News

NASA snubbed SpaceX, common sense to overpay Boeing for astronaut launches, says audit

A detailed government audit has revealed that NASA went out of its way to overpay Boeing for its Commercial Crew Program (CCP) astronaut launch services, making a mockery of its fixed-price contract with the company and blatantly snubbing SpaceX throughout the process.

Over the last several years, the NASA inspector general has published a number of increasingly discouraging reports about Boeing’s behavior and track-record as a NASA contractor, and November 14th’s report is possibly the most concerning yet. On November 14th, NASA’s Office of the Inspector General (OIG) published a damning audit titled “NASA’s Management of Crew Transportation to the International Space Station [ISS]” (PDF).

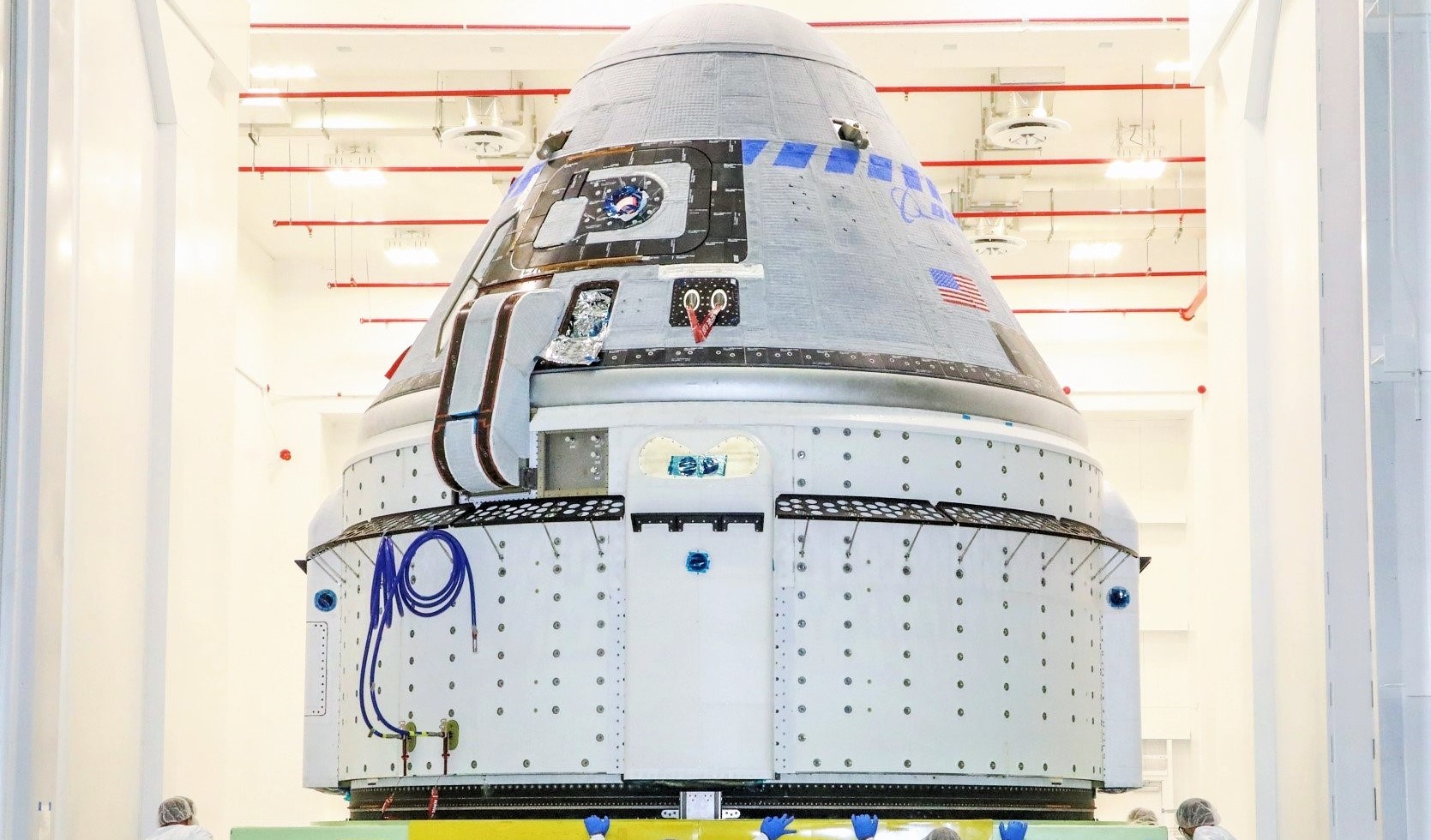

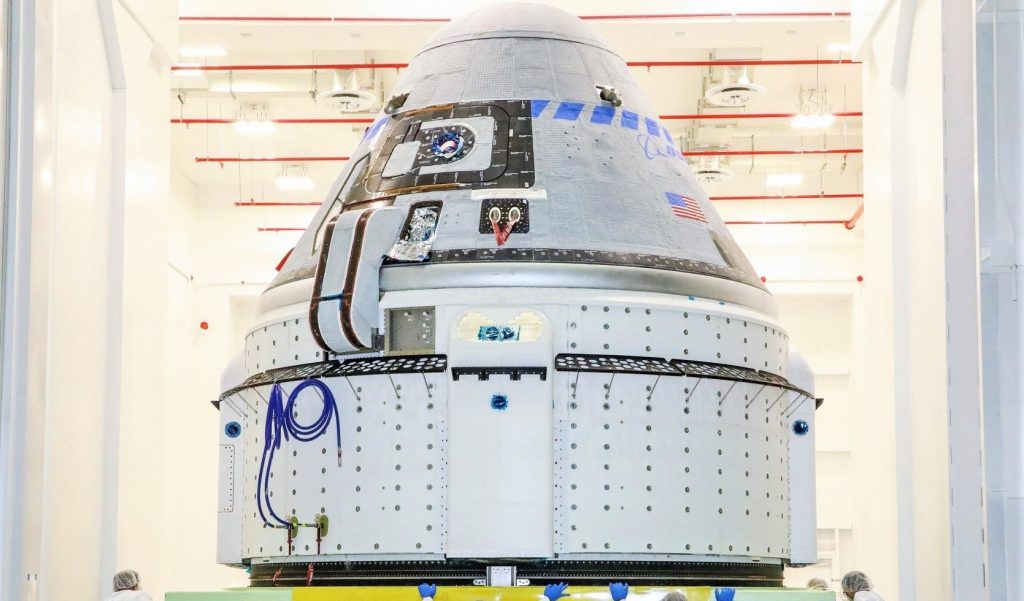

Offering more than 50 pages of detailed analysis of behavior that was at best inept and at worst deeply corrupt, OIG’s analysis uncovered some uncomfortable revelations about NASA’s relationship with Boeing in a different realm than usual: NASA’s Commercial Crew Program (CCP). Begun in the 2010s in an effort to develop multiple redundant commercial alternatives to the Space Shuttle, prematurely canceled before a US alternative was even on the horizon, the CCP ultimately awarded SpaceX and Boeing major development contracts in September 2014.

