News

General Motors ends the Chevy Bolt, along with an old narrative [Op-Ed]

General Motors’ decision to end the Chevy Bolt also brought closure to an old narrative that the vehicle, which has been plagued by a disastrous perspective driven by major battery issues, is not dependable. Ending what accounted for more than 98 percent of its 2022 EV sales last year may be more than a public relations move than anything.

There is no doubt the Chevy Bolt is a common option among electric vehicle buyers. The car is still commonly considered one of the more affordable electric options on the market, and the most recent model year was no different. Offering both the EV and slightly more spacious EUV at a price point below $30,000 is just what GM needed to surge sales of sustainable powertrains within its offerings after stalled efforts to widely manufacture its other models, like the GMC Hummer EV and Cadillac Lyriq, slowed the so-called “leader in EVs” potential rise to prominence.

While GM executives noted yesterday during the company’s Q1 2023 Earnings Call that the termination of the Bolt EV and EUV will make way for more popular and soon-to-be-offered pickups and SUVs, it is not a far-fetched thought to think that eliminating the two models is a move that offers both high risks and high rewards. On one hand, GM has been extremely dependent on the Bolt models to drive EV sales. On the other, the vehicles are basically the only reason GM has any credibility in the space.

GM bids farewell to the Chevy Bolt, bringing closure to its best-selling EV

Eliminating the Bolt means two things: GM will have immense pressure to ramp up production of its other vehicles. If successful, it will truly launch itself into an entirely new status. Failure could set the automaker back years in terms of what it has worked so hard to build, all of which can be attributed to the Bolt’s prowess as the manufacturer’s most popular EV.

But even more important is that an old narrative that has hovered over the Bolt like a dark storm cloud will go, and that is that it is a car plagued with old stories of battery issues, which were widely fixed as a result of a major overhaul that cost GM over $1 billion.

