News

SpaceX to give BFR update and announce a private Moon mission on Monday

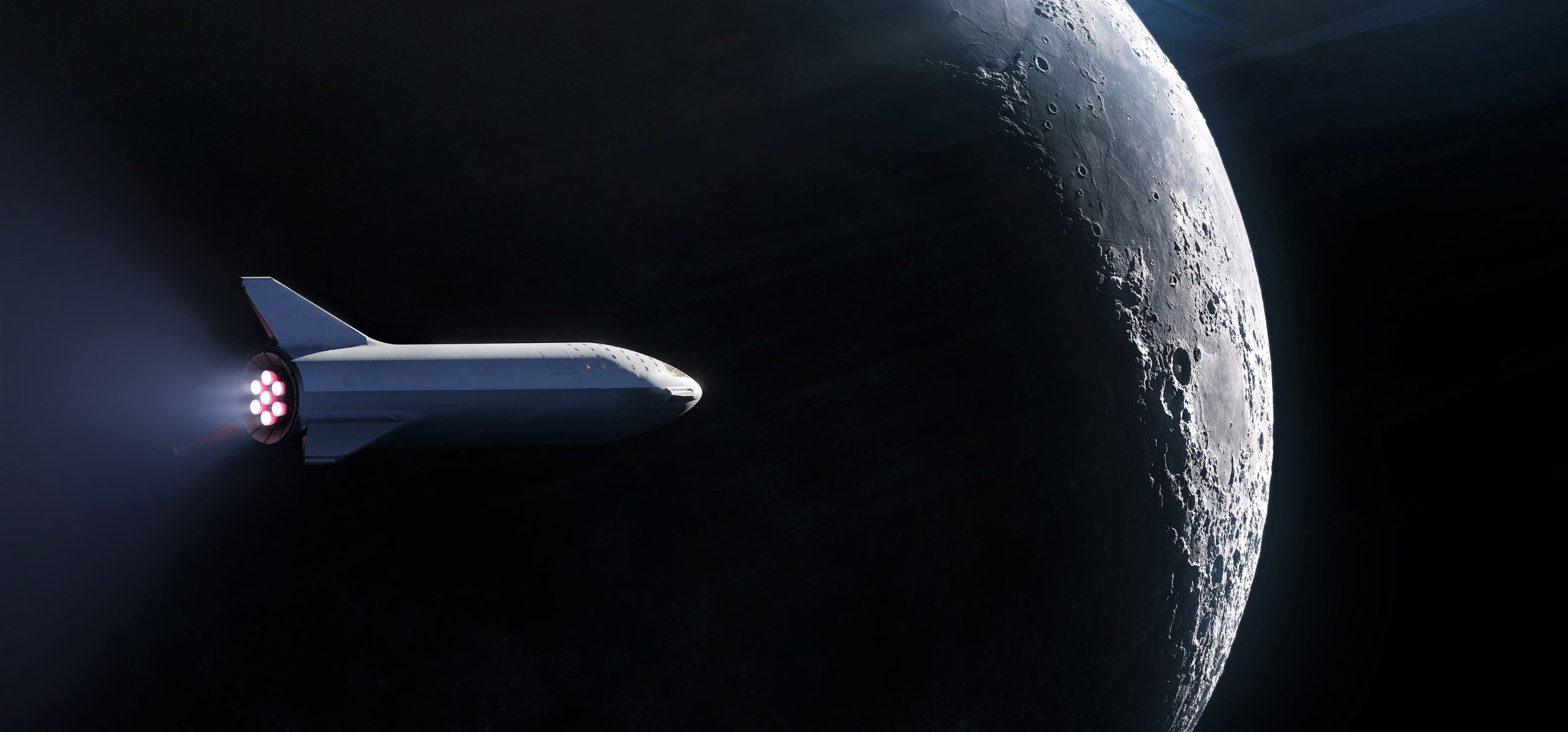

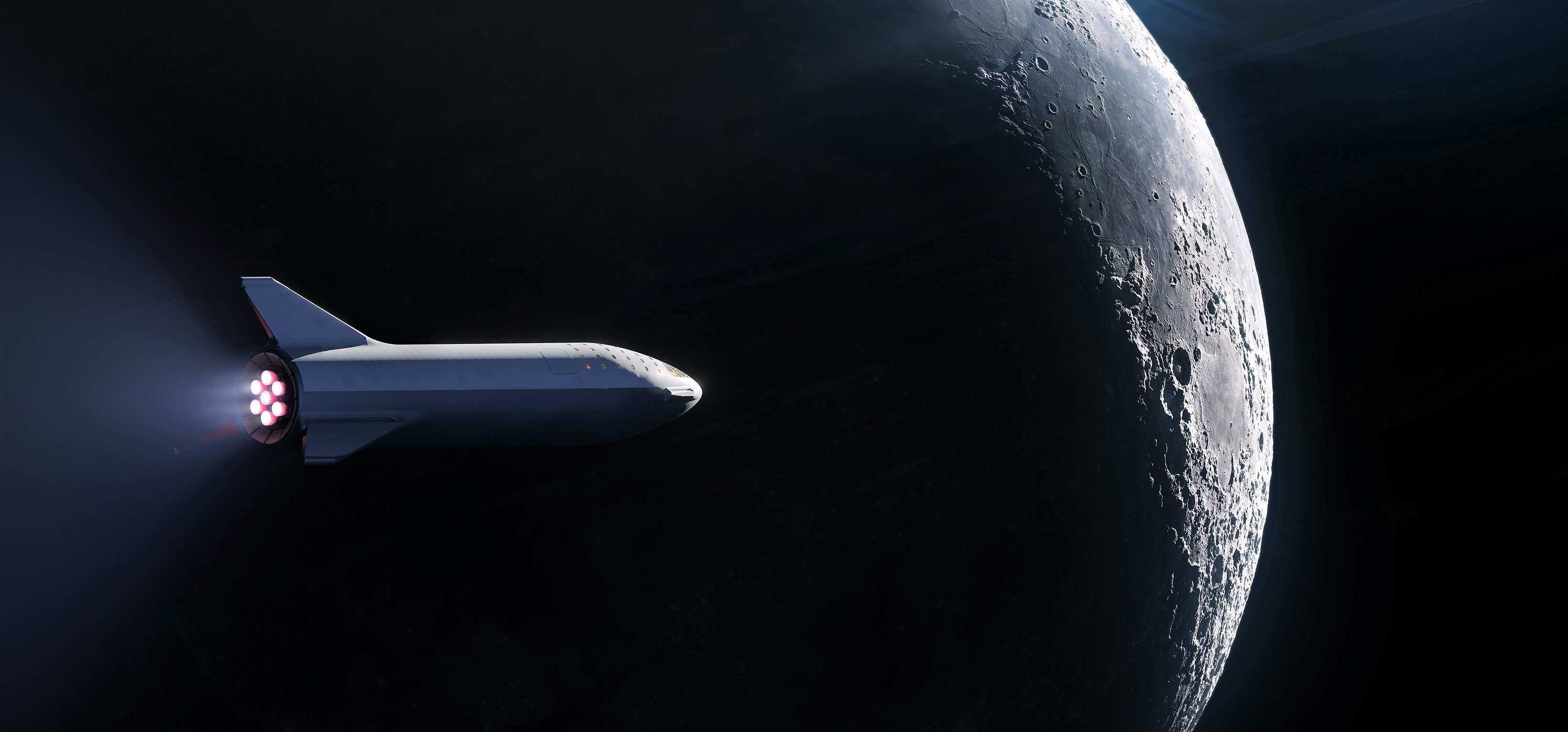

SpaceX is set for a surprise event that is expected to revolve the announcement of a newly-contracted launch planned to send a private individual around the Moon with BFR, potentially queuing up a true race (back) to the Moon between SpaceX and NASA sometime in the early to mid-2020s.

Alongside the official announcement and a fascinating render revealing a dramatically-updated iteration of BFR’s spaceship upper stage, CEO Elon Musk cryptically hinted on Twitter that the private customer could be Japanese, as well as confirming that the spaceship as shown was indicative of a new BFR design.

We’re going to the Moon, people! What I wouldn’t give to be this passenger… https://t.co/11ahm2LhE8

— Darby Dunn (@RocketJoy) September 14, 2018

Most importantly, at least for anyone eager to learn more, SpaceX will be hosting an official webcast of the announcement, NET 6:00 pm PDT on Monday, September 17th (01:00 UTC, Sept 18). Given the extreme rarity of streamed SpaceX updates unrelated to launches, as well as the fact that all of those updates have been presented by Elon Musk, it’s safe to expect that this particular update will be no different.

With any luck, this announcement may actually be the BFR update Musk teased on Twitter in mid-July, and his quoted “in a month or so” ETA meshes well with an actual update roughly two months later, Musk-time accounted for. It’s also possible that this newly-announced space tourism contract is directly related to a similar announcement made in 2017 that would have instead launched “two private customers” around the Moon with Falcon Heavy and Crew Dragon – SpaceX’s official press release noted that both of those customers had “paid a significant deposit”.

- Falcon Heavy visualized launching a Dragon 2 spacecraft, either Red Dragon or a circumlunar tourist mission (both now defunct). (SpaceX)

- SpaceX’s BFR booster seen landing back at a heavily-upgraded Pad 39A as a Crew Spaceship (left) awaits its ride to orbit. (SpaceX)

Prior to Falcon Heavy’s launch debut in February 2018, Musk offered a new perspective on human missions with Falcon Heavy, stating that SpaceX had made an internal decision to skip over a human-rated Falcon Heavy and head directly for BFR, citing his feeling that development of the next-gen rocket was proceeding quite smoothly.

