News

SpaceX aims to launch critical Crew Dragon abort test before the end of 2019

SpaceX has applied for an FCC Special Temporary Authority license to authorize rocket communications during what is likely Crew Dragon’s In-Flight Abort (IFA) test, now scheduled to occur no earlier than November 23rd.

In line with recent comments from SpaceX executives, a November or December In-Flight Abort test would almost certainly preclude Crew Dragon from launching with astronauts in 2019, pushing the Demo-2 mission into the Q1 2020. Nevertheless, it would serve as a good sign that Crew Dragon remains on track if SpaceX can complete the critical abort test – meant to prove that Dragon can whisk astronauts away from a failing rocket at any point during launch – before the year is out.

The FCC application describes “SpaceX Mission 1357” launch from NASA’s Kennedy Space Center (KSC) Launch Complex 39A, leased by SpaceX and primarily dedicated to launches involving either Falcon Heavy or Crew Dragon. Most tellingly, the STA request describes the mission as involving a “simulated orbital second stage”, an unusual phrase for SpaceX applications that almost certainly reveals it to be Crew Dragon’s IFA.

In the history of Falcon 9, all booster launches from Florida or California have carried functional Falcon upper stages. The FCC application’s “simulated” descriptor implies that this particular mission’s upper stage will not actually be capable of flight – a fact Elon Musk confirmed for the In-Flight Abort test in February 2019. Although the upper stage will otherwise be orbit-capable, the stage on Crew Dragon’s abort test is never meant to ignite and will thus feature a mass simulator in place of a functioning Merlin Vacuum (MVac) engine. A flight-proven Falcon 9 Block 5 booster – likely B1046.4 – will power the mission and both it and the upper stage are very unlikely to survive.

During the In-Flight Abort test, the Falcon 9 stack will lift off like any other launch, flying for approximately 60-70 seconds on a normal trajectory. Shortly thereafter, during a period of peak aerodynamic stress known as Max-Q, Crew Dragon’s SuperDraco abort system will somehow be triggered, causing the spacecraft to rapidly speed away from what it perceives to be a failing rocket. As Crew Dragon departs its perch atop Falcon 9’s upper stage, the rocket’s top will be instantly subjected to a supersonic windstream, akin to smashing into a brick wall. If the upper stage is quickly torn away, the booster will find its large, hollow interstage subjected to the same windstream, likely tearing it apart. The mission will undoubtedly be a spectacle regardless of how things transpire.

This filing comes ahead of the imminent resolution of a multi-month investigation to determine the cause of an anomaly that resulted in the loss of the DM-1 Crew Dragon capsule during a static fire test in April 2019. With that investigation nearly wrapped up and the Florida Department of Environmental Protection declaring “no further action” required with clean up efforts, as reported by Florida Today, SpaceX is likely ready to begin prelaunch preparations for Crew Dragon’s next major milestones.

