News

Tesla Cybertruck vs Ford F-150: Cost of ownership battle ends with eye-opening results

The Tesla Cybertruck offers several benefits that make it an ideal alternative to conventional pickup trucks like the best-selling Ford F-150. But beyond its polarizing design and healthy set of features, one thing may really be the difference-maker for customers who are considering a Cybertruck purchase: its cost of ownership.

Pickups are very popular in the United States, holding about 17% of the US auto sales market last year. Yet, for all their popularity, trucks are also notoriously expensive to own, thanks to their large engines that guzzle fuel. Considering that the Tesla Cybertruck promises a lower cost of ownership compared to traditional trucks like the Ford F-150, it then becomes pertinent to run the numbers between the futuristic upstart and the tried-and-tested veteran.

This was the topic of a recent video from Tesla owner-enthusiast Ben Sullins of YouTube’s Teslanomics channel. In his video, Sullins compared the cost of ownership between the Tesla Cybertruck and the Ford F-150 over a five-year period. The results were notably eye-opening.

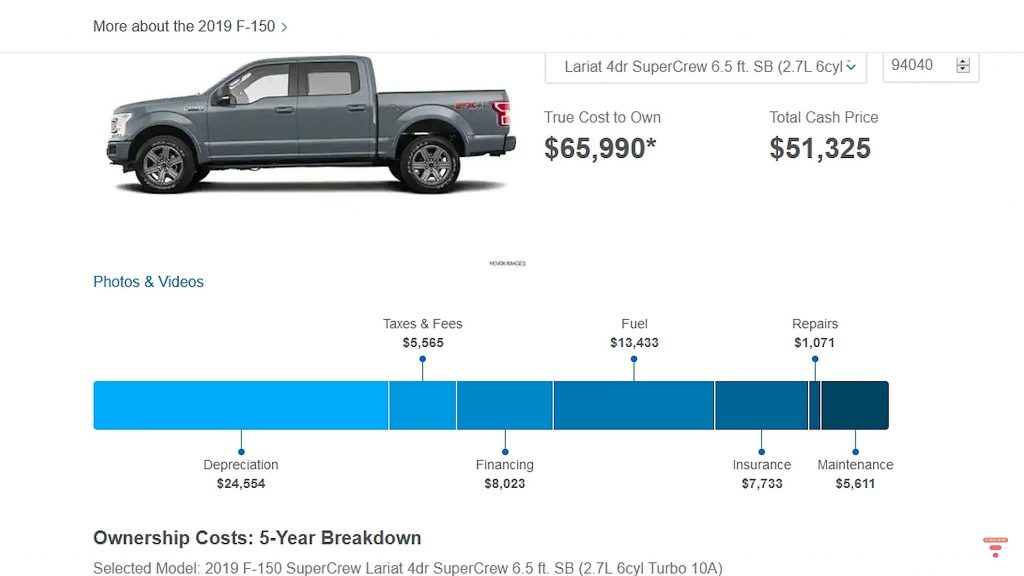

Sullins opted to utilize the Ford F-150 because it is the most popular pickup in the United States. He also selected the 2020 Ford F-150 Lariat SuperCrew as the truck of choice for his comparison, since the variant was the trim which received Edmunds‘ recommendation. This version was compared with the Tesla Cybertruck’s Dual Motor AWD variant, which CEO Elon Musk noted was receiving the majority of reservations from consumers. To make the comparison as fair as possible, Sullins opted for options in the F-150 that would make it as similar to the mid-level Cybertruck as possible, such as 4×4 and a six-seat configuration.

For the vehicle’s true cost of ownership over 5 years, the Teslanomics host referred to Edmunds‘ TCO metrics, which includes Depreciation, Taxes and Fees, Financing, Fuel, Insurance, Repairs, and Maintenance. Considering that the Cybertruck is not on the road yet, Sullins opted to estimate the all-electric pickup’s depreciation, taxes and fees, and financing on the F-150’s numbers. The same was true for the Cybertruck’s estimated insurance costs.