NASA awarded fixed-cost contracts worth $4.2 billion and $2.6 billion to Boeing and SpaceX, respectively, to essentially accomplish the same goals: design, build, test, and fly new spacecraft capable of transporting NASA astronauts to and from the International Space Station (ISS). The intention behind fixed-price contracts was to hold contractors responsible for any delays they might incur over the development of human-rated spacecraft, a task NASA acknowledged as challenging but far from unprecedented.

Off the rails

The most likely trigger of the bizarre events that would unfold a few years down the road began in part on June 28th, 2015 and culminated on September 1st, 2016, the dates of the two catastrophic failures SpaceX’s Falcon 9 rocket has suffered since its 2010 debut. In the most generous possible interpretation of the OIG’s findings, NASA headquarters and CCP managers may have been shaken and not thinking on an even keel after SpaceX’s second major failure in a little over a year.

Under this stress, the agency may have ignored common sense and basic contracting due-diligence, leading “numerous officials” to sign off on a plan that would subvert Boeing’s fixed-price contract, paying the company an additional $287 million (~7%) to prevent a perceived gap in NASA astronaut access to the ISS. This likely arose because NASA briefly believed that SpaceX’s failures could cause multiple years of delays, making Boeing the only available crew transport provider for a significant period of time. Starliner was already delayed by more than a year, making it increasingly unlikely that Boeing alone would be able to ensure continuous NASA access to the ISS.