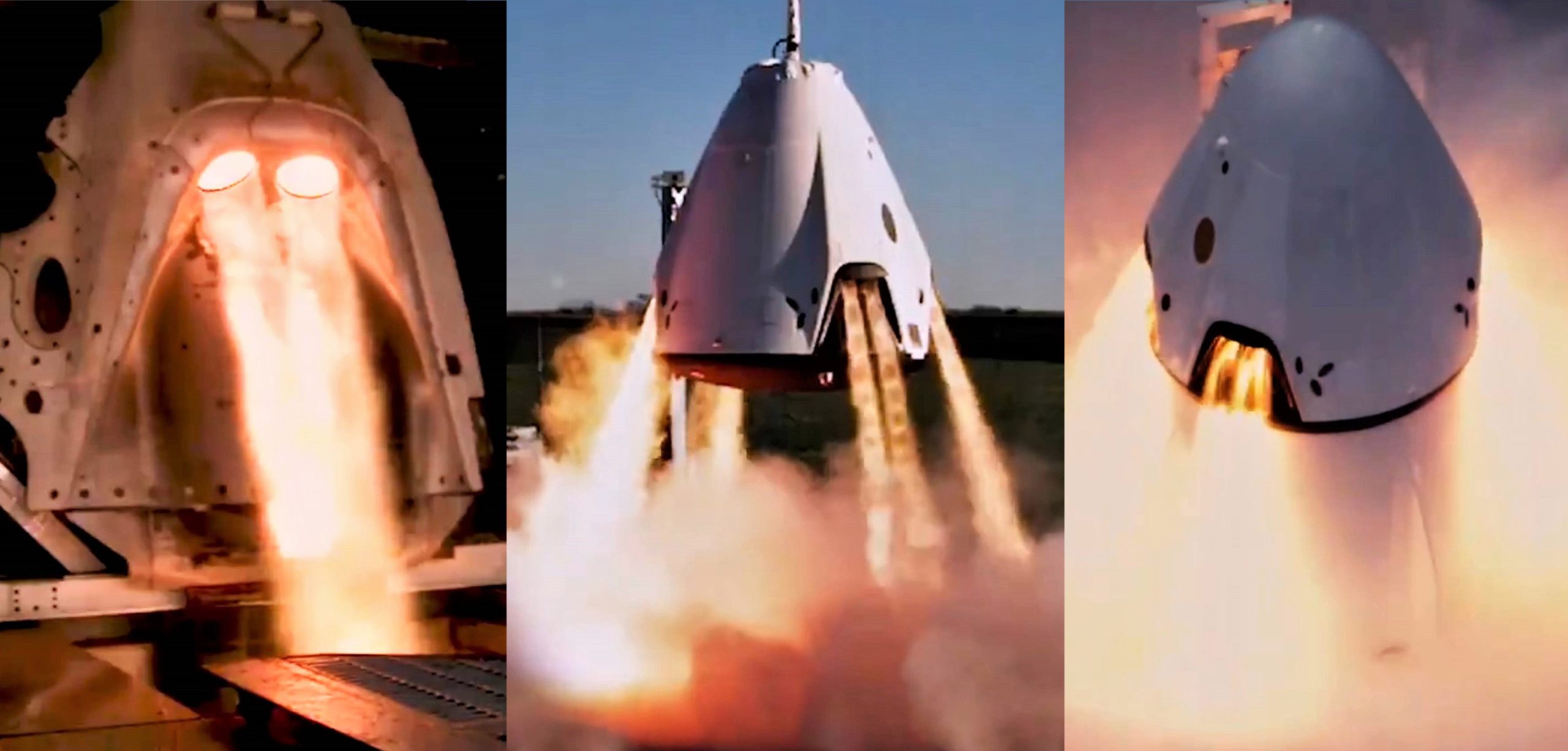

SpaceX recently posted a video highlighting extensive testing of Crew Dragon’s SuperDraco abort system, noting the thrusters’ ability to propel a Crew Dragon capsule half a mile away from a failing rocket in just 7.5 seconds. SpaceX has performed more than 700 successful static fires, ranging from individual double-engine powerpack tests to a 2015 pad-abort test and integrated hover testing before propulsive Crew Dragon landing development was canceled in 2017.

The late-2019 IFA launch window means that a 2019 crewed Dragon debut is more or less impossible. Nevertheless, if SpaceX can successfully complete Crew Dragon’s IFA test in November or December, chances are good that there will be opportunities to attempt Crew Dragon’s crewed launch debut sometime in Q1 2020.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