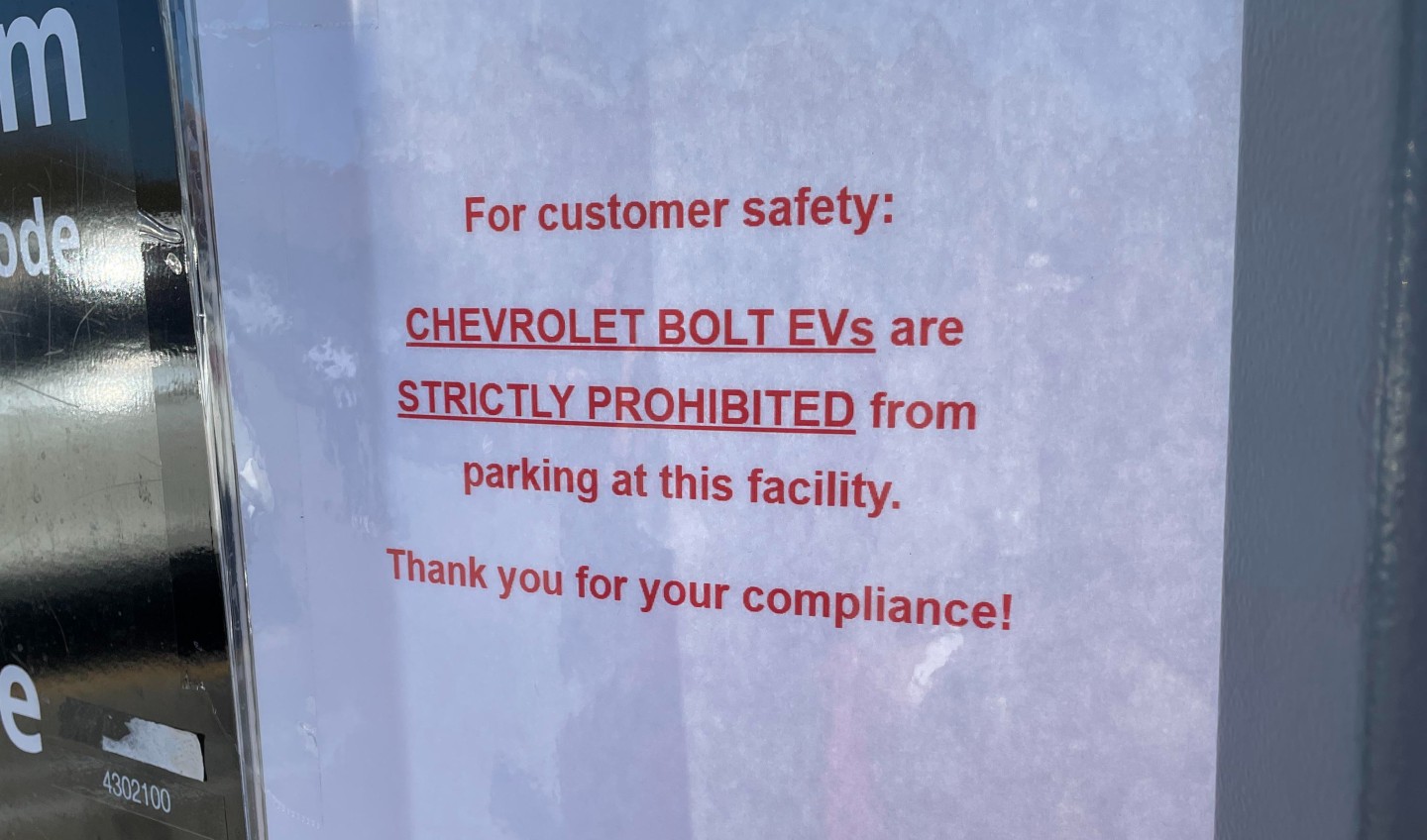

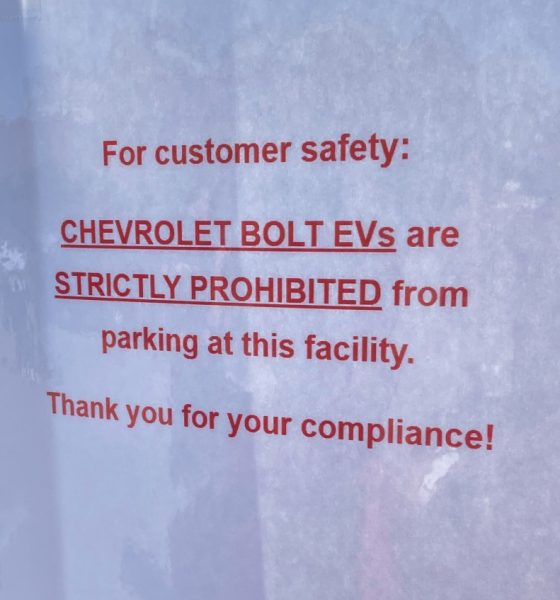

Various Bolt EVs were widely followed by the massive recall, which the automaker paid $1.8 billion to remedy. During the Q2 2021 Earnings call, the company said it would voluntarily recall all 2020-2022 model year vehicles to fix a series of manufacturing defects within battery cells. These problems forced owners to do things like limit the state of charge, park outside of their garages, and even avoid certain parking lots, as Bolts were banned from parking on some properties.

It worked quickly to fix the issues, and eventually, the Bolts were handed back to their owners and were safe to drive once again.

While the problems and defects disappeared, the opinions didn’t.

It begs the question of whether GM is eliminating the Bolt for another reason, at least partially. Bringing an end to a vehicle that brought so much of both triumph and turmoil to the GM name has its positives and negatives. Ultimately, GM plans to be all-electric in the long term, and getting off the ground running with a new lineup of EVs on its Ultium platform is the most crucial part of the process.

Unfortunately, this includes bringing closure to a model that may come with a negative narrative in the future.

Don’t hesitate to contact us with tips! Email us at tips@teslarati.com, or you can email me directly at joey@teslarati.com.

Elon Musk

Tesla is ramping up its advertising strategy on social media

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

Tesla seems to be ramping up its advertising strategy on social media once again. Marketing and advertising have not been a major focus of Tesla’s, something that has brought some criticism to the company from its fans.

However, the company looks to be making adjustments to that narrative, as it has at times in the past, as ads were spotted on several different platforms over the past few days.

On Facebook and YouTube, ads were spotted that were evidently placed by Tesla. On Facebook, Tesla was advertising Full Self-Driving, and on YouTube, an ad for its Energy Division was spotted:

Tesla also threw up some ads on YouTube for Energy https://t.co/19DGQMjBsA pic.twitter.com/XQRfgaDKxY

— TESLARATI (@Teslarati) March 9, 2026

Tesla has long stood out in the automotive world for its unconventional approach to advertising—or, more accurately, its near-total avoidance of it. For over a decade, the company spent virtually nothing on traditional marketing.

In 2022, Tesla’s U.S. ad spend was roughly $152,000, a rounding error compared to General Motors’ $3.6 billion the following year.

Traditional automakers averaged about $495 per vehicle on ads; Tesla spent $0. CEOElon Musk’s stance was explicit: “Tesla does not advertise or pay for endorsements,” he posted on X in 2019. “Instead, we use that money to make the product great.”

The strategy relied on word-of-mouth from delighted owners, Elon’s massive X following, viral product launches, media frenzy, and customer referrals. A great product, Musk argued, sells itself. It does not need Super Bowl spots or billboards. Resources poured into R&D instead, with Tesla investing nearly $3,000 per car, far more than rivals.

Tesla counters jab at lack of advertising with perfect response

This reluctance wasn’t arrogance; it was philosophy, and Musk made it clear that the money was better spent on the product. Heavy spending on ads was seen as wasteful when innovation and authenticity drove organic demand. Shareholder calls for marketing budgets were ignored.

The current shift, paid Facebook ads promoting Full Self-Driving (Supervised) and YouTube Shorts offering up to $1,000 back on Powerwall batteries, marks a pragmatic evolution.

