News

SpaceX worth $33B after raising more than $1B for Starlink and Starship

Since April 2018, SpaceX has successfully raised more than $1.24 billion through the sale of equity, likely sold to investors by extrapolating the company’s current record of success to include the potential of its next two products, Starlink and Starship.

Thanks to SpaceX’s successful streak of fundraising, the company is now valued at $33.3 billion according to sources that spoke with CNBC reporter Michael Sheetz. The same source indicated that demand for SpaceX equity remains strong as the company seeks to continue extremely expensive development and production programs. Most notably, SpaceX is simultaneously building two full-scale orbital Starship prototypes at separate facilities in Texas and Florida, readying an earlier Starhopper testbed for serious test flights, and is in the midst of ramping up its Starlink satellite production to levels unprecedented in the history of spaceflight.

Put simply, with SpaceX’s Starship and Starlink programs simultaneously entering into capital-intensive phases of development and production, the company has a huge amount of work on its plate. Most of that work involves testing prototypes with technologies that are frequently unprecedented, as well as refining those designs into something final and worthy of serious production. In the case of Starship, a great deal of integrated testing and design finalization lies ahead before SpaceX can even think about starting serial production of its ~50m (160 ft) tall steel Starships or ~60m (200 ft) Super Heavy boosters.

Although large-scale aerospace development programs already tend to be very expensive, SpaceX (led by CEO Elon Musk) has structured its Starship/Super Heavy development program to be extremely hardware-rich. This is another way to say that prototypes are constantly being built, designs are ever-changing, and hardware is constantly being severely damaged (or even destroyed) during fast-paced testing. SpaceX (and Musk) have often been famous for preferring development programs that move fast and break things, delivering knowledge and optimizing designs through lessons learned (often the hard way). SpaceX also values “scrappiness” in its programs, although that sadly ends up coming at the cost of employee pay (below industry standards) and benefits (scarce bonuses, no 401K-matching, extreme hours, minimal work-life balance).

Put it all together and the results of SpaceX-style development programs have frequently defied cemented industry expectations and beliefs. SpaceX has built – from scratch – entire launch vehicles (Falcon 9 V1.0) and spacecraft (Cargo Dragon) 5-10 times cheaper than NASA believed possible. SpaceX has successfully developed a commercially viable style of reusable rockets and took just ~30 months to go from its first attempted landing to a successful booster recovery and less than 15 months after that to reuse its first booster on a commercial, orbital-class launch. Competitors that vehemently denied that SpaceX would succeed are now 5-10 years behind with disinterested responses to the reusable titan that is Falcon 9/Falcon Heavy.

Still, while SpaceX’s record of commercial and technical spaceflight success is second-to-none since the Apollo Program and the early days of the Space Shuttle, even its extraordinarily cost-effective development style requires major funding in the face of ambitions as grand as Starship and Starlink.

