Fisker has had a tough time getting its first battery-electric vehicle (BEV) product off the ground, and now the startup automaker is facing both federal probes and potential delisting from the stock exchange.

After complaints of a partial loss of braking in the 2023 Fisker Ocean sparked a probe from the National Highway Traffic Safety Administration (NHTSA) last month, the automaker now faces an additional NHTSA probe over complaints of unintended vehicle movement and an inability to shift into park or other intended gears.

The Office of Defects Investigation (ODI) has received four complaints about the unintended vehicle movement issue in the 2023 Fisker Ocean, one of which alleges that the issue resulted in an injury. The ODI has opened a Preliminary Evaluation (PE) to investigate the issue in around 4,000 Fisker Ocean units, and the report says that the issue could result vehicle rollaway, whether the driver is inside the vehicle or not, along with other unintended movements.

You can see the NHTSA’s ODI resume for the unintended vehicle movement issue below, as shared earlier this month.

Along with the recent NHTSA probe being opened last week, Fisker has also been issued a non-compliance notice from the New York Stock Exchange (NYSE), after the automaker’s stock dipped below $1 on average for 30 consecutive days (via Automotive News). The notice gives the automaker six months to become compliant again, or else the company will be delisted from the NYSE.

Fisker produced over 10,000 of its electric Ocean SUVs last year, which was under a fourth of its initial production forecast. However, the company only delivered around 4,700 of the BEVs despite producing thousands more. The company has said it plans to offload all of the extra vehicles in the first quarter of this year, and it has also moved away from its direct sales model to instead work with dealerships.

MKBHD says the Fisker Ocean is the ‘worst car’ he’s ever reviewed

What are your thoughts? Let me know at zach@teslarati.com, find me on X at @zacharyvisconti, or send us news tips at tips@teslarati.com.

News

Tesla Cybercab spotted with interesting charging solution, stimulating discussion

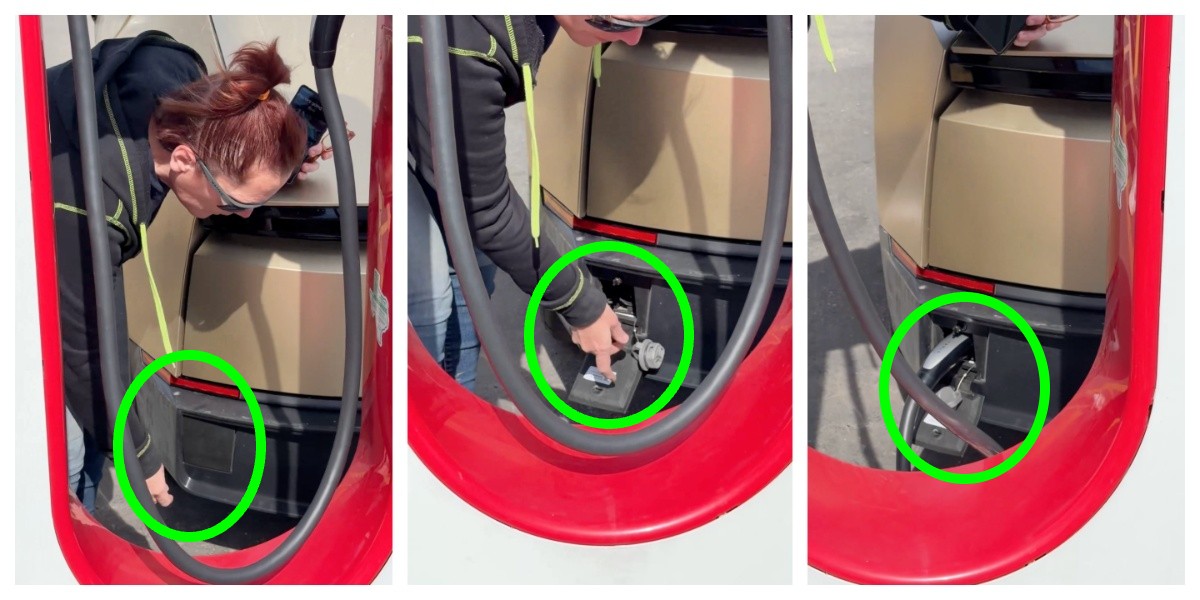

The port is located in the rear of the vehicle and features a manual door and latch for plug-in, and the video shows an employee connecting to a Tesla Supercharger.

Tesla Cybercab units are being tested publicly on roads throughout various areas of the United States, and a recent sighting of the vehicle’s charging port has certainly stimulated some discussions throughout the community.

The Cybercab is geared toward being a fully-autonomous vehicle, void of a steering wheel or pedals, only operating with the use of the Full Self-Driving suite. Everything from the driving itself to the charging to the cleaning is intended to be operated autonomously.

But a recent sighting of the vehicle has incited some speculation as to whether the vehicle might have some manual features, which would make sense, but let’s take a look:

🚨 Tesla Cybercab charging port is in the rear of the vehicle!

Here’s a great look at plugging it in!!

— TESLARATI (@Teslarati) January 29, 2026

The port is located in the rear of the vehicle and features a manual door and latch for plug-in, and the video shows an employee connecting to a Tesla Supercharger.

Now, it is important to remember these are prototype vehicles, and not the final product. Additionally, Tesla has said it plans to introduce wireless induction charging in the future, but it is not currently available, so these units need to have some ability to charge.

However, there are some arguments for a charging system like this, especially as the operation of the Cybercab begins after production starts, which is scheduled for April.

