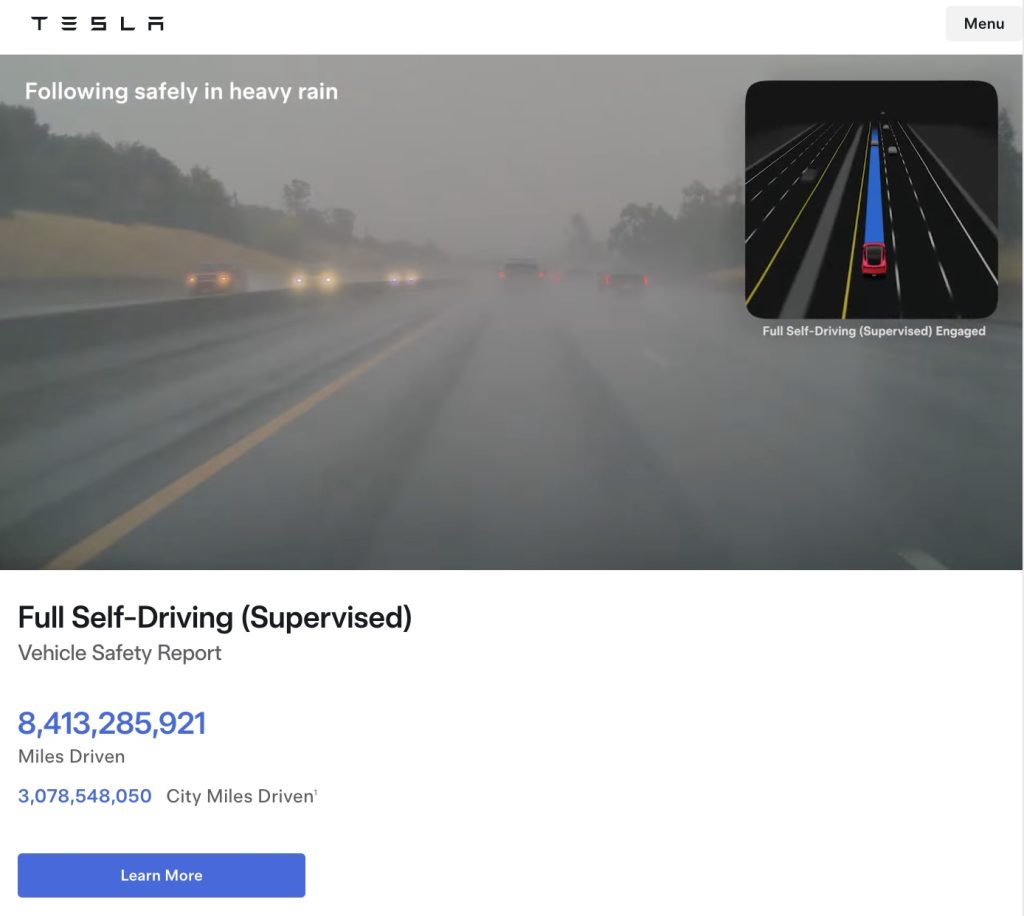

Tesla FSD (Supervised) fleet passes 8.4 billion cumulative miles

The figure appears on Tesla’s official safety page, which tracks performance data for FSD (Supervised) and other safety technologies.

Tesla’s Full Self-Driving (Supervised) system has now surpassed 8.4 billion cumulative miles.

The figure appears on Tesla’s official safety page, which tracks performance data for FSD (Supervised) and other safety technologies.

Tesla has long emphasized that large-scale real-world data is central to improving its neural network-based approach to autonomy. Each mile driven with FSD (Supervised) engaged contributes additional edge cases and scenario training for the system.

The milestone also brings Tesla closer to a benchmark previously outlined by CEO Elon Musk. Musk has stated that roughly 10 billion miles of training data may be needed to achieve safe unsupervised self-driving at scale, citing the “long tail” of rare but complex driving situations that must be learned through experience.

The growth curve of FSD Supervised’s cumulative miles over the past five years has been notable.

As noted in data shared by Tesla watcher Sawyer Merritt, annual FSD (Supervised) miles have increased from roughly 6 million in 2021 to 80 million in 2022, 670 million in 2023, 2.25 billion in 2024, and 4.25 billion in 2025. In just the first 50 days of 2026, Tesla owners logged another 1 billion miles.

At the current pace, the fleet is trending towards hitting about 10 billion FSD Supervised miles this year. The increase has been driven by Tesla’s growing vehicle fleet, periodic free trials, and expanding Robotaxi operations, among others.