“What we decided internally is to focus our future efforts on BFR. If that ends up taking longer than expected, then we’ll return to the idea of sending a Crew Dragon on Falcon Heavy around the Moon. But right now it looks like BFR development is moving quickly and it will not be necessary to qualify Falcon Heavy for crewed spaceflight.” – Elon Musk, 5 February 2018

Discussed last week, the render SpaceX published alongside this fresh announcement featured a new variant of BFR, suggesting that the company is still iterating on the spaceship’s design. This helps to explain a roughly 6-12 months schedule delay for prototype spaceship hop tests and a full BFR’s first orbital mission, slipping slightly from NET H1 2019 (hops) and 2020 (orbit) to late-2019 and 2021, respectively.

Still, it’s believed that SpaceX is already building composite propellant tank and structural prototypes in a temporary tent set up at Port of Los Angeles, evidenced by massive stacks of boxes of materials (some empty and some not) necessary for composite manufacturing (prepreg, resin, industrial HVAC, etc.). Raptor, the critical propulsion system that will power both booster and spaceship, was said by Tom Mueller – VP of Propulsion Engineering – to have all but completed prototype Raptor testing, with eyes now on building and testing engines optimized for flight. Located in the Port of LA, a dedicated BFR factory is in the early stages of construction, and completion of the first phase (a smaller factory floor) could happen sometime between Q2 and Q4 2019.

Catch the event live at the webcast below and stay tuned for Teslarati’s on-site coverage.

For prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket recovery fleet check out our brand new LaunchPad and LandingZone newsletters!

Elon Musk

Tesla Full Self-Driving set to get an awesome new feature, Elon Musk says

Tesla Full Self-Driving is set to get an awesome new feature in the near future, CEO Elon Musk confirmed on X.

Full Self-Driving is the company’s semi-autonomous driving program, which is among the best available to the general public. It still relies on the driver to ultimately remain in control and pay attention, but it truly does make traveling less stressful and easier.

However, Tesla still continuously refines the software through Over-the-Air updates, which are meant to resolve shortcomings in the performance of the FSD suite. Generally, Tesla does a great job of this, but some updates are definitely regressions, at least with some of the features.

Tesla Cybertruck owner credits FSD for saving life after freeway medical emergency

Tesla and Musk are always trying to improve the suite’s performance by fixing features that are presently available, but they also try to add new things that would be beneficial to owners. One of those things, which is coming soon, is giving the driver the ability to prompt FSD with voice demands.

For example, asking the car to park close to the front door of your destination, or further away in an empty portion of the parking lot, would be an extremely beneficial feature. Adjusting navigation is possible through Grok integration, but it is not always effective.

Musk confirmed that voice prompts for FSD would be possible:

Coming

— Elon Musk (@elonmusk) February 21, 2026

Tesla Full Self-Driving is a really great thing, but it definitely has its shortcomings. Navigation is among the biggest complaints that owners have, and it is easily my biggest frustration with using it. Some of the routes it chooses to take are truly mind-boggling.

Another thing it has had issues with is being situated in the correct lane at confusing intersections or even managing to properly navigate through local traffic signs. For example, in Pennsylvania, there are a lot of stop signs with “Except Right Turn” signs directly under.

This gives those turning right at a stop sign the opportunity to travel through it. FSD has had issues with this on several occasions.

Parking preferences would be highly beneficial and something that could be resolved with this voice prompt program. Grocery stores are full of carts not taken back by customers, and many people choose to park far away. Advising FSD of this preference would be a great advantage to owners.

Cybertruck

Elon Musk clarifies Tesla Cybertruck ’10 day’ comment, fans respond

Some are arguing that the decision to confirm a price hike in ten days is sort of counterproductive, especially considering it is based on demand. Giving consumers a timeline of just ten days to make a big purchase like a pickup truck for $60,000, and basically stating the price will go up, will only push people to make a reservation.

Elon Musk has clarified what he meant by his comment on X yesterday that seemed to indicate that Tesla would either do away with the new All-Wheel-Drive configuration of the Cybertruck or adjust the price.

The response was cryptic as nobody truly knew what Musk’s plans were for the newest Tesla Cybertruck trim level. We now have that answer, and fans of the company are responding in a polarizing fashion.

On Thursday night, Tesla launched the Cybertruck All-Wheel-Drive, priced competitively at $59,990. It was a vast improvement from the Rear-Wheel-Drive configuration Tesla launched last year at a similar price point, which was eventually cancelled just a few months later due to low demand.

