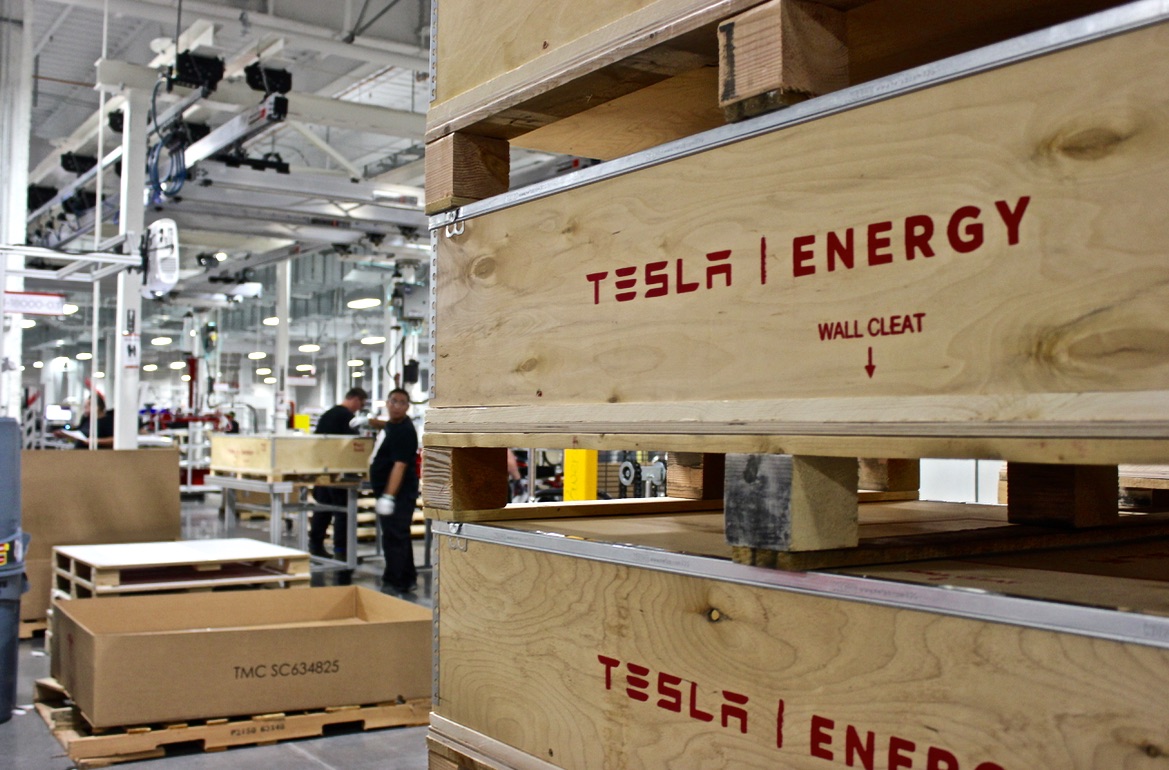

With the surge in demand for electric vehicles causing the need for more ‘Gigafactories’ to be built, demand is high for lithium ion batteries’ key ingredient: cobalt.

Cobalt is an earth metal that makes up about 35 percent of the lithium ion battery mix — the battery used in EVs and smartphones. The battery business makes up 42 percent of the global cobalt demand, and companies such as Tesla, Apple and Google are scrambling to secure as much of the precious metal as possible. Like most things, this is easier said than done.

Cobalt supply is already in a severe deficit and that’s without considering the exponential increase of nearly 500 percent in demand that is to come in the near future with the rise in popularity of EVs. Analysts at Macquarie Research predict that the global deficit for cobalt supply will reach 885 tons this year increasing year-over-year to about 5,340 tons in 2020. That’s a big problem.

Source: Materialscientist via Wikimedia Commons

Why not just get more cobalt?

The answer is not that simple.

Nearly 60 percent of the planet’s global cobalt supply comes from the tumultuous Democratic Republic of Congo where mining procedures aren’t exactly the portrait of safety. It’s reported that over 40,000 child workers employ the vast cobalt mines of the Congo and the UN estimates that 80 children die per year working in the mines. Among other hazards such as unsupervised and unprotected mining, excessive exposure can cause “cobalt lung” — a form of pneumonia that can lead to long-term respiratory illness and death.

With the extremely hazardous conditions of mines in the Congo going vastly unreported until recently, it is fair to expect that CEOs of tech companies will have to start answering some hard-hitting questions about the ethical sourcing of their cobalt supply.

So what does this all mean?

Well it means several different things depending on who you are.

If you’re an industry giant who consumes mass quantities of cobalt for production, you’re prob

U.S. Cobalt has key assets in Idaho, Utah and Alberta (Source: U.S. Cobalt)

ably looking for alternatives to the Congo. A more homegrown solution to this problem may be U.S. Cobalt. Tesla’s new Gigafactory in Reno, NV, will soon become the largest producer of lithium ion batteries in the world — for that they will need a lot of cobalt, something that may be difficult considering the global competition for this precious metal. Ethically sourced American cobalt could be the answer that Tesla needs.

If you’re an investor at a hedge fund, the cobalt deficit could mean big bucks for you. Several firms have begun buying up large physical amounts of cobalt in a hoarding maneuver. The plan is that they will hold the cobalt supply until demand increases more. The metal is now sold at around $19 per pound — a 50 percent increase since September 2017. Investors will likely sit on the supply until it’s increased to around $25 per pound. Several of these purchasers are the China State Reserve who bought 5,000 tons, and Pala Investments, Ltd. Pala has recently started a $150 million fund to buy more of the Earth’s cobalt supply.