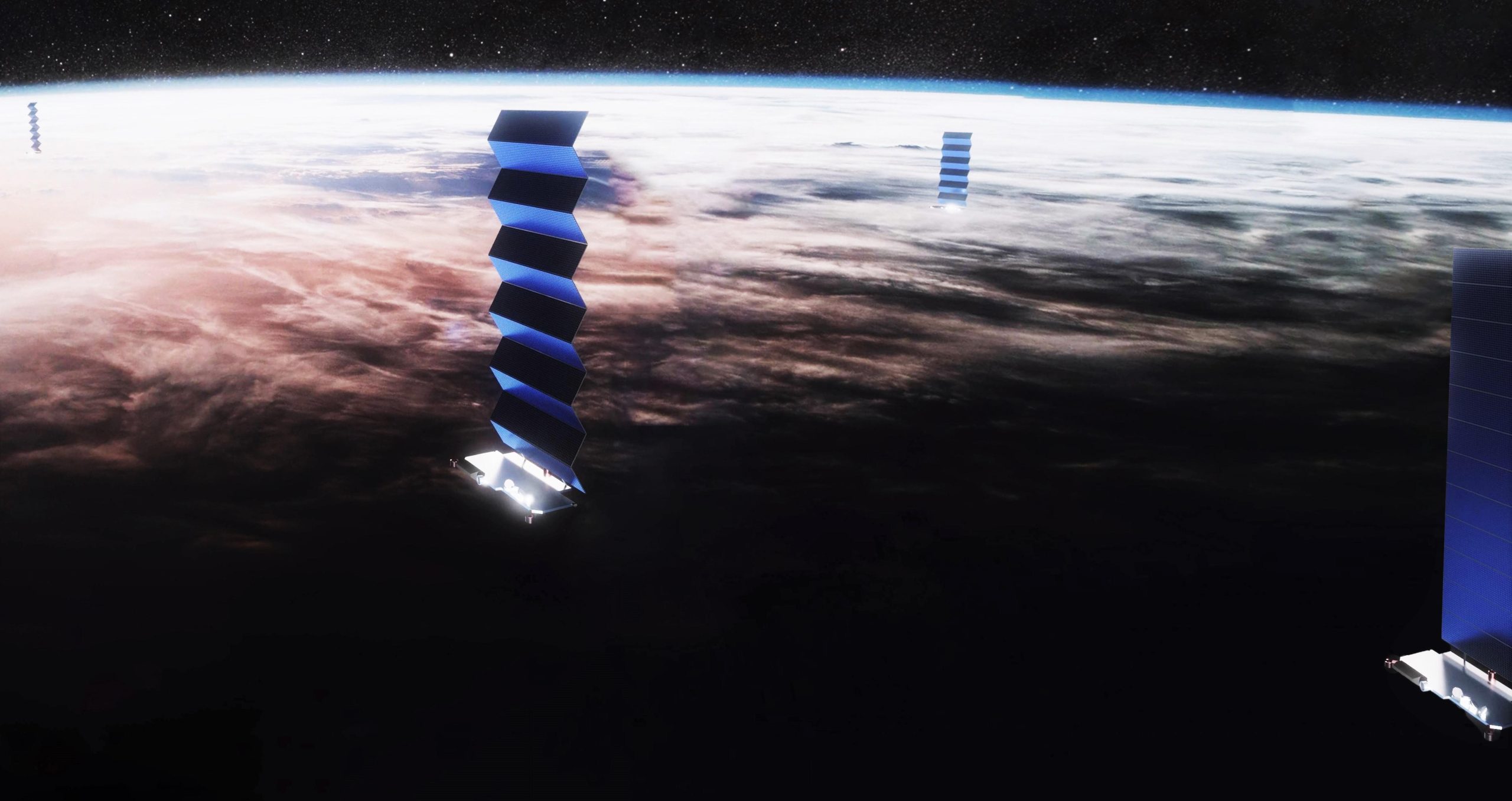

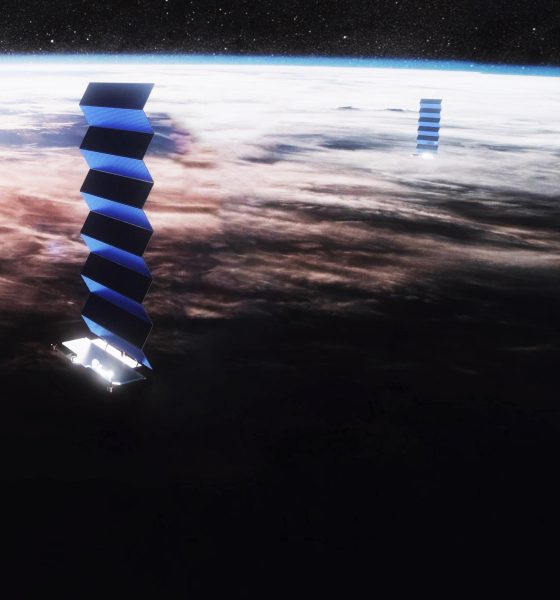

Starlink races ahead

On May 23rd, SpaceX completed an extraordinarily ambitious Starlink launch debut, placing sixty “v0.9” spacecraft into low Earth orbit (LEO). Weighing no less than 16.5 tons (~36,000 lb), SpaceX’s first dedicated Starlink mission also became the heaviest payload the company has ever launched by at least ~30%. Aside from the spectacular statistics associated with the mission, SpaceX also debuted an exotic and largely unprecedented satellite form factor, stacking each flat, rectangular ~230 kg (510 lb) spacecraft like a deck of cards. With Starlink, SpaceX has also flown the first krypton-powered ion thrusters, replacing the traditional xenon to cut as much as $100,000 (or even more) from the cost of each satellite.