As NASA attempted to argue in its response to the audit, “the final price [increase] was agreed to by NASA and Boeing and was reviewed and approved by numerous NASA officials at the Kennedy Space Center and Headquarters”. In the heat of the moment, perhaps those officials forgot that Boeing had already purchased several Russian Soyuz seats to sell to NASA or tourists, and perhaps those officials missed the simple fact that those seats and some elementary schedule tweaks could have almost entirely alleviated the perceived “access gap” with minimal cost and effort.

The OIG audit further implied that the timing of a Boeing proposal – submitted just days after NASA agreed to pay the company extra to prevent that access gap – was suspect.

“Five days after NASA committed to pay $287.2 million in price increases for four commercial crew missions, Boeing submitted an official proposal to sell NASA up to five Soyuz seats for $373.5 million for missions during the same time period. In total, Boeing received $660.7 million above the fixed prices set in the CCtCap pricing tables to pay for an accelerated production timetable for four crew missions and five Soyuz seats.”

NASA OIG — November 14th, 2019 [PDF]

In other words, NASA officials somehow failed to realize or remember that Boeing owned multiple Soyuz seats during “prolonged negotiations” (p. 24) with Boeing and subsequently awarded Boeing an additional $287M to expedite Starliner production and preparations, thus averting an access gap. The very next week, Boeing asked NASA if it wanted to buy five Soyuz seats it had already acquired to send NASA astronauts to the ISS.

Bluntly speaking, this series of events has three obvious explanations, none of them particularly reassuring.

- Boeing intentionally withheld an obvious (partial) solution to a perceived gap in astronaut access to the ISS, exploiting NASA’s panic to extract a ~7% premium from its otherwise fixed-price Starliner development contract.

- Through gross negligence and a lack of basic contracting due-diligence, NASA ignored obvious (and cheaper) possible solutions at hand, taking Boeing’s word for granted and opening up the piggy bank.

- A farcical ‘crew access analysis’ study ignored multiple obvious and preferable solutions to give “numerous NASA officials” an excuse to violate fixed-price contracting principles and pay Boeing a substantial premium.

Extortion with a friendly smile

The latter explanation, while possibly the worst and most corruption-laden, is arguably the likeliest choice based on the history of NASA’s relationship with Boeing. In fact, a July 2019 report from the US Government Accountability Office (GAO) revealed that NASA was consistently paying Boeing hundreds of millions of dollars worth of “award fees” as part of the company’s SLS booster (core stage) production contract, which is no less than four years behind schedule and $1.8 billion over budget. From 2014 to 2018, NASA awarded Boeing a total of $271M in award fees, a practice meant to award a given contractor’s excellent performance.

In several of those years, NASA reviews reportedly described Boeing’s performance as “good”, “very good”, and “excellent”, all while Boeing repeatedly fumbled SLS core stage production, adding years of delays to the SLS rocket’s launch debut. This is to say that “numerous NASA officials” were also presumably more than happy to give Boeing hundreds of millions of dollars in awards even as the company was and is clearly a big reason why the SLS program continues to fail to deliver.

Ultimately, although NASA’s concern about SpaceX’s back-to-back Falcon 9 failures and some combination of ineptitude, ignorance, and corruption all clearly played a role, the fact remains that NASA – according to the inspector general – never approached SpaceX as part of their 2016/2017 efforts to prevent a ‘crew access gap’. Given that the CCP has two partners, that decision was highly improper regardless of the circumstances and is made even more inexplicable by the fact that NASA was apparently well aware that SpaceX’s Crew Dragon had significantly shorter lead times and far lower costs compared to Starliner.

This would have meant that had NASA approached SpaceX to attempt to mitigate the access gap, SpaceX could have almost certainly done it significantly cheaper and faster, or at minimum injected a bit of good-faith competition into the endeavor.

