Energy

Panasonic slumps as Tesla branches out with new battery deal

Japanese battery maker Panasonic’s appears to be feeling the direct effects of its partnership with California-based electric car maker Tesla. Just recently, Panasonic opted to cut its profit outlook for 2019 over China’s slowing economy due to the trade war against the United States. Amidst these headwinds, Panasonic’s partnership with Tesla proved to be a silver lining for the Japanese company, pushing its battery business towards profitability — the first time in three quarters.

During a briefing about its adjusted forecasts, Panasonic Chief Financial Officer Hirokazu Umeda pointed out that there have been improvements with sales and profit on its battery business over the past months. Umeda notes that much of these improvements are due to its partnership with Tesla, especially considering the upgrades that Panasonic rolled out to its battery cell lines in Gigafactory 1. Overall, Tesla’s business gave Panasonic an operating profit of 16.5 billion yen (around $150M).

“Sales and profit at the Tesla business have improved,” Umeda said, later adding that additional lines at Gigafactory 1 would be installed by the end of March. The Panasonic CFO noted that with the upcoming improvements, Gigafactory 1’s total capacity could reach 35 GWh.

While its battery business appears to be thriving under its partnership with Tesla, Panasonic’s shares were walloped on Tuesday nonetheless. The Japanese firm’s 6.5% decline on Tuesday transpired amidst news that Tesla is acquiring ultracapacitor firm Maxwell Technologies in an all-stock deal valued at around $218 million. Considering that the opportunities presented by the Maxwell acquisition are related to Tesla’s battery technology, one could almost assume that Panasonic is practically losing its exclusivity as the electric car maker’s sole battery provider.

That said, industry analysts from Japan have noted that Panasonic’s recent decline in the market is primarily due to the company’s bleak quarterly earnings and annual profit estimate, which featured a 9% cut in its operating profit outlook and a decline of 19% for Q4 2018. This was a point highlighted by Masahiko Ishino, an analyst from the Tokai Tokyo Research Center, who noted in a statement to Reuters that Panasonic’s dive in the market was mostly due to the company’s outlook.

“The latest earnings have revealed how tough the situation is for Panasonic,” he said.

In a way, both Tesla and Panasonic appear to be branching out in their respective battery endeavors. Apart from acquiring Maxwell and its ultracapacitor tech, Tesla is also reportedly looking to partner with local battery suppliers in China for vehicles that will be produced at Gigafactory 3. On the other hand, Panasonic appears to be doing the same thing, recently teaming up with Toyota Motor Corp to collaborate in the development and production of rectangular-shaped prismatic batteries. Panasonic is also hoping to supply prismatic batteries to carmakers such as Honda, using the technology it would be developing with Toyota.

While these updates from Tesla and Panasonic might give the impression that the two companies are starting to diverge from each other, such an idea would be inaccurate. The batteries for Tesla’s electric cars and energy storage devices built in the US, after all, are still exclusively supplied by Panasonic. That means that the Japanese company would still be heavily invested in Tesla, as the electric car maker continues the Model 3 ramp and as it raises the production of its energy products like the Powerwall 2. Considering Tesla’s product roadmap, there is a very good chance that the electric car maker’s partnership with Panasonic would last for a long time to come.

Energy

Tesla meets Giga New York’s Buffalo job target amid political pressures

Giga New York reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease.

Tesla has surpassed its job commitments at Giga New York in Buffalo, easing pressure from lawmakers who threatened the company with fines, subsidy clawbacks, and dealership license revocations last year.

The company reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease at the state-built facility.

As per an employment report reviewed by local media, Tesla employed 2,399 full-time workers at Gigafactory New York and 1,060 additional employees across the state at the end of 2025. Part-time roles pushed the total headcount of Tesla’s New York staff above the 3,460-job target.

The gains stemmed in part from a new Long Island service center, a Buffalo warehouse, and additional showrooms in White Plains and Staten Island. Tesla also said it has invested $350 million in supercomputing infrastructure at the site and has begun manufacturing solar panels.

Empire State Development CEO Hope Knight said the agency was “very happy” with Giga New York’s progress, as noted in a WXXI report. The current lease runs through 2029, and negotiations over updated terms have included potential adjustments to job requirements and future rent payments.