Things started to diverge when maintenance and fuel costs between the two vehicles were considered. The Tesla Cybertruck’s maintenance will likely be marginal compared to the F-150, which is equipped with an internal combustion engine. Fuel costs were also very different between the two vehicles. If one were to consider the average price of fuel in CA and TX and a yearly mileage of 15,000 miles, a Ford F-150 owner in CA could spend about $3,183 in fuel costs per year considering the state’s average fuel cost of $3.82 per gallon. An F-150 owner in TX, where gas prices average $2.24 per gallon, could spend about $1,866 per year in fuel costs.

In comparison, a Cybertruck owner in CA, where electricity costs a pretty steep $0.26 per kWh on average, will spend about $1,950 in charging costs for a year. A Cybertruck owner from TX, where electricity costs $0.09 per kWh, could spend as little as $675 per year. It’s pertinent to note that these costs do not account for off-peak hours, where electricity is cheaper.

Overall, Sullins estimated that the total cost of ownership for a Ford F-150 in CA would be around $72,459 over five years, while one in TX stands at about $65,467. Thanks to low charging and maintenance costs, the Cybertruck would likely have a TCO of $53,379 in CA and $46,610 in TX, respectively. That’s a difference of $19,080 and $18,858 over the course of five years. Of course, if a Tesla owner charges the Cybertruck through solar panels, then the TCO of the all-electric vehicle will be even lower.

Inasmuch as the Cybertruck is polarizing for its looks, it is difficult not to see the value of the vehicle when it comes to cost of ownership compared to traditional pickups. This is something that is key to potential Cybertruck customers such as companies that are managing fleets of vehicles. If something like the Cybertruck comes along and offers the same utility and better performance while offering lower operating costs, there is very little incentive to ignore the vehicle just because it doesn’t look like every other pickup in the market.

Watch Ben Sullins’ breakdown of the Tesla Cybertruck and the Ford F-150’s cost of ownership in the video below.

Cybertruck

Tesla confirms date when new Cybertruck trim will go up in price

Tesla has officially revealed that this price will only be available until February 28, as the company has placed a banner atop the Design Configurator on its website reflecting this.

Tesla has confirmed the date when its newest Cybertruck trim level will increase in price, after CEO Elon Musk noted that the All-Wheel-Drive configuration of the all-electric pickup would only be priced at its near-bargain level for ten days.

Last week, Tesla launched the All-Wheel-Drive configuration of the Cybertruck. Priced at $59,990, the Cybertruck featured many excellent features and has seemingly brought some demand to the pickup, which has been underwhelming in terms of sales figures over the past couple of years.

Tesla launches new Cybertruck trim with more features than ever for a low price

When Tesla launched it, many fans and current owners mulled the possibility of ordering it. However, Musk came out and said just hours after launching the pickup that Tesla would only keep it at the $59,990 price level for ten days.

What it would be priced at subsequently was totally dependent on how much demand Tesla felt for the new trim level, which is labeled as a “Dual Motor All-Wheel-Drive” configuration.

Tesla has officially revealed that this price will only be available until February 28, as the company has placed a banner atop the Design Configurator on its website reflecting this:

NEWS: Tesla has officially announced that the price of the new Cybertruck Dual-Motor AWD will be increasing after February 28th. pic.twitter.com/vZpA521ZwC

— Sawyer Merritt (@SawyerMerritt) February 24, 2026

Many fans and owners have criticized Tesla’s decision to unveil a trim this way, and then price it at something, only to change that price a few days later based on how well it sells.

Awful way to treat customers – particularly when they already sent out a marketing email announcing the $59,990 truck…with zero mention of it being a limited-time offer.

— Ryan McCaffrey (@DMC_Ryan) February 24, 2026

It seems the most ideal increase in price would be somewhere between $5,000 and $10,000, but it truly depends on how many orders Tesla sees for this new trim level. The next step up in configuration is the Premium All-Wheel-Drive, which is priced at $79,990.

The difference between the Dual Motor AWD Cybertruck and the Premium AWD configuration comes down to towing, interior quality, and general features. The base package is only capable of towing up to 7,500 pounds, while the Premium can handle 11,000 pounds. Additionally, the seats in the Premium build are Vegan Leather, while the base trim gets the textile seats.

It also has only 7 speakers compared to the 15 that the Premium trim has. Additionally, the base model does not have an adjustable ride height, although it does have a coil spring with an adaptive damping suspension package.

