News

Adoption of Tesla’s electric truck will be driven by regulation

It’s expected that the commercial trucking industry will begin to transform in the same way that the passenger automotive industry has. Fuel efficiency has become a new priority and electrification is now the go-to plan for achieving higher MPGs in heavy trucking. In much the same way that regulations pushed trucking towards lower pollution at the expense of efficiency in the 1970s, today’s trucking paradigm is seeing a push for more efficiency. At what expense?

A new report from Ravi Shanker at Morgan Stanley urges investors to consider electric and self-driving commercial trucking as an opportunity. Shanker says that regulations and economics will drive the industry towards electrification and autonomous technologies. The analyst says that this could happen as early as 2020, which is when new federal fuel economy regulations on heavy-duty vehicles begin to really gather steam. Although efficiency gains will be had with electrification and self-driving, Shanker makes it clear that this will be secondary to the demand created by regulatory pressure.

As usual, we look to California for a glimpse of what could be coming. California’s Sustainable Freight Action Plan calls for 100,000+ zero-emissions trucks to be on the road by 2030 in that state. There is debate as to whether this plan is realistic, but federal standards are also playing a large role. The U.S. Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (part of the federal Department of Transportation) have proposed emissions and fuel economy standards for heavy-duty vehicles. The first of these began with the 2014 model year.

For our purposes, the regulations affecting “combination tractors” (aka “tractor-trailer” or “18 wheeler”) models are pertinent. The 2018 standards are relatively loose and most in the industry believe they are achievable, but the EPA and NHTSA have proposed further standards to begin in 2021, with incremental increases thereafter through to 2027. The goals are largely aimed towards lower CO2 emissions with reductions of about four percent (depending on the vehicle type) being the goal. The reduction is not the issue with industry insiders, however, it’s the test cycle to be used, which some argue is less realistic and which disfavors other emissions that also have requirements to be met. This Phase 2 of the federal efficiency standards for heavy trucks is not yet finalized, but will very likely be the driving force behind national changes in trucks.

Equating these changes into standard numbers that the general public would understand is difficult. Heavy-duty trucks can range in fuel efficiency from 20 mpg or better down to 2-3 mpg. For most tractor-trailer combinations, MPG averages of 4-9 mpg are the norm, depending on load, tractor type, and area of operation. Most analysts calculate efficiency using fuel use in tons per mile with a relatively long distance (100-500 miles) being the average. Using this method, for example, in my time driving a tractor pulling a refrigerated trailer across all 48 states, my fuel economy average was about average for that sector of the industry at roughly 60 ton-miles per gallon. Today, these numbers are slightly higher, according to the latest U.S. Transportation Energy book. Using this method of calculation, a 2015 Toyota Prius is about a third as efficient at moving freight as was my truck.

This doesn’t mean there isn’t room for improvement, of course. There are more companies than Tesla working towards deleting the smoke stacks from big trucks.

In Europe, Volvo trucks is working hard towards a zero-emissions (at the tailpipe anyway) trucking solution with several approaches being tested. An overhead tram-like charging system has been deployed for a short stretch of highway in Sweden, aiming to improve plug-in trucks’ range in EV mode. Short-haul battery electrics and two different versions of autonomous (or semi-autonomous) systems are also being tested.

Here in the States, Volvo’s Mack Trucks is working on a handful of electrification options for heavy-duty drivetrains. So is Daimler (Freightliner, Western Star in the U.S.). Startups like Nikola also have eyes on this electric trucking future. Other startups have hoped to get into the mix as well, but the failure rate is high with companies like Smith Electric, Vision Industries, and Boulder Electric having designed and marketed innovative commercial truck options that ultimately never caught on.

Meanwhile, the largest maker of electric heavy vehicles is Chinese maker BYD, who branched out from making gadget batteries into building electric buses, trucks, and more. They are currently filling contracts internationally for buses and trucks in places as disparate at California, Malaysia, and Europe. BYD builds battery-electric, hydrogen fuel cell electric, plug-in hybrid, and hybrid drivetrains and machines for several commercial market sectors.