“We have been focused on the evolution of the battery chemistries and this has allowed us to invest early in different components of the battery,” Stephen Gill, managing partner at Zug, Switzerland-based Pala Investments, told Bloomberg. “We hope to continue to be ahead of the curve as technologies evolve.”

For now they certainly are ahead of the curve, but this could potentially be a lucrative position for even the most modest investor. Right now on the Toronto Stock Exchange, U.S. Cobalt (TSX: USCO.V) is trading at around just 42 cents. Investors could quickly snatch up large amounts of stock at a low price, in hopes that the cobalt demand shifts from the Congo to America.

Renowned mathematician Banesh Hoffman said it best, “with every new discovery in science brings with it a host of new problems.” That certainly rings true in the search for an alternative to gas-burning vehicles, where we found a solution, only to discover the dire conditions involved in sourcing it.

Energy

Tesla Powerwall distribution expands in Australia

Inventory is expected to arrive in late February and official sales are expected to start mid-March 2026.

Supply Partners Group has secured a distribution agreement for the Tesla Powerwall in Australia, with inventory expected to arrive in late February and official sales beginning in mid-March 2026.

Under the new agreement, Supply Partners will distribute Tesla Powerwall units and related accessories across its national footprint, as noted in an ecogeneration report. The company said the addition strengthens its position as a distributor focused on premium, established brands.

“We are proud to officially welcome Tesla Powerwall into the Supply Partners portfolio,” Lliam Ricketts, Co-Founder and Director of Innovation at Supply Partners Group, stated.

“Tesla sets a high bar, and we’ve worked hard to earn the opportunity to represent a brand that customers actively ask for. This partnership reflects the strength of our logistics, technical services and customer experience, and it’s a win for installers who want premium options they can trust.”

Supply Partners noted that initial Tesla Powerwall stock will be warehoused locally before full commercial rollout in March. The distributor stated that the timing aligns with renewed growth momentum for the Powerwall, supported by competitive installer pricing, consumer rebates, and continued product and software updates.

“Powerwall is already a category-defining product, and what’s ahead makes it even more compelling,” Ricketts stated. “As pricing sharpens and capability expands, we see a clear runway for installers to confidently spec Powerwall for premium residential installs, backed by Supply Partners’ national distribution footprint and service model.”

Supply Partners noted that a joint go-to-market launch is planned, including Tesla-led training for its sales and technical teams to support installers during the home battery system’s domestic rollout.

Energy

Tesla Megapack Megafactory in Texas advances with major property sale

Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet.

Tesla’s planned Megapack factory in Brookshire, Texas has taken a significant step forward, as two massive industrial buildings fully leased to the company were sold to an institutional investor.

In a press release, Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet. The properties are 100% leased to Tesla under a long-term agreement and were acquired by BGO on behalf of an institutional investor.

The two facilities, located at 100 Empire Boulevard in Brookshire, Texas, will serve as Tesla’s new Megafactory dedicated to manufacturing Megapack battery systems.

According to local filings previously reported, Tesla plans to invest nearly $200 million into the site. The investment includes approximately $44 million in facility upgrades such as electrical, utility, and HVAC improvements, along with roughly $150 million in manufacturing equipment.

Building 9, spanning roughly 1 million square feet, will function as the primary manufacturing floor where Megapacks are assembled. Building 10, covering approximately 600,000 square feet, will be dedicated to warehousing and logistics operations, supporting storage and distribution of completed battery systems.

Waller County Commissioners have approved a 10-year tax abatement agreement with Tesla, offering up to a 60% property-tax reduction if the company meets hiring and investment targets. Tesla has committed to employing at least 375 people by the end of 2026, increasing to 1,500 by the end of 2028, as noted in an Austin County News Online report.

The Brookshire Megafactory will complement Tesla’s Lathrop Megafactory in California and expand U.S. production capacity for the utility-scale energy storage unit. Megapacks are designed to support grid stabilization and renewable-energy integration, a segment that has become one of Tesla’s fastest-growing businesses.

Energy

Tesla meets Giga New York’s Buffalo job target amid political pressures

Giga New York reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease.

Tesla has surpassed its job commitments at Giga New York in Buffalo, easing pressure from lawmakers who threatened the company with fines, subsidy clawbacks, and dealership license revocations last year.

The company reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease at the state-built facility.

As per an employment report reviewed by local media, Tesla employed 2,399 full-time workers at Gigafactory New York and 1,060 additional employees across the state at the end of 2025. Part-time roles pushed the total headcount of Tesla’s New York staff above the 3,460-job target.

The gains stemmed in part from a new Long Island service center, a Buffalo warehouse, and additional showrooms in White Plains and Staten Island. Tesla also said it has invested $350 million in supercomputing infrastructure at the site and has begun manufacturing solar panels.

Empire State Development CEO Hope Knight said the agency was “very happy” with Giga New York’s progress, as noted in a WXXI report. The current lease runs through 2029, and negotiations over updated terms have included potential adjustments to job requirements and future rent payments.

Some lawmakers remain skeptical, however. Assemblymember Pat Burke questioned whether the reported job figures have been fully verified. State Sen. Patricia Fahy has also continued to sponsor legislation that would revoke Tesla’s company-owned dealership licenses in New York. John Kaehny of Reinvent Albany has argued that the project has not delivered the manufacturing impact originally promised as well.

Knight, for her part, maintained that Empire State Development has been making the best of a difficult situation.

“(Empire State Development) has tried to make the best of a very difficult situation. There hasn’t been another use that has come forward that would replace this one, and so to the extent that we’re in this place, the fact that 2,000 families at (Giga New York) are being supported through the activity of this employer. It’s the best that we can have happen,” the CEO noted.