Some lawmakers remain skeptical, however. Assemblymember Pat Burke questioned whether the reported job figures have been fully verified. State Sen. Patricia Fahy has also continued to sponsor legislation that would revoke Tesla’s company-owned dealership licenses in New York. John Kaehny of Reinvent Albany has argued that the project has not delivered the manufacturing impact originally promised as well.

Knight, for her part, maintained that Empire State Development has been making the best of a difficult situation.

“(Empire State Development) has tried to make the best of a very difficult situation. There hasn’t been another use that has come forward that would replace this one, and so to the extent that we’re in this place, the fact that 2,000 families at (Giga New York) are being supported through the activity of this employer. It’s the best that we can have happen,” the CEO noted.

Energy

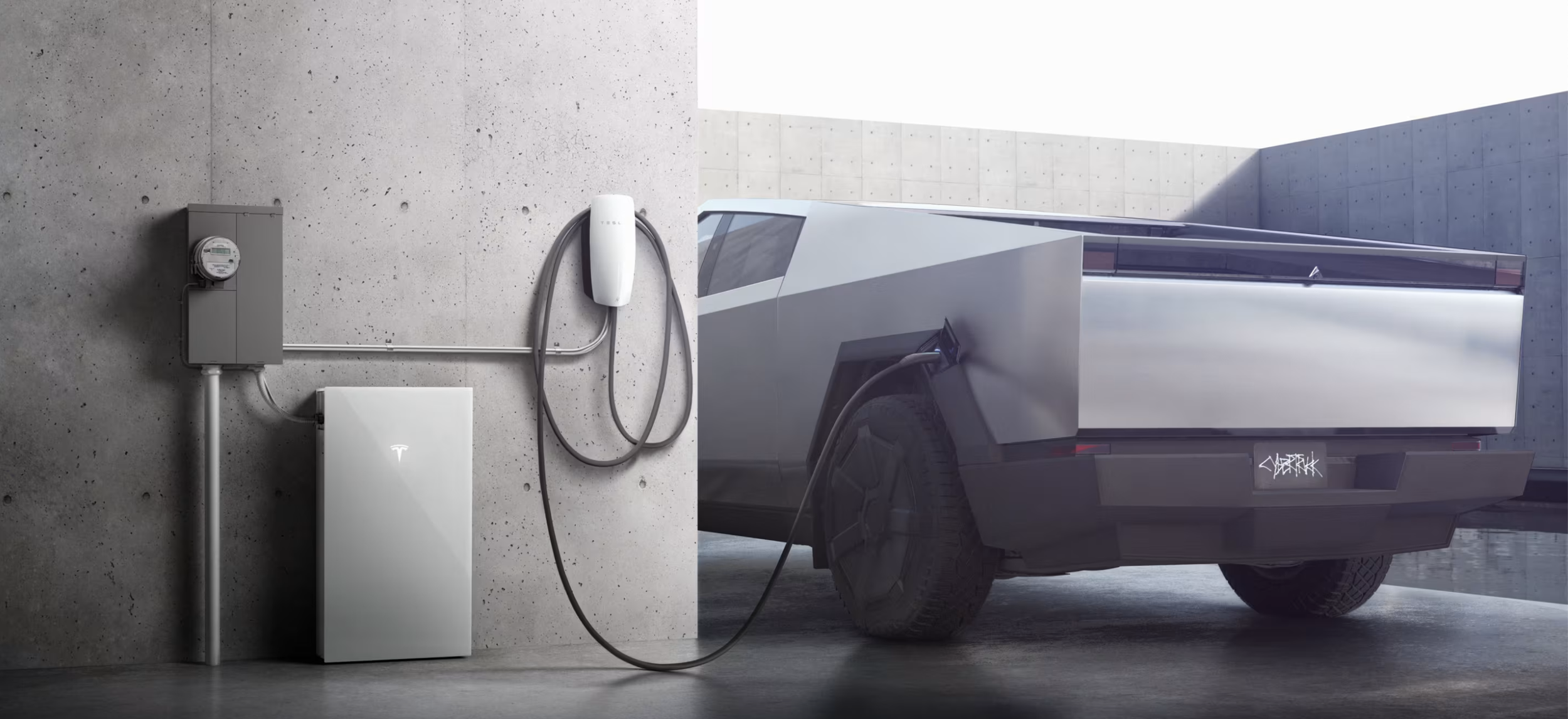

Tesla launches Cybertruck vehicle-to-grid program in Texas

The initiative was announced by the official Tesla Energy account on social media platform X.