With the fleet now past 8.4 billion cumulative miles, Tesla’s supervised system is approaching that threshold, even as regulatory approval for fully unsupervised deployment remains subject to further validation and oversight.

Elon Musk

Elon Musk fires back after Wikipedia co-founder claims neutrality and dubs Grokipedia “ridiculous”

Musk’s response to Wales’ comments, which were posted on social media platform X, was short and direct: “Famous last words.”

Elon Musk fired back at Wikipedia co-founder Jimmy Wales after the longtime online encyclopedia leader dismissed xAI’s new AI-powered alternative, Grokipedia, as a “ridiculous” idea that is bound to fail.

Musk’s response to Wales’ comments, which were posted on social media platform X, was short and direct: “Famous last words.”

Wales made the comments while answering questions about Wikipedia’s neutrality. According to Wales, Wikipedia prides itself on neutrality.

“One of our core values at Wikipedia is neutrality. A neutral point of view is non-negotiable. It’s in the community, unquestioned… The idea that we’ve become somehow ‘Wokepidea’ is just not true,” Wales said.

When asked about potential competition from Grokipedia, Wales downplayed the situation. “There is no competition. I don’t know if anyone uses Grokipedia. I think it is a ridiculous idea that will never work,” Wales wrote.

After Grokipedia went live, Larry Sanger, also a co-founder of Wikipedia, wrote on X that his initial impression of the AI-powered Wikipedia alternative was “very OK.”

“My initial impression, looking at my own article and poking around here and there, is that Grokipedia is very OK. The jury’s still out as to whether it’s actually better than Wikipedia. But at this point I would have to say ‘maybe!’” Sanger stated.

Musk responded to Sanger’s assessment by saying it was “accurate.” In a separate post, he added that even in its V0.1 form, Grokipedia was already better than Wikipedia.

During a past appearance on the Tucker Carlson Show, Sanger argued that Wikipedia has drifted from its original vision, citing concerns about how its “Reliable sources/Perennial sources” framework categorizes publications by perceived credibility. As per Sanger, Wikipedia’s “Reliable sources/Perennial sources” list leans heavily left, with conservative publications getting effectively blacklisted in favor of their more liberal counterparts.

As of writing, Grokipedia has reportedly surpassed 80% of English Wikipedia’s article count.

News

Tesla Sweden appeals after grid company refuses to restore existing Supercharger due to union strike

The charging site was previously functioning before it was temporarily disconnected in April last year for electrical safety reasons.

Tesla Sweden is seeking regulatory intervention after a Swedish power grid company refused to reconnect an already operational Supercharger station in Åre due to ongoing union sympathy actions.

The charging site was previously functioning before it was temporarily disconnected in April last year for electrical safety reasons. A temporary construction power cabinet supplying the station had fallen over, described by Tesla as occurring “under unclear circumstances.” The power was then cut at the request of Tesla’s installation contractor to allow safe repair work.

While the safety issue was resolved, the station has not been brought back online. Stefan Sedin, CEO of Jämtkraft elnät, told Dagens Arbete (DA) that power will not be restored to the existing Supercharger station as long as the electric vehicle maker’s union issues are ongoing.

“One of our installers noticed that the construction power had been backed up and was on the ground. We asked Tesla to fix the system, and their installation company in turn asked us to cut the power so that they could do the work safely.

“When everything was restored, the question arose: ‘Wait a minute, can we reconnect the station to the electricity grid? Or what does the notice actually say?’ We consulted with our employer organization, who were clear that as long as sympathy measures are in place, we cannot reconnect this facility,” Sedin said.

The union’s sympathy actions, which began in March 2024, apply to work involving “planning, preparation, new connections, grid expansion, service, maintenance and repairs” of Tesla’s charging infrastructure in Sweden.

Tesla Sweden has argued that reconnecting an existing facility is not equivalent to establishing a new grid connection. In a filing to the Swedish Energy Market Inspectorate, the company stated that reconnecting the installation “is therefore not covered by the sympathy measures and cannot therefore constitute a reason for not reconnecting the facility to the electricity grid.”

Sedin, for his part, noted that Tesla’s issue with the Supercharger is quite unique. And while Jämtkraft elnät itself has no issue with Tesla, its actions are based on the unions’ sympathy measures against the electric vehicle maker.

“This is absolutely the first time that I have been involved in matters relating to union conflicts or sympathy measures. That is why we have relied entirely on the assessment of our employer organization. This is not something that we have made any decisions about ourselves at all.

“It is not that Jämtkraft elnät has a conflict with Tesla, but our actions are based on these sympathy measures. Should it turn out that we have made an incorrect assessment, we will correct ourselves. It is no more difficult than that for us,” the executive said.