News

SpaceX’s next Falcon Heavy launch may feature record-breaking center core landing

Thanks to a temporary reopening of the US federal government, SpaceX was finally able to continue the process of filing FCC and FAA paperwork needed to acquire permits for upcoming launches, including Falcon Heavy.

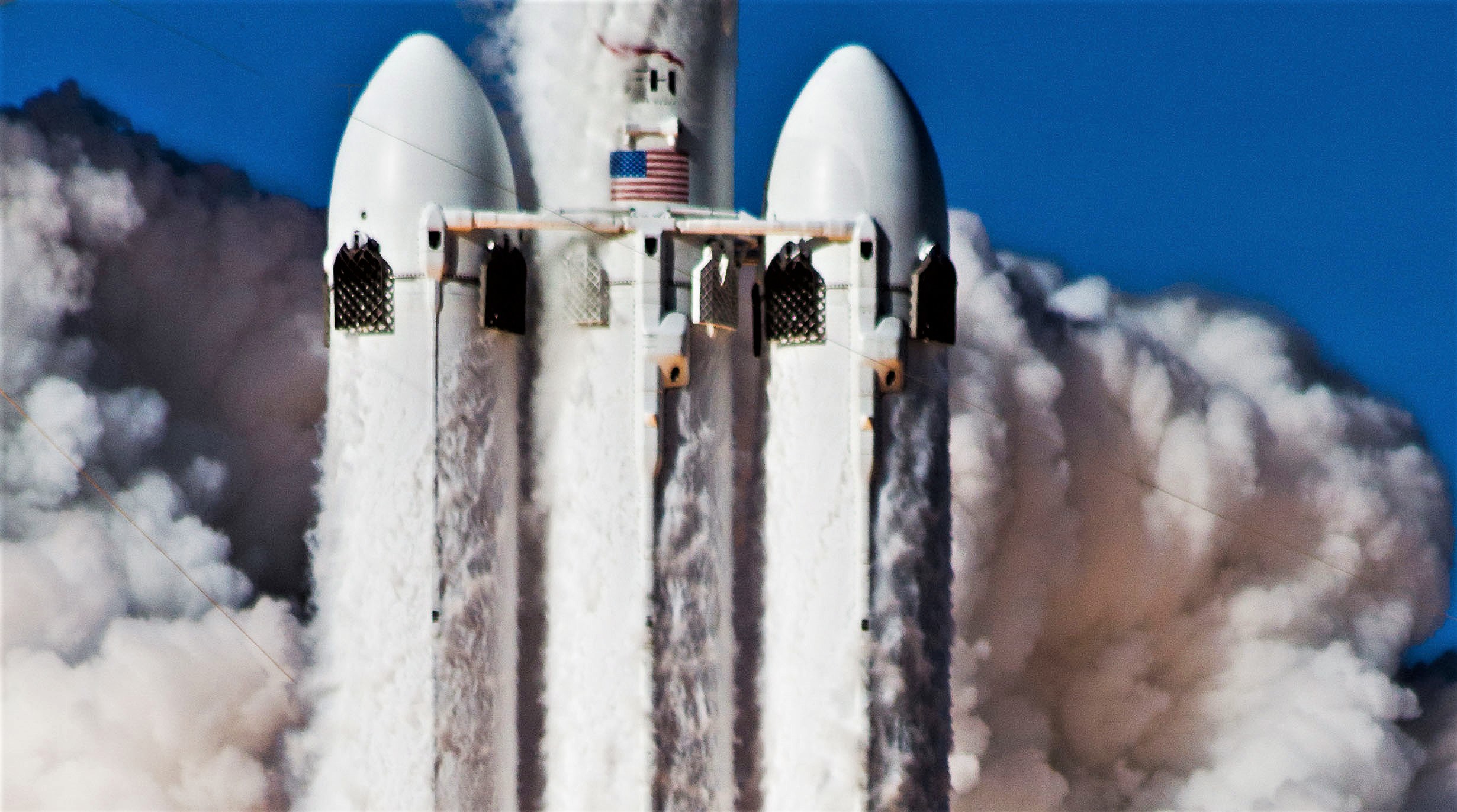

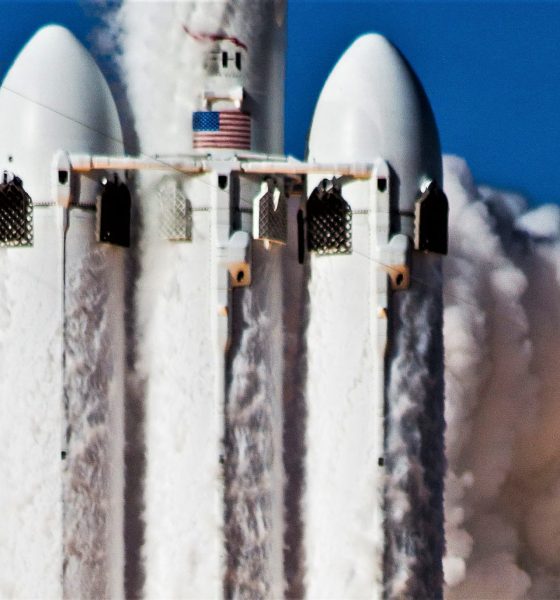

One such filing related to the first operational Falcon Heavy launch has revealed a fairly impressive statistic: comprised of three first stage boosters, SpaceX indicated that Falcon Heavy’s center core will attempt to land on drone ship Of Course I Still Love You (OCISLY) nearly 1000 km (600 mi) away from its launch site, easily smashing the record for the greatest distance traveled by a Falcon booster in flight.

Of Course I Still Love You will be positioned a record ~965km downrange. That's nearly 300km further that the previous greatest distance of 681km, set during the Eutelsat-117WB mission in June 2016. (The landing was a failure, with the booster running out of LOX!) https://t.co/RECKjMtd37

— Gav Cornwell (@SpaceOffshore) January 28, 2019

The same FCC filings also revealed a No Earlier Than (NET) launch date: March 7, 2019. Originally targeted for mid to late February, the complexity and logistical challenges of building, shipping, testing, and delivering two side boosters, a center core, one upper stage, and a payload fairing from SpaceX’s California factory to its Texas test facilities and Florida launch pad unsurprisingly took a small toll on the launch’s aspirational schedule. Nevertheless, if the launch data actually holds to March 7th, SpaceX will not have missed the mark by much considering that this Falcon Heavy – based on new and more powerful Block 5 boosters – is likely a significant departure from the Block 2/Block 3 hardware that has flight heritage from the triple-booster rocket’s Feb. 2018 launch debut.

