News

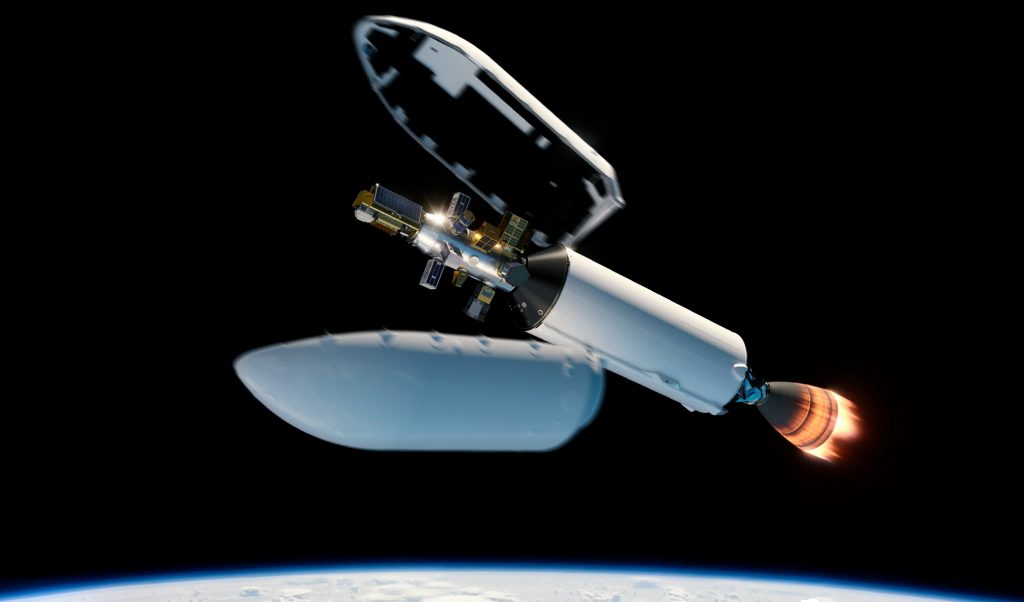

SpaceX is about to crush the record for most satellites launched on one rocket

While delayed from Friday to Saturday, SpaceX’s next Falcon 9 launch still appears to be on track to obliterate the world’s current record for most satellites launched on a single rocket.

Currently set at 104 satellites by an Indian PSLV rocket launch in 2017, all signs point to SpaceX beating that record by almost 50% on its very first dedicated Smallsat Rideshare Program launch. Kicked off in 2019, not long after SpaceX completed its first dedicated rideshare launch for company Spaceflight Industries in December 2018, the Smallsat Program aimed to offer exceptionally affordable prices to companies and institutions open to rideshare arrangements.

While primarily centered around more frequent but mass and volume-limited Starlink tag-a-longs, three of which SpaceX has already completed, executives also promised regular bus-like Falcon 9 launches entirely dedicated to rideshare payloads. SpaceX’s first such mission, known as Transporter-1, is now scheduled to launch no earlier than 9:40 am EST (14:40 UTC) on Saturday, January 22nd.

In a surprising but welcome development, SpaceX continues to work closely with Celestrak – an extensive space-tracking catalog – and provided prelaunch data estimating the number of satellites and their positions shortly after deploying from Falcon 9’s upper stage. Notably, the data offers the first unofficial but likely reliable way to determine the number of spacecraft set to be deployed on SpaceX’s first dedicated Smallsat Program launch.

It’s extremely difficult to determine exactly how many satellites are aboard without an official account due to the fact that no less than four companies – Exolaunch, Spaceflight, Nanoracks, and SpaceX itself – are simultaneously operating as payload integrators with their own separate deployment systems (and even spacecraft). Uncertainty aside, based on unofficial analysis of the numbers provided to Celestrak by SpaceX, Transporter-1 will likely be carrying anywhere from 133 to 155+ small satellites come liftoff. In other words, SpaceX is set to beat the current record of 104 satellites by 25-49%.

While adding complexity, SpaceX’s willingness to effectively subcontract large portions of rideshare launch service management to other companies also gives prospective customers ways to get their satellites into orbit at prices far lower than what SpaceX directly offers. Per SpaceX.com, the company continues to require a minimum order of $1 million for 200 kg to sun-synchronous orbit (SSO) and customers can choose to buy additional mass for $5,000 per kilogram. Those prices may sound expensive but are actually extremely competitive relative to the rest of the space launch market.

