News

Rivian R1T has the highest range for an electric truck with a 328-mile EPA estimate

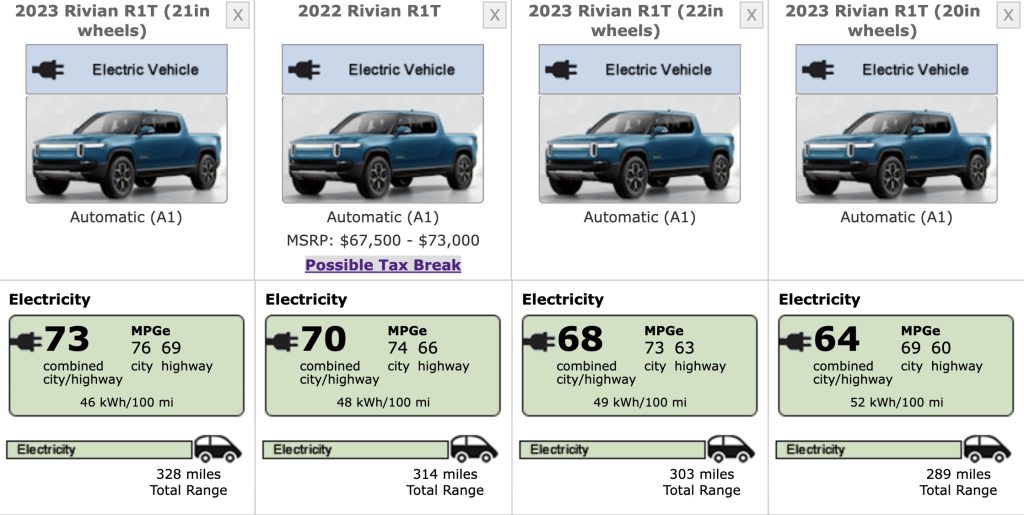

The Rivian R1T is now the electric truck with the most range after receiving a 328-mile range estimate from the Environmental Protection Agency (EPA).

The 2023 Rivian R1T with 21-inch wheels received an EPA range estimate of 328 for the Quad-Motor with a Large battery pack configuration. 2023 Rivian R1T owners who ordered the Quad-motor with a Large battery pack configuration can save up to $3,500 in fuel costs over the next 5 years.

For comparison, the 2023 R1T with 22-inch wheels has an EPA estimated range of 303 miles, with calculated fuel savings of $3,000 over 5 years. While the 2022 Rivian R1T with 20-inch wheels saves owners up to $2,750 in fuel costs in 5 years with an EPA estimated range of 289 miles.

Recently, Rivian sent letters to reservation holders who ordered Quad-Motor R1Ts with the Max battery pack. The company advised reservation holders to switch to Quad-Motor R1Ts with Large battery packs if they want to accept delivery in early 2023.

Rivian informed R1T reservation holders that the Quad-Motor R1T with Max battery pack would not be available beginning in 2023. The Max battery pack will only be available with Dual-Motor R1T orders next year.

Rivian offers three battery options for R1T orders: Standard, Large, and Max packs. The Standard pack has an estimated range of 260+ miles, while the Max pack has a range of up to 400 miles. In the middle is Rivian’s Large pack, which has an EPA estimate of 328 miles. The Max pack costs an additional $16,000 in the U.S. and $21,750 in Canada, while the Large pack costs $6,000 in the United States and $8,250 in Canada.

Rivian R1T Tax Breaks

According to the EPA, the 2022 Rivian R1T—with an MSRP between $63,500 and $73,000—may qualify for tax breaks. The Inflation Reduction Act of 2022 introduced a federal tax credit of up to $7,500 on electric vehicles that meet specific government guidelines.

The EPA offered some advice to R1T reservation holders that might help them get tax breaks on 2022 R1T orders.