Just shy of a year after Falcon Heavy’s launch debut, it appears that the rocket’s second and third launches were pushed back by a fundamental lack of production capacity. In other words, SpaceX’s Hawthorne rocket factory simply had to focus on more critical priorities in the 6-9 months that followed the demo mission. At nearly the same time as Falcon Heavy was lifting off for the first time, SpaceX’s world-class production crew was in the midst of manufacturing the first upgraded Falcon 9 Block 5 booster (B1046) and wrapped up final checkouts just 10 days after Heavy’s Feb. 6 launch debut, sending the pathfinder rocket to McGregor, Texas for the first static fire of a Block 5 booster.

In the meantime, SpaceX’s decision to intentionally expend otherwise recoverable reused Falcon boosters after their second launches meant that the company’s fleet of flightworthy rockets was rapidly approaching zero, a move CEO Elon Musk specifically indicated was meant to make room for Block 5, the future (and final form) of the Falcon family. SpaceX’s busy 2018 launch manifest and multiple critical missions for the US government were thus balanced on the success, reliability, and rapid production of a serious number of Merlin engines, boosters, and upper stages. This included B1051 – the first explicitly crew-rated Falcon 9 – and B1054, the first SpaceX rocket rated to launch high-value US military (specifically Air Force) satellites. However, SpaceX also needed to produce a cadre of Falcon 9 boosters capable of easy reuse to support the dozen or so other commercial launches on the manifest.