Finally and perhaps most disturbingly of all, NASA OIG investigators were told by “several NASA officials” that – in spite of several preferable alternatives – they ultimately chose to sign off Boeing’s demanded price increases because they were worried that Boeing would quit the Commercial Crew Program entirely without it. Boeing and NASA unsurprisingly denied this in their official responses to the OIG audit, but a US government inspector generally would never publish such a claim without substantial confidence and plenty of evidence to support it.

According to OIG sources, “senior CCP officials believed that due to financial considerations, Boeing could not continue as a commercial crew provider unless the contractor received the higher prices.” A lot remains unsaid, like why those officials believed that Boeing’s full withdrawal from CCP was a serious possibility and how they came to that conclusion, enough to make it impossible to conclude that Boeing legitimately threatened to quit in lieu of NASA payments.

All things considered, these fairly damning revelations should by no means take away from the excellent work Boeing engineers and technicians are trying to do to design, build, and launch Starliner. However, they do serve to draw a fine line between the mindsets and motivations of Boeing and SpaceX. One puts profit, shareholders, and itself above all else, while the other is trying hard to lower the cost of spaceflight and enable a sustainable human presence on the Moon, Mars, and beyond.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

News

Tesla preps to build its most massive Supercharger yet: 400+ V4 stalls

The project will be an expansion of the current Eddie World Supercharger in Yermo, California, and will take place in several stages.

Tesla is preparing to build its most massive Supercharger yet, as it recently submitted plans for an over 400-stall Supercharging station in California, which would dwarf its massive 168-stall location in Lost Hills, California.

The project will be an expansion of the current Eddie World Supercharger in Yermo, California, and will take place in several stages.

The expansion, adjacent to the existing Eddie World Supercharger, which is currently comprised of 22 older V2 and V3 stalls limited to 150 kW, unfolds across six phases.

Construction on Phase 1 begins later this year with 72 V4 stalls. Subsequent stages will progressively add hundreds more, culminating in over 400 next-generation chargers. Site plans label expansive parking arrays across Phases 1–5 along Calico Boulevard, with Phase 6 design still to be determined.

Tesla is planning an absolutely massive Supercharger expansion in Yermo, California!!

Over the course of 6 phases, Tesla is set to add over 400 V4 stalls in a commercial development known as Eddie World 2.

The first phase, which should begin construction sometime this year,… pic.twitter.com/ks5Y5dE8lR

— MarcoRP (@MarcoRPi1) March 6, 2026

The project was first flagged by MarcoRP, a notable Tesla Supercharger watcher.

Strategically located midway on I-15 between Los Angeles and Las Vegas, the station targets heavy EV traffic on this high-demand corridor.

The surrounding 20-mile stretch already hosts over 200 high-power stalls (including 40 at 250 kW, 120 at 325 kW, and more), plus 96 in nearby Baker—yet bottlenecks persist during peak travel.

In scale, it eclipses all existing Tesla Superchargers. The current record holder, the solar- and Megapack-powered “Project Oasis” in Lost Hills, California, offers 164 stalls. Barstow’s former leader had 120. Eddie World 2 will be more than double that size, cementing Tesla’s dominance in ultra-high-capacity charging.

Tesla finishes its biggest Supercharger ever with 168 stalls

Development blends charging with convenience. Architectural drawings show integrated retail: a 10,100 square foot Cracker Barrel, a 4,300 square foot McDonald’s, a 3,800 square foot convenience store, additional restaurants, drive-thrus, outdoor dining, and lease space.

EV-centric features include pull-through bays for Cybertrucks and trailers, ensuring accessibility for larger vehicles and future Semi trucks.

News

Tesla makes latest move to remove Model S and Model X from its lineup

Tesla’s latest decisive step toward phasing out its flagship sedan and SUV was quietly removing the Model S and Model X from its U.S. referral program earlier this week.

Tesla has made its latest move that indicates the Model S and Model X are being removed from the company’s lineup, an action that was confirmed by the company earlier this quarter, that the two flagship vehicles would no longer be produced.

Tesla has ultimately started phasing out the Model S and Model X in several ways, as it recently indicated it had sold out of a paint color for the two vehicles.

Now, the company is making even more moves that show its plans for the two vehicles are being eliminated slowly but surely.

Tesla’s latest decisive step toward phasing out its flagship sedan and SUV was quietly removing the Model S and Model X from its U.S. referral program earlier this week.