So we can guarantee that changes to the trucking industry are coming, but no one can say how fast or how much change that will be. Current federal regulations will drive the industry forward until 2018 and it’s likely that new standards will be in place to keep carrying change forward after that. California’s ambitious plans for adopting electric trucks will be largely regulation and incentive driven, but that has down sides as well. Many of the startups we’ve seen who’ve created electrified big rigs or delivery trucks ultimately failed when the incentives began to dry up.

For Tesla, this could mean that the financial case for the Tesla Semi will need to be more economics-based and less dependent on single market, incentives-based plans. This means that Elon and Co should be looking beyond California and it’s 100,000 vehicle plans into a broader market. We’ll discuss the potential economic case for a Tesla Semi in a future editorial.

News

Tesla UK sales see 14% year-over-year rebound in June: SMMT data

The SMMT stated that Tesla sales grew 14% year-over-year to 7,719 units in June 2025.

Tesla’s sales in the United Kingdom rose in June, climbing 14% year-over-year to 7,719 units, as per data from the Society of Motor Manufacturers and Traders (SMMT). The spike in the company’s sales coincided with the first deliveries of the updated Model Y last month.

Model Y deliveries support Tesla’s UK recovery

Tesla’s June performance marked one of its strongest months in the UK so far this year, with new Model Y deliveries contributing significantly to the company’s momentum.

While the SMMT listed Tesla with 7,719 deliveries in June, independent data from New AutoMotive suggested that the electric vehicle maker registered 7,891 units during the month instead. However, year-to-date figures for Tesla remain 2% down compared to 2024, as per a report from Reuters.

While Tesla made a strong showing in June, rivals are also growing. Chinese automaker BYD saw UK sales rise nearly fourfold to 2,498 units, while Ford posted the highest EV growth among major automakers, with a more than fourfold increase in the first half of 2025.

Overall, the UK’s battery electric vehicle (BEV) demand surged 39% to to 47,354 units last month, helping push total new car sales in the UK to 191,316 units, up 6.7% from the same period in 2024.

EV adoption accelerates, but concerns linger

June marked the best month for UK car sales since 2019, though the SMMT cautioned that growth in the electric vehicle sector remains heavily dependent on discounting and support programs. Still, one in four new vehicle buyers in June chose a battery electric vehicle.

SMMT Chief Executive Mike Hawes noted that despite strong BEV demand, sales levels are still below regulatory targets. “Further growth in sales, and the sector will rely on increased and improved charging facilities to boost mainstream electric vehicle adoption,” Hawes stated.

Also taking effect this week was a new US-UK trade deal, which lowers tariffs on UK car exports to the United States from 27.5% to 10%. The agreement could benefit UK-based EV producers aiming to expand across the country.

News

Tesla Model 3 ranks as the safest new car in Europe for 2025, per Euro NCAP tests

Despite being on the market longer than many of its rivals, the Tesla Model 3 continues to set the bar for vehicle safety.

The Tesla Model 3 has been named the safest new car on sale in 2025, according to the latest results from the Euro NCAP. Among 20 newly tested vehicles, the Model 3 emerged at the top of the list, scoring an impressive 359 out of 400 possible points across all major safety categories.

Tesla Model 3’s safety systems

Despite being on the market longer than many of its rivals, the Tesla Model 3 continues to set the bar for vehicle safety. Under Euro NCAP’s stricter 2025 testing protocols, the electric sedan earned 90% for adult occupant protection, 93% for child occupant protection, 89% for pedestrian protection, and 87% for its Safety Assist systems.

The updated Model 3 received particular praise for its advanced driver assistance features, including Tesla’s autonomous emergency braking (AEB) system, which performed well across various test scenarios. Its Intelligent Speed Assistance and child presence detection system were cited as noteworthy features as well, as per a WhatCar report.

Other notable safety features include the Model 3’s pedestrian-friendly pop-up hood and robust crash protection for both front and side collisions. Euro NCAP also highlighted the Model 3’s ability to detect vulnerable road users during complex maneuvers, such as turning across oncoming traffic.