- Falcon 9 B1046 is processed in Port of LA shortly after its third successful launch and landing, December 2018. (Pauline Acalin)

- Falcon 9 B1047 is pictured here beneath an upper stage and satellite Es’hail-2 prior to its second launch. (Tom Cross)

- Falcon 9 B1048 returned to Port of Los Angeles aboard drone ship Just Read The Instructions after its first launch. July 27. (Pauline Acalin)

- Falcon 9 B1049 returned to Port of Los Angeles after its second successful launch and landing in four months. (Pauline Acalin)

- Falcon 9 B1050 is seen here just after liftoff. GPS III SV01’s Falcon 9 will feature no grid fins or landing legs. ☹ (Tom Cross)

- Falcon 9 B1051 and Crew Dragon vertical at Pad 39A. (SpaceX)

That gamble ultimately paid off, with Block 5 performing admirably and supporting a reasonable – if not record-breaking – rate of reuse. SpaceX successfully launched B1054 for the USAF, completed B1051 (now at Pad 39A awaiting NASA’s go-ahead), and built enough reusable Block 5 boosters to support nine additional commercial missions in 2018. In hindsight, barring an assumption of a truly miraculous and unprecedented Falcon booster production rate, Falcon Heavy’s next launches were almost guaranteed to occur no fewer than 6-12 months after the rocket’s launch debut – SpaceX’s entire launch business depended on building 5+ unrelated Falcon 9 boosters, while Falcon Heavy customers Arabsat and the USAF were unlikely to be swayed to launch on flight-proven hardware so early into Block 5’s career.

https://twitter.com/_TomCross_/status/1048483536917823488

All cylinders firing

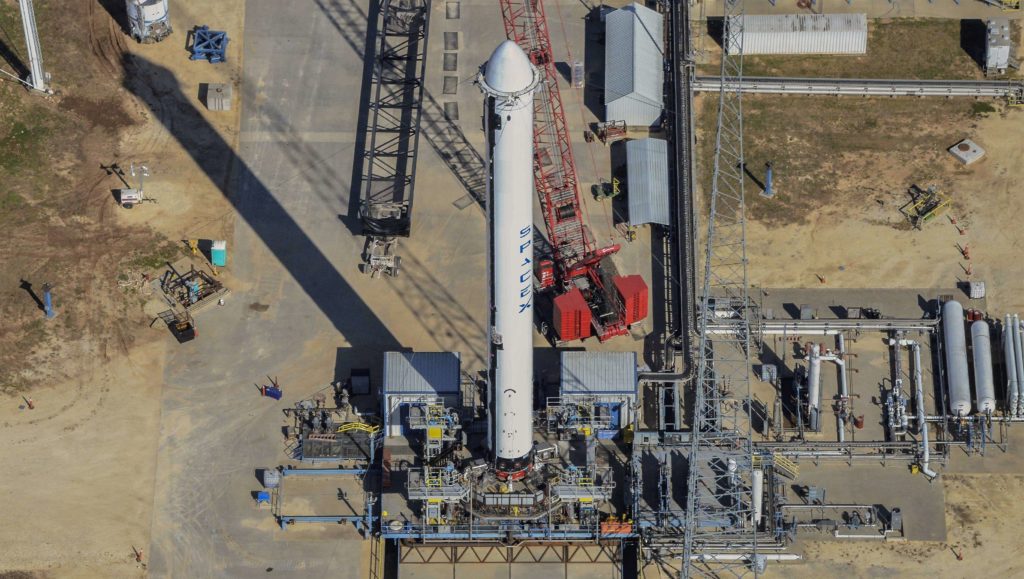

Once Falcon 9 B1054 departed SpaceX’s Hawthorne factory (see above) in early October, it appears that the company’s production team pivoted directly to integrating and shipping the next three (or more) Falcon Heavy boosters back to back for the rocket’s second and third launches. The first new side booster departed the factory in mid-November, followed by a second side booster in early December and a (presumed but highly likely) center core at the turn of 2019. Both side boosters have been static-fired in Texas and are now at SpaceX’s Florida facilities, while the center core either just completed its Texas static fire testing or is already on its way East.