The change eliminates the $1,000 referral discount previously available to new buyers of these vehicles. Existing Tesla owners purchasing a new Model S or Model X will now only receive a halved loyalty discount of $500, down from $1,000.

The updates extend beyond the two flagship vehicles. New Cybertruck buyers using a referral code on Premium AWD or Cyberbeast configurations will no longer get $1,000 off. Instead, both referrer and buyer receive three months of Full Self-Driving (Supervised).

The loyalty discount for Cybertruck purchases, excluding the new Dual Motor AWD trim level, has also been cut to $500.

NEWS: Tesla has removed the Model S and Model X from the referral program.

New owners also no longer get a $1,000 referral discount on a new Cybertruck Premium AWD or Cyberbeast. Instead, you now get 3 months of FSD (Supervised).

Additionally, Tesla has reduced the loyalty… pic.twitter.com/IgIY8Hi2WJ

— Sawyer Merritt (@SawyerMerritt) March 6, 2026

These adjustments apply only in the United States, and reflect Tesla’s broader strategy to optimize margins while boosting adoption of its autonomous driving software.

The timing is no coincidence. Tesla confirmed earlier this year that Model S and Model X production will end in the second quarter of 2026, roughly June, as the company reallocates factory capacity toward its Optimus humanoid robot and next-generation vehicles.

With annual sales of the low-volume flagships already declining (just 53,900 units in 2025), incentives are no longer needed to drive demand. Production is winding down, and Tesla expects strong remaining interest without subsidies.

Industry observers see this as the clearest sign yet of an “end-of-life” phase for the vehicles that once defined Tesla’s luxury segment. Community reactions on X range from nostalgia, “Rest in power S and X”, to frustration among long-time owners who feel perks are eroding just as the models approach discontinuation.

Some buyers are rushing orders to lock in final discounts before they vanish entirely.

Doug DeMuro names Tesla Model S the Most Important Car of the last 30 years

For Tesla, the move prioritizes efficiency: fewer discounts on outgoing models, a stronger push for FSD subscriptions, and a focus on high-margin Cybertruck trims amid surging orders.

Loyalists still have a narrow window to purchase a refreshed Plaid or Long Range model with remaining incentives, but the message is clear: Tesla’s lineup is evolving, and the era of the original flagships is drawing to a close.

News

Tesla Australia confirms six-seat Model Y L launch in 2026

Compared with the standard five-seat Model Y, the Model Y L features a longer body and extended wheelbase to accommodate an additional row of seating.

Tesla has confirmed that the larger six-seat Model Y L will launch in Australia and New Zealand in 2026.

The confirmation was shared by techAU through a media release from Tesla Australia and New Zealand.

The Model Y L expands the Model Y lineup by offering additional seating capacity for customers seeking a larger electric SUV. Compared with the standard five-seat Model Y, the Model Y L features a longer body and extended wheelbase to accommodate an additional row of seating.

The Model Y L is already being produced at Tesla’s Gigafactory Shanghai for the Chinese market, though the vehicle will be manufactured in right-hand-drive configuration for markets such as Australia and New Zealand.

Tesla Australia and New Zealand confirmed the vehicle will feature seating for six passengers.

“As shown in pictures from its launch in China, Model Y L will have a new seating configuration providing room for 6 occupants,” Tesla Australia and New Zealand said in comments shared with techAU.

Instead of a traditional seven-seat arrangement, the Model Y L uses a 2-2-2 layout. The middle row features two individual seats, allowing easier access to the third row while providing additional space for passengers.

Tesla Australia and New Zealand also confirmed that the Model Y L will be covered by the company’s updated warranty structure beginning in 2026.

“As with all new Tesla Vehicles from the start of 2026, the Model Y L will come with a 5-year unlimited km vehicle warranty and 8 years for the battery,” the company said.

The updated policy increases Tesla’s vehicle warranty from the previous four-year or 80,000-kilometer coverage.

Battery and drive unit warranties remain unchanged depending on the variant. Rear-wheel-drive models carry an eight-year or 160,000-kilometer warranty, while Long Range and Performance variants are covered for eight years or 192,000 kilometers.

Tesla has not yet announced official pricing or range figures for the Model Y L in Australia.