“We continue to track the progress of the Starlink satellites during early orbit operations. At this point, all 60 satellites have deployed their solar arrays successfully, generated positive power and communicated with our ground stations. Most are already using their onboard propulsion system to reach their operational altitude and have made initial contact using broadband phased array antennas. SpaceX continues to monitor the constellation for any satellites that may need to be safely deorbited. All the satellites have maneuvering capability and are programmed to avoid each other and other objects in orbit by a wide margin.” — SpaceX, May 31st

~20 days after launch, all 60 satellites are in contact with SpaceX ground controllers and all but 3-4 have managed to successfully begin raising their orbits from ~450 km to 550 km (280-340 mi). Roughly two dozen have already passed 500 km and most should reach their final orbits within 1-2 weeks.

By far the most significant news, however, was CEO Elon Musk’s confidence that SpaceX already has “sufficient capital to build an operational constellation”, likely referring to a constellation of 750-1500 spacecraft capable of either covering the entire US or offering “decent global coverage”. Of note, Musk made this comment days before SpaceX – via SEC filings – effectively announced that it has already raised more than $1B in 2019. A large portion – if not all – of that funding is thus likely bound for Starlink as the program’s shockingly small team of ~400 prepares to aggressively ramp up production.

According to both COO Gwynne Shotwell, Musk, and SpaceX, the company hopes to conduct an additional 1-5 launches of 60 Starlink satellites this year, potentially leaving SpaceX with a constellation of more than 400 satellites – with a total bandwidth of 7 terabits per second (tbps) – after just eight months of launches. Equally significant, SpaceX’s official Starlink.com website states that SpaceX wants to offer real internet service to an unspecified number of US and Canada consumers after just six launches. In other words, SpaceX could deliver the first (possibly alpha or beta) taste of consumer Starlink internet service by the end of 2019.

If SpaceX can deploy the constellation soon and Starlink reaches its cost, performance, and longevity targets, it’s safe to say that SpaceX’s private investors are going to be extraordinarily happy with their financial decision.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

Cybertruck

Tesla analyst claims another vehicle, not Model S and X, should be discontinued

Tesla analyst Gary Black of The Future Fund claims that the company is making a big mistake getting rid of the Model S and Model X. Instead, he believes another vehicle within the company’s lineup should be discontinued: the Cybertruck.

Black divested The Future Fund from all Tesla holdings last year, but he still covers the stock as an analyst as it falls in the technology and autonomy sectors, which he covers.

In a new comment on Thursday, Black said the Cybertruck should be the vehicle Tesla gets rid of due to the negatives it has drawn to the company.

The Cybertruck is also selling in an underwhelming fashion considering the production capacity Tesla has set aside for it. It’s worth noting it is still the best-selling electric pickup on the market, and it has outlasted other EV truck projects as other manufacturers are receding their efforts.

Black said:

“IMHO it’s a mistake to keep Tesla Cybertruck which has negative brand equity and sold 10,000 units last year, and discontinue S/X which have strong repeat brand loyalty and together sold 30K units and are highly profitable. Why not discontinue CT and covert S/X to be fully autonomous?”

IMHO it’s a mistake to keep $TSLA Cybertruck which has negative brand equity and sold 10,000 units last year, and discontinue S/X which have strong repeat brand loyalty and together sold 30K units and are highly profitable. Why not discontinue CT and covert S/X to be fully…

— Gary Black (@garyblack00) January 29, 2026

On Wednesday, CEO Elon Musk confirmed that Tesla planned to transition Model S and Model X production lines at the Fremont Factory to handle manufacturing efforts of the Optimus Gen 3 robot.

Musk said that it was time to wind down the S and X programs “with an honorable discharge,” also noting that the two cars are not major contributors to Tesla’s mission any longer, as its automotive division is more focused on autonomy, which will be handled by Model 3, Model Y, and Cybercab.

Tesla begins Cybertruck deliveries in a new region for the first time

The news has drawn conflicting perspectives, with many Tesla fans upset about the decision, especially as it ends the production of the largest car in the company’s lineup. Tesla’s focus is on smaller ride-sharing vehicles, especially as the vast majority of rides consist of two or fewer passengers.

The S and X do not fit in these plans.