- SpaceX’s Falcon Heavy Block 5 side booster is pictured here in Texas in November 2018. (Teslarati/Aero Photo)

- The second (and third) flight of Falcon Heavy is even closer to reality as a new side booster heads to Florida after finishing static fire tests in Texas. (Reddit /u/e32revelry)

- SpaceX Facebook group member Joshua Murrah captured the second Falcon Heavy side booster to arrive in Florida in the last month. (Joshua Murrah, 01/17/19)

- The next Falcon Heavy’s first side booster delivery was caught by several onlookers around December 21. (Instagram)

- A booster – likely the next Falcon Heavy center core – was vertical at McGregor’s S1 static fire stand. (Instagram /u/tcryguy)

- A booster – either Falcon Heavy’s next center core or a new Falcon 9 – was vertical at SpaceX’s McGregor, TX test facilities on Jan 28. (Instagram /u/n75sd)

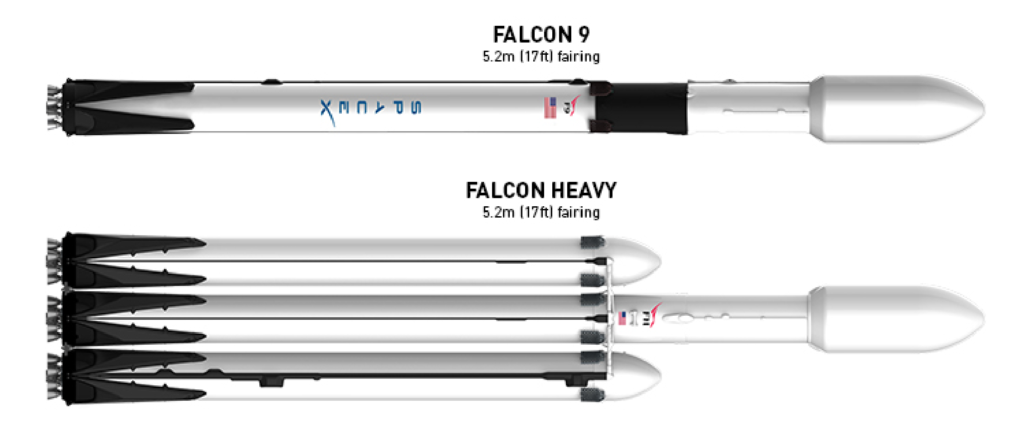

- A diagram from a recent SpaceX document offers an idea of what Falcon Heavy Block 5 will look like. (SpaceX)

Once the center core and upper stage make their way to SpaceX’s Kennedy Space Center Pad 39A, the company’s technicians and engineers will be able to integrate the second Falcon Heavy to have ever existed in preparation for a critical static fire test. That could occur as early as February, although the launch debut of Crew Dragon (DM-1) – now NET March from Pad 39A after a relentless string of slips – will likely take precedence over Falcon Heavy and could thus directly interfere with its launch, as the launch pad and transporter/erector (T/E) has to undergo at least a few days of modifications to switch between Falcon 9 and Heavy.

Regardless, the next two Falcon Heavy launches will be well worth the wait. SpaceX’s FCC filings indicate that the center core may travel nearly 1000 km (600 mi) East of Pad 39A to land on drone ship OCISLY after launch, smashing the previous record attempt – during the June 2016 launch of Eutelsat 117WB – of ~700 km (430 mi). That Falcon 9 booster – albeit a less-powerful Block 2 variant – was unsuccessful in its landing attempt, running out of oxidizer seconds before landing. Falcon Heavy’s debut center core also happened to suffer a wholly different but no less fatal anomaly during landing, causing it to miss the drone ship and slam into the Atlantic Ocean at almost half the speed of sound (300 mph/480 km/h).

