Investor's Corner

Tesla upsells Model 3 Performance as Musk ponders ‘mental scar tissue’ from production ramp

Tesla is starting to upsell the Model 3 Performance to reservation holders, with CEO Elon Musk announcing more exciting aspects of the vehicle on Twitter. Musk’s recent announcements describe the vehicle’s suspension and brakes, as well as the company’s ongoing test drive program for the compact electric car.

According to Musk, the Model 3 Performance will feature a lower ride height helped by the performance suspension system and stronger brakes than non-Performance variants, which would enhance the vehicles’ track capabilities. The upgrade would further bolster claims that Model 3 Performance will outperform all vehicles in its class on the race track, including the BMW M3.

Performance version suspension is 1cm lower & has stronger brakes in upgrade package

— Elon Musk (@elonmusk) July 13, 2018

Equipping larger brakes on the Model 3 Performance is definitely the right decision from Tesla. The car’s stock brakes, after all, are unable to handle hard track driving, as evidenced in a Laguna Seca run by a mostly stock Model 3 earlier this year. With upgraded brakes, the Model 3, even the single motor, non-Performance Long Range RWD version, becomes a formidable vehicle on the racecourse, recently beating Porsche to win a Time Attack challenge in a Canadian racing event.

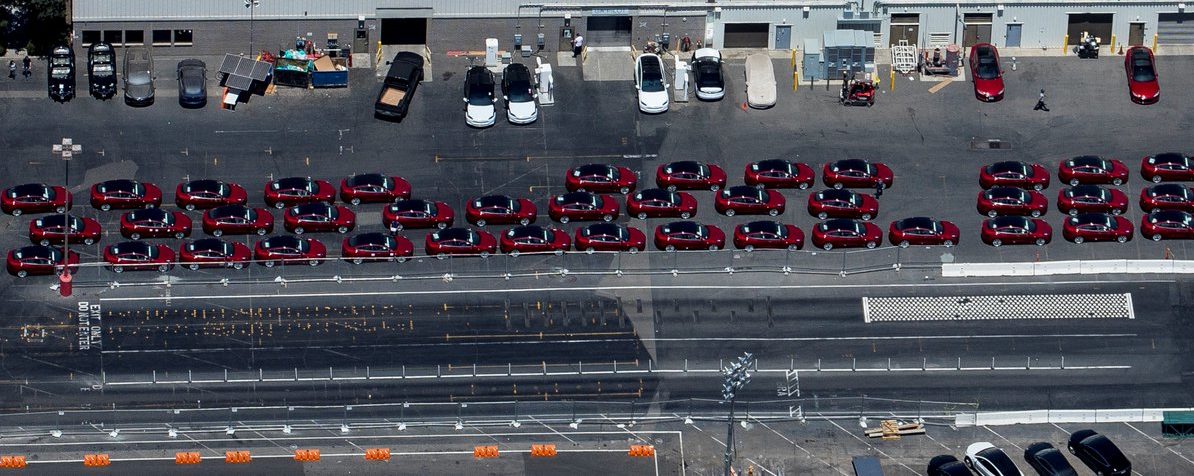

Overall, Musk’s recent Twitter statements for the Model 3 Performance comes amidst the company’s latest attempt to upsell the vehicle. Tesla, after all, has been putting some extra attention on the Model 3 Performance, with the electric car maker recently showcasing the car’s drifting capabilities in a skidpad testing video. Elon Musk also noted that the company had produced approximately 100 units of the Model 3 Performance to date, which would be used for test drive units in the company’s showrooms. In a recent Twitter announcement, Musk further encouraged reservation holders to test drive the Model 3 Performance regardless of whether they plan to buy the top trim variant or not.