Nevertheless, the Cybertruck fits in Tesla’s future plans. Musk said the pickup will be needed for the transportation of local goods. Musk also said Cybertruck would be transitioned to an autonomous line.

Elon Musk

SpaceX reportedly discussing merger with xAI ahead of blockbuster IPO

In a groundbreaking new report from Reuters, SpaceX is reportedly discussing merger possibilities with xAI ahead of the space exploration company’s plans to IPO later this year, in what would be a blockbuster move.

The outlet said it would combine rockets and Starlink satellites, as well as the X social media platform and AI project Grok under one roof. The report cites “a person briefed on the matter and two recent company filings seen by Reuters.”

Musk, nor SpaceX or xAI, have commented on the report, so, as of now, it is unconfirmed.

With that being said, the proposed merger would bring shares of xAI in exchange for shares of SpaceX. Both companies were registered in Nevada to expedite the transaction, according to the report.

On January 21, both entities were registered in Nevada. The report continues:

“One of them, a limited liability company, lists SpaceX and Bret Johnsen, the company’s chief financial officer, as managing members, while the other lists Johnsen as the company’s only officer, the filings show.”

The source also stated that some xAI executives could be given the option to receive cash in lieu of SpaceX stock. No agreement has been reached, nothing has been signed, and the timing and structure, as well as other important details, have not been finalized.

SpaceX is valued at $800 billion and is the most valuable privately held company, while xAI is valued at $230 billion as of November. SpaceX could be going public later this year, as Musk has said as recently as December that the company would offer its stock publicly.

The plans could help move along plans for large-scale data centers in space, something Musk has discussed on several occasions over the past few months.

At the World Economic Forum last week, Musk said:

“It’s a no-brainer for building solar-powered AI data centers in space, because as I mentioned, it’s also very cold in space. The net effect is that the lowest cost place to put AI will be space and that will be true within two to three years, three at the latest.”

He also said on X that “the most important thing in the next 3-4 years is data centers in space.”

If the report is true and the two companies end up coming together, it would not be the first time Musk’s companies have ended up coming together. He used Tesla stock to purchase SolarCity back in 2016. Last year, X became part of xAI in a share swap.

Elon Musk

Tesla hits major milestone with Full Self-Driving subscriptions

Tesla has announced it has hit a major milestone with Full Self-Driving subscriptions, shortly after it said it would exclusively offer the suite without the option to purchase it outright.

Tesla announced on Wednesday during its Q4 Earnings Call for 2025 that it had officially eclipsed the one million subscription mark for its Full Self-Driving suite. This represented a 38 percent increase year-over-year.

This is up from the roughly 800,000 active subscriptions it reported last year. The company has seen significant increases in FSD adoption over the past few years, as in 2021, it reported just 400,000. In 2022, it was up to 500,000 and, one year later, it had eclipsed 600,000.

NEWS: For the first time, Tesla has revealed how many people are subscribed or have purchased FSD (Supervised).

Active FSD Subscriptions:

• 2025: 1.1 million

• 2024: 800K

• 2023: 600K

• 2022: 500K

• 2021: 400K pic.twitter.com/KVtnyANWcs— Sawyer Merritt (@SawyerMerritt) January 28, 2026

In mid-January, CEO Elon Musk announced that the company would transition away from giving the option to purchase the Full Self-Driving suite outright, opting for the subscription program exclusively.

Musk said on X:

“Tesla will stop selling FSD after Feb 14. FSD will only be available as a monthly subscription thereafter.”

The move intends to streamline the Full Self-Driving purchase option, and gives Tesla more control over its revenue, and closes off the ability to buy it outright for a bargain when Musk has said its value could be close to $100,000 when it reaches full autonomy.

It also caters to Musk’s newest compensation package. One tranche requires Tesla to achieve 10 million active FSD subscriptions, and now that it has reached one million, it is already seeing some growth.

The strategy that Tesla will use to achieve this lofty goal is still under wraps. The most ideal solution would be to offer a less expensive version of the suite, which is not likely considering the company is increasing its capabilities, and it is becoming more robust.

Tesla is shifting FSD to a subscription-only model, confirms Elon Musk

Currently, Tesla’s FSD subscription price is $99 per month, but Musk said this price will increase, which seems counterintuitive to its goal of increasing the take rate. With that being said, it will be interesting to see what Tesla does to navigate growth while offering a robust FSD suite.