These targeted campaigns coincide with the end of one-time FSD purchases and a March 31 deadline for FSD transfer eligibility on new vehicles.

This move likely signals Tesla adapting to scale, as well as a more concerted effort to stop misinformation regarding its platform. As EV competition intensifies and the company bets big on robotaxis and energy storage, pure organic buzz may not suffice to hit adoption targets. Selective digital ads allow precise, cost-effective reach without abandoning core principles.

If successful, it could foreshadow measured expansion into marketing, boosting high-margin software and home energy revenue while preserving Tesla’s innovative edge. But, it’s nice to see the strategy return, especially as Tesla has been reluctant to change its mind in the past.

News

Tesla Model Y outsells everything in three states, but Ford dominates

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

The Tesla Model Y was the best-selling vehicle in three different states in the U.S. last year, according to new data that shows the all-electric crossover outsold every other car in a few places. However, Ford widely dominated the sales figures with its popular F-Series of pickups.

According to new vehicle registration data compiled by Edmunds and visualized by Visual Capitalist, the Ford F-Series, encompassing models like the F-150, F-250, F-350, and F-450, claimed the title of best-selling vehicle in 29 states.

This dominance underscores the pickup truck’s unbreakable appeal across much of the country, particularly in rural, Midwestern, Southern, and Western states, where towing capacity, durability, and utility for work or recreation remain top priorities.

The Tesla Model Y is the best-selling vehicle in California, Washington, and Nevada

How many states will it dominate next year? https://t.co/ERyoyce42D

— TESLARATI (@Teslarati) March 9, 2026

The F-Series has held the crown as America’s overall best-selling vehicle for decades, a streak that continued strong into 2025 despite broader market shifts.

Yet, amid this truck-heavy reality, Tesla made a notable breakthrough. The Model Y emerged as the top-selling vehicle, not just the leading EV, but the outright best-seller in three key states: California, Nevada, and Washington.

These West Coast strongholds reflect regions with robust EV infrastructure, high environmental awareness, generous incentives, and tech-savvy populations. In California alone, nearly 50 percent of new vehicle registrations were electrified, far outpacing the national average of around 25 percent.

The Model Y’s success here highlights accelerating mainstream adoption of electric SUVs, which offer spacious interiors, impressive range, rapid acceleration, and low operating costs.

Elon Musk: Tesla Model Y is world’s best-selling car for 3rd year in a row

Elsewhere, Japanese crossovers filled many gaps: Toyota’s RAV4 and Honda’s CR-V topped charts in several urban and densely populated Northeastern and Midwestern states, where fuel efficiency, reliability, and family-friendly features win out over larger trucks.

While Ford’s broad reach shows traditional preferences persist, at least for now, Tesla’s Model Y victories in high-population, influential states signal a gradual but undeniable transition toward electrification. As charging networks expand and battery technology improves, more states could follow the West Coast’s lead in the coming years.

This 2025 map captures a pivotal moment: pickup trucks still rule the majority, but EVs are carving out meaningful territory where consumer priorities align with sustainability and innovation. The road ahead promises continued competition between legacy giants and electric disruptors.

Elon Musk

Elon Musk shares updated Starship V3 maiden launch target date

The comment was posted on Musk’s official account on social media platform X.

SpaceX CEO Elon Musk shared a brief Starship V3 update in a post on social media platform X, stating the next launch attempt of the spacecraft could take place in about four weeks.

The comment was posted on Musk’s official account on social media platform X.

Musk’s update suggests that Starship Flight 12 could target a launch around early April, though the schedule will depend on several remaining milestones at SpaceX’s Starbase launch facility in Texas.

Among the key steps is testing and certification of the site’s new launch tower, launch mount, and tank farm systems. These upgrades will support the next generation of Starship vehicles.

Booster 19 is expected to roll to the launch site and be placed on the launch mount before returning to the production facility to receive its 33 Raptor engines. The booster would then return for a static fire test, which could mark the first time a Super Heavy booster equipped with Raptor V3 engines is fired on the pad.

Ship 39 is expected to undergo a similar preparation process. The vehicle will likely return to the production site to receive its six engines before heading to Massey’s test site for static fire testing.

Once both stages are prepared, the booster and ship will roll out to the launch site for the first full stack of a V3 Super Heavy and V3 Starship. A full wet dress rehearsal is expected to follow before any launch attempt.

Elon Musk has previously shared how SpaceX plans to eventually recover Starship’s upper stage using the launch tower’s robotic arms. Musk noted that the company will only attempt to catch the Starship spacecraft after two successful soft landings in the ocean. The approach is intended to reduce risk before attempting a recovery over land.

“Should note that SpaceX will only try to catch the ship with the tower after two perfect soft landings in the ocean. The risk of the ship breaking up over land needs to be very low,” Musk wrote in a post on X.

Such a milestone would represent a major step toward the full reuse of the Starship system, which remains a central goal for SpaceX’s long-term launch strategy.