Cybertruck

Tesla set to activate long-awaited Cybertruck feature

Tesla will officially activate the Active Noise Cancellation (ANC) feature on Cybertruck soon, as the company has officially added the feature to its list of features by trim on its website.

Tesla is set to activate a long-awaited Cybertruck feature, and no matter when you bought your all-electric pickup, it has the hardware capable of achieving what it is designed to do.

Tesla simply has to flip the switch, and it plans to do so in the near future.

Tesla will officially activate the Active Noise Cancellation (ANC) feature on Cybertruck soon, according to Not a Tesla App, as the company has officially added the feature to its list of features by trim on its website.

Tesla rolls out Active Road Noise Reduction for new Model S and Model X

The ANC feature suddenly appeared on the spec sheet for the Premium All-Wheel-Drive and Cyberbeast trims, which are the two configurations that have been delivered since November 2023.

However, those trims have both had the ANC disabled, and although they are found in the Model S and Model X, and are active in those vehicles, Tesla is planning to activate them.

In Tesla’s Service Toolbox, it wrote:

“ANC software is not enabled on Cybertruck even though the hardware is installed.”

Tesla has utilized an ANC system in the Model S and Model X since 2021. The system uses microphones embedded in the front seat headrests to detect low-frequency road noise entering the cabin. It then generates anti-noise through phase-inverted sound waves to cancel out or reduce that noise, creating quieter zones, particularly around the vehicle’s front occupants.

The Model S and Model X utilize six microphones to achieve this noise cancellation, while the Cybertruck has just four.

Tesla Cybertruck Dual Motor AWD estimated delivery slips to early fall 2026

As previously mentioned, this will be activated through a software update, as the hardware is already available within Cybertruck and can simply be activated at Tesla’s leisure.

The delays in activating the system are likely due to Tesla Cybertruck’s unique design, which is unlike anything before. In the Model S and Model X, Tesla did not have to do too much, but the Cybertruck has heavier all-terrain tires and potentially issues from the aluminum castings that make up the vehicle’s chassis, which are probably presenting some challenges.

Unfortunately, this feature will not be available on the new Dual Motor All-Wheel-Drive configuration, which was released last week.

News

Tesla Model S and X customization options begin to thin as their closure nears

Tesla’s Online Design Studio for both vehicles now shows the first color option to be listed as “Sold Out,” as Lunar Silver is officially no longer available for the Model S or Model X. This color is exclusive to these cars and not available on the Model S or Model X.

Tesla Model S and Model X customization options are beginning to thin for the first time as the closure of the two “sentimental” vehicles nears.

We are officially seeing the first options disappear as Tesla begins to work toward ending production of the two cars and the options that are available to those vehicles specifically.

Tesla’s Online Design Studio for both vehicles now shows the first color option to be listed as “Sold Out,” as Lunar Silver is officially no longer available for the Model S or Model X. This color is exclusive to these cars and not available on the Model S or Model X.

🚨 Tesla Model S and Model X availability is thinning, as Tesla has officially shown that the Lunar Silver color option on both vehicles is officially sold out

To be fair, Frost Blue is still available so no need to freak out pic.twitter.com/YnwsDbsFOv

— TESLARATI (@Teslarati) February 25, 2026

Tesla is making way for the Optimus humanoid robot project at the Fremont Factory, where the Model S and Model X are produced. The two cars are low-volume models and do not contribute more than a few percent to Tesla’s yearly delivery figures.

With CEO Elon Musk confirming that the Model S and Model X would officially be phased out at the end of the quarter, some of the options are being thinned out.

This is an expected move considering Tesla’s plans for the two vehicles, as it will make for an easier process of transitioning that portion of the Fremont plant to cater to Optimus manufacturing. Additionally, this is likely one of the least popular colors, and Tesla is choosing to only keep around what it is seeing routine demand for.

During the Q4 Earnings Call in January, Musk confirmed the end of the Model S and Model X:

“It is time to bring the Model S and Model X programs to an end with an honorable discharge. It is time to bring the S/X programs to an end. It’s part of our overall shift to an autonomous future.”

Fremont will now build one million Optimus units per year as production is ramped.