However, $1 million would be about as expensive as it gets for average nanosatellites (~1-10 kg). Instead, intermediaries like Exolaunch and Spaceflight work to win and wrangle multiple customers into a certain timeframe and then purchase necessary space aboard one or more optimal rideshare launch opportunities. In the case of SpaceX, for example, an intermediary can pay SpaceX $2 million for two docking ports and 400 kg of payload capacity, find 20 customers in need of launch, and charge each customer an average of $200,000 per satellite while still making a profit.

Transporter-1 launch delays aren’t exactly shocking when one considers the fact that SpaceX is attempting to manage the needs of multiple different launch servicers and several dozen customers. To an extent, every customer satellite is unique and has unique requirements. In several cases, some of the mission’s payloads are quite literally experimental, adding even more challenges and uncertainty.

With any luck, the stars will align and allow Falcon 9 to launch Transporter-1 this Saturday. Stay tuned for updates and webcast details.

Investor's Corner

Tesla delivers 384,000 vehicles in Q2 2025, deploys 9.6 GWh in energy storage

The quarter’s 9.6 GWh energy storage deployment marks one of Tesla’s highest to date.

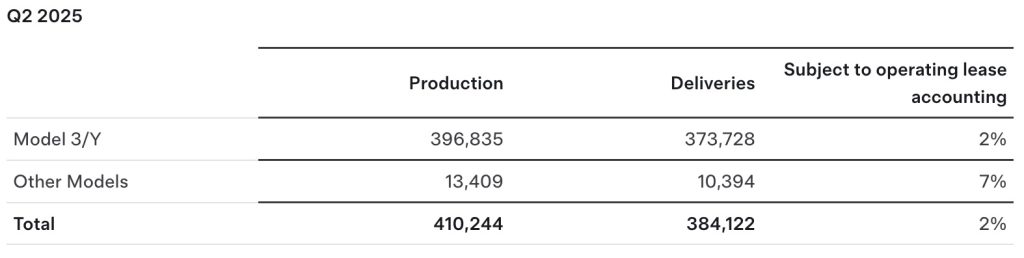

Tesla (NASDAQ: TSLA) has released its Q2 2025 vehicle delivery and production report. As per the report, the company delivered over 384,000 vehicles in the second quarter of 2025, while deploying 9.6 GWh in energy storage. Vehicle production also reached 410,244 units for the quarter.

Model 3/Y dominates output, ahead of earnings call

Of the 410,244 vehicles produced during the quarter, 396,835 were Model 3 and Model Y units, while 13,409 were attributed to Tesla’s other models, which includes the Cybertruck and Model S/X variants. Deliveries followed a similar pattern, with 373,728 Model 3/Ys delivered and 10,394 from other models, totaling 384,122.

The quarter’s 9.6 GWh energy storage deployment marks one of Tesla’s highest to date, signaling continued strength in the Megapack and Powerwall segments.

Year-on-year deliveries edge down, but energy shows resilience

Tesla will share its full Q2 2025 earnings results after the market closes on Wednesday, July 23, 2025, with a live earnings call scheduled for 4:30 p.m. CT / 5:30 p.m. ET. The company will publish its quarterly update at ir.tesla.com, followed by a Q&A webcast featuring company leadership. Executives such as CEO Elon Musk are expected to be in attendance.

Tesla investors are expected to inquire about several of the company’s ongoing projects in the upcoming Q2 2025 earnings call. Expected topics include the new Model Y ramp across the United States, China, and Germany, as well as the ramp of FSD in territories outside the US and China. Questions about the company’s Robotaxi business, as well as the long-referenced but yet to be announced affordable models are also expected.

News

Tesla China breaks 8-month slump by selling 71,599 vehicles wholesale in June

Tesla China’s June numbers were released by the China Passenger Car Association (CPCA) on Tuesday.

Tesla China was able to sell 71,599 vehicles wholesale in June 2025, reversing eight consecutive months of year-over-year declines. The figure marks a 0.83% increase from the 71,599 vehicles sold wholesale in June 2024 and a 16.1% jump compared to the 61,662 vehicles sold wholesale in May.

Tesla China’s June numbers were released by the China Passenger Car Association (CPCA) on Tuesday.