Euro NCAP’s Autopilot caution

While the Model 3’s safety scores were impressive across the board, Euro NCAP did raise concerns about driver expectations of Tesla’s Autopilot system. The organization warned that some owners may overestimate the system’s capabilities, potentially leading to misuse or inattention behind the wheel. Even so, the Model 3 remained the highest-scoring vehicle tested under Euro NCAP’s updated criteria this year.

The Euro NCAP’s concerns are also quite interesting because Tesla’s Full Self-Driving (FSD) Supervised, which is arguably the company’s most robust safety suite, is not allowed for public rollout in Europe yet. FSD Supervised would allow the Model 3 to navigate inner city streets with only minimal human supervision.

Other top scorers included the Volkswagen ID.7, Polestar 3, and Geely EX5, but none matched the Model 3’s total score or consistency across categories. A total of 14 out of 20 newly tested cars earned five stars, while several models, including the Kia EV3, MG ZS, and Renault 5, fell short of the top rating.

Elon Musk

Why Tesla’s Q3 could be one of its biggest quarters in history

Tesla could stand to benefit from the removal of the $7,500 EV tax credit at the end of Q3.

Tesla has gotten off to a slow start in 2025, as the first half of the year has not been one to remember from a delivery perspective.

However, Q3 could end up being one of the best the company has had in history, with the United States potentially being a major contributor to what might reverse a slow start to the year.

Earlier today, the United States’ House of Representatives officially passed President Trump’s “Big Beautiful Bill,” after it made its way through the Senate earlier this week. The bill will head to President Trump, as he looks to sign it before his July 4 deadline.

The Bill will effectively bring closure to the $7,500 EV tax credit, which will end on September 30, 2025. This means, over the next three months in the United States, those who are looking to buy an EV will have their last chance to take advantage of the credit. EVs will then be, for most people, $7,500 more expensive, in essence.

The tax credit is available to any single filer who makes under $150,000 per year, $225,000 a year to a head of household, and $300,000 to couples filing jointly.

Ending the tax credit was expected with the Trump administration, as his policies have leaned significantly toward reliance on fossil fuels, ending what he calls an “EV mandate.” He has used this phrase several times in disagreements with Tesla CEO Elon Musk.

Nevertheless, those who have been on the fence about buying a Tesla, or any EV, for that matter, will have some decisions to make in the next three months. While all companies will stand to benefit from this time crunch, Tesla could be the true winner because of its sheer volume.

If things are done correctly, meaning if Tesla can also offer incentives like 0% APR, special pricing on leasing or financing, or other advantages (like free Red, White, and Blue for a short period of time in celebration of Independence Day), it could see some real volume in sales this quarter.

You can now buy a Tesla in Red, White, and Blue for free until July 14 https://t.co/iAwhaRFOH0

— TESLARATI (@Teslarati) July 3, 2025

Tesla is just a shade under 721,000 deliveries for the year, so it’s on pace for roughly 1.4 million for 2025. This would be a decrease from the 1.8 million cars it delivered in each of the last two years. Traditionally, the second half of the year has produced Tesla’s strongest quarters. Its top three quarters in terms of deliveries are Q4 2024 with 495,570 vehicles, Q4 2023 with 484,507 vehicles, and Q3 2024 with 462,890 vehicles.

-

Elon Musk4 days ago

Elon Musk4 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News1 week ago

News1 week agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

Elon Musk2 weeks ago

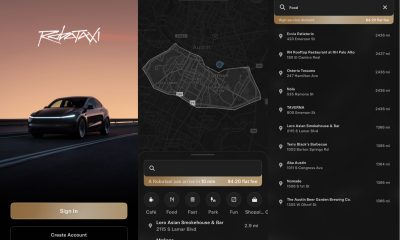

Elon Musk2 weeks agoFirst Look at Tesla’s Robotaxi App: features, design, and more

-

News2 weeks ago

News2 weeks agoSpaceX and Elon Musk share insights on Starship Ship 36’s RUD

-

News2 weeks ago

News2 weeks agoWatch Tesla’s first driverless public Robotaxi rides in Texas

-

News1 week ago

News1 week agoWatch the first true Tesla Robotaxi intervention by safety monitor

-

News2 weeks ago

News2 weeks agoTesla has started rolling out initial round of Robotaxi invites

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla to launch in India in July with vehicles already arriving: report