“If you entered into a written binding contract to purchase a new qualifying electric vehicle before August 16, 2022, but do not take possession of the vehicle until on or after August 16, 2022 (for example, because the vehicle has not been delivered), you may claim the EV credit based on the rules that were in effect before August 16, 2022,” noted the agency.

“If you purchased a qualifying electric vehicle on or before August 16, 2022, and placed it in service before January 1, 2023, you may claim the EV credit based on the rules that were in effect before August 16, 2022,” it advised.

If you have any tips, contact me at maria@teslarati.com or via Twitter @Writer_01001101.

Elon Musk

Tesla engineers deflected calls from this tech giant’s now-defunct EV project

Tesla engineers deflected calls from Apple on a daily basis while the tech giant was developing its now-defunct electric vehicle program, which was known as “Project Titan.”

Back in 2022 and 2023, Apple was developing an EV in a top-secret internal fashion, hoping to launch it by 2028 with a fully autonomous driving suite.

However, Apple bailed on the project in early 2024, as Project Titan abandoned the project in an email to over 2,000 employees. The company had backtracked its expectations for the vehicle on several occasions, initially hoping to launch it with no human driving controls and only with an autonomous driving suite.

Apple canceling its EV has drawn a wide array of reactions across tech

It then planned for a 2028 launch with “limited autonomous driving.” But it seemed to be a bit of a concession at that point; Apple was not prepared to take on industry giants like Tesla.

Wedbush’s Dan Ives noted in a communication to investors that, “The writing was on the wall for Apple with a much different EV landscape forming that would have made this an uphill battle. Most of these Project Titan engineers are now all focused on AI at Apple, which is the right move.”

Apple did all it could to develop a competitive EV that would attract car buyers, including attempting to poach top talent from Tesla.

In a new podcast interview with Tesla CEO Elon Musk, it was revealed that Apple had been calling Tesla engineers nonstop during its development of the now-defunct project. Musk said the engineers “just unplugged their phones.”

Musk said in full:

“They were carpet bombing Tesla with recruiting calls. Engineers just unplugged their phones. Their opening offer without any interview would be double the compensation at Tesla.”

Interestingly, Apple had acquired some ex-Tesla employees for its project, like Senior Director of Engineering Dr. Michael Schwekutsch, who eventually left for Archer Aviation.

Tesla took no legal action against Apple for attempting to poach its employees, as it has with other companies. It came after EV rival Rivian in mid-2020, after stating an “alarming pattern” of poaching employees was noticed.

Elon Musk

Tesla to a $100T market cap? Elon Musk’s response may shock you

There are a lot of Tesla bulls out there who have astronomical expectations for the company, especially as its arm of reach has gone well past automotive and energy and entered artificial intelligence and robotics.

However, some of the most bullish Tesla investors believe the company could become worth $100 trillion, and CEO Elon Musk does not believe that number is completely out of the question, even if it sounds almost ridiculous.

To put that number into perspective, the top ten most valuable companies in the world — NVIDIA, Apple, Alphabet, Microsoft, Amazon, TSMC, Meta, Saudi Aramco, Broadcom, and Tesla — are worth roughly $26 trillion.

Will Tesla join the fold? Predicting a triple merger with SpaceX and xAI

Cathie Wood of ARK Invest believes the number is reasonable considering Tesla’s long-reaching industry ambitions:

“…in the world of AI, what do you have to have to win? You have to have proprietary data, and think about all the proprietary data he has, different kinds of proprietary data. Tesla, the language of the road; Neuralink, multiomics data; nobody else has that data. X, nobody else has that data either. I could see $100 trillion. I think it’s going to happen because of convergence. I think Tesla is the leading candidate [for $100 trillion] for the reason I just said.”

Musk said late last year that all of his companies seem to be “heading toward convergence,” and it’s started to come to fruition. Tesla invested in xAI, as revealed in its Q4 Earnings Shareholder Deck, and SpaceX recently acquired xAI, marking the first step in the potential for a massive umbrella of companies under Musk’s watch.