News

BREAKING: Tesla launches public Robotaxi rides in Austin with no Safety Monitor

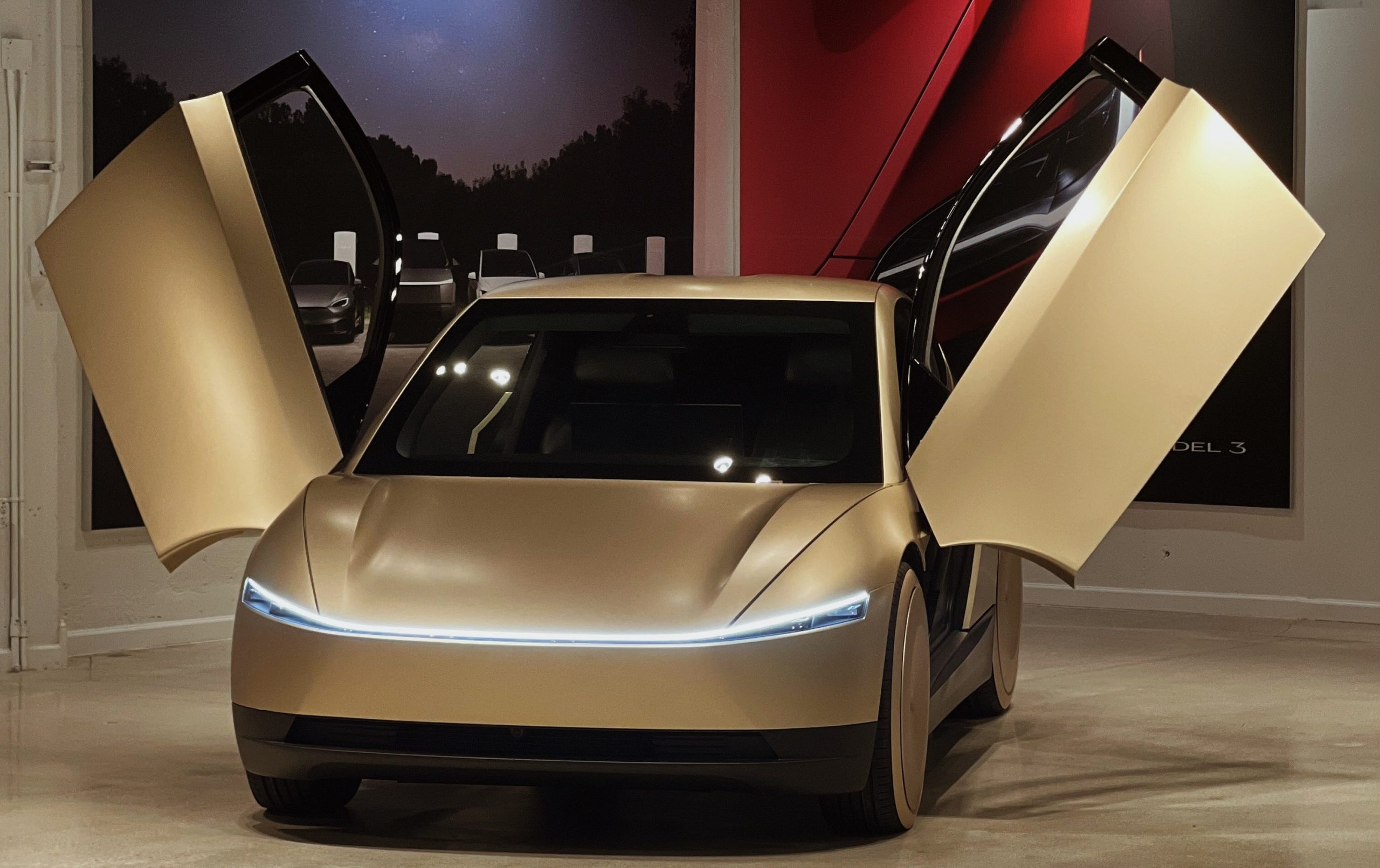

Tesla has officially launched public Robotaxi rides in Austin, Texas, without a Safety Monitor in the vehicle, marking the first time the company has removed anyone from the vehicle other than the rider.

The Safety Monitor has been present in Tesla Robotaxis in Austin since its launch last June, maintaining safety for passengers and other vehicles, and was placed in the passenger’s seat.

Tesla planned to remove the Safety Monitor at the end of 2025, but it was not quite ready to do so. Now, in January, riders are officially reporting that they are able to hail a ride from a Model Y Robotaxi without anyone in the vehicle:

I am in a robotaxi without safety monitor pic.twitter.com/fzHu385oIb

— TSLA99T (@Tsla99T) January 22, 2026

Tesla started testing this internally late last year and had several employees show that they were riding in the vehicle without anyone else there to intervene in case of an emergency.

Tesla has now expanded that program to the public. It is not active in the entire fleet, but there are a “few unsupervised vehicles mixed in with the broader robotaxi fleet with safety monitors,” Ashok Elluswamy said:

Robotaxi rides without any safety monitors are now publicly available in Austin.