Tesla launches new Cybertruck trim with more features than ever for a low price

However, Musk said early on Friday, “just for 10 days,” the truck would either be available or priced at $59,990. We can now confirm Tesla will adjust the price based on more recent comments from the CEO.

Musk said the price will fluctuate, but it “depends on how much demand we see at this price level.”

Depends on how much demand we see at this price level

— Elon Musk (@elonmusk) February 20, 2026

Some are defending the decision, stating that it is simply logical to see how the Cybertruck sells at this price and adjust accordingly.

Case 1: You don’t like it -> don’t buy it

Case 2 (me): You like it, it’s fits your situation and needs -> you buy it.

Case 3: Complain endlessly for no reason, you weren’t going to get one anyway, but you want people to know you’re mad, for some reason.Silly netizens.

— Ryan Scanlan 👥 (@Xenius) February 21, 2026

Others, not so much.

Alright I’m obviously not the one successful enough to be calling the shots at Tesla and worth almost a trillion dollars

But people were excited about the awesome Cybertruck news and then it got taken away, that’s why people are annoyed. The wording felt more like a threat.… pic.twitter.com/NWVNklcXoJ

— Dirty Tesla (@DirtyTesLa) February 21, 2026

No but fr wtf you doing dude???????

— Greggertruck (@greggertruck) February 20, 2026

It’s how it was communicated.

If it had been stated clearly on the website for everyone to see, everyone would be fine.— KiTT_2020 (@kitt_2020) February 20, 2026

Some are arguing that the decision to confirm a price hike in ten days is sort of counterproductive, especially considering it is based on demand. Giving consumers a timeline of just ten days to make a big purchase like a pickup truck for $60,000, and basically stating the price will go up, will only push people to make a reservation.

Demand will look strong because people want to lock in this price. The price will inevitably go up, and demand for the trim will likely fall a bit because of the increased cost.

Many are arguing Musk should have kept this detail internal, but transparency is a good policy to have. It is a polarizing move to confirm a price increase in just a week-and-a-half, but the community is obviously split on how to feel.

Cybertruck

Tesla Cybertruck’s newest trim will undergo massive change in ten days, Musk says

It appears as if the new All-Wheel-Drive trim of Cybertruck won’t be around for too long, however. Elon Musk revealed this morning that it will be around “only for the next 10 days.”

Tesla’s new Cybertruck trim has already gotten the axe from CEO Elon Musk, who said the All-Wheel-Drive configuration of the all-electric pickup will only be available “for the next ten days.”

Musk could mean the price, which is $59,990, or the availability of the trim altogether.

Last night, Tesla launched the All-Wheel-Drive configuration of the Cybertruck, a pickup that comes in at less than $60,000 and features a competitive range and features that are not far off from the offerings of the premium trim.

Tesla launches new Cybertruck trim with more features than ever for a low price

It was a nice surprise from Tesla, considering that last year, it offered a Rear-Wheel-Drive trim of the Cybertruck that only lasted a few months. It had extremely underwhelming demand because it was only $10,000 cheaper than the next trim level up, and it was missing a significant number of premium features.

Simply put, it was not worth the money. Tesla killed the RWD Cybertruck just a few months after offering it.

With the news that Tesla was offering this All-Wheel-Drive configuration of the Cybertruck, many fans and consumers were encouraged. The Cybertruck has been an underwhelming seller, and this seemed to be a lot of truck for the price when looking at its features:

- Dual Motor AWD w/ est. 325 mi of range

- Powered tonneau cover

- Bed outlets (2x 120V + 1x 240V) & Powershare capability

- Coil springs w/ adaptive damping

- Heated first-row seats w/ textile material that is easy to clean

- Steer-by-wire & Four Wheel Steering

- 6’ x 4’ composite bed

- Towing capacity of up to 7,500 lbs

- Powered frunk

It appears as if this trim of Cybertruck won’t be around for too long, however. Musk revealed this morning that it will be around “only for the next 10 days.”

Only for the next 10 days https://t.co/82JnvZQGh2

— Elon Musk (@elonmusk) February 20, 2026

Musk could mean the price of the truck and not necessarily the ability to order it. However, most are taking it as a cancellation.

If it is, in fact, a short-term availability decision, it is baffling, especially as Tesla fans and analysts claim that metrics like quarterly deliveries are no longer important. This seems like a way to boost sales short-term, and if so many people are encouraged about this offering, why would it be kept around for such a short period of time?

Some are even considering the potential that Tesla axes the Cybertruck program as a whole. Although Musk said during the recent Q4 Earnings Call that Cybertruck would still be produced, the end of the Model S and Model X programs indicates Tesla might be prepared to do away with any low-volume vehicles that do not contribute to the company’s future visions of autonomy.

The decision to axe the car just ten days after making it available seems like a true head-scratcher.