SpaceX officially acquires xAI, merging rockets with AI expertise

Now that it is happening, it seems Musk is even more enthusiastic about a massive valuation that would swell to nearly four-times the value of the top ten most valuable companies in the world currently, as he said on X, the idea of a $100 trillion valuation is “not impossible.”

It’s not impossible

— Elon Musk (@elonmusk) February 6, 2026

Tesla is not just a car company. With its many projects, including the launch of Robotaxi, the progress of the Optimus robot, and its AI ambitions, it has the potential to continue gaining value at an accelerating rate.

Musk’s comments show his confidence in Tesla’s numerous projects, especially as some begin to mature and some head toward their initial stages.

Elon Musk

Celebrating SpaceX’s Falcon Heavy Tesla Roadster launch, seven years later (Op-Ed)

Seven years later, the question is no longer “What if this works?” It’s “How far does this go?”

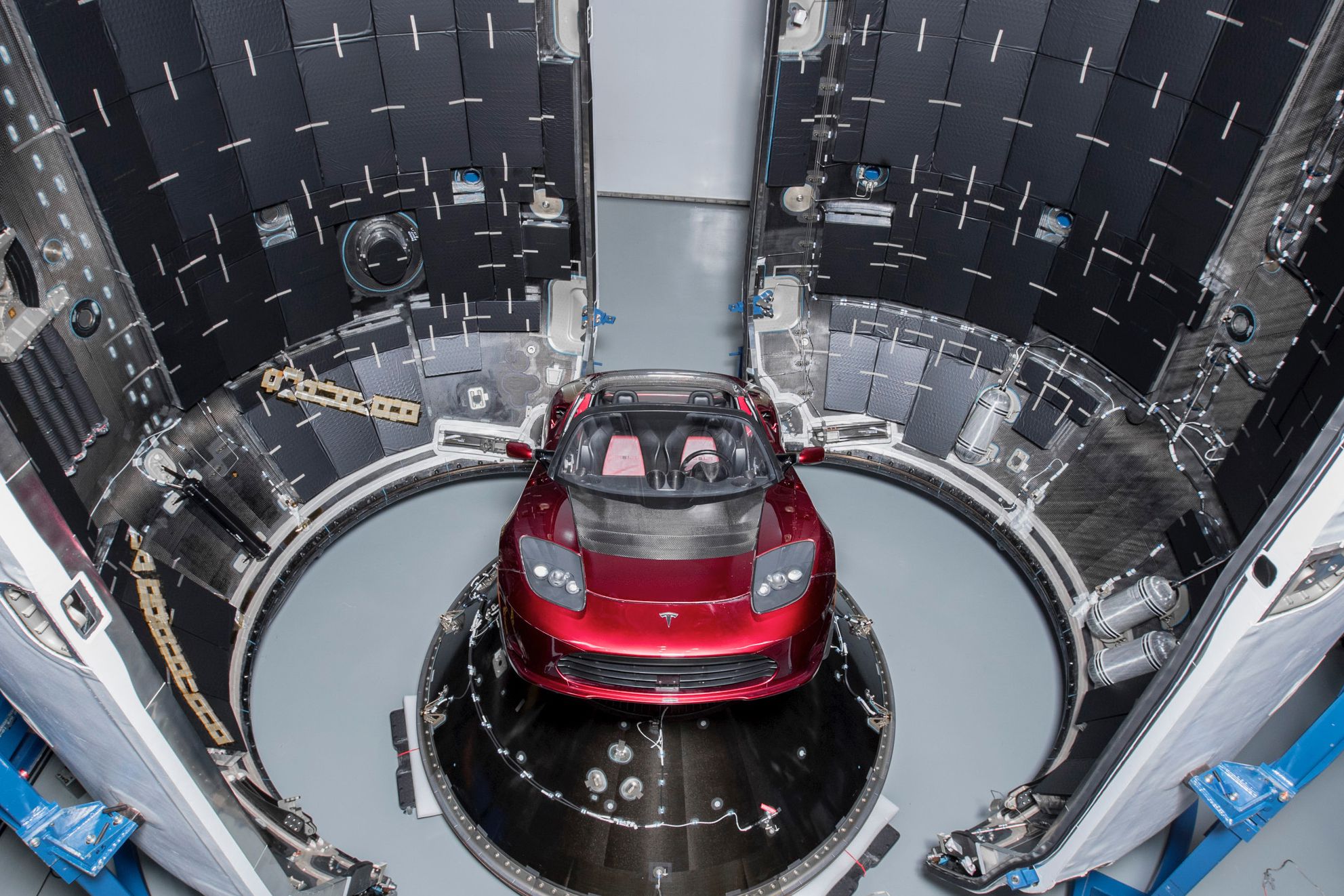

When Falcon Heavy lifted off in February 2018 with Elon Musk’s personal Tesla Roadster as its payload, SpaceX was at a much different place. So was Tesla. It was unclear whether Falcon Heavy was feasible at all, and Tesla was in the depths of Model 3 production hell.

At the time, Tesla’s market capitalization hovered around $55–60 billion, an amount critics argued was already grossly overvalued. SpaceX, on the other hand, was an aggressive private launch provider known for taking risks that traditional aerospace companies avoided.

The Roadster launch was bold by design. Falcon Heavy’s maiden mission carried no paying payload, no government satellite, just a car drifting past Earth with David Bowie playing in the background. To many, it looked like a stunt. For Elon Musk and the SpaceX team, it was a bold statement: there should be some things in the world that simply inspire people.

Inspire it did, and seven years later, SpaceX and Tesla’s results speak for themselves.

Today, Tesla is the world’s most valuable automaker, with a market capitalization of roughly $1.54 trillion. The Model Y has become the best-selling car in the world by volume for three consecutive years, a scenario that would have sounded insane in 2018. Tesla has also pushed autonomy to a point where its vehicles can navigate complex real-world environments using vision alone.