Tesla has launched a vehicle-to-grid (V2G) program in Texas, allowing eligible Cybertruck owners to send energy back to the grid during high-demand events and receive compensation on their utility bills.

The initiative, dubbed Powershare Grid Support, was announced by the official Tesla Energy account on social media platform X.

Texas’ Cybertruck V2G program

In its post on X, Tesla Energy confirmed that vehicle-to-grid functionality is “coming soon,” starting with select Texas markets. Under the new Powershare Grid Support program, owners of the Cybertruck equipped with Powershare home backup hardware can opt in through the Tesla app and participate in short-notice grid stress events.

During these events, the Cybertruck automatically discharges excess energy back to the grid, supporting local utilities such as CenterPoint Energy and Oncor. In return, participants receive compensation in the form of bill credits. Tesla noted that the program is currently invitation-only as part of an early adopter rollout.

The launch builds on the Cybertruck’s existing Powershare capability, which allows the vehicle to provide up to 11.5 kW of power for home backup. Tesla added that the program is expected to expand to California next, with eligibility tied to utilities such as PG&E, SCE, and SDG&E.

Powershare Grid Support

To participate in Texas, Cybertruck owners must live in areas served by CenterPoint Energy or Oncor, have Powershare equipment installed, enroll in the Tesla Electric Drive plan, and opt in through the Tesla app. Once enrolled, vehicles would be able to contribute power during high-demand events, helping stabilize the grid.

Tesla noted that events may occur with little notice, so participants are encouraged to keep their Cybertrucks plugged in when at home and to manage their discharge limits based on personal needs. Compensation varies depending on the electricity plan, similar to how Powerwall owners in some regions have earned substantial credits by participating in Virtual Power Plant (VPP) programs.

Cybertruck

Tesla updates Cybertruck owners about key Powershare feature

Tesla is updating Cybertruck owners on its timeline of a massive feature that has yet to ship: Powershare with Powerwall.

Powershare is a bidirectional charging feature exclusive to Cybertruck, which allows the vehicle’s battery to act as a portable power source for homes, appliances, tools, other EVs, and more. It was announced in late 2023 as part of Tesla’s push into vehicle-to-everything energy sharing, and acting as a giant portable charger is the main advantage, as it can provide backup power during outages.

Cybertruck’s Powershare system supports both vehicle-to-load (V2L) and vehicle-to-home (V2H), making it flexible and well-rounded for a variety of applications.

However, even though the feature was promised with Cybertruck, it has yet to be shipped to vehicles. Tesla communicated with owners through email recently regarding Powershare with Powerwall, which essentially has the pickup act as an extended battery.

Powerwall discharge would be prioritized before tapping into the truck’s larger pack.

However, Tesla is still working on getting the feature out to owners, an email said:

“We’re writing to let you know that the Powershare with Powerwall feature is still in development and is now scheduled for release in mid-2026.

This new release date gives us additional time to design and test this feature, ensuring its ability to communicate and optimize energy sharing between your vehicle and many configurations and generations of Powerwall. We are also using this time to develop additional Powershare features that will help us continue to accelerate the world’s transition to sustainable energy.”

Owners have expressed some real disappointment in Tesla’s continuous delays in releasing the feature, as it was expected to be released by late 2024, but now has been pushed back several times to mid-2026, according to the email.

Foundation Series Cybertruck buyers paid extra, expecting the feature to be rolled out with their vehicle upon pickup.

Cybertruck’s Lead Engineer, Wes Morrill, even commented on the holdup:

As a Cybertruck owner who also has Powerwall, I empathize with the disappointed comments.

To their credit, the team has delivered powershare functionality to Cybertruck customers who otherwise have no backup with development of the powershare gateway. As well as those with solar…

— Wes (@wmorrill3) December 12, 2025

He said that “it turned out to be much harder than anticipated to make powershare work seamlessly with existing Powerwalls through existing wall connectors. Two grid-forming devices need to negotiate who will form and who will follow, depending on the state of charge of each, and they need to do this without a network and through multiple generations of hardware, and test and validate this process through rigorous certifications to ensure grid safety.”

It’s nice to see the transparency, but it is justified for some Cybertruck owners to feel like they’ve been bait-and-switched.