These sure look like the ~100 performance #Model3 that $TSLA says were built for test drives. Question is when will they move off the lot into stores? Or have they already and these are leftovers? Images are from July 10th. https://t.co/PRuKZUvBtf #Tesla pic.twitter.com/SpU3ivTIA7

— RS Metrics (@RSMetrics) July 12, 2018

Tesla’s upselling of the Model 3 Performance comes amidst the company’s push to sustain mass production of its electric car. Since the company achieved its ever-elusive goal of producing 5,000 Model 3 per week during the end of Q2 2018, Tesla has been ramping the deliveries of the vehicle. Recent signs from Tesla also appear to be teasing that the company would be able to sustain a 5,000/week pace this Q3 2018. Among these are frequent mass VIN registrations, a new 5-minute Sign & Drive delivery program, and recent statements related by Senior Director of Investor Relations Aaron Chew, who reportedly stated in meeting with investors and analysts that the company is targeting a sustained 5,000-6,000/week production pace for the current quarter.

Whether you plan to buy a Dual Motor Performance Model 3 or not, take it for a test drive anyway. It’s like having pure fun jacked straight into your brain whenever you want.

— Elon Musk (@elonmusk) July 13, 2018

While Tesla appears to have broken through a massive roadblock with the Model 3, Elon Musk’s recent statements to Bloomberg reveal that the manufacturing feat came at a high price. As noted by Musk in a recent interview with the publication, the Model 3 ramp has been incredibly difficult for him and Tesla, to the point where he feels he developed permanent mental scars from the experience.

“It’s been super-hard. Like there is for sure some permanent mental scar tissue here. But I do feel good about the months to come. I think the results will speak for themselves,” Musk said.

Musk, however, noted that the risks Tesla took with the Model 3 ramp, such as betting the entire company on the vehicle’s success, will likely not be replicated in the future. According to Musk, he does not foresee any bet-the-company situations arising, regardless of Tesla’s upcoming projects and vehicles.

“To the best of my judgment, I do not think we have any future bet-the-company situations. We will still need to work hard and be vigilant and not be complacent because it is very difficult just to survive as a car company. But it will not be the same level of strain as getting to volume production of Model 3,” he said.

Elon Musk

Tesla locks in Elon Musk’s top problem solver as it enters its most ambitious era

The generous equity award was disclosed by the electric vehicle maker in a recent regulatory filing.

Tesla has granted Senior Vice President of Automotive Tom Zhu more than 520,000 stock options, tying a significant portion of his compensation to the company’s long-term performance.

The generous equity award was disclosed by the electric vehicle maker in a recent regulatory filing.

Tesla secures top talent

According to a Form 4 filing with the U.S. Securities and Exchange Commission, Tom Zhu received 520,021 stock options with an exercise price of $435.80 per share. Since the award will not fully vest until March 5, 2031, Zhu must remain at Tesla for more than five years to realize the award’s full benefit.

Considering that Tesla shares are currently trading at around the $445 to $450 per share level, Zhu will really only see gains in his equity award if Tesla’s stock price sees a notable rise over the years, as noted in a Sina Finance report.

Still, even at today’s prices, Zhu’s stock award is already worth over $230 million. If Tesla reaches the market cap targets set forth in Elon Musk’s 2025 CEO Performance Award, Zhu would become a billionaire from this equity award alone.

Tesla’s problem solver

Zhu joined Tesla in April 2014 and initially led the company’s Supercharger rollout in China. Later that year, he assumed the leadership of Tesla’s China business, where he played a central role in Tesla’s localization efforts, including expanding retail and service networks, and later, overseeing the development of Gigafactory Shanghai.

Zhu’s efforts helped transform China into one of Tesla’s most important markets and production hubs. In 2023, Tesla promoted Zhu to Senior Vice President of Automotive, placing him among the company’s core global executives and expanding his influence beyond China. He has since garnered a reputation as the company’s problem solver, being tapped by Elon Musk to help ramp Giga Texas’s vehicle production.

With this in mind, Tesla’s recent filing seems to suggest that the company is locking in its top talent as it enters its newest, most ambitious era to date. As could be seen in the targets of Elon Musk’s 2025 pay package, Tesla is now aiming to be the world’s largest company by market cap, and it is aiming to achieve production levels that are unheard of. Zhu’s talents would definitely be of use in this stage of the company’s growth.