Looks like early liquid oxygen depletion caused engine shutdown just above the deck pic.twitter.com/Sa6uCkpknY

— Elon Musk (@elonmusk) June 17, 2016

Known for their rocket performance estimates, NASASpaceflight forum user “Orbiter” first pointed out the impressive distance – gathered by mapping coordinates included in SpaceX’s Jan. 28th FCC filing – and estimated that the Falcon Heavy center booster flying a trajectory as implied could be traveling as fast as ~3.5 km/s (2.2 mi/s) at main engine cut-off (MECO), the point at which the booster separates from the upper stage and fairing. This would be a nearly unprecedented velocity for any Falcon booster, let alone a booster with plans to land after launch. Falcon 9 MECO typically occurs at velocities between 1.5 and 2.5 km/s for recoverable missions, while even the recent expendable GPS III launch saw F9 S1’s engines cut off around 2.7 km/s.

Whether that MECO velocity estimate is correct, Falcon Heavy’s NET March launch of the ~6000 kg (13,300 lb) Arabsat 6A satellite is likely to be an exceptionally hot reentry and recovery for the center core, while the rocket’s duo of side boosters will attempt a repeat of the debut mission’s spectacular double-landing at LZ-1.

Cybertruck

Tesla analyst claims another vehicle, not Model S and X, should be discontinued

Tesla analyst Gary Black of The Future Fund claims that the company is making a big mistake getting rid of the Model S and Model X. Instead, he believes another vehicle within the company’s lineup should be discontinued: the Cybertruck.

Black divested The Future Fund from all Tesla holdings last year, but he still covers the stock as an analyst as it falls in the technology and autonomy sectors, which he covers.

In a new comment on Thursday, Black said the Cybertruck should be the vehicle Tesla gets rid of due to the negatives it has drawn to the company.

The Cybertruck is also selling in an underwhelming fashion considering the production capacity Tesla has set aside for it. It’s worth noting it is still the best-selling electric pickup on the market, and it has outlasted other EV truck projects as other manufacturers are receding their efforts.

Black said:

“IMHO it’s a mistake to keep Tesla Cybertruck which has negative brand equity and sold 10,000 units last year, and discontinue S/X which have strong repeat brand loyalty and together sold 30K units and are highly profitable. Why not discontinue CT and covert S/X to be fully autonomous?”

IMHO it’s a mistake to keep $TSLA Cybertruck which has negative brand equity and sold 10,000 units last year, and discontinue S/X which have strong repeat brand loyalty and together sold 30K units and are highly profitable. Why not discontinue CT and covert S/X to be fully…

— Gary Black (@garyblack00) January 29, 2026

On Wednesday, CEO Elon Musk confirmed that Tesla planned to transition Model S and Model X production lines at the Fremont Factory to handle manufacturing efforts of the Optimus Gen 3 robot.

Musk said that it was time to wind down the S and X programs “with an honorable discharge,” also noting that the two cars are not major contributors to Tesla’s mission any longer, as its automotive division is more focused on autonomy, which will be handled by Model 3, Model Y, and Cybercab.

Tesla begins Cybertruck deliveries in a new region for the first time

The news has drawn conflicting perspectives, with many Tesla fans upset about the decision, especially as it ends the production of the largest car in the company’s lineup. Tesla’s focus is on smaller ride-sharing vehicles, especially as the vast majority of rides consist of two or fewer passengers.

The S and X do not fit in these plans.

Nevertheless, the Cybertruck fits in Tesla’s future plans. Musk said the pickup will be needed for the transportation of local goods. Musk also said Cybertruck would be transitioned to an autonomous line.

Elon Musk

SpaceX reportedly discussing merger with xAI ahead of blockbuster IPO

In a groundbreaking new report from Reuters, SpaceX is reportedly discussing merger possibilities with xAI ahead of the space exploration company’s plans to IPO later this year, in what would be a blockbuster move.