Starting with a few unsupervised vehicles mixed in with the broader robotaxi fleet with safety monitors, and the ratio will increase over time. https://t.co/ShMpZjefwB

— Ashok Elluswamy (@aelluswamy) January 22, 2026

Tesla Robotaxi goes driverless as Musk confirms Safety Monitor removal testing

The Robotaxi program also operates in the California Bay Area, where the fleet is much larger, but Safety Monitors are placed in the driver’s seat and utilize Full Self-Driving, so it is essentially the same as an Uber driver using a Tesla with FSD.

In Austin, the removal of Safety Monitors marks a substantial achievement for Tesla moving forward. Now that it has enough confidence to remove Safety Monitors from Robotaxis altogether, there are nearly unlimited options for the company in terms of expansion.

While it is hoping to launch the ride-hailing service in more cities across the U.S. this year, this is a much larger development than expansion, at least for now, as it is the first time it is performing driverless rides in Robotaxi anywhere in the world for the public to enjoy.

Investor's Corner

Tesla Earnings Call: Top 5 questions investors are asking

Tesla has scheduled its Earnings Call for Q4 and Full Year 2025 for next Wednesday, January 28, at 5:30 p.m. EST, and investors are already preparing to get some answers from executives regarding a wide variety of topics.

The company accepts several questions from retail investors through the platform Say, which then allows shareholders to vote on the best questions.

Tesla does not answer anything regarding future product releases, but they are willing to shed light on current timelines, progress of certain projects, and other plans.

There are five questions that range over a variety of topics, including SpaceX, Full Self-Driving, Robotaxi, and Optimus, which are currently in the lead to be asked and potentially answered by Elon Musk and other Tesla executives:

- You once said: Loyalty deserves loyalty. Will long-term Tesla shareholders still be prioritized if SpaceX does an IPO?

- Our Take – With a lot of speculation regarding an incoming SpaceX IPO, Tesla investors, especially long-term ones, should be able to benefit from an early opportunity to purchase shares. This has been discussed endlessly over the past year, and we must be getting close to it.

- When is FSD going to be 100% unsupervised?

- Our Take – Musk said today that this is essentially a solved problem, and it could be available in the U.S. by the end of this year.

- What is the current bottleneck to increase Robotaxi deployment & personal use unsupervised FSD? The safety/performance of the most recent models or people to monitor robots, robotaxis, in-car, or remotely? Or something else?

- Our Take – The bottleneck seems to be based on data, which Musk said Tesla needs 10 billion miles of data to achieve unsupervised FSD. Once that happens, regulatory issues will be what hold things up from moving forward.

- Regarding Optimus, could you share the current number of units deployed in Tesla factories and actively performing production tasks? What specific roles or operations are they handling, and how has their integration impacted factory efficiency or output?

- Our Take – Optimus is going to have a larger role in factories moving forward, and later this year, they will have larger responsibilities.

- Can you please tie purchased FSD to our owner accounts vs. locked to the car? This will help us enjoy it in any Tesla we drive/buy and reward us for hanging in so long, some of us since 2017.

- Our Take – This is a good one and should get us some additional information on the FSD transfer plans and Subscription-only model that Tesla will adopt soon.

Tesla will have its Earnings Call on Wednesday, January 28.

Elon Musk

Elon Musk shares incredible detail about Tesla Cybercab efficiency

Elon Musk shared an incredible detail about Tesla Cybercab’s potential efficiency, as the company has hinted in the past that it could be one of the most affordable vehicles to operate from a per-mile basis.