Investor's Corner

Tesla analyst teases self-driving dominance in new note: ‘It’s not even close’

Tesla analyst Andrew Percoco of Morgan Stanley teased the company’s dominance in its self-driving initiative, stating that its lead over competitors is “not even close.”

Percoco recently overtook coverage of Tesla stock from Adam Jonas, who had covered the company at Morgan Stanley for years. Percoco is handling Tesla now that Jonas is covering embodied AI stocks and no longer automotive.

His first move after grabbing coverage was to adjust the price target from $410 to $425, as well as the rating from ‘Overweight’ to ‘Equal Weight.’

Percoco’s new note regarding Tesla highlights the company’s extensive lead in self-driving and autonomy projects, something that it has plenty of competition in, but has established its prowess over the past few years.

He writes:

“It’s not even close. Tesla continues to lead in autonomous driving, even as Nvidia rolls out new technology aimed at helping other automakers build driverless systems.”

Percoco’s main point regarding Tesla’s advantage is the company’s ability to collect large amounts of training data through its massive fleet, as millions of cars are driving throughout the world and gathering millions of miles of vehicle behavior on the road.

This is the main point that Percoco makes regarding Tesla’s lead in the entire autonomy sector: data is King, and Tesla has the most of it.

One big story that has hit the news over the past week is that of NVIDIA and its own self-driving suite, called Alpamayo. NVIDIA launched this open-source AI program last week, but it differs from Tesla’s in a significant fashion, especially from a hardware perspective, as it plans to use a combination of LiDAR, Radar, and Vision (Cameras) to operate.

Percoco said that NVIDIA’s announcement does not impact Morgan Stanley’s long-term opinions on Tesla and its strength or prowess in self-driving.

NVIDIA CEO Jensen Huang commends Tesla’s Elon Musk for early belief

And, for what it’s worth, NVIDIA CEO Jensen Huang even said some remarkable things about Tesla following the launch of Alpamayo:

“I think the Tesla stack is the most advanced autonomous vehicle stack in the world. I’m fairly certain they were already using end-to-end AI. Whether their AI did reasoning or not is somewhat secondary to that first part.”

Percoco reiterated both the $425 price target and the ‘Equal Weight’ rating on Tesla shares.

Investor's Corner

Tesla price target boost from its biggest bear is 95% below its current level

Tesla stock (NASDAQ: TSLA) just got a price target boost from its biggest bear, Gordon Johnson of GLJ Research, who raised his expected trading level to one that is 95 percent lower than its current trading level.

Johnson pushed his Tesla price target from $19.05 to $25.28 on Wednesday, while maintaining the ‘Sell’ rating that has been present on the stock for a long time. GLJ has largely been recognized as the biggest skeptic of Elon Musk’s company, being particularly critical of the automotive side of things.

Tesla has routinely been called out by Johnson for negative delivery growth, what he calls “weakening demand,” and price cuts that have occurred in past years, all pointing to them as desperate measures to sell its cars.

Johnson has also said that Tesla is extremely overvalued and is too reliant on regulatory credits for profitability. Other analysts on the bullish side recognize Tesla as a company that is bigger than just its automotive side.

Many believe it is a leader in autonomous driving, like Dan Ives of Wedbush, who believes Tesla will have a widely successful 2026, especially if it can come through on its targets and schedules for Robotaxi and Cybercab.

Justifying the price target this week, Johnson said that the revised valuation is based on “reality rather than narrative.” Tesla has been noted by other analysts and financial experts as a stock that trades on narrative, something Johnson obviously disagrees with.

Dan Nathan, a notorious skeptic of the stock, turned bullish late last year, recognizing the company’s shares trade on “technicals and sentiment.” He said, “From a trading perspective, it looks very interesting.”

Tesla bear turns bullish for two reasons as stock continues boost

Johnson has remained very consistent with this sentiment regarding Tesla and his beliefs regarding its true valuation, and has never shied away from putting his true thoughts out there.

Tesla shares closed at $431.40 today, about 95 percent above where Johnson’s new price target lies.