And then there is Optimus. What began as a literal man in a suit has evolved into a humanoid robot program that Musk now describes as potential Von Neumann machines: systems capable of building civilizations beyond Earth. Whether that vision takes decades or less, one thing is evident: Tesla is no longer just a car company. It is positioning itself at the intersection of AI, robotics, and manufacturing.

SpaceX’s trajectory has been just as dramatic.

The Falcon 9 has become the undisputed workhorse of the global launch industry, having completed more than 600 missions to date. Of those, SpaceX has successfully landed a Falcon booster more than 560 times. The Falcon 9 flies more often than all other active launch vehicles combined, routinely lifting off multiple times per week.

Falcon 9 has ferried astronauts to and from the International Space Station via Crew Dragon, restored U.S. human spaceflight capability, and even stepped in to safely return NASA astronauts Butch Wilmore and Suni Williams when circumstances demanded it.

Starlink, once a controversial idea, now dominates the satellite communications industry, providing broadband connectivity across the globe and reshaping how space-based networks are deployed. SpaceX itself, following its merger with xAI, is now valued at roughly $1.25 trillion and is widely expected to pursue what could become the largest IPO in history.

And then there is Starship, Elon Musk’s fully reusable launch system designed not just to reach orbit, but to make humans multiplanetary. In 2018, the idea was still aspirational. Today, it is under active development, flight-tested in public view, and central to NASA’s future lunar plans.

In hindsight, Falcon Heavy’s maiden flight with Elon Musk’s personal Tesla Roadster was never really about a car in space. It was a signal that SpaceX and Tesla were willing to think bigger, move faster, and accept risks others wouldn’t.

The Roadster is still out there, orbiting the Sun. Seven years later, the question is no longer “What if this works?” It’s “How far does this go?”