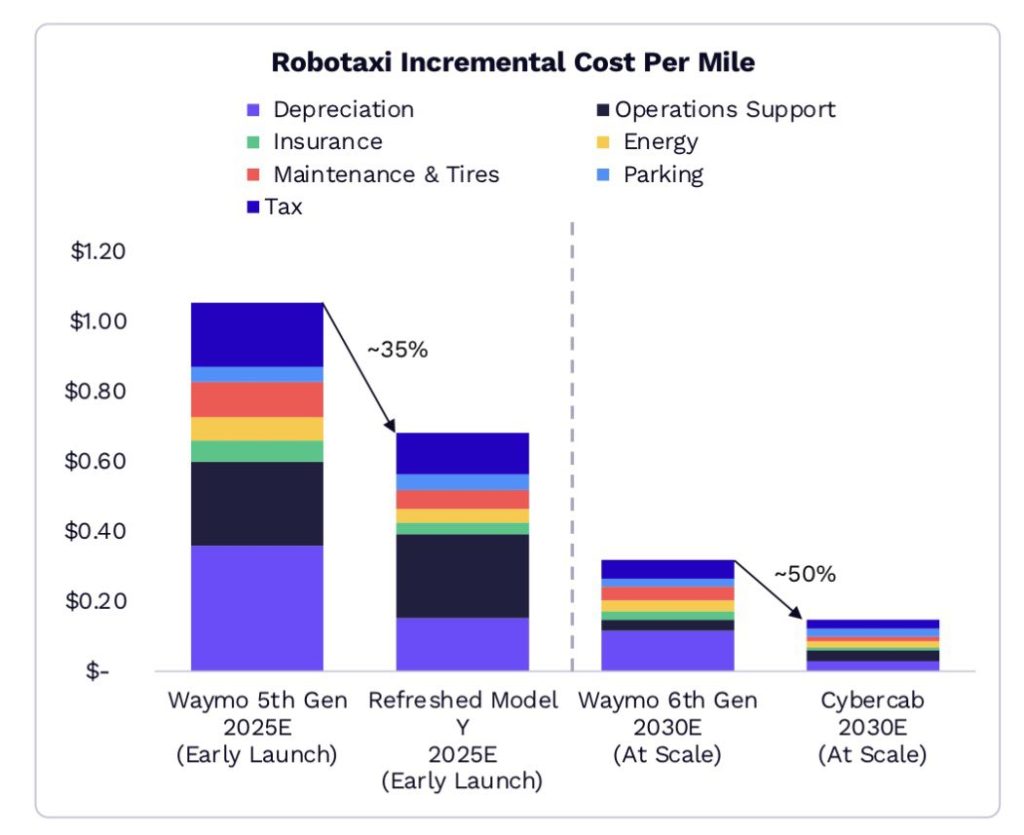

ARK Invest released a report recently that shed some light on the potential incremental cost per mile of various Robotaxis that will be available on the market in the coming years.

The Cybercab, which is detailed for the year 2030, has an exceptionally low cost of operation, which is something Tesla revealed when it unveiled the vehicle a year and a half ago at the “We, Robot” event in Los Angeles.

Musk said on numerous occasions that Tesla plans to hit the $0.20 cents per mile mark with the Cybercab, describing a “clear path” to achieving that figure and emphasizing it is the “full considered” cost, which would include energy, maintenance, cleaning, depreciation, and insurance.

Probably true

— Elon Musk (@elonmusk) January 22, 2026

ARK’s report showed that the Cybercab would be roughly half the cost of the Waymo 6th Gen Robotaxi in 2030, as that would come in at around $0.40 per mile all in. Cybercab, at scale, would be at $0.20.

Credit: ARK Invest

This would be a dramatic decrease in the cost of operation for Tesla, and the savings would then be passed on to customers who choose to utilize the ride-sharing service for their own transportation needs.

The U.S. average cost of new vehicle ownership is about $0.77 per mile, according to AAA. Meanwhile, Uber and Lyft rideshares often cost between $1 and $4 per mile, while Waymo can cost between $0.60 and $1 or more per mile, according to some estimates.

Tesla’s engineering has been the true driver of these cost efficiencies, and its focus on creating a vehicle that is as cost-effective to operate as possible is truly going to pay off as the vehicle begins to scale. Tesla wants to get the Cybercab to about 5.5-6 miles per kWh, which has been discussed with prototypes.

Additionally, fewer parts due to the umboxed manufacturing process, a lower initial cost, and eliminating the need to pay humans for their labor would also contribute to a cheaper operational cost overall. While aspirational, all of the ingredients for this to be a real goal are there.

It may take some time as Tesla needs to hammer the manufacturing processes, and Musk has said there will be growing pains early. This week, he said regarding the early production efforts:

“…initial production is always very slow and follows an S-curve. The speed of production ramp is inversely proportionate to how many new parts and steps there are. For Cybercab and Optimus, almost everything is new, so the early production rate will be agonizingly slow, but eventually end up being insanely fast.”