The outlet said it would combine rockets and Starlink satellites, as well as the X social media platform and AI project Grok under one roof. The report cites “a person briefed on the matter and two recent company filings seen by Reuters.”

Musk, nor SpaceX or xAI, have commented on the report, so, as of now, it is unconfirmed.

With that being said, the proposed merger would bring shares of xAI in exchange for shares of SpaceX. Both companies were registered in Nevada to expedite the transaction, according to the report.

On January 21, both entities were registered in Nevada. The report continues:

“One of them, a limited liability company, lists SpaceX and Bret Johnsen, the company’s chief financial officer, as managing members, while the other lists Johnsen as the company’s only officer, the filings show.”

The source also stated that some xAI executives could be given the option to receive cash in lieu of SpaceX stock. No agreement has been reached, nothing has been signed, and the timing and structure, as well as other important details, have not been finalized.

SpaceX is valued at $800 billion and is the most valuable privately held company, while xAI is valued at $230 billion as of November. SpaceX could be going public later this year, as Musk has said as recently as December that the company would offer its stock publicly.

The plans could help move along plans for large-scale data centers in space, something Musk has discussed on several occasions over the past few months.

At the World Economic Forum last week, Musk said:

“It’s a no-brainer for building solar-powered AI data centers in space, because as I mentioned, it’s also very cold in space. The net effect is that the lowest cost place to put AI will be space and that will be true within two to three years, three at the latest.”

He also said on X that “the most important thing in the next 3-4 years is data centers in space.”

If the report is true and the two companies end up coming together, it would not be the first time Musk’s companies have ended up coming together. He used Tesla stock to purchase SolarCity back in 2016. Last year, X became part of xAI in a share swap.

Elon Musk

Tesla hits major milestone with Full Self-Driving subscriptions

Tesla has announced it has hit a major milestone with Full Self-Driving subscriptions, shortly after it said it would exclusively offer the suite without the option to purchase it outright.

Tesla announced on Wednesday during its Q4 Earnings Call for 2025 that it had officially eclipsed the one million subscription mark for its Full Self-Driving suite. This represented a 38 percent increase year-over-year.

This is up from the roughly 800,000 active subscriptions it reported last year. The company has seen significant increases in FSD adoption over the past few years, as in 2021, it reported just 400,000. In 2022, it was up to 500,000 and, one year later, it had eclipsed 600,000.

NEWS: For the first time, Tesla has revealed how many people are subscribed or have purchased FSD (Supervised).

Active FSD Subscriptions:

• 2025: 1.1 million

• 2024: 800K

• 2023: 600K

• 2022: 500K

• 2021: 400K pic.twitter.com/KVtnyANWcs— Sawyer Merritt (@SawyerMerritt) January 28, 2026

In mid-January, CEO Elon Musk announced that the company would transition away from giving the option to purchase the Full Self-Driving suite outright, opting for the subscription program exclusively.

Musk said on X:

“Tesla will stop selling FSD after Feb 14. FSD will only be available as a monthly subscription thereafter.”

The move intends to streamline the Full Self-Driving purchase option, and gives Tesla more control over its revenue, and closes off the ability to buy it outright for a bargain when Musk has said its value could be close to $100,000 when it reaches full autonomy.

It also caters to Musk’s newest compensation package. One tranche requires Tesla to achieve 10 million active FSD subscriptions, and now that it has reached one million, it is already seeing some growth.

The strategy that Tesla will use to achieve this lofty goal is still under wraps. The most ideal solution would be to offer a less expensive version of the suite, which is not likely considering the company is increasing its capabilities, and it is becoming more robust.

Tesla is shifting FSD to a subscription-only model, confirms Elon Musk

Currently, Tesla’s FSD subscription price is $99 per month, but Musk said this price will increase, which seems counterintuitive to its goal of increasing the take rate. With that being said, it will be interesting to see what Tesla does to navigate growth while offering a robust FSD suite.