Wireless for Operation, Wired for Downtime

It seems ideal to use induction charging when the Cybercab is in operation. As it is for most Tesla owners taking roadtrips, Supercharging stops are only a few minutes long for the most part.

The Cybercab would benefit from more frequent Supercharging stops in between rides while it is operating a ride-sharing program.

Tesla wireless charging patent revealed ahead of Robotaxi unveiling event

However, when the vehicle rolls back to its hub for cleaning and maintenance, standard charging, where it is plugged into a charger of some kind, seems more ideal.

In the 45-minutes that the car is being cleaned and is having maintenance, it could be fully charged and ready for another full shift of rides, grabbing a few miles of range with induction charging when it’s out and about.

Induction Charging Challenges

Induction charging is still something that presents many challenges for companies that use it for anything, including things as trivial as charging cell phones.

While it is convenient, a lot of the charge is lost during heat transfer, which is something that is common with wireless charging solutions. Even in Teslas, the wireless charging mat present in its vehicles has been a common complaint among owners, so much so that the company recently included a feature to turn them off.

Production Timing and Potential Challenges

With Tesla planning to begin Cybercab production in April, the real challenge with the induction charging is whether the company can develop an effective wireless apparatus in that short time frame.

It has been in development for several years, but solving the issue with heat and energy loss is something that is not an easy task.

In the short-term, Tesla could utilize this port for normal Supercharging operation on the Cybercab. Eventually, it could be phased out as induction charging proves to be a more effective and convenient option.

News

Tesla confirms that it finally solved its 4680 battery’s dry cathode process

The suggests the company has finally resolved one of the most challenging aspects of its next-generation battery cells.

Tesla has confirmed that it is now producing both the anode and cathode of its 4680 battery cells using a dry-electrode process, marking a key breakthrough in a technology the company has been working to industrialize for years.

The update, disclosed in Tesla’s Q4 and FY 2025 update letter, suggests the company has finally resolved one of the most challenging aspects of its next-generation battery cells.

Dry cathode 4680 cells

In its Q4 and FY 2025 update letter, Tesla stated that it is now producing 4680 cells whose anode and cathode were produced during the dry electrode process. The confirmation addresses long-standing questions around whether Tesla could bring its dry cathode process into sustained production.

The disclosure was highlighted on X by Bonne Eggleston, Tesla’s Vice President of 4680 batteries, who wrote that “both electrodes use our dry process.”

Tesla first introduced the dry-electrode concept during its Battery Day presentation in 2020, pitching it as a way to simplify production, reduce factory footprint, lower costs, and improve energy density. While Tesla has been producing 4680 cells for some time, the company had previously relied on more conventional approaches for parts of the process, leading to questions about whether a full dry-electrode process could even be achieved.

4680 packs for Model Y

Tesla also revealed in its Q4 and FY 2025 Update Letter that it has begun producing battery packs for certain Model Y vehicles using its in-house 4680 cells. As per Tesla:

“We have begun to produce battery packs for certain Model Ys with our 4680 cells, unlocking an additional vector of supply to help navigate increasingly complex supply chain challenges caused by trade barriers and tariff risks.”

The timing is notable. With Tesla preparing to wind down Model S and Model X production, the Model Y and Model 3 are expected to account for an even larger share of the company’s vehicle output. Ensuring that the Model Y can be equipped with domestically produced 4680 battery packs gives Tesla greater flexibility to maintain production volumes in the United States, even as global battery supply chains face increasing complexity.

Elon Musk

Tesla Giga Texas to feature massive Optimus V4 production line

This suggests that while the first Optimus line will be set up in the Fremont Factory, the real ramp of Optimus’ production will happen in Giga Texas.

Tesla will build Optimus 4 in Giga Texas, and its production line will be massive. This was, at least, as per recent comments by CEO Elon Musk on social media platform X.

Optimus 4 production

In response to a post on X which expressed surprise that Optimus will be produced in California, Musk stated that “Optimus 4 will be built in Texas at much higher volume.” This suggests that while the first Optimus line will be set up in the Fremont Factory, and while the line itself will be capable of producing 1 million humanoid robots per year, the real ramp of Optimus’ production will happen in Giga Texas.

This was not the first time that Elon Musk shared his plans for Optimus’ production at Gigafactory Texas. During the 2025 Annual Shareholder Meeting, he stated that Giga Texas’ Optimus line will produce 10 million units of the humanoid robot per year. He did not, however, state at the time that Giga Texas would produce Optimus V4.

“So we’re going to launch on the fastest production ramp of any product of any large complex manufactured product ever, starting with building a one-million-unit production line in Fremont. And that’s Line one. And then a ten million unit per year production line here,” Musk stated.

How big Optimus could become

During Tesla’s Q4 and FY 2025 earnings call, Musk offered additional context on the potential of Optimus. While he stated that the ramp of Optimus’ production will be deliberate at first, the humanoid robot itself will have the potential to change the world.

“Optimus really will be a general-purpose robot that can learn by observing human behavior. You can demonstrate a task or verbally describe a task or show it a task. Even show it a video, it will be able to do that task. It’s going to be a very capable robot. I think long-term Optimus will have a very significant impact on the US GDP.

“It will actually move the needle on US GDP significantly. In conclusion, there are still many who doubt our ambitions for creating amazing abundance. We are confident it can be done, and we are making the right moves technologically to ensure that it does. Tesla, Inc. has never been a company to shy away from solving the hardest problems,” Musk stated.