Tesla China’s June results in focus

Tesla produces both the Model 3 and Model Y at its Shanghai Gigafactory, which serves as the company’s primary vehicle export hub. Earlier this year, Tesla initiated a changeover for its best-selling vehicle, the Model Y, resulting in a drop in vehicle sales during the first and second quarters.

Tesla’s second-quarter China sales totaled 191,720 units including exports. While these numbers represent a 6.8% year-over-year decline for Tesla China, Q2 did show sequential improvement, rising about 11% from Q1 2025, as noted in a CNEV Post report.

For the first half of the year, Tesla sold 364,474 vehicles wholesale. This represents a 14.6% drop compared to the 426,623 units sold wholesale in the first half of 2024.

China’s competitive local EV market

Tesla’s position in China is notable, especially as the new Model Y is gaining ground in the country’s BEV segment. That being said, Tesla is also facing competition from impressive local brands such as Xiaomi, whose new YU7 electric SUV is larger and more affordable than the Model Y.

The momentum of the YU7 is impressive, as the vehicle was able to secure 200,000 firm orders within three minutes and over 240,000 locked-in orders within 18 hours. Xiaomi’s previous model, the SU7 electric sedan, which is aimed at the Tesla Model 3, also remains popular, with June deliveries surpassing 25,000 units for the ninth straight month.

While China’s EV market is getting more competitive, Tesla’s new Model Y is also ramping its production and deliveries. Needless to say, Tesla China’s results for the remaining two quarters of 2025 will be very interesting.

Elon Musk

Tesla reveals it is using AI to make factories more sustainable: here’s how

Tesla is using AI in its Gigafactory Nevada factory to improve HVAC efficiency.

Tesla has revealed in its Extended Impact Report for 2024 that it is using Artificial Intelligence (AI) to enable its factories to be more sustainable. One example it used was its achievement of managing “the majority of the HVAC infrastructure at Gigafactory Nevada is now AI-controlled” last year.

In a commitment to becoming more efficient and making its production as eco-friendly as possible, Tesla has been working for years to find solutions to reduce energy consumption in its factories.

For example, in 2023, Tesla implemented optimization controls in the plastics and paint shops located at Gigafactory Texas, which increased the efficiency of natural gas consumption. Tesla plans to phase out natural gas use across its factories eventually, but for now, it prioritizes work to reduce emissions from that energy source specifically.

It also uses Hygrometric Control Logic for Air Handling Units at Giafactory Berlin, resulting in 17,000 MWh in energy savings each year. At Gigafactory Nevada, Tesla saves 9.5 GWh of energy through the use of N-Methylpyrrolidone refineries when extracting critical raw material.

Perhaps the most interesting way Tesla is conserving energy is through the use of AI at Gigafactory Nevada, as it describes its use of AI to reduce energy demand:

“In 2023, AI Control for HVAC was expanded from Nevada and Texas to now include our Berlin-Brandenburg and Fremont factories. AI Control policy enables HVAC systems within each factory to work together to process sensor data, model factory dynamics, and apply control actions that safely minimize the energy required to support production. In 2024, this system achieved two milestones: the majority of HVAC infrastructure at Gigafactory Nevada is now AI-controlled, reducing fan and thermal energy demand; and the AI algorithm was extended to manage entire chiller plants, creating a closed-loop control system that optimizes both chilled water consumption and the energy required for its generation, all while maintaining factory conditions.”

Tesla utilizes AI Control “primarily on systems that heat or cool critical factory production spaces and equipment.” AI Control communicates with the preexisting standard control logic of each system, and any issues can be resolved by quickly reverting back to standard control. There were none in 2024.

Tesla says that it is utilizing AI to drive impact at its factories, and it has proven to be a valuable tool in reducing energy consumption at one of its facilities.

-

Elon Musk2 days ago

Elon Musk2 days agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

News7 days ago

News7 days agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

News2 weeks ago

News2 weeks agoTesla’s Grok integration will be more realistic with this cool feature

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk slams Bloomberg’s shocking xAI cash burn claims

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

News2 weeks ago

News2 weeks agoTesla dominates Cars.com’s Made in America Index with clean sweep

-

Elon Musk1 week ago

Elon Musk1 week agoFirst Look at Tesla’s Robotaxi App: features, design, and more

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla Robotaxis are becoming